概述

该策略结合了相对强弱指数(RSI)和布林带(Bollinger Bands)两个技术指标,当价格低于布林带下轨时产生买入信号,当价格高于布林带上轨时产生卖出信号。该策略只有在RSI指标和布林带指标同时处于超卖或超买状态时才会触发交易信号。

策略原理

- 根据设定的RSI参数计算RSI值。

- 使用布林带公式计算布林带中轨、上轨和下轨。

- 判断当前收盘价是否突破布林带上轨或下轨。

- 判断当前RSI值是否高于超买阈值或低于超卖阈值。

- 当布林带和RSI指标同时满足买入或卖出条件时,产生相应的交易信号。

策略优势

- 结合了趋势和动量两种技术指标,能够更全面地判断市场状态。

- 同时使用两个指标作为过滤条件,有效降低了假信号的出现概率。

- 代码逻辑清晰,参数设置灵活,适合不同市场环境和交易风格。

策略风险

- 在震荡市中,该策略可能会产生较多的亏损交易。

- 参数设置不当可能导致策略表现欠佳,需要根据实际情况进行优化。

- 该策略未设置止损,可能面临较大的回撤风险。

策略优化方向

- 可以根据市场特点和个人偏好,对RSI和布林带的参数进行优化。

- 引入其他技术指标如MACD、均线等,提高信号的可靠性。

- 设置合理的止损和止盈,控制单笔交易风险。

- 对于震荡市,可以考虑增加判断条件或减小仓位,降低频繁交易带来的成本。

总结

RSI和布林带双重策略通过结合趋势和动量指标,能够比较全面地判断市场状态,并给出相应的交易信号。但该策略在震荡市中表现可能欠佳,且未设置风险控制措施,因此实盘运用时需要谨慎。通过优化参数、引入其他指标和设置合理的止损止盈等方式,可以进一步提升该策略的稳定性和盈利能力。

