概述

该策略结合了多个技术指标,包括相对强弱指数(RSI)、移动平均线收敛发散指标(MACD)和几个不同周期的简单移动平均线(SMA),旨在为比特币(BTC)交易提供全面的分析工具。该策略的主要思路是通过综合考虑不同指标的信号,在RSI处于特定区间、MACD出现金叉、价格低于多个SMA时进行做多,同时设置止损和止盈,并在RSI达到50时更新止损位置。

策略原理

- 计算RSI、MACD和不同周期的SMA指标。

- 判断前一个RSI值是否低于下限或高于上限,当前RSI值是否在下限和上限之间,MACD是否出现金叉,以及收盘价是否低于所有SMA。

- 如果满足上述条件且当前无持仓,则开仓做多。

- 根据风险百分比设置止损和止盈价格。

- 如果持有多头仓位且RSI达到50,则将止损位置更新为最高价。

- 如果MACD出现死叉,则平仓。

策略优势

- 综合考虑多个技术指标,提高信号的可靠性。

- 在RSI处于特定区间时开仓,避免在极端情况下入场。

- 设置止损和止盈,控制风险。

- 动态调整止损位置,锁定部分利润。

- 根据MACD死叉信号及时平仓,减少潜在损失。

策略风险

- 在震荡市场中,频繁的交易信号可能导致过多的交易和手续费损失。

- 固定的风险百分比止损和止盈可能无法适应不同的市场环境。

- 仅依赖技术指标而忽略基本面因素可能导致错误的交易决策。

策略优化方向

- 引入更多的技术指标或市场情绪指标,以提高信号的准确性。

- 根据市场波动性动态调整止损和止盈水平,以适应不同的市场环境。

- 结合基本面分析,如重大新闻事件或监管政策变化,以辅助交易决策。

- 考虑不同时间周期的指标,捕捉多个时间尺度上的交易机会。

总结

该策略通过综合运用RSI、MACD和SMA等技术指标,为比特币交易提供了一个全面的分析框架。它利用多个指标的共同确认来生成交易信号,并设置了风险控制措施。然而,策略仍有优化空间,如引入更多指标、动态调整参数以及结合基本面分析等。在实际应用中,交易者应根据自己的风险偏好和市场环境对策略进行适当调整。

