概述

该策略基于相对强弱指数(RSI)指标的超卖信号,在日内低点买入,然后设置固定百分比的止盈和止损,回测策略在触及止盈和止损时的概率。主要思路是利用RSI指标超卖时的反转机会,在日内低点介入,博取反转带来的短期收益。同时,使用移动平均线过滤趋势,只在价格高于均线时入场做多。

策略原理

- 计算2周期的RSI指标和200周期简单移动平均线

- 当收盘价高于均线且RSI小于超卖阈值(默认10)时,在下一个交易日开盘买入

- 记录买入当日的最低价作为进场价

- 基于进场价计算6%的止盈价和3%的止损价

- 下个交易日,若触及止盈价则平仓止盈,若触及止损价则平仓止损

- 统计止盈和止损的次数,计算策略在设定周期内的胜率

优势分析

- 在日内低点买入,博取当日RSI指标超卖后的反转收益

- 固定百分比止盈和止损,控制单次交易风险

- 使用长周期均线过滤,减少逆势交易情况

- 简单易用,参数设置灵活,适合短线交易者

风险分析

- RSI超卖不能保证必然反转,市场在极端情况下会持续下跌

- 固定百分比止盈止损可能无法覆盖交易成本

- 入场点基于日内最低价,实际操作很难精准买在最低点

- 缺乏趋势判断,单纯依靠超买超卖信号,回报比可能不高

优化方向

- 使用自适应止盈止损,根据价格波动率等指标动态调整

- 加入趋势确认指标,如MACD,DMI等,避免逆势交易

- 优化入场点,如使用可变距离海龟交易法则

- 增加仓位管理,提高资金利用率和回报率

- 结合其他短周期指标,提高信号确认度,如布林带,KDJ等

总结

RSI2策略尝试捕捉RSI指标超卖后的日内反转机会,通过设置固定百分比止盈止损来控制风险,同时使用长周期均线来过滤逆势信号。该策略思路简单,适合短线投机交易者。但其也存在一定局限性,如缺乏趋势判断,难以精准买在最低点,固定止盈止损也限制了策略收益空间。未来可以从动态止盈止损,结合趋势指标,优化入场点,强化仓位管理等方面来改进该策略,提升系统性和鲁棒性,更好地适应多变的市场环境。

策略源码

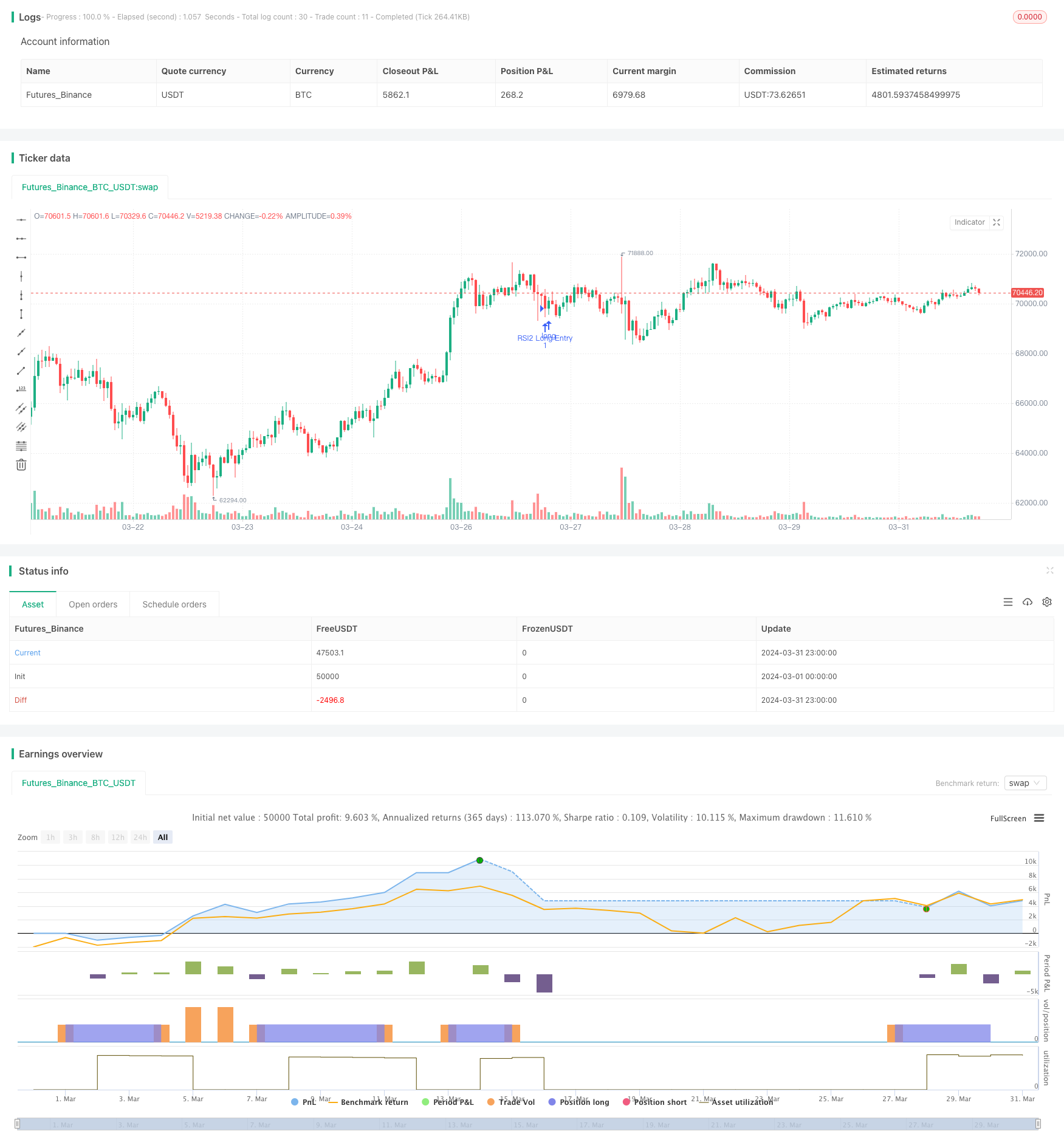

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © rajk1987

//@version=5

strategy("RSI2 strategy Raj", overlay=true, margin_long=100, margin_short=100)

rsi_len = input.int( 2, title = "RSI Length", group = "Indicators")

rsi_os = input.float(10, title = "RSI Oversold", group = "Indicators")

rsi_ob = input.float(90, title = "RSI OverBrought", group = "Indicators")

max_los = input.float(3,title = "Max Loss Percent", group = "Indicators")

tar_per = input.float(6,title = "Target Percent",group = "Indicators")

//Get the rsi value of the stock

rsi = ta.rsi(close, rsi_len)

sma = ta.sma(close,200)

var ent_dat = 0

var tar = 0.0

var los = 0.0

var bp = 0.0

if ((close > sma) and (rsi < rsi_os))

strategy.entry("RSI2 Long Entry", strategy.long,1)

ent_dat := time(timeframe = timeframe.period)

if(ent_dat == time(timeframe = timeframe.period))

bp := low //high/2 + low/2

tar := bp * (1 + (tar_per/100))

los := bp * (1 - (max_los/100))

if (time(timeframe = timeframe.period) > ent_dat)

strategy.exit("RSI2 Exit", "RSI2 Long Entry",qty = 1, limit = tar, stop = los, comment_profit = "P", comment_loss = "L")

//plot(rsi,"RSI")

//plot(bp,"BP")

//plot(tar,"TAR")

//plot(los,"LOS")

相关推荐