策略源码

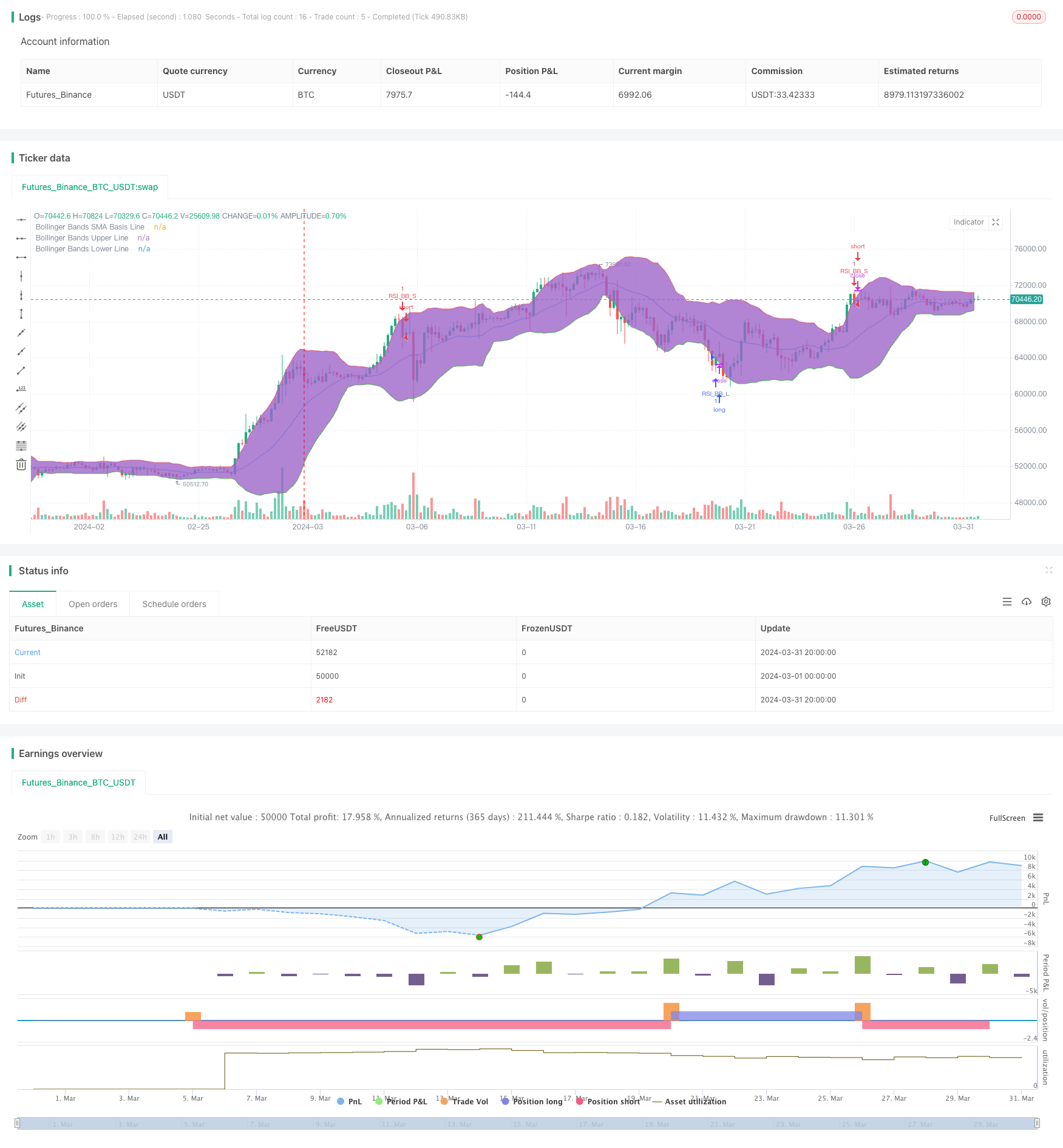

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Bollinger + RSI, Double Strategy (by ChartArt) v1.1", shorttitle="CA_-_RSI_Bol_Strat_1.1", overlay=true)

// ChartArt's RSI + Bollinger Bands, Double Strategy - Update

//

// Version 1.1

// Idea by ChartArt on January 18, 2015.

//

// This strategy uses the RSI indicator

// together with the Bollinger Bands

// to sell when the price is above the

// upper Bollinger Band (and to buy when

// this value is below the lower band).

//

// This simple strategy only triggers when

// both the RSI and the Bollinger Bands

// indicators are at the same time in

// a overbought or oversold condition.

//

// In this version 1.1 the strategy was

// both simplified for the user and

// made more successful in backtesting.

//

// List of my work:

// https://www.tradingview.com/u/ChartArt/

//

// __ __ ___ __ ___

// / ` |__| /\ |__) | /\ |__) |

// \__, | | /~~\ | \ | /~~\ | \ |

//

//

///////////// RSI

RSIlength = input(14,title="RSI Period Length")

RSIoverSold = 30

RSIoverBought = 70

price = close

vrsi = rsi(price, RSIlength)

///////////// Bollinger Bands

BBlength = input(20, minval=1,title="Bollinger Period Length")

BBmult = input(2.0, minval=0.001, maxval=50,title="Bollinger Bands Standard Deviation")

BBbasis = sma(price, BBlength)

BBdev = BBmult * stdev(price, BBlength)

BBupper = BBbasis + BBdev

BBlower = BBbasis - BBdev

source = close

buyEntry = crossover(source, BBlower)

sellEntry = crossunder(source, BBupper)

plot(BBbasis, color=color.blue,title="Bollinger Bands SMA Basis Line")

p1 = plot(BBupper, color=color.red,title="Bollinger Bands Upper Line")

p2 = plot(BBlower, color=color.green,title="Bollinger Bands Lower Line")

fill(p1, p2)

// Entry conditions

crossover_rsi = crossover(vrsi, RSIoverSold) and crossover(source, BBlower)

crossunder_rsi = crossunder(vrsi, RSIoverBought) and crossunder(source, BBupper)

///////////// RSI + Bollinger Bands Strategy

if (not na(vrsi))

if (crossover_rsi)

strategy.entry("RSI_BB_L", strategy.long, comment="RSI_BB_L")

else

strategy.cancel(id="RSI_BB_L")

if (crossunder_rsi)

strategy.entry("RSI_BB_S", strategy.short, comment="RSI_BB_S")

else

strategy.cancel(id="RSI_BB_S")

相关推荐