概述

该策略结合了向量蜡烛图(Vector Candles)的概念与传统的通道突破(Channel Breakout)和巧克力酱(Chocolate Sauce, ChoCH)模式识别,旨在捕捉市场的突破性行情。策略通过比较收盘价与前一根K线的高低点,并结合成交量放大的向量蜡烛图来确认信号,同时采用了一定数量的确认K线来过滤噪音。

策略原理

- 计算过去一定数量K线的平均成交量,并根据成交量放大倍数定义四种不同颜色(红、绿、蓝、紫)的向量蜡烛图。

- 当收盘价低于前一根K线低点,且为红色向量蜡烛图时,识别为红色ChoCH信号;当收盘价高于前一根K线高点,且为绿色向量蜡烛图时,识别为绿色BOS信号。

- 在一定数量的确认K线内,如果红色向量蜡烛图出现次数达到设定阈值,则确认红色ChoCH信号;如果绿色向量蜡烛图出现次数达到设定阈值,则确认绿色BOS信号。

- 当确认红色ChoCH信号时开仓做多,当确认绿色BOS信号时平仓。

策略优势

- 结合了向量蜡烛图与传统的通道突破和ChoCH模式,提高了信号的可靠性。

- 引入确认K线机制,有效过滤了噪音和假信号。

- 通过向量蜡烛图的颜色区分,使得信号更加直观和易于识别。

- 参数可调,灵活性较高,可根据不同市场环境和交易风格进行优化。

策略风险

- 在震荡市中,频繁的突破和回撤可能导致策略产生较多的假信号和亏损交易。

- 确认K线的数量设置不当可能导致信号滞后或过早入场。

- 单纯依赖于技术指标而忽视基本面因素,可能面临意外风险。

- 策略未设置止损,在行情急剧反转时可能承担较大损失。

策略优化方向

- 引入趋势确认指标,如移动平均线,在突破信号出现后确认趋势方向,提高信号质量。

- 对于震荡市,可以考虑引入范围交易策略,如在通道内部设置做多和做空的触发条件。

- 优化确认K线的数量,找到合适的平衡点,既能有效过滤噪音,又不会过于滞后。

- 设置合理的止损和止盈规则,控制单笔交易风险和总体回撤。

- 与其他技术指标或市场情绪指标相结合,提供更多的交易决策依据。

总结

该策略创新性地将向量蜡烛图与经典的通道突破和ChoCH模式相结合,通过颜色区分和确认K线机制,提高了信号的可靠性和识别度。策略优势在于规则明确、信号直观,同时具有一定的灵活性和可优化空间。然而,策略也存在一些局限性和风险,如在震荡市表现欠佳,对市场趋势把握不足,以及缺乏止损止盈管理等。未来可以从趋势确认、范围交易、参数优化、风险控制等方面对策略进行完善,以期获得更稳健的交易表现。