策略源码

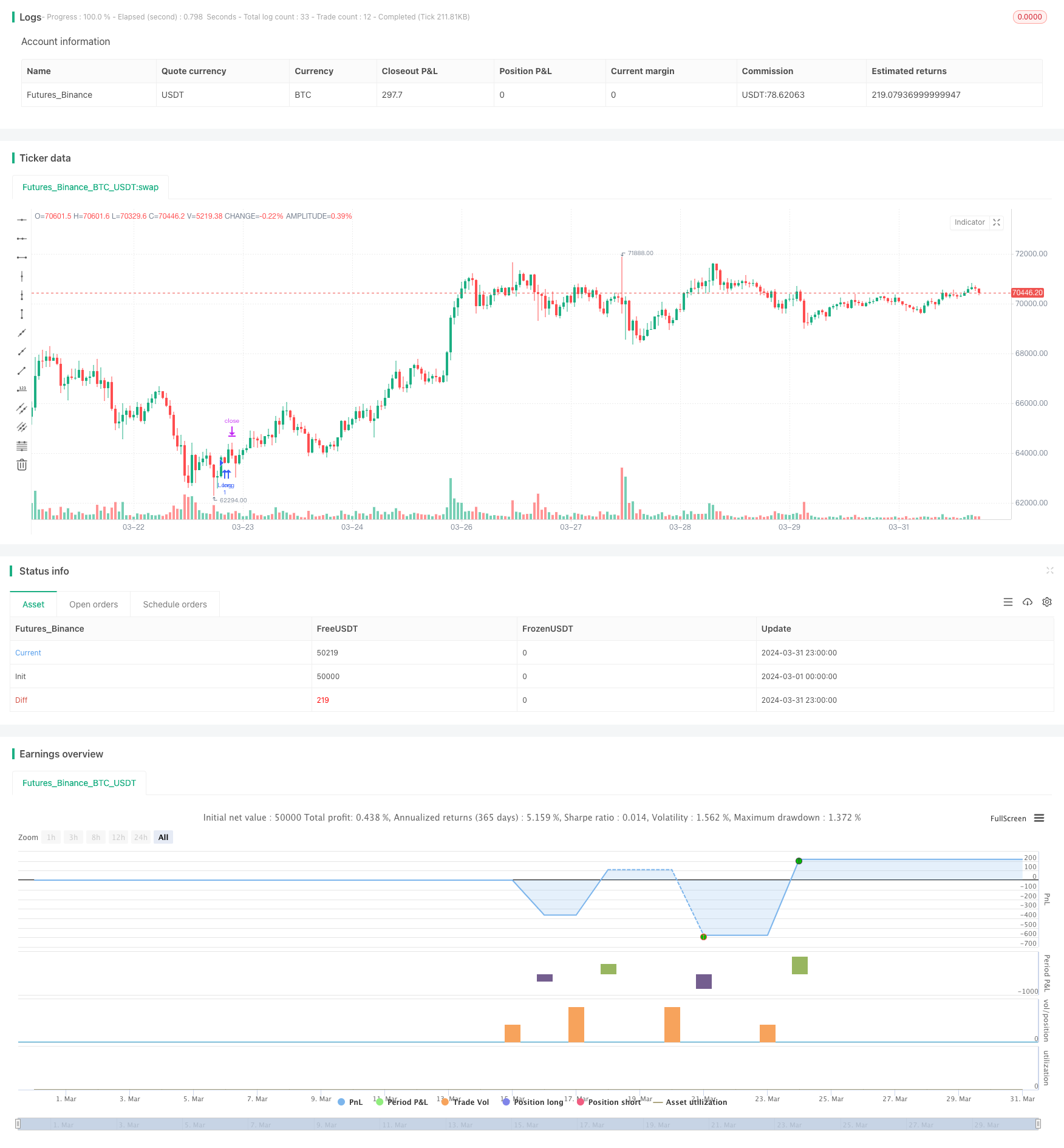

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Advanced Strategy", shorttitle="1M Advanced Strat", overlay=true)

// Input settings

rsiLength = input(14, title="RSI Length")

rsiLowerBound = input(20, title="RSI Lower Bound")

rsiUpperBound = input(30, title="RSI Upper Bound")

atrLength = input(14, title="ATR Length")

smaFastLength = input(20, title="SMA 20 Length")

smaMediumLength = input(50, title="SMA 50 Length")

smaSlowLength = input(200, title="SMA 200 Length")

riskPercent = input(0.005, title="Risk Percentage for SL and Target")

// Calculate indicators

rsiValue = rsi(close, rsiLength)

[macdLine, signalLine, _] = macd(close, 12, 26, 9)

smaFast = sma(close, smaFastLength)

smaMedium = sma(close, smaMediumLength)

smaSlow = sma(close, smaSlowLength)

atrValue = atr(atrLength)

// Checking previous RSI value

prevRsiValue = rsi(close[1], rsiLength)

// Conditions for Entry

longCondition = rsiValue > rsiLowerBound and rsiValue < rsiUpperBound and prevRsiValue < rsiLowerBound or prevRsiValue > rsiUpperBound and crossover(macdLine, signalLine) and close < smaFast and close < smaMedium and close < smaSlow

// Strategy Entry

if (longCondition and not strategy.position_size)

strategy.entry("Long", strategy.long)

// Setting Stop Loss and Take Profit

stopLoss = close - riskPercent * close

takeProfit = close + atrValue

strategy.exit("Exit Long", "Long", stop = stopLoss, limit = takeProfit)

//Update Stop Loss when RSI reaches 50

if (strategy.position_size > 0 and rsiValue >= 50)

strategy.exit("Update SL", "Long", stop = high)

// Conditions for Exit

shortCondition = crossunder(macdLine, signalLine)

// Strategy Exit

if (shortCondition)

strategy.close("Long")