概述

该策略结合了波动率分析和趋势跟踪技术,旨在捕捉受市场波动率影响的价格变动,同时有效识别和跟踪趋势。策略通过ATR指标对趋势跟踪策略进行动态调整,以适应不断变化的市场环境,更有效地捕捉趋势。策略使用布林带的长度和偏差等可定制参数,以及使用或绕过波动率过滤器的选项,为交易者提供灵活性。策略提供了趋势线、买卖信号和基于波动率的过滤器的清晰可视化,使交易者更容易解释信号并做出明智的交易决策。

策略原理

该策略的核心原理是将波动率分析与趋势跟踪相结合。它通过使用ATR指标来调整趋势跟踪参数,以适应不同的市场波动率环境。在高波动率期间,策略会相应地扩大趋势线,以避免频繁的虚假信号;而在低波动率期间,策略会收缩趋势线,以更敏感地捕捉趋势变化。

该策略使用布林带来确定趋势方向。当收盘价突破上轨时,表明上升趋势;当收盘价跌破下轨时,表明下降趋势。策略通过动态调整布林带的宽度(基于ATR)来适应不同的市场波动率。

在确定趋势方向后,该策略使用趋势线来生成交易信号。当趋势从下降转为上升时,策略会发出买入信号;当趋势从上升转为下降时,策略会发出卖出信号。这种方法可以有效地捕捉趋势,同时通过波动率过滤器来减少虚假信号。

策略优势

动态适应性:该策略通过ATR指标对趋势跟踪参数进行动态调整,以适应不断变化的市场环境,提高了趋势捕捉的有效性。

减少虚假信号:通过结合波动率分析,该策略能够过滤掉低波动率期间的噪声和虚假信号,提高信号的准确性。

灵活性:该策略提供了可定制的参数,如布林带的长度和偏差,以及使用或绕过波动率过滤器的选项,使交易者能够根据自己的风险承受能力和市场偏好进行调整。

清晰可视化:该策略提供了趋势线、买卖信号和基于波动率的过滤器的清晰可视化,使交易者更容易解释信号并做出明智的交易决策。

策略风险

参数敏感性:该策略的性能在很大程度上取决于布林带和ATR的参数选择。不恰当的参数设置可能导致策略表现不佳。

趋势识别延迟:像所有趋势跟踪策略一样,该策略在识别趋势变化方面存在一定的延迟。这可能导致错过趋势初期的一部分潜在利润。

范围束缚市场:在波动率较低且价格在狭窄区间内波动的市场环境中,该策略可能会产生较多的虚假信号,导致频繁的交易和潜在的损失。

策略优化方向

参数优化:对布林带的长度、偏差以及ATR的长度进行优化,以找到最佳的参数组合,从而提高策略的性能。

信号过滤:引入额外的技术指标或价格行为模式,如RSI或MACD,以进一步过滤交易信号,提高信号的可靠性。

动态止损:根据ATR或其他波动率指标设置动态止损水平,以更好地控制风险并保护利润。

多时间框架分析:结合不同时间框架的趋势分析,以确认趋势的强度和可持续性,从而做出更明智的交易决策。

总结

波动率趋势跟踪策略通过将波动率分析与趋势跟踪相结合,为交易者提供了一个强大的框架,用于应对动态的市场条件。该策略能够适应不断变化的市场环境,减少虚假信号,并提供清晰的视觉线索,使其成为寻求趋势交易机会且希望有效管理风险的交易者的宝贵工具。通过进一步优化参数、改进信号过滤和动态风险管理,该策略有望提高其性能和可靠性。

