概述

该策略利用20日和55日两条指数移动平均线(EMA)的交叉来判断交易信号。当短期EMA上穿长期EMA时发出买入信号,反之则发出卖出信号。策略还引入了杠杆交易,通过杠杆放大收益,同时也放大了风险。此外,策略还增加了条件限制,只有在两条均线交叉后,当价格触及短期均线时才会开仓,以降低假信号风险。最后,用户还可以选择使用简单移动平均线(MA)代替EMA。

策略原理

- 计算20日和55日EMA(或MA)。

- 判断短期EMA是否上穿长期EMA,如果是,则将readyToEnter变量设为true,表示可以准备进场。

- 如果readyToEnter为true,并且价格触及短期EMA,则执行买入,同时将readyToEnter重置为false。

- 如果短期EMA下穿长期EMA,则平仓。

- 根据杠杆参数设置仓位大小。

- 只在用户设定的回测区间内执行策略。

策略优势

- 均线交叉是一种简单易用的趋势判断方法,适合大多数市场。

- 引入杠杆交易,可以放大收益。

- 增加条件限制,降低假信号风险。

- 提供EMA和MA两种均线选择,适应不同用户偏好。

- 代码结构清晰,易于理解和修改。

策略风险

- 杠杆交易会放大风险,如果判断失误,可能导致大额损失。

- 均线交叉存在滞后性,可能错过最佳入场时机。

- 只适用于趋势明显的市场,如果市场震荡,可能会频繁交易,导致高额手续费。

策略优化方向

- 可以尝试优化均线周期,找到最适合当前市场的参数。

- 可以引入其他指标,如RSI、MACD等,综合判断趋势,提高胜率。

- 可以设置止损和止盈,控制单笔交易风险。

- 可以根据市场波动率动态调整杠杆大小,在波动小时加大杠杆,波动大时减小杠杆。

- 可以引入机器学习算法,自适应优化参数。

总结

该策略通过均线交叉和杠杆交易的结合,在把握市场趋势的同时放大收益。但杠杆也带来了高风险,需要谨慎使用。此外,该策略还有优化空间,可以通过引入更多指标、动态调整参数等方式提升策略表现。总的来说,该策略适合追求高收益,同时能够承担高风险的交易者。

