概述

该策略基于布林带指标,通过双层标准差过滤,在5分钟时间框架上实现快速交易。当价格跌破下轨时买入,突破上轨时卖出。上下轨由不同标准差设定,并使用不同颜色标识,直观显示趋势强弱。

策略原理

- 计算布林带基准线、上轨1、上轨2、下轨1和下轨2。

- 当收盘价从下轨1下方向上穿越时,产生买入信号。

- 当收盘价从上轨1上方向下穿越时,产生卖出信号。

- 买入后,当出现卖出信号时平仓。卖出后,当出现买入信号时平仓。

- 上轨2和下轨2标识趋势强度,提供辅助判断。

策略优势

- 双层标准差设置提高了趋势判断的准确性。

- 5分钟级别的交易频率高,适合快进快出。

- 趋势强度辅助判断有助于风险控制。

- 参数可调,适应不同市场。

策略风险

- 频繁交易可能导致高额手续费。

- 趋势判断误差会带来亏损。

- 缺乏止损措施,风险暴露较大。

- 对单边趋势把握不足。

策略优化方向

- 引入止损和止盈机制,控制单笔交易风险。

- 优化布林带参数,提高趋势捕捉能力。

- 加入趋势判断辅助指标,如MA,提高胜率。

- 针对震荡行情设置过滤条件。

总结

该策略利用布林带的统计特性,双层过滤增强趋势判断,适合在5分钟级别快速捕捉趋势机会。但频繁交易和风控措施不足的问题仍需优化。未来可继续完善止损止盈、参数优选和辅助判断等方面,提升整体稳健性和盈利能力。

策略源码

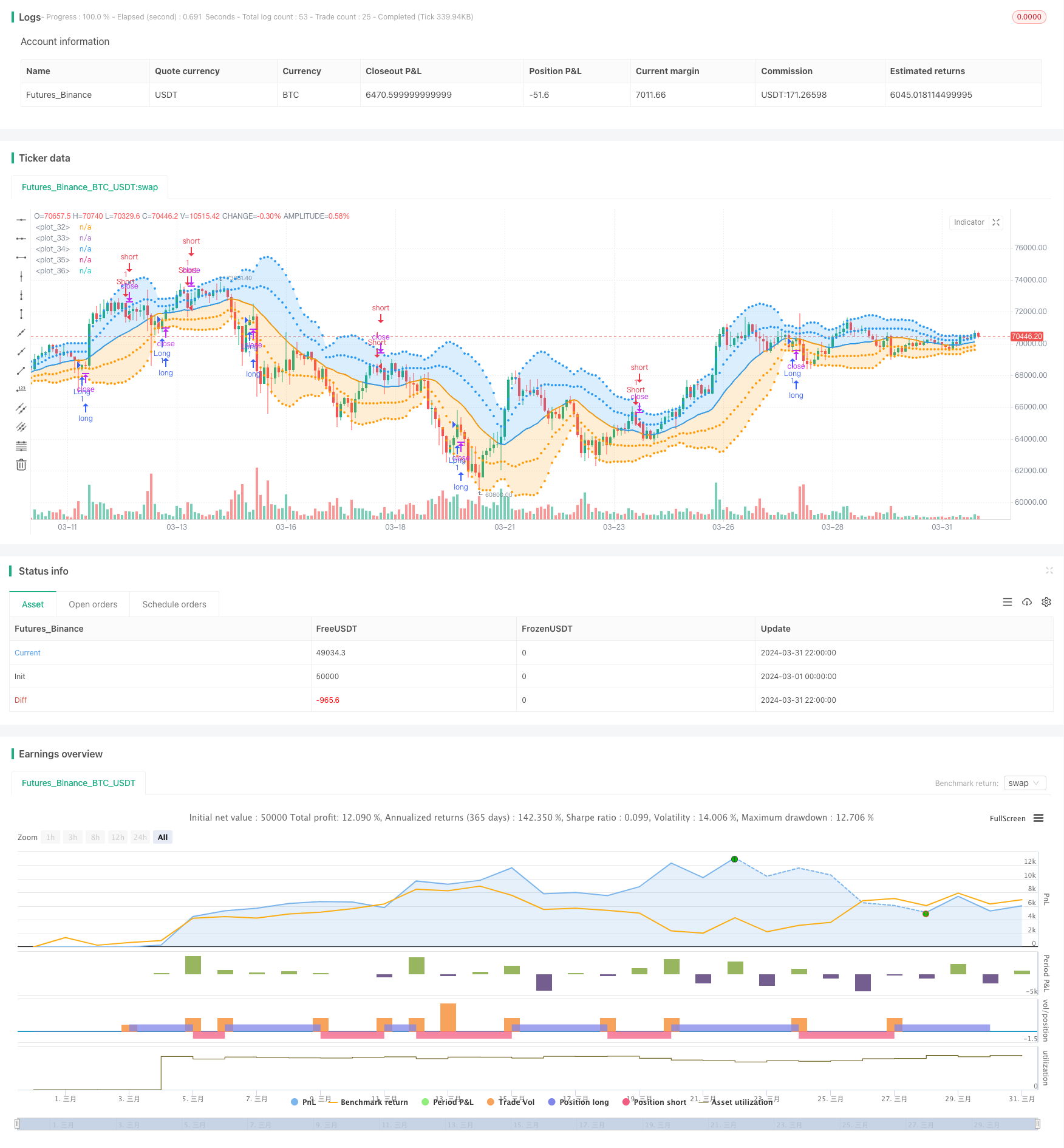

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//This displays the traditional Bollinger Bands, the difference is

//that the 1st and 2nd StdDev are outlined with two colors and two

//different levels, one for each Standard Deviation

strategy("Five Min Scalping Strategy", overlay=true)

src = input(close, title="Source")

length = input.int(20, minval=1, title="Length")

mult = input.float(2.0, minval=0.001, maxval=50, title="Multiplier")

basis = ta.sma(src, length)

dev = ta.stdev(src,length)

dev2 = mult * dev

upper1 = basis + dev

lower1 = basis - dev

upper2 = basis + dev2

lower2 = basis - dev2

LongCondition = close[1] < lower1 and close > lower1

ShortCondition = close[1] > upper1 and close < upper1

strategy.entry("Long", strategy.long, when = LongCondition)

strategy.entry("Short", strategy.short, when = ShortCondition)

strategy.close("Long", when = ShortCondition)

strategy.close("Short", when = LongCondition)

colorBasis = src >= basis ? color.blue : color.orange

pBasis = plot(basis, linewidth=2, color=colorBasis)

pUpper1 = plot(upper1, color=color.new(color.blue, 0), style=plot.style_circles)

pUpper2 = plot(upper2, color=color.new(color.blue, 0), style=plot.style_circles)

pLower1 = plot(lower1, color=color.new(color.orange, 0), style=plot.style_circles)

pLower2 = plot(lower2, color=color.new(color.orange, 0), style=plot.style_circles)

fill(pBasis, pUpper2, color=color.new(color.blue, 80))

fill(pUpper1, pUpper2, color=color.new(color.blue, 80))

fill(pBasis, pLower2, color=color.new(color.orange, 80))

fill(pLower1, pLower2, color=color.new(color.orange, 80))

相关推荐