概述

MACD趋势跟踪策略是一个基于MACD指标的量化交易策略。该策略的主要思路是利用MACD指标的金叉和死叉信号来判断趋势的方向,并在合适的时机建立多头或空头仓位。当MACD线上穿信号线并且上穿0轴时,开多头仓位;当MACD线下穿信号线并且下穿0轴时,开空头仓位。该策略使用最近的低点作为多头止损位,最近的高点作为空头止损位。平仓条件是MACD线反向穿越信号线。

策略原理

MACD趋势跟踪策略的核心原理是使用MACD指标来捕捉趋势的形成和反转。MACD指标由两条均线(快速均线和慢速均线)的差值构成,并配合信号线来生成交易信号。当MACD线上穿信号线并且上穿0轴时,表明上涨趋势形成,此时开多头仓位。当MACD线下穿信号线并且下穿0轴时,表明下跌趋势形成,此时开空头仓位。策略使用最近的显著低点作为多头止损位,最近的显著高点作为空头止损位,以控制风险。当MACD线反向穿越信号线时,平掉当前仓位。

策略优势

MACD趋势跟踪策略能够有效捕捉趋势性机会,在趋势形成初期就建仓,充分利用了趋势的动能。

该策略同时使用MACD金叉死叉和0轴作为过滤条件,能够较好地过滤掉震荡市中的虚假信号。

策略采用最近显著高低点作为止损位,能够控制单笔交易的风险敞口。

策略逻辑清晰,容易理解和实现,适合初学者学习。

策略风险

MACD指标本质上是一个滞后指标,在趋势反转初期可能会出现较大的回撤。

策略在震荡市中可能会出现频繁交易,导致较高的交易成本。

止损位的设置依赖于最近的显著高低点,在某些情况下可能出现止损过早或过晚的情况。

该策略没有考虑仓位管理和资金管理,实际应用中需要结合具体情况进行优化。

策略优化方向

可以考虑引入其他技术指标或价格行为模式作为过滤条件,以提高信号的可靠性和准确性。

优化止损位的设置方法,例如使用ATR或百分比止损等方式,以更好地控制风险。

引入仓位管理和资金管理机制,根据市场波动性和账户equity等来动态调整仓位大小。

针对不同的市场和交易标的,对参数进行优化和调整,找到最适合的参数组合。

总结

MACD趋势跟踪策略是一个简单而有效的量化交易策略,通过利用MACD指标的特性来捕捉趋势性机会。该策略逻辑清晰,易于理解和实现,适合初学者学习。但在实际应用中,需要注意控制风险,并结合其他方法进行优化和改进,以获得更稳健的交易表现。