策略源码

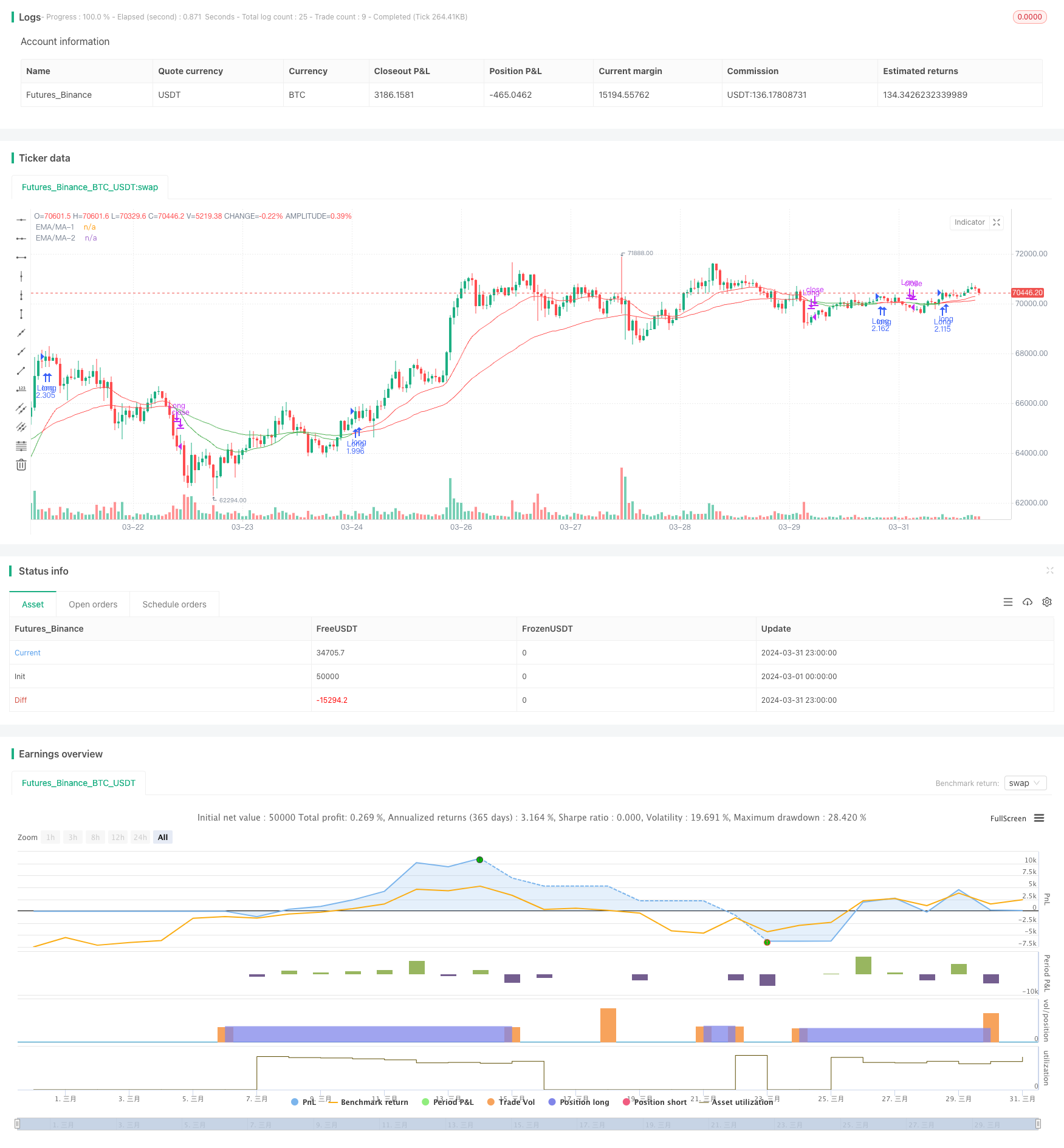

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Crossover Strategy with Leverage, Conditional Entry, and MA Option", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Inputs for backtesting period

startDate = input(defval=timestamp("2023-01-01"), title="Start Date")

endDate = input(defval=timestamp("2024-04-028"), title="End Date")

// Input for leverage multiplier

leverage = input.float(3.0, title="Leverage Multiplier", minval=1.0, maxval=10.0, step=0.1)

// Input for choosing between EMA and MA

useEMA = input.bool(true, title="Use EMA (true) or MA (false)?")

// Input source and lengths for MAs

src = close

ema1_length = input.int(20, title='EMA/MA-1 Length')

ema2_length = input.int(55, title='EMA/MA-2 Length')

// Calculate the MAs based on user selection

pema1 = useEMA ? ta.ema(src, ema1_length) : ta.sma(src, ema1_length)

pema2 = useEMA ? ta.ema(src, ema2_length) : ta.sma(src, ema2_length)

// Tracking the crossover condition for strategy entry

crossedAbove = ta.crossover(pema1, pema2)

// Define a variable to track if a valid entry condition has been met

var bool readyToEnter = false

// Check for MA crossover and update readyToEnter

if (crossedAbove)

readyToEnter := true

// Entry condition: Enter when price touches MA-1 after the crossover // and (low <= pema1 and high >= pema1)

entryCondition = readyToEnter

// Reset readyToEnter after entry

if (entryCondition)

readyToEnter := false

// Exit condition: Price crosses under MA-1

exitCondition = ta.crossunder(pema1, pema2)

// Check if the current bar's time is within the specified period

inBacktestPeriod = true

// Execute trade logic only within the specified date range and apply leverage to position sizing

if (inBacktestPeriod)

if (entryCondition)

strategy.entry("Long", strategy.long, qty=strategy.equity * leverage / close)

if (exitCondition)

strategy.close("Long")

// Plotting the MAs for visual reference

ema1_color = pema1 > pema2 ? color.red : color.green

ema2_color = pema1 > pema2 ? color.red : color.green

plot(pema1, color=ema1_color, style=plot.style_line, linewidth=1, title='EMA/MA-1')

plot(pema2, color=ema2_color, style=plot.style_line, linewidth=1, title='EMA/MA-2')

相关推荐