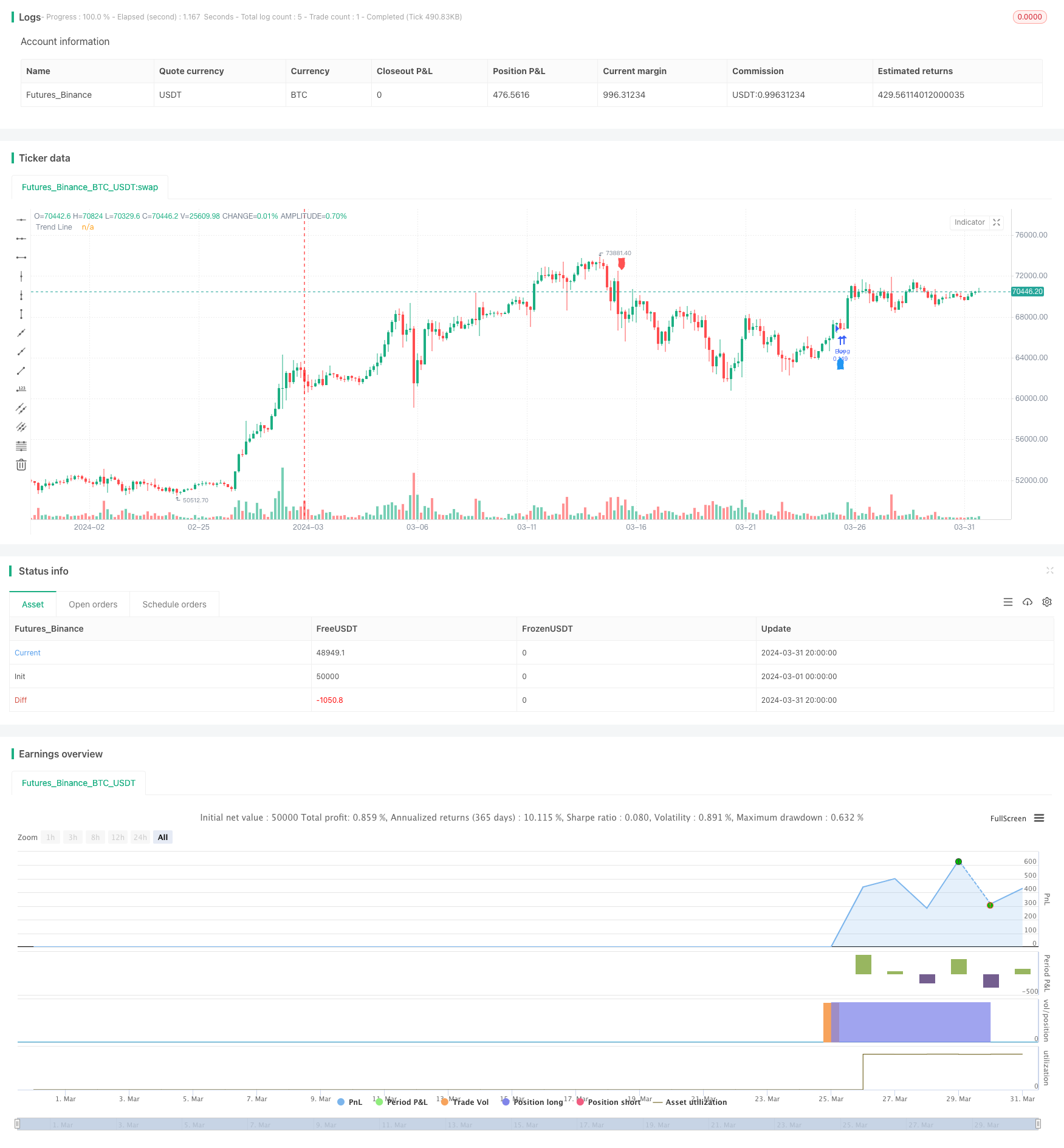

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// © Julien_Eche

//@version=5

strategy('Volatility Trend Strategy', overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=20)

// Input parameters

Length = input.int(defval=20, title='Length', minval=1) // Length parameter for Bollinger Bands

Dev = input.float(defval=1.0, title='Deviation', minval=0.1, step=0.05) // Deviation parameter for Bollinger Bands

UseFilter = input(defval=true, title='Use Filter') // Option to use filter

ATRLength = input.int(defval=14, title='ATR Length', minval=1) // ATR Length parameter

HideLabels = input(defval=false, title='Hide Labels') // Option to hide labels

// Calculation of Bollinger Bands

UpperBand = ta.sma(close, Length) + ta.stdev(close, Length) * Dev

LowerBand = ta.sma(close, Length) - ta.stdev(close, Length) * Dev

// Initialization of variables

Line = 0.0

Trend = 0.0

// Calculation of Average True Range (ATR)

atrValue = ta.atr(ATRLength)

// Determine signal based on Bollinger Bands

Signal = close > UpperBand ? 1 : close < LowerBand ? -1 : 0

// Determine trend line based on signal and filter option

if Signal == 1

if UseFilter == true

Line := low - atrValue

if Line < Line[1]

Line := Line[1]

else

Line := low

if Line < Line[1]

Line := Line[1]

if Signal == -1

if UseFilter == true

Line := high + atrValue

if Line > Line[1]

Line := Line[1]

else

Line := high

if Line > Line[1]

Line := Line[1]

if Signal == 0

Line := Line[1]

// Determine trend direction

Trend := Trend[1]

if Line > Line[1]

Trend := 1

if Line < Line[1]

Trend := -1

// Determine buy and sell signals

BuySignal = Trend[1] == -1 and Trend == 1 ? true : false

SellSignal = Trend[1] == 1 and Trend == -1 ? true : false

// Plot trend line

plot(Line, color=Trend > 0 ? color.new(color.blue, 100) : color.new(color.red, 100), style=plot.style_line, linewidth=2, title='Trend Line')

// Plot buy and sell signals

plotshape(BuySignal == true and HideLabels == false ? Line - atrValue : na, style=shape.labelup, location=location.absolute, color=color.new(color.blue, 0), textcolor=color.new(color.white, 0), offset=0, size=size.auto)

plotshape(SellSignal == true and HideLabels == false ? Line + atrValue : na, style=shape.labeldown, location=location.absolute, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), offset=0, size=size.auto)

// Entry and exit strategy

if BuySignal

strategy.entry('Buy', strategy.long)

if SellSignal

strategy.close('Buy')