概述

“双均线滞后突破策略”是一种常用的技术分析交易策略。该策略结合了两条不同周期的简单移动平均线(SMA)和平均真实波幅(ATR)指标,旨在捕捉市场趋势转折点,实现低风险高收益的交易。其核心思路是利用均线的滞后性和市场波动性,当价格突破均线且波动率处于可控范围内时产生交易信号。

策略原理

该策略的主要原理如下:

- 计算两条不同周期的简单移动平均线(SMA),默认周期分别为14和50。

- 计算ATR指标,用于衡量市场波动率,默认周期为14。

- 绘制ATR上下轨,作为价格波动的参考区间。上轨由最高价加上ATR乘以倍数(默认1.5)得到,下轨由最低价减去ATR乘以倍数得到。

- 当收盘价上穿短期均线且短期均线在长期均线之上时,产生做多信号,并在K线下方绘制向上箭头。

- 当收盘价下穿短期均线且短期均线在长期均线之下时,产生做空信号,并在K线上方绘制向下箭头。

- 设置止损和止盈位,止损位为最低价减去ATR乘以倍数,止盈位为开仓价加上(开仓价-止损位)乘以2倍。

通过以上原理可以看出,该策略结合均线系统的趋势判断和ATR指标的波动率衡量,以趋势跟踪为主,同时控制回撤风险,是一个趋势型策略。

优势分析

“双均线滞后突破策略”具有以下优势:

- 趋势跟踪:通过均线系统判断趋势方向,捕捉大的市场趋势,顺应市场。

- 风险控制:利用ATR指标衡量市场波动率,设置合理的止损位,将回撤控制在可接受范围内。

- 参数灵活:均线周期、ATR周期和倍数等参数可以根据不同市场和品种进行优化和调整,具有一定的普适性。

- 直观明了:交易信号简单明了,适合不同层次的投资者使用。

风险分析

尽管该策略具有一定优势,但仍存在以下风险:

- 频繁交易:当市场波动较大、趋势不明显时,该策略可能产生频繁的交易信号,增加交易成本。

- 滞后性:均线系统本质上具有一定的滞后性,在市场转折初期可能出现一定的回撤。

- 参数优化:不同参数设置对策略表现有较大影响,需要针对不同市场和品种进行参数优化,增加了实施难度。

针对以上风险,可以从以下方面进行优化和改进: 1. 引入趋势过滤:在产生交易信号前,先判断大周期的趋势方向,只有在大周期趋势明确的情况下才进行交易,减少频繁交易。 2. 优化止损止盈:可以考虑引入移动止损、波动率止损等动态止损方式,以及根据市场波动率动态调整止盈位,提高策略灵活性。 3. 组合优化:将该策略与其他技术指标或者基本面因素相结合,提高策略稳健性。

优化方向

该策略可以从以下几个方面进行优化:

- 参数自适应优化:针对不同品种和周期,自动寻找最优参数组合,减少人工参数调试的工作量。可以采用遗传算法、网格搜索等方法进行优化。

- 信号过滤:在产生交易信号后,可以进一步引入其他技术指标或者基本面因素对信号进行二次确认,提高信号质量。比如加入成交量指标,判断趋势强度;加入宏观经济数据,判断大环境是否有利于趋势延续。

- 仓位管理:在开仓时,可以根据市场波动率、账户风险等因素动态调整仓位大小,控制单笔交易风险。比如采用凯利公式、固定比例法等方法进行仓位管理。

- 移动止损:初始止损位是固定的,随着价格向有利方向移动,可以考虑将止损位也向有利方向移动,降低回撤,提高资金利用效率。常见的有追踪止损、破位止损等方法。

以上优化可以提高策略的适应性、稳健性和盈利能力,但需要注意的是,过度优化可能导致策略曲线拟合,在样本外表现不佳,因此需要在样本内外进行充分的回测验证。

总结

“双均线滞后突破策略”是一个经典的趋势跟踪型策略,通过均线系统判断趋势方向,利用ATR指标控制风险,在捕捉趋势行情的同时兼顾风险管理。尽管存在一定的滞后性和频繁交易的问题,但通过优化止损止盈、引入信号过滤、参数自适应优化、仓位管理等方法,可以进一步提升该策略的表现,使其成为一个实用的量化交易策略。

