概述

“基于Z值的趋势跟踪策略”利用了Z值这一统计学指标,通过衡量价格偏离其移动平均线的程度,并以标准差作为归一化尺度,来捕捉趋势性机会。该策略以其简洁性和有效性著称,尤其适用于价格运动常常回归均值的市场。与依赖多个指标的复杂系统不同,“Z值趋势策略”聚焦于明确、统计学上显著的价格变动,非常适合偏好精简、数据驱动型方法的交易者。

策略原理

该策略的核心在于Z值的计算。Z值通过计算当前价格与用户定义长度的价格指数移动平均线(EMA)之差,再除以同样长度的价格标准差而得:

z = (x - μ) / σ

其中,x为当前价格,μ为EMA均值,σ为标准差。

交易信号基于Z值穿越预定阈值而生成:

- 多头入场:当Z值向上穿越正阈值。

- 多头出场:当Z值向下穿越负阈值。

- 空头入场:当Z值向下穿越负阈值。

- 空头出场:当Z值向上穿越正阈值。

策略优势

- 简洁有效:该策略仅依赖少数参数,易于理解和实施,同时在捕捉趋势性机会方面卓有成效。

- 统计学基础:Z值作为成熟的统计学工具,为该策略提供了扎实的理论基础。

- 适应性强:通过调整阈值、EMA和标准差的计算周期等参数,该策略可灵活适应不同的交易风格和市场环境。

- 明确信号:基于Z值穿越阈值的交易信号简单明了,有利于快速决策和执行。

策略风险

- 参数敏感:不恰当的参数设置(如阈值过高或过低)可能导致交易信号失真,错失机会或招致损失。

- 趋势识别:在震荡或盘整市,该策略可能面临频繁的虚假信号,表现欠佳。

- 滞后效应:作为趋势跟踪策略,其入场和出场信号均存在一定滞后,可能错失最佳时机。

上述风险可通过持续的市场分析、参数优化和在回测的基础上审慎地实施,予以控制和缓释。

策略优化方向

- 动态阈值:引入与波动率相关的动态阈值,可有效适应不同市场状态,提升信号质量。

- 组合指标:综合其他技术指标如RSI、MACD等,对交易信号进行二次确认,提高可靠性。

- 仓位管理:纳入ATR等仓位控制机制,在震荡市中及时减仓,趋势市中及时加仓,优化收益风险比。

- 多时间尺度:跨越多个时间尺度计算Z值,捕捉不同级别的趋势,丰富策略维度。

总结

“基于Z值的趋势跟踪策略”以其简洁、稳健、灵活的特点,为捕捉趋势性机会提供了独特视角。通过合理的参数设置、审慎的风险管理和持续的优化,该策略有望成为量化交易者的得力助手,在多变的市场中稳健前行。

