这个策略名为”动态阈值价格变化突破策略”。该策略的主要思路是通过设置一个动态阈值,当价格变化率超过该阈值时产生买入信号,当价格变化率低于该阈值的负值时产生卖出信号。同时,策略还设置了止损,当价格跌破前6根K线的最低价时平仓。

策略原理

该策略的核心是计算价格变化率,通过当前收盘价除以前一个收盘价再减去1来得到。然后,将计算得到的价格变化率与用户输入的阈值进行比较,当价格变化率大于等于阈值时,如果当前没有持仓或者持有空头头寸,则产生买入信号;当价格变化率小于等于阈值的负值时,如果当前没有持仓或者持有多头头寸,则产生卖出信号。在产生买入信号后,策略会记录之前6根K线的最低价作为止损价位,一旦价格跌破止损价位,策略就会平掉多头头寸。

策略优势

- 该策略使用了动态阈值,可以适应不同的市场环境,具有一定的灵活性。

- 策略逻辑简单清晰,易于理解和实现。

- 设置了止损,在一定程度上控制了风险。

- 适合在上涨行情中使用,可以有效捕捉上涨趋势。

策略风险

- 该策略在震荡行情中可能会出现频繁交易的情况,导致交易成本增加。

- 止损设置可能不够灵活,在某些情况下可能导致过早止损。

- 策略只考虑了价格变化率这一个因素,没有考虑其他可能影响价格走势的因素,如成交量、市场情绪等。

策略优化方向

- 可以考虑引入更多的指标,如成交量、波动率等,以提高策略的可靠性。

- 可以优化止损设置,如使用移动止损或者动态止损,使止损更加灵活。

- 可以对参数进行优化,如阈值的大小、止损的计算周期等,以找到最优的参数组合。

- 可以加入仓位管理,根据市场情况动态调整仓位,以控制风险。

总结

“动态阈值价格变化突破策略”通过比较价格变化率与动态阈值来产生交易信号,适合在上涨行情中使用。该策略逻辑简单清晰,具有一定的灵活性和风险控制能力。但是,该策略也存在一些不足,如在震荡行情中可能出现频繁交易、止损设置不够灵活等。未来可以考虑从引入更多指标、优化止损设置、优化参数、加入仓位管理等方面对策略进行优化,以进一步提高策略的表现。

策略源码

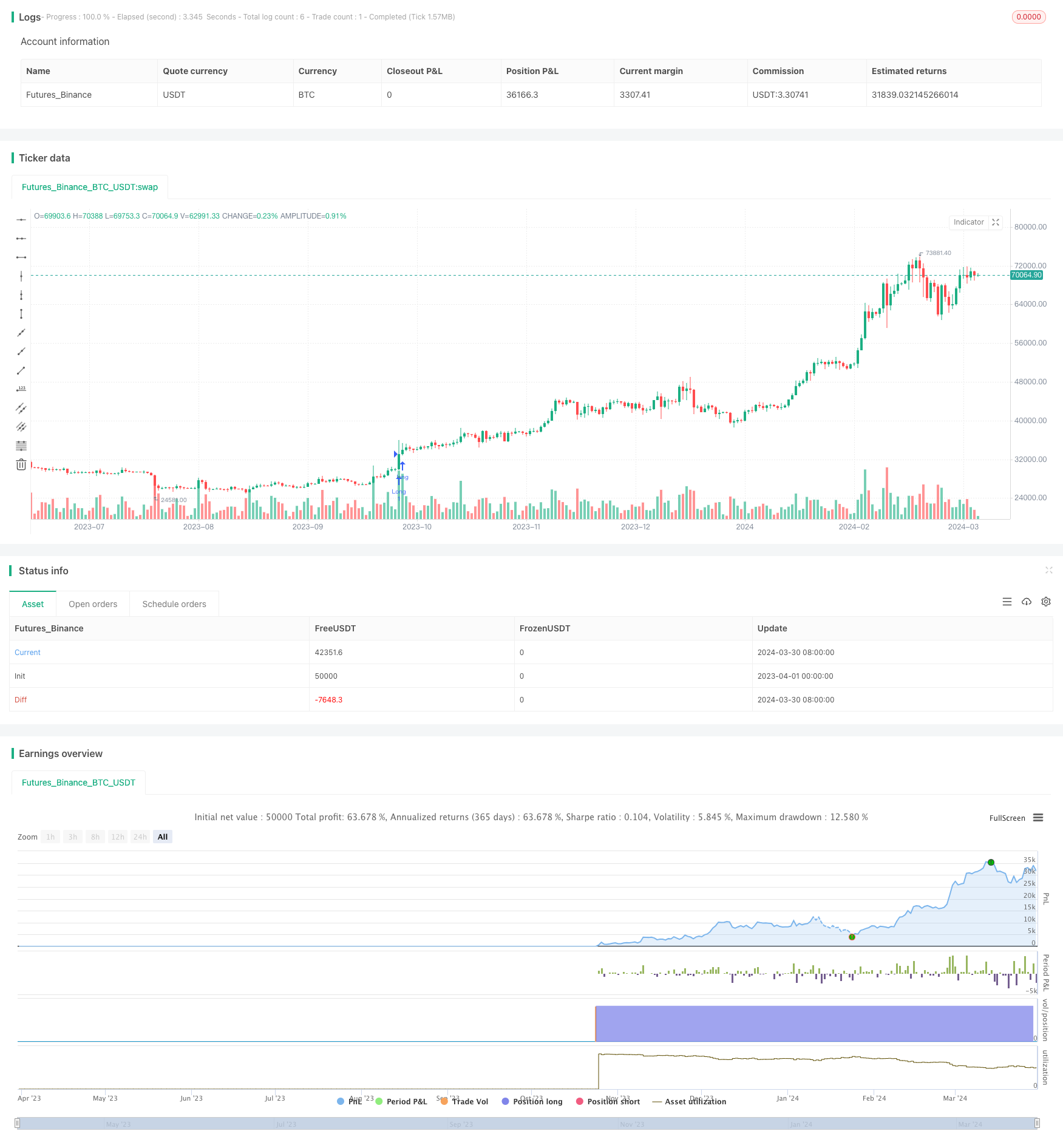

/*backtest

start: 2023-04-01 00:00:00

end: 2024-03-31 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Price Change", shorttitle="Price Change", overlay=true)

change = input(00.1, title="Change", minval=0.0001, maxval=1, type=input.float)

// Calculate price change

priceChange = close / close[1] - 1

// Buy and Sell Signals

buyp = priceChange >= change

sellp = priceChange <= (change * -1)

// Initialize position and track the current position

var int position = na

// Strategy entry conditions

buy_condition = buyp and (na(position) or position == -1)

sell_condition = sellp and (na(position) or position == 1)

var float stop = na

if (buy_condition)

strategy.entry("Long", strategy.long)

stop := lowest(low, 6)

position := 1

if (sell_condition or low < stop)

strategy.close("Long")

position := -1

// Plot Buy and Sell signals using plotshape

plotshape(series=buy_condition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=sell_condition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)