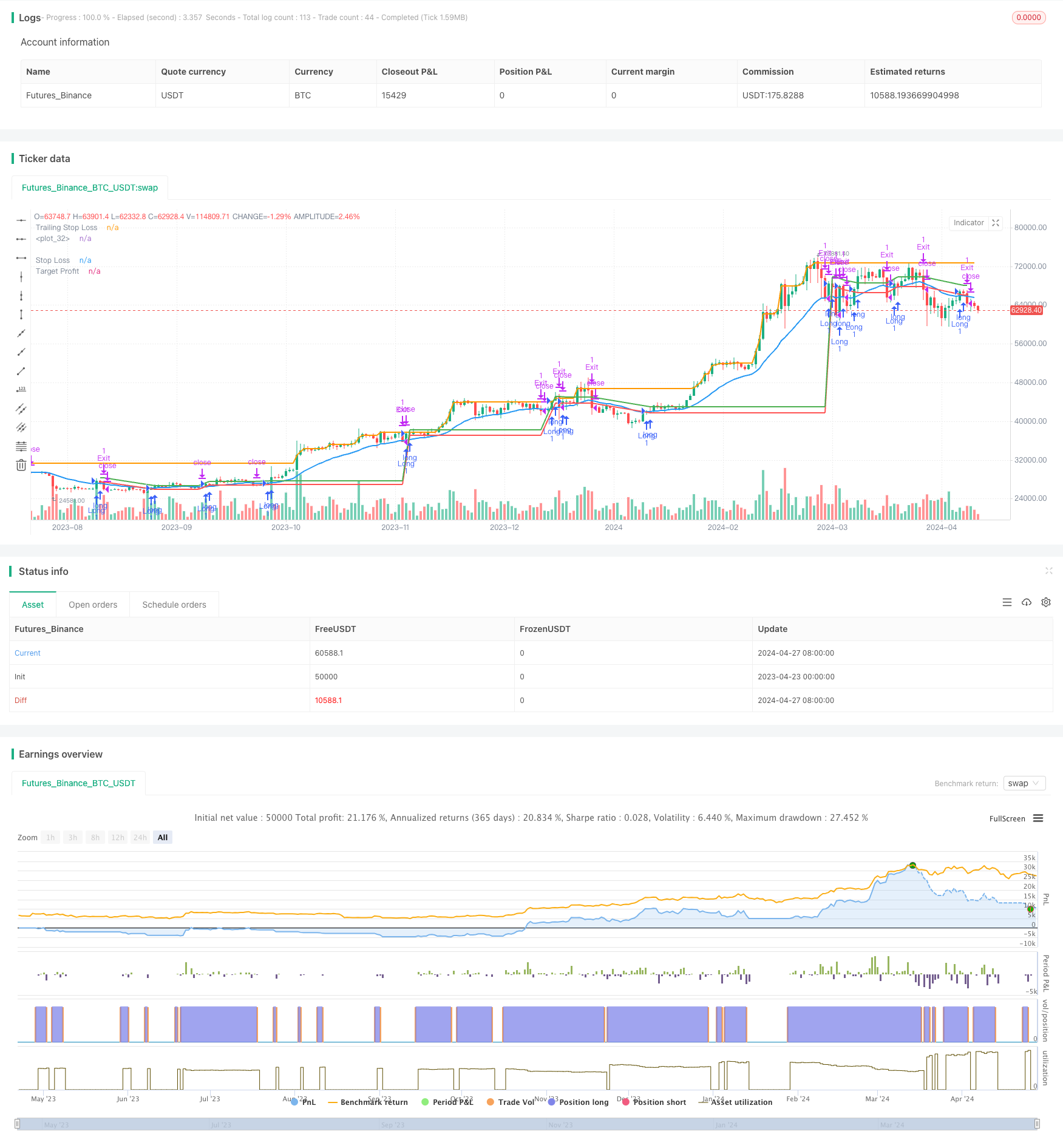

概述

该策略是一个基于指数移动平均线(EMA)交叉的多头策略。当价格从下方突破EMA时进行多头入场,当价格从上方跌破EMA时平仓。该策略还incorporates止损(SL)、目标盈利(TP)和追踪止损(TSL)作为辅助风险管理措施,以控制潜在的下行风险并lock定利润。

