概述

该策略利用布林带作为买卖信号,当价格突破下轨时买入,突破上轨时卖出。同时使用金字塔式加仓方式,当持仓数低于设定值时继续买入,高于设定值时卖出。该策略适用于有明显趋势的市场行情。

策略原理

- 计算布林带上轨、中轨和下轨。中轨为收盘价的简单移动平均线,上下轨为中轨加减收盘价标准差的倍数。

- 当收盘价低于或等于下轨时,产生买入信号;高于或等于上轨时,产生卖出信号。

- 若当前持仓数小于设定的金字塔加仓数,则继续买入;大于设定数则卖出。

- 在图表上绘制布林带的上中下轨。

策略优势

- 布林带能够量化价格的波动区间,提供明确的买卖信号,易于操作。

- 金字塔加仓方式能够放大趋势行情的收益。

- 布林带具有一定的趋势识别和风险控制能力,适合趋势交易者使用。

策略风险

- 当市场处于震荡行情时,频繁的买卖信号可能导致亏损。

- 金字塔加仓方式如果遇到趋势反转,放大了下跌风险。

- 布林带参数的选择需要根据不同市场和周期进行优化,不恰当的参数可能导致策略失效。

策略优化方向

- 可以结合其他指标如RSI、MACD等,对布林带信号进行二次确认,提高信号准确性。

- 对金字塔加仓的数量和比例进行控制,设置止损位置,降低下跌风险。

- 对布林带的参数如周期、倍数等进行优化测试,选择最佳参数组合。

- 在震荡市可以考虑使用布林带通道策略,在上下轨间进行高抛低吸。

总结

布林带突破策略利用价格相对布林带的位置产生趋势跟踪信号,同时通过金字塔加仓放大趋势收益。但在震荡市表现欠佳,并且金字塔加仓可能放大亏损。因此实际运用中需要结合其他指标验证信号,控制加仓风险,并对参数进行优化。同时要根据市场特点灵活调整策略。

策略源码

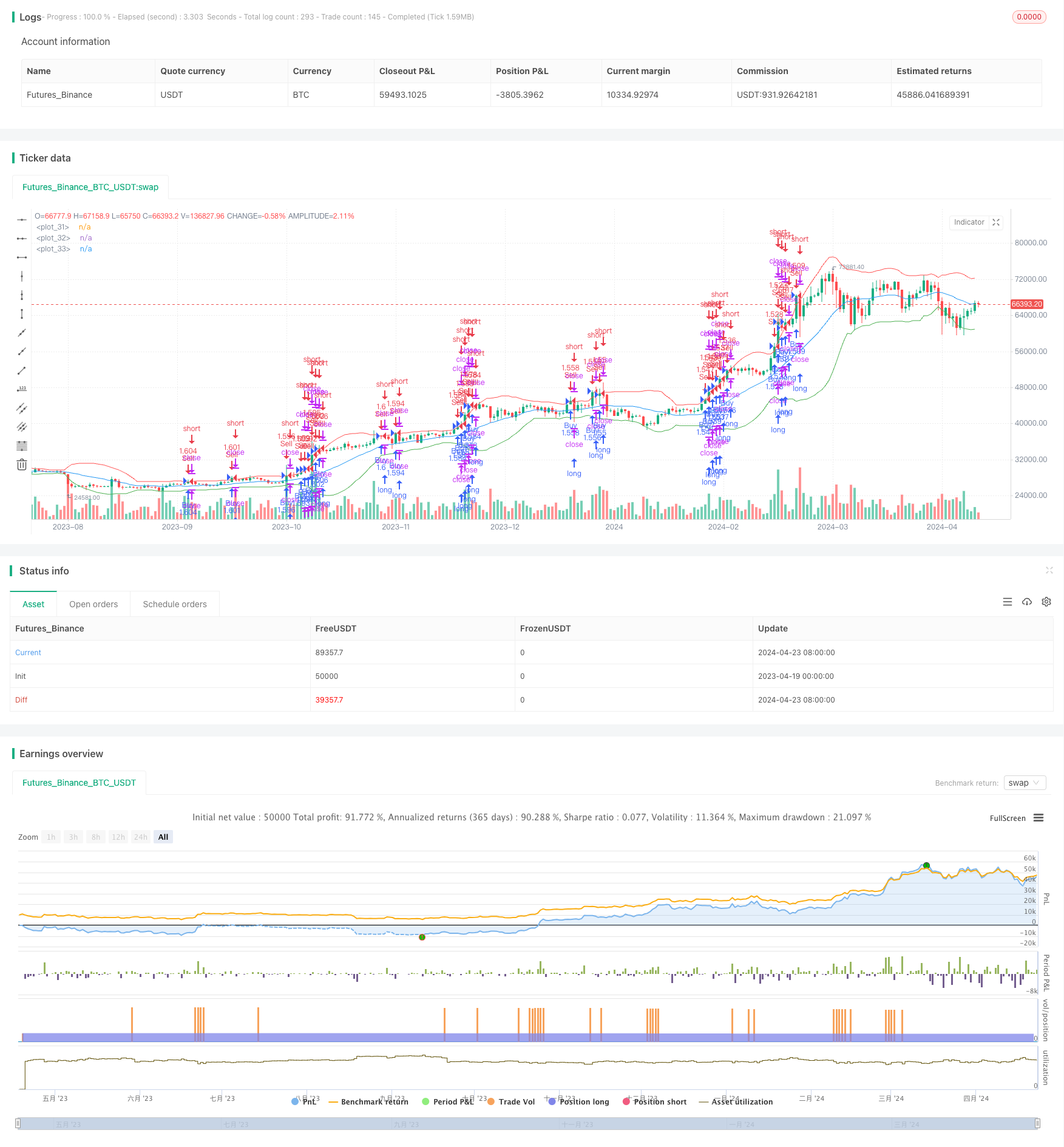

/*backtest

start: 2023-04-19 00:00:00

end: 2024-04-24 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands Breakout Strategy", overlay=true, initial_capital=100, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Définition des paramètres

length = input(20, title="Bollinger Bands Length")

multiplier = input(2.0, title="Multiplier")

pyramiding = input(10, title="Pyramiding")

// Calcul des bandes de Bollinger

basis = ta.sma(close, length)

dev = multiplier * ta.stdev(close, length)

upper_band = basis + dev

lower_band = basis - dev

// Règles d'entrée

buy_signal = close <= lower_band

sell_signal = close >= upper_band

// Gestion des positions

if (buy_signal)

strategy.entry("Buy", strategy.long)

if (sell_signal)

strategy.entry("Sell", strategy.short)

// Pyramiding

if (strategy.opentrades < pyramiding)

strategy.entry("Buy", strategy.long)

else if (strategy.opentrades > pyramiding)

strategy.entry("Sell", strategy.short)

// Tracé des bandes de Bollinger

plot(basis, color=color.blue)

plot(upper_band, color=color.red)

plot(lower_band, color=color.green)

相关推荐