概述

该策略的主要思路是利用亚洲盘的高低点作为突破点,在欧美盘开盘后的几个小时内,如果价格突破亚洲盘高点则做多,突破亚洲盘低点则做空。同时设置止损和止盈,控制风险。该策略每天只开一个交易,最大同时开仓数量为100000。

策略原理

- 确定亚洲盘的交易时间,用户可以自定义起始时间和结束时间。

- 在亚洲盘期间,记录当天的最高价和最低价。

- 在欧美盘开盘后的某个时间(用户自定义的偏移小时数),如果价格突破亚洲盘高点则做多,突破亚洲盘低点则做空。

- 设置止损和止盈,止损和止盈的点数可以自定义。

- 每天只开一个新的交易,同时最大同时开仓数量为100000。

- 如果当天已经开过仓,则不再开新的交易。

优势分析

- 利用亚洲盘相对平静的特点,以当天亚洲盘的高低点作为突破点,可以较好地捕捉欧美盘的趋势机会。

- 设置了止损和止盈,可以有效控制风险,让盈利单够跑,亏损单快止损。

- 限制了每天只开一单以及最大同时开仓数量,可以避免过度交易和资金的过度使用。

- 用户可以根据自己的需求,灵活设置亚洲盘时间和偏移小时数等参数。

风险分析

- 亚洲盘高低点不一定是当天真正的高低点,有可能欧美盘突破后又快速回撤,造成亏损。

- 固定点数的止损和止盈可能无法应对行情的大幅波动,有时可能止损过早,有时可能止盈过早。

- 在趋势不明显或者市场波动较大的情况下,该策略可能会出现频繁开仓止损的情况。

优化方向

- 可以考虑根据ATR等波动率指标来动态调整止损和止盈的点数,以适应不同的行情。

- 可以加入一些趋势判断的指标,如MA,只有在大趋势向上时做多,向下时做空,以提高成功率。

- 可以考虑分时段设置不同的参数,如在欧美盘开盘初期使用较小的止损止盈,而在趋势明显时则加大止损止盈。

总结

该策略利用亚洲盘的高低点作为突破点来进行交易,适合在欧美盘趋势较为明显的品种上使用。但是固定点数止损止盈以及标准的突破入场方式也存在一些局限性。通过引入一些动态化和趋势性的指标,可以对该策略进行优化,以期获得更好的效果。

