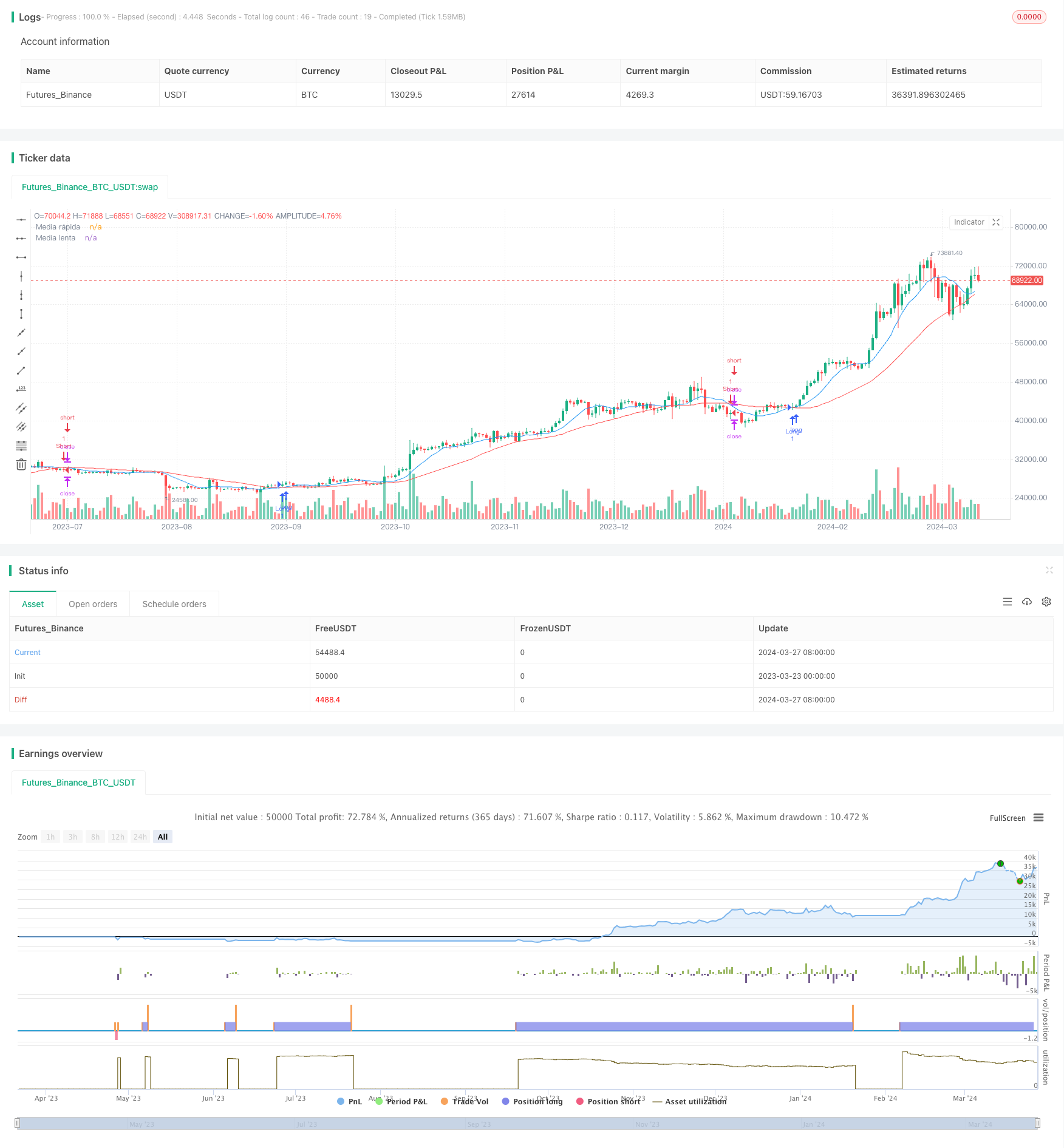

概述

该策略使用两条不同周期的移动平均线(快速移动平均线和慢速移动平均线)来识别交易信号。当快速移动平均线从下向上穿过慢速移动平均线时,产生做多信号;当快速移动平均线从上向下穿过慢速移动平均线时,产生做空信号。该策略同时设置了止损和止盈水平,以控制风险和锁定利润。