策略原理

- 计算指定周期(如20)的EMA。

- 当价格从下方突破EMA时,执行多头入场。

- 设置止损价格为入场价格的一定百分比(如1%)below。

- 设置目标盈利价格为入场价格的一定百分比(如2%)above。

- 设置追踪止损价格为当前价格的一定百分比(如0.5%)below,并随价格上涨而上移。

- 当价格从上方跌破EMA时,或者触及止损价格、目标盈利价格或追踪止损价格时,平仓退出。

策略优势

- 简单易懂:该策略基于广泛使用的技术指标EMA,易于理解和实现。

- 趋势跟随:通过在价格突破EMA时入场,该策略能够捕捉潜在的趋势性机会。

- 风险管理:内置止损、目标盈利和追踪止损等风控措施,有助于控制下行风险并lock定利润。

- 适应性强:EMA周期、止损百分比、目标盈利百分比和追踪止损百分比等参数可以根据不同的市场和交易风格进行灵活调整。

策略风险

- 假突破:价格可能在突破EMA后迅速反转,导致虚假信号和潜在损失。

- 滞后性:作为一个滞后指标,EMA可能在趋势已经开始后才发出信号,错失早期入场机会。

- 震荡市:在震荡市场条件下,频繁的EMA交叉可能导致过度交易和潜在亏损。

- 参数敏感:不恰当的参数设置(如EMA周期或百分比)可能导致策略性能不佳。

策略优化方向

- 结合其他指标:考虑将EMA与其他技术指标(如RSI、MACD等)结合,以提高信号可靠性并filter伪信号。

- 动态止损和盈利:根据市场波动性或价格水平动态调整止损和盈利目标,而非使用固定百分比。

- 趋势确认:在EMA交叉后,等待确认趋势建立的进一步证据(如更高的高点或更高的低点),以减少假突破的风险。

- 多时间框架分析:在不同时间框架(如日线、4小时等)上观察EMA交叉,寻求多个时间框架的趋势一致性确认。

总结

该策略提供了一个基于EMA交叉的简单而有效的交易方法,通过跟随突破EMA的潜在趋势,同时采用止损、目标盈利和追踪止损等风控措施。然而,策略存在假突破、信号滞后、震荡市表现欠佳和parameters敏感性等风险。优化策略可考虑与其他指标结合、动态止损盈利设置、趋势确认和多时间框架分析。实际应用中,需要根据具体市场和交易风格进行适当调整。在real账户中部署之前,务必在回测和模拟环境中全面测试和优化该策略。

策略源码

/*backtest

start: 2023-04-23 00:00:00

end: 2024-04-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Long Entry on EMA Cross with Risk Management", overlay=true)

// Parameters

emaLength = input(20, title="EMA Length")

stopLossPercent = input(1, title="Stop Loss %")

targetPercent = input(2, title="Target %")

trailingStopLossPercent = input(0.5, title="Trailing Stop Loss %")

// Calculate EMA

ema = ema(close, emaLength)

// Long Entry Condition

longCondition = crossover(close, ema)

// Exit Condition

exitCondition = crossunder(close, ema)

// Stop Loss, Target Profit, Trailing Stop Loss

stopLossLevel = strategy.position_avg_price * (1 - stopLossPercent / 100)

targetProfitLevel = strategy.position_avg_price * (1 + targetPercent / 100)

trailingStopLossLevel = close * (1 - trailingStopLossPercent / 100)

trailingStopLossLevel := max(trailingStopLossLevel, nz(trailingStopLossLevel[1]))

// Submit Long Order

strategy.entry("Long", strategy.long, when=longCondition)

// Submit Exit Orders

strategy.exit("Exit", "Long", stop=stopLossLevel, limit=targetProfitLevel, trail_offset=trailingStopLossLevel, when=exitCondition)

// Plot EMA

plot(ema, color=color.blue, linewidth=2)

// Plot Stop Loss, Target Profit, and Trailing Stop Loss Levels

plot(stopLossLevel, title="Stop Loss", color=color.red, linewidth=2)

plot(targetProfitLevel, title="Target Profit", color=color.green, linewidth=2)

plot(trailingStopLossLevel, title="Trailing Stop Loss", color=color.orange, linewidth=2)

相关推荐