策略源码

/*backtest

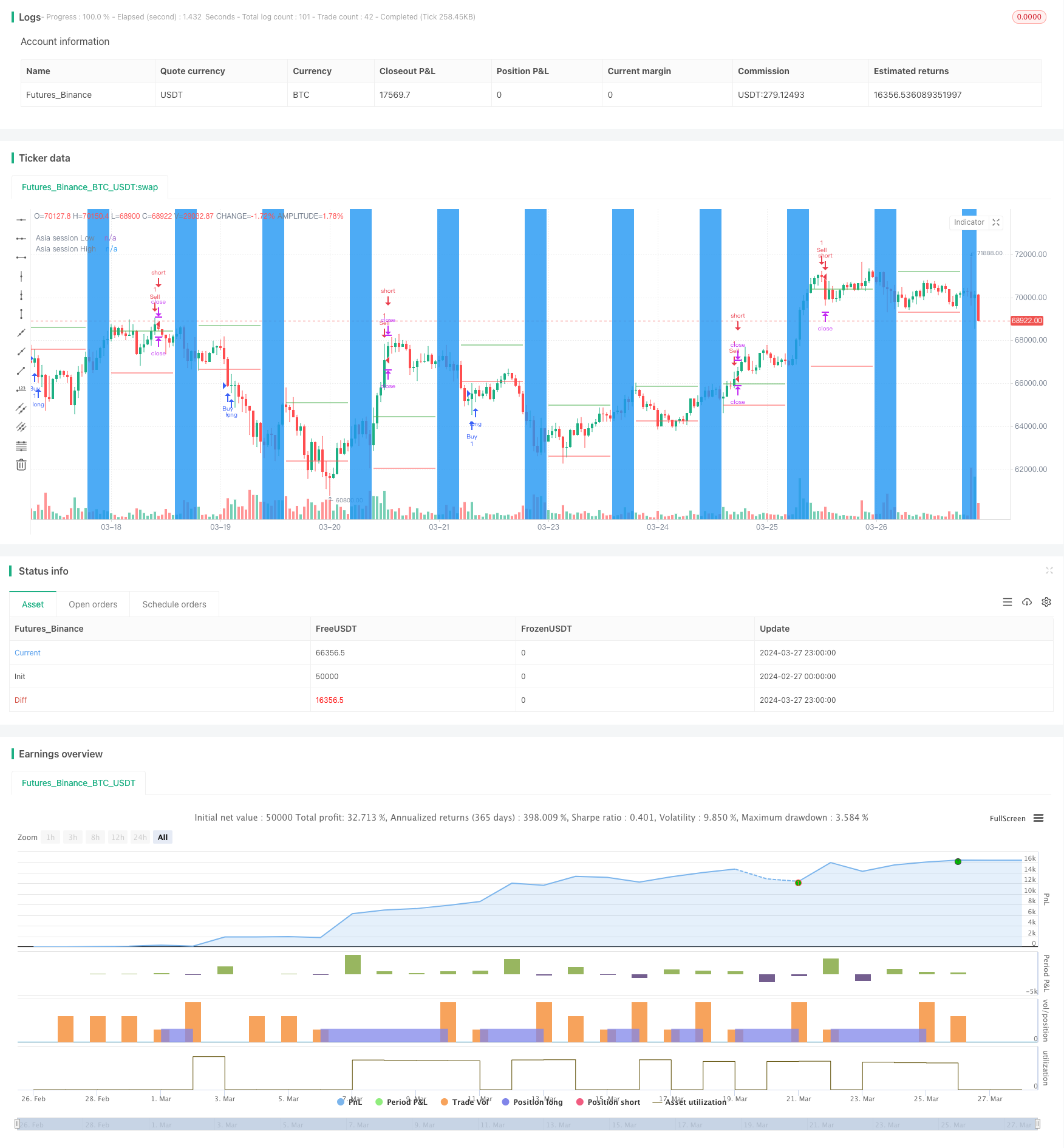

start: 2024-02-27 00:00:00

end: 2024-03-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Asia Session", overlay=true)

var hourSessionStart = input(19, "Asia session start hour", minval=0, maxval=23)

var hourSessionStop = input(1, "Asia session end hour", minval=0, maxval=23)

var offsetHours = input(3, "Offset hours after Asia session end")

var float hi = na

var float lo = na

var float plotHi = na

var float plotLo = na

var bool inSession = na

var bool enteringSession = na

var bool exitingSession = na

inSession := (hour >= hourSessionStart or hour < hourSessionStop)

enteringSession := inSession and not inSession[1]

exitingSession := not inSession and inSession[1]

if enteringSession

plotLo := na

plotHi := na

if inSession

lo := min(low, nz(lo, 1.0e23))

hi := max(high, nz(hi))

if exitingSession

plotLo := lo

plotHi := hi

lo := na

hi := na

bgcolor(inSession ? color.blue : na)

plot(plotLo, "Asia session Low", color.red, style=plot.style_linebr)

plot(plotHi, "Asia session High", color.green, style=plot.style_linebr)

// Implementazione delle condizioni di entrata

var float asiaSessionLow = na

var float asiaSessionHigh = na

var int maxTrades = 100000 // Impostiamo il massimo numero di operazioni contemporanee

var int tradesOpened = 0 // Variabile per tenere traccia del numero di operazioni aperte

var bool tradeOpened = false

var bool operationClosed = false // Nuova variabile per tenere traccia dello stato di chiusura dell'operazione

// Calcolo del range asiatico

if (inSession)

asiaSessionLow := lo

asiaSessionHigh := hi

// Apertura di un solo trade al giorno

if (enteringSession)

tradeOpened := false

// Condizioni di entrata

var float stopLoss = 300 * syminfo.mintick

var float takeProfit = 300 * syminfo.mintick

if (not tradeOpened and not operationClosed and close < asiaSessionLow and tradesOpened < maxTrades and hour >= hourSessionStop + offsetHours)

strategy.entry("Buy", strategy.long)

tradeOpened := true

tradesOpened := tradesOpened + 1 // Incrementiamo il contatore delle operazioni aperte

if (not tradeOpened and not operationClosed and close > asiaSessionHigh and tradesOpened < maxTrades and hour >= hourSessionStop + offsetHours)

strategy.entry("Sell", strategy.short)

tradeOpened := true

tradesOpened := tradesOpened + 1 // Incrementiamo il contatore delle operazioni aperte

// Impostazione dello stop loss e del take profit

strategy.exit("Stop Loss / Take Profit", "Buy", stop=close - stopLoss, limit=close + takeProfit)

strategy.exit("Stop Loss / Take Profit", "Sell", stop=close + stopLoss, limit=close - takeProfit)