概述

该策略是一个基于相对强弱指数(RSI)的动量策略,结合了手动设置止盈(TP)和止损(SL)的功能。策略的主要思路是通过RSI指标来捕捉市场的超买和超卖状态,同时考虑日线收盘价相对于近期最高价和最低价的位置,以此来判断进场时机。一旦达到预设的止盈或止损水平,策略就会自动平仓。

策略原理

- 计算指定周期的RSI指标值。

- 判断RSI是否突破了预设的超卖和超买阈值,分别作为多头和空头进场的条件之一。

- 判断日线收盘价是否高于近50根K线最高收盘价的70%,作为多头进场的另一个条件;判断日线收盘价是否低于近50根K线最低收盘价的130%,作为空头进场的另一个条件。

- 当多头或空头的两个进场条件同时满足时,策略会发出相应的进场信号。

- 根据进场价格和预设的止盈止损百分比,计算出多头和空头的止盈和止损价位。

- 当价格达到止盈或止损价位时,策略会自动平仓。

策略优势

- 结合RSI指标和价格水平,能够较好地捕捉市场的短期动量变化。

- 手动设置止盈止损水平,允许交易者根据自己的风险偏好和市场波动性来管理仓位。

- 适用于震荡市场,在RSI信号较为可靠的情况下可能表现良好。

- 提供了一个基于RSI信号的结构化交易方法,同时允许交易者自定义风险管理参数。

策略风险

- 在趋势市场中,RSI指标可能长时间处于超买或超卖状态,导致策略表现欠佳。

- 固定的止盈止损百分比可能无法适应不同的市场条件和波动性。

- 策略的表现很大程度上取决于参数的选择,不恰当的参数设置可能导致频繁的交易或错失良机。

- 仅依赖技术指标进行交易决策,忽略了基本面因素和市场情绪的影响。

策略优化方向

- 对RSI的参数(如长度、超买超卖阈值)进行优化,以适应不同的市场状况。

- 引入自适应的止盈止损机制,根据市场波动性动态调整止盈止损水平。

- 结合其他技术指标或市场情绪指标,以提高信号的可靠性和稳健性。

- 对策略进行分段优化,针对不同的市场趋势(如上涨、下跌、震荡)采用不同的参数设置。

总结

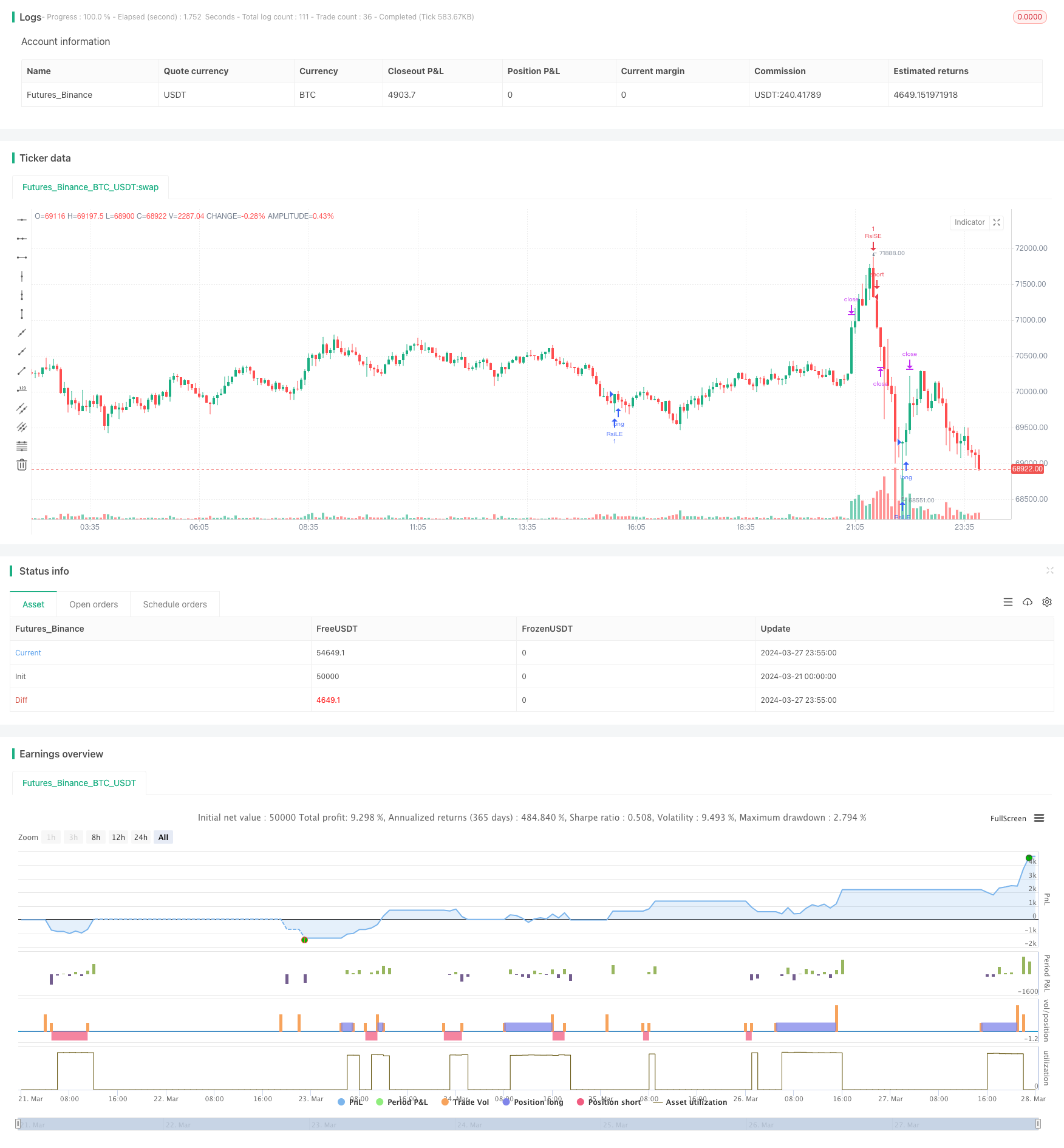

该策略提供了一个基于RSI动量指标的交易框架,同时引入了手动止盈止损的功能,使得交易者可以根据自己的风险偏好和市场观点来管理仓位。然而,策略的表现很大程度上依赖于参数的选择和市场状况。因此,交易者应当谨慎使用该策略,对其进行充分的回测和优化,并结合其他形式的分析和风险管理技术,以获得更稳健的交易表现。

策略源码

//@version=5

strategy("RSI Strategy with Manual TP and SL", overlay=true)

// Strategy Parameters

length = input(14, title="RSI Length")

overSold = input(30, title="Oversold Level")

overBought = input(70, title="Overbought Level")

trail_profit_pct = input.float(20, title="Trailing Profit (%)")

// RSI Calculation