策略源码

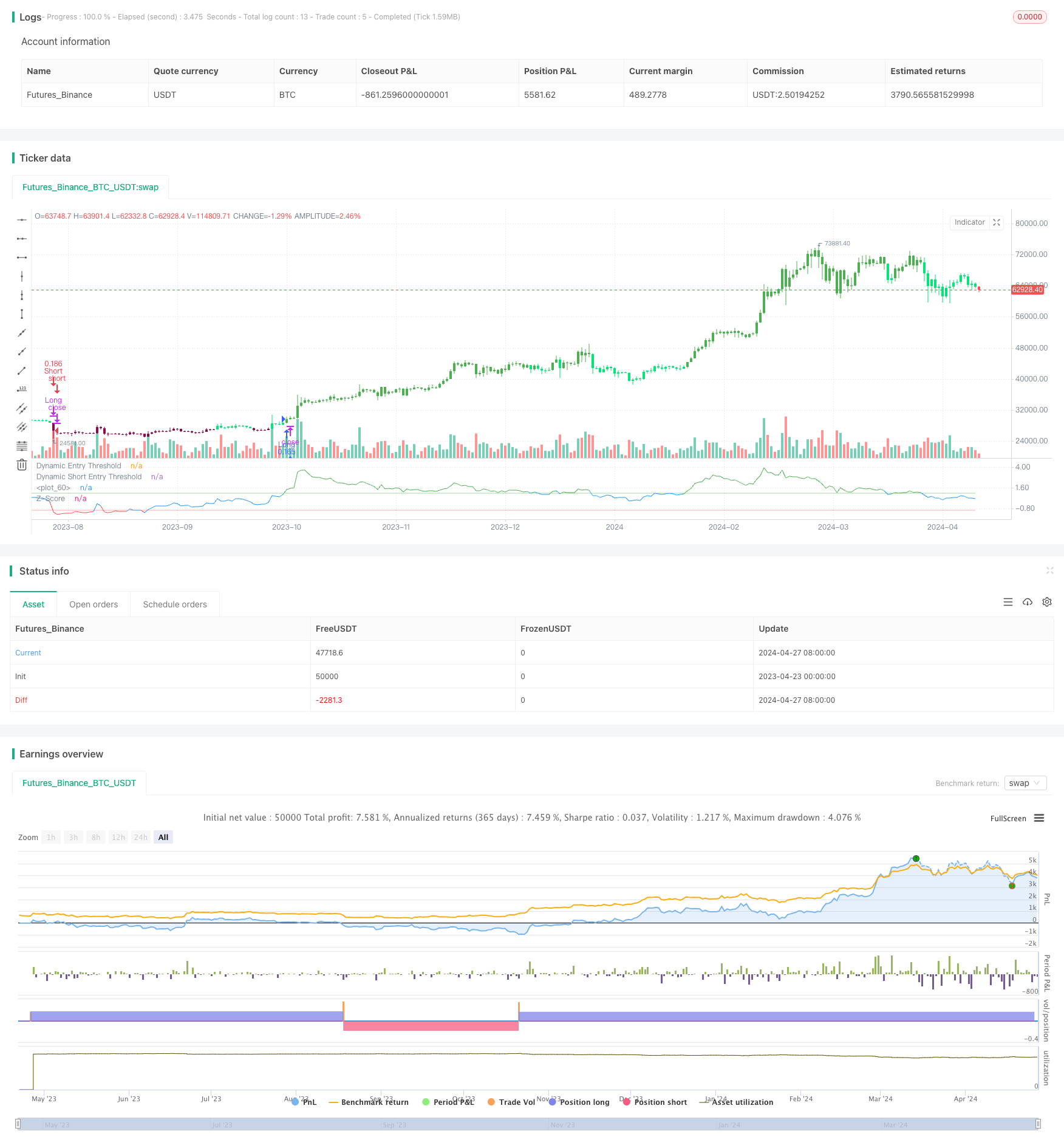

/*backtest

start: 2023-04-23 00:00:00

end: 2024-04-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PresentTrading

// This strategy employs a statistical approach by using a Z-score, which measures the deviation of the price from its moving average normalized by the standard deviation.

// Very simple and effective approach

//@version=5

strategy('Price Based Z-Trend - strategy [presentTrading]',shorttitle = 'Price Based Z-Trend - strategy [presentTrading]', overlay=false, precision=3,

commission_value=0.1, commission_type=strategy.commission.percent, slippage=1,

currency=currency.USD, default_qty_type=strategy.percent_of_equity, default_qty_value=10, initial_capital=10000)

// User-definable parameters for the Z-score calculation and bar coloring

tradeDirection = input.string("Both", "Trading Direction", options=["Long", "Short", "Both"]) // User selects trading direction

priceDeviationLength = input.int(100, "Standard Deviation Length", step=1) // Length for standard deviation calculation

priceAverageLength = input.int(100, "Average Length", step=1) // Length for moving average calculation

Threshold = input.float(1, "Threshold", step=0.1) // Number of standard deviations for Z-score threshold

priceBar = input(title='Bar Color', defval=true) // Toggle for coloring price bars based on Z-score

// Z-score calculation based on user input for the price source (typically the closing price)

priceSource = input(close, title="Source")

priceZScore = (priceSource - ta.ema(priceSource, priceAverageLength)) / ta.stdev(priceSource, priceDeviationLength) // Z-score calculation

// Conditions for entering and exiting trades based on Z-score crossovers

priceLongCondition = ta.crossover(priceZScore, Threshold) // Condition to enter long positions

priceExitLongCondition = ta.crossunder(priceZScore, -Threshold) // Condition to exit long positions

longEntryCondition = ta.crossover(priceZScore, Threshold)

longExitCondition = ta.crossunder(priceZScore, -Threshold)

shortEntryCondition = ta.crossunder(priceZScore, -Threshold)

shortExitCondition = ta.crossover(priceZScore, Threshold)

// Strategy conditions and execution based on Z-score crossovers and trading direction

if (tradeDirection == "Long" or tradeDirection == "Both") and longEntryCondition

strategy.entry("Long", strategy.long) // Enter a long position

if (tradeDirection == "Long" or tradeDirection == "Both") and longExitCondition

strategy.close("Long") // Close the long position

if (tradeDirection == "Short" or tradeDirection == "Both") and shortEntryCondition

strategy.entry("Short", strategy.short) // Enter a short position

if (tradeDirection == "Short" or tradeDirection == "Both") and shortExitCondition

strategy.close("Short") // Close the short position

// Dynamic Thresholds Visualization using 'plot'

plot(Threshold, "Dynamic Entry Threshold", color=color.new(color.green, 50))

plot(-Threshold, "Dynamic Short Entry Threshold", color=color.new(color.red, 50))

// Color-coding Z-Score

priceZScoreColor = priceZScore > Threshold ? color.green :

priceZScore < -Threshold ? color.red : color.blue

plot(priceZScore, "Z-Score", color=priceZScoreColor)

// Lines

hline(0, color=color.rgb(255, 255, 255, 50), linestyle=hline.style_dotted)

// Bar Color

priceBarColor = priceZScore > Threshold ? color.green :

priceZScore > 0 ? color.lime :

priceZScore < Threshold ? color.maroon :

priceZScore < 0 ? color.red : color.black

barcolor(priceBar ? priceBarColor : na)

相关推荐