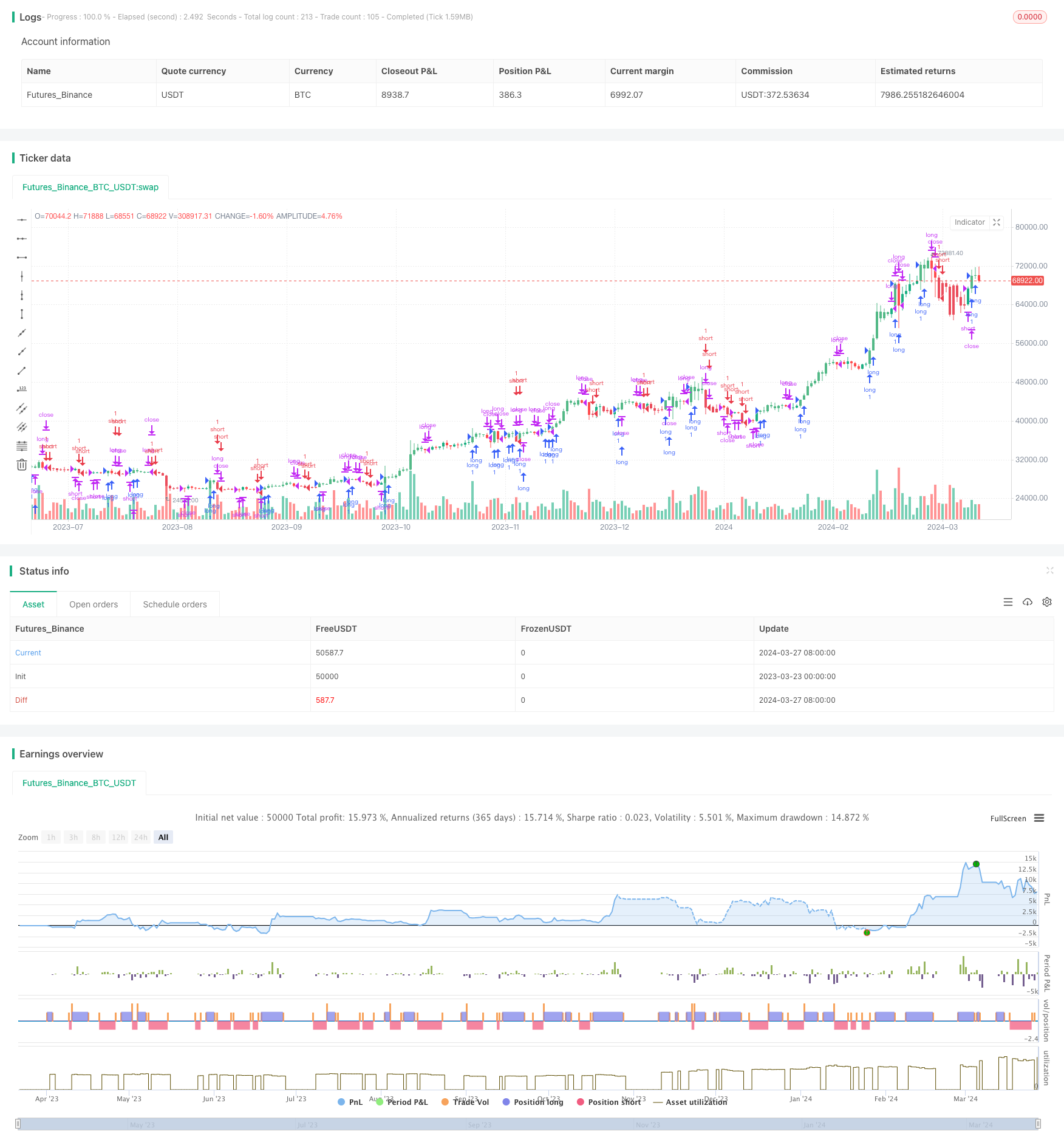

/*backtest

start: 2023-03-23 00:00:00

end: 2024-03-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("MACD trendfollow", shorttitle="MACD TF", overlay=true)

// switch = input(true, title="Enable MACD Bar Color")

// X001TK MACD trendfollow Strategy

//

//

// This strategy combines the non standart approach in MACD strategy to buy once to buy when the MACD value goes above Signal line and a zero line, to sell on the opposite condition.

//

//

// This strategy goes long if the MACD (3,9,5) goes above its Signal and above zero

//

// You can set Stop loss on the recent lowest low when long position is opened and recent highest hugh in short

//

//

// Exit rule is simple. We close the LONG position once MACD goes below Signal line and close SHORT on the opposite condition

//

//

//

//

// Input

fastMAlen = input(3, minval=1, title="MACD fast moving average")

slowMAlen = input(9,minval=1, title="MACD slow moving average")

signalMACDlen = input(5,minval=1, title="MACD signal line moving average")

// switch = input(true, title="Enable MACD Bar Color")

length = input(1, minval=1)

// === INPUT BACKTEST RANGE ===

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2002, title = "From Year", minval = 2000)

ToMonth = input(defval = 3, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 2029, title = "To Year", minval = 2017)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 00, 00) // backtest finish window

window() => true // create function "within window of time"

// MACD Calculation

MACD = ema(close, fastMAlen) - ema(close, slowMAlen)

signalMACD = ema(MACD, signalMACDlen)

delta = MACD - signalMACD

fastMA = ema(close,fastMAlen)

slowMA = ema(close,slowMAlen)

// Colors

//bartrendcolor = MACD > signalMACD and MACD > 0? green : MACD < signalMACD and MACD < 0? red : MACD < signalMACD? gray : gray

//barcolor(switch?bartrendcolor:na)

barcolour=(MACD > signalMACD and MACD > 0)?#53B987:(MACD < signalMACD and MACD < 0)?#EB4D5C:na

barcolor(color=barcolour)

// === STRATEGY ===

// conditions

longCond = MACD > signalMACD and MACD > 0

XlongCond = MACD < signalMACD

ShortCond = MACD < signalMACD and MACD < 0

XShortCond = MACD > signalMACD

strategy.entry("long", strategy.long, when=longCond==true and window()==true )

//strategy.exit(id="Close Long", stop=longStop)//, limit=longTake)

strategy.close("long", when=XlongCond==true and window()==true)

strategy.entry("short", strategy.short, when=ShortCond==true and window()==true )

//strategy.exit(id="Close Short", stop=shortStop)//, limit=shortTake)

strategy.close("short", when=XShortCond==true and window()==true)

// === /STRATEGY ===