策略源码

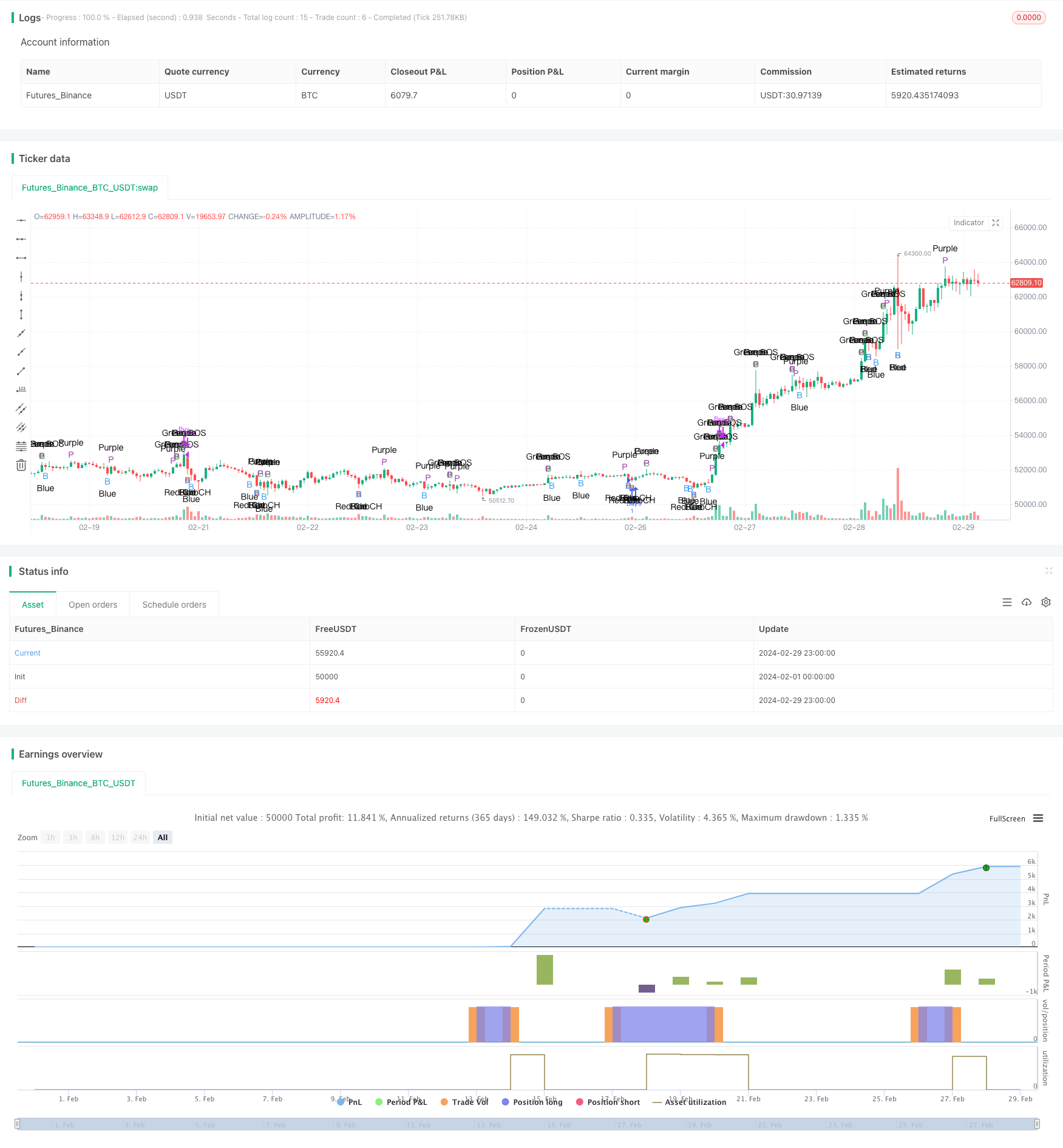

/*backtest

start: 2024-02-01 00:00:00

end: 2024-02-29 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Custom ChoCH and BOS Strategy with Vector Candles", overlay=true)

// Input Parameters

length = input(10, title="Lookback Length for Volume")

volMultiplier = input(2.0, title="Volume Multiplier for Vector Candles")

confirmationCandles = input(3, title="Confirmation Candles")

// Calculate the average volume of the last 'length' candles

avgVol = sma(volume, length)

// Vector Candle Definitions

vectorCandleRed = (close < open) and (volume > avgVol * volMultiplier) ? 1.0 : 0.0

vectorCandleGreen = (close > open) and (volume > avgVol * volMultiplier) ? 1.0 : 0.0

vectorCandleBlue = (close < open) and (volume > avgVol * 1.5) ? 1.0 : 0.0 // 150% volume for blue

vectorCandlePurple = (close > open) and (volume > avgVol * 1.5) ? 1.0 : 0.0 // 150% volume for purple

// Detecting BOS and ChoCH

isRedChoCH = vectorCandleRed > 0 and (close < low[1]) // Red ChoCH

isGreenBOS = vectorCandleGreen > 0 and (close > high[1]) // Green BOS

// Confirmation Logic

redChoCHConfirmed = (sum(vectorCandleRed, confirmationCandles) >= 2) ? 1.0 : 0.0

greenBOSConfirmed = (sum(vectorCandleGreen, confirmationCandles) >= 2) ? 1.0 : 0.0

// Entry Conditions

buyCondition = redChoCHConfirmed > 0

sellCondition = greenBOSConfirmed > 0

// Strategy Execution

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.close("Buy")

// Plotting Vector Candles and Signals

plotshape(series=isRedChoCH, title="Red ChoCH Signal", location=location.belowbar, color=color.red, style=shape.circle, text="Red ChoCH")

plotshape(series=isGreenBOS, title="Green BOS Signal", location=location.abovebar, color=color.green, style=shape.circle, text="Green BOS")

// Plotting Vector Candles for Visualization

plotchar(vectorCandleRed > 0, title="Vector Candle Red", location=location.belowbar, color=color.red, char='R', text="Red")

plotchar(vectorCandleGreen > 0, title="Vector Candle Green", location=location.abovebar, color=color.green, char='G', text="Green")

plotchar(vectorCandleBlue > 0, title="Vector Candle Blue", location=location.belowbar, color=color.blue, char='B', text="Blue")

plotchar(vectorCandlePurple > 0, title="Vector Candle Purple", location=location.abovebar, color=color.purple, char='P', text="Purple")