vrsi = ta.rsi(close, length)

// Entry Conditions for Long Position

rsi_crossed_below_30 = vrsi > overSold and ta.sma(vrsi, 2) <= overSold // RSI crossed above 30

daily_close_above_threshold = close > (ta.highest(close, 50) * 0.7) // Daily close above 70% of the highest close in the last 50 bars

// Entry Conditions for Short Position

rsi_crossed_above_70 = vrsi < overBought and ta.sma(vrsi, 2) >= overBought // RSI crossed below 70

daily_close_below_threshold = close < (ta.lowest(close, 50) * 1.3) // Daily close below 130% of the lowest close in the last 50 bars

// Entry Signals

if (rsi_crossed_below_30 and daily_close_above_threshold)

strategy.entry("RsiLE", strategy.long, comment="RsiLE")

if (rsi_crossed_above_70 and daily_close_below_threshold)

strategy.entry("RsiSE", strategy.short, comment="RsiSE")

// Manual Take Profit and Stop Loss

tp_percentage = input.float(1, title="Take Profit (%)")

sl_percentage = input.float(1, title="Stop Loss (%)")

long_tp = strategy.position_avg_price * (1 + tp_percentage / 100)

long_sl = strategy.position_avg_price * (1 - sl_percentage / 100)

short_tp = strategy.position_avg_price * (1 - tp_percentage / 100)

short_sl = strategy.position_avg_price * (1 + sl_percentage / 100)

strategy.exit("TP/SL Long", "RsiLE", limit=long_tp, stop=long_sl)

strategy.exit("TP/SL Short", "RsiSE", limit=short_tp, stop=short_sl)