策略原理

该策略的核心原理是利用不同周期移动平均线的交叉关系来判断市场趋势的变化。快速移动平均线对价格变化更敏感,而慢速移动平均线则反映了更长期的趋势。当快速移动平均线穿过慢速移动平均线时,表明市场趋势可能发生了改变,从而产生交易信号。

具体来说,当快速移动平均线从下向上穿过慢速移动平均线时,表明市场可能进入上升趋势,此时开仓做多;相反,当快速移动平均线从上向下穿过慢速移动平均线时,表明市场可能进入下降趋势,此时开仓做空。同时,该策略设置了止损和止盈水平,以控制风险和锁定利润。

策略优势

简单易懂:该策略使用简单的移动平均线交叉原理,易于理解和实现。

趋势跟踪:通过不同周期移动平均线的交叉关系,该策略能够有效捕捉市场趋势的变化,适合趋势跟踪交易。

风险控制:策略内置了止损和止盈机制,有助于控制风险和锁定利润。

策略风险

市场波动:在市场波动较大的情况下,频繁的移动平均线交叉可能会产生较多的假信号,导致频繁交易和损失。

参数选择:策略的表现依赖于移动平均线的周期选择,不同的参数设置可能会导致不同的结果。

趋势延迟:移动平均线是一个滞后指标,交叉信号可能在趋势已经形成后才出现,错失早期入场机会。

策略优化方向

参数优化:通过对不同周期组合进行回测和优化,找到最佳的移动平均线周期参数。

结合其他指标:考虑将其他技术指标如RSI、MACD等与移动平均线交叉信号结合,提高信号的可靠性。

动态止损:根据市场波动情况动态调整止损水平,而非固定比例,以更好地控制风险。

总结

均线金叉死叉策略是一个简单易懂、适合趋势跟踪的交易策略。通过不同周期移动平均线的交叉关系,该策略能够捕捉市场趋势变化,同时内置了止损和止盈机制以控制风险。但是,该策略在市场波动较大时可能产生较多假信号,且交叉信号存在滞后性。因此,可以考虑对参数进行优化、结合其他技术指标、动态调整止损水平等方式对策略进行改进。总的来说,均线金叉死叉策略是一个值得尝试的基础策略。

//@version=4

strategy("barreto es marica", overlay=true)

// Parámetros de entrada

fastLength = input(10, title="Periodo de la media rápida")

slowLength = input(30, title="Periodo de la media lenta")

// Cálculo de las medias móviles

fastMA = sma(close, fastLength)

slowMA = sma(close, slowLength)

// Condiciones de entrada

enterLong = crossover(fastMA, slowMA)

enterShort = crossunder(fastMA, slowMA)

// Condiciones de salida

exitLong = crossunder(fastMA, slowMA)

exitShort = crossover(fastMA, slowMA)

// Gestión de posiciones

if (enterLong)

strategy.entry("Long", strategy.long)

if (enterShort)

strategy.entry("Short", strategy.short)

if (exitLong)

strategy.close("Long")

if (exitShort)

strategy.close("Short")

// Stop loss y toma de ganancias

stopLossLevel = strategy.position_avg_price * (1 - 0.01)

takeProfitLevel = strategy.position_avg_price * (1 + 0.03)

strategy.exit("Stop Loss/Take Profit", "Long", stop=stopLossLevel, limit=takeProfitLevel)

strategy.exit("Stop Loss/Take Profit", "Short", stop=stopLossLevel, limit=takeProfitLevel)

// Plotting

plot(fastMA, color=color.blue, title="Media rápida")

plot(slowMA, color=color.red, title="Media lenta")