策略源码

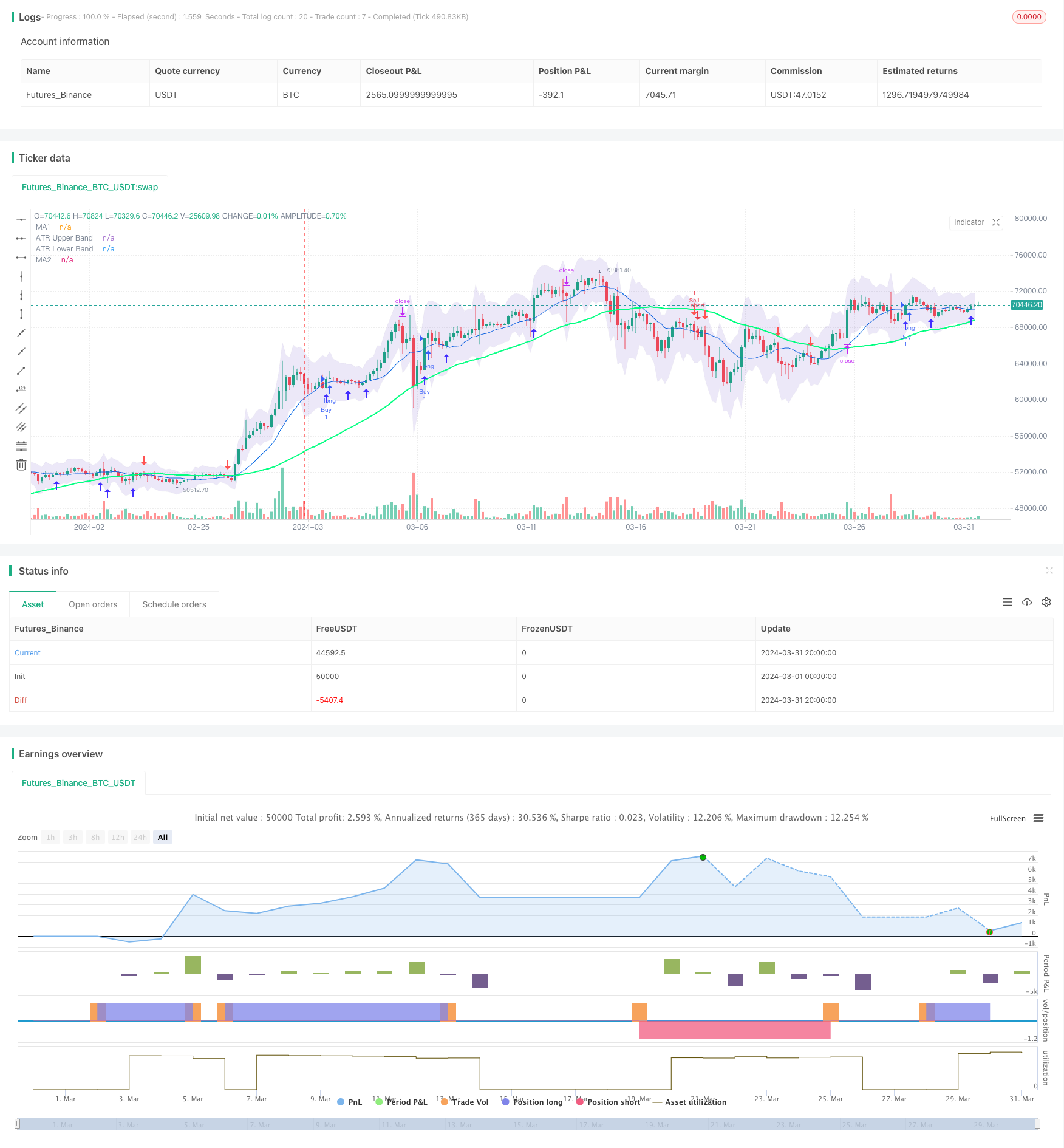

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="2 Moving Averages", shorttitle="2MA", overlay=true)

// Moving Averages

len = input(14, minval=1, title="Length MA1")

src = input(close, title="Source MA1")

ma1 = sma(src, len)

len2 = input(50, minval=1, title="Length MA2")

src2 = input(close, title="Source MA2")

ma2 = sma(src2, len2)

// Plotting Moving Averages

plot(ma1, color=#0b6ce5, title="MA1")

plot(ma2, color=#00ff80, linewidth=2, title="MA2")

// ATR Bands

atrLength = input(14, title="ATR Length")

atrMultiplier = input(1.5, title="ATR Multiplier")

upperBand = high + atr(atrLength) * atrMultiplier

lowerBand = low - atr(atrLength) * atrMultiplier

u =plot(upperBand, color=color.rgb(217, 220, 223, 84), title="ATR Upper Band")

l = plot(lowerBand, color=color.rgb(217, 220, 223, 84), title="ATR Lower Band")

fill(u, l, color=#471eb821, title="ATR Background")

// Conditions for plotting arrows

upArrowCondition = ma1 > ma2 and crossover(close, ma1)

downArrowCondition = ma1 < ma2 and crossunder(close, ma1)

// Plotting arrows

plotshape(upArrowCondition, style=shape.arrowup, color=color.rgb(66, 45, 255), size=size.normal, location=location.belowbar, title="Up Arrow")

plotshape(downArrowCondition, style=shape.arrowdown, color=color.red, size=size.normal, location=location.abovebar, title="Down Arrow")

// Checkbox for trade execution

showTrades = input(true, title="Hiển thị giao dịch")

// Buy Condition

if (upArrowCondition and showTrades)

strategy.entry("Buy", strategy.long)

// Sell Condition

if (downArrowCondition and showTrades)

strategy.entry("Sell", strategy.short)

// Stop Loss and Take Profit

stopLossBuy = low - atr(14) * atrMultiplier

takeProfitBuy = close + (close - stopLossBuy) * 2

stopLossSell = high + atr(14) * atrMultiplier

takeProfitSell = close - (stopLossSell - close) * 2

strategy.exit("Exit Buy", "Buy", stop=stopLossBuy, limit=takeProfitBuy)

strategy.exit("Exit Sell", "Sell", stop=stopLossSell, limit=takeProfitSell)