概述

三重EMA交叉策略是一种基于三条不同周期的指数移动平均线(EMA)交叉信号进行交易的策略。该策略使用快速EMA(10期)、中速EMA(25期)和慢速EMA(50期)来捕捉市场趋势,同时使用平均真实波幅(ATR)来设置止损和止盈水平,以适应不同的市场波动状况。当快速EMA在慢速EMA上方交叉,且中速EMA也在慢速EMA上方时,产生看涨信号;反之,当快速EMA在慢速EMA下方交叉,且中速EMA也在慢速EMA下方时,产生看跌信号。

策略原理

- 计算三条不同周期的EMA:快速(10期)、中速(25期)和慢速(50期)。

- 当快速EMA从下往上穿越慢速EMA,且中速EMA在慢速EMA上方时,产生看涨交叉信号。

- 当快速EMA从上往下穿越慢速EMA,且中速EMA在慢速EMA下方时,产生看跌交叉信号。

- 使用ATR来计算动态止损和止盈水平,止损设置为ATR的3倍,止盈设置为ATR的6倍。

- 当看涨交叉信号出现时,开仓做多,设置止损和止盈。

- 当看跌交叉信号出现时,开仓做空,设置止损和止盈。

策略优势

- 三重EMA交叉策略能够有效地过滤掉市场噪音,专注于捕捉主要趋势。

- 通过使用不同周期的EMA,该策略能够更快地对价格变化做出反应,同时确保信号得到中长期趋势的支持。

- 利用ATR动态调整止损和止盈水平,使策略能够适应不同的市场波动状况,提高风险管理的有效性。

策略风险

- 在震荡或高波动市场中,该策略可能会产生错误信号,导致频繁交易和潜在损失。

- 策略的表现在很大程度上取决于EMA周期的选择,不恰当的参数设置可能导致信号质量下降。

- 单独依赖移动平均线交叉信号可能无法提供全面的市场分析,需要与其他技术指标结合使用以确认趋势和信号。

策略优化方向

- 考虑引入其他技术指标,如相对强弱指数(RSI)或随机指标(Stochastic),以确认趋势和交叉信号的有效性。

- 对不同市场状况和资产类别进行参数优化测试,找出最佳的EMA周期组合和ATR倍数设置。

- 引入风险管理措施,如基于市场波动性动态调整仓位大小,或在特定市场条件下停止交易,以进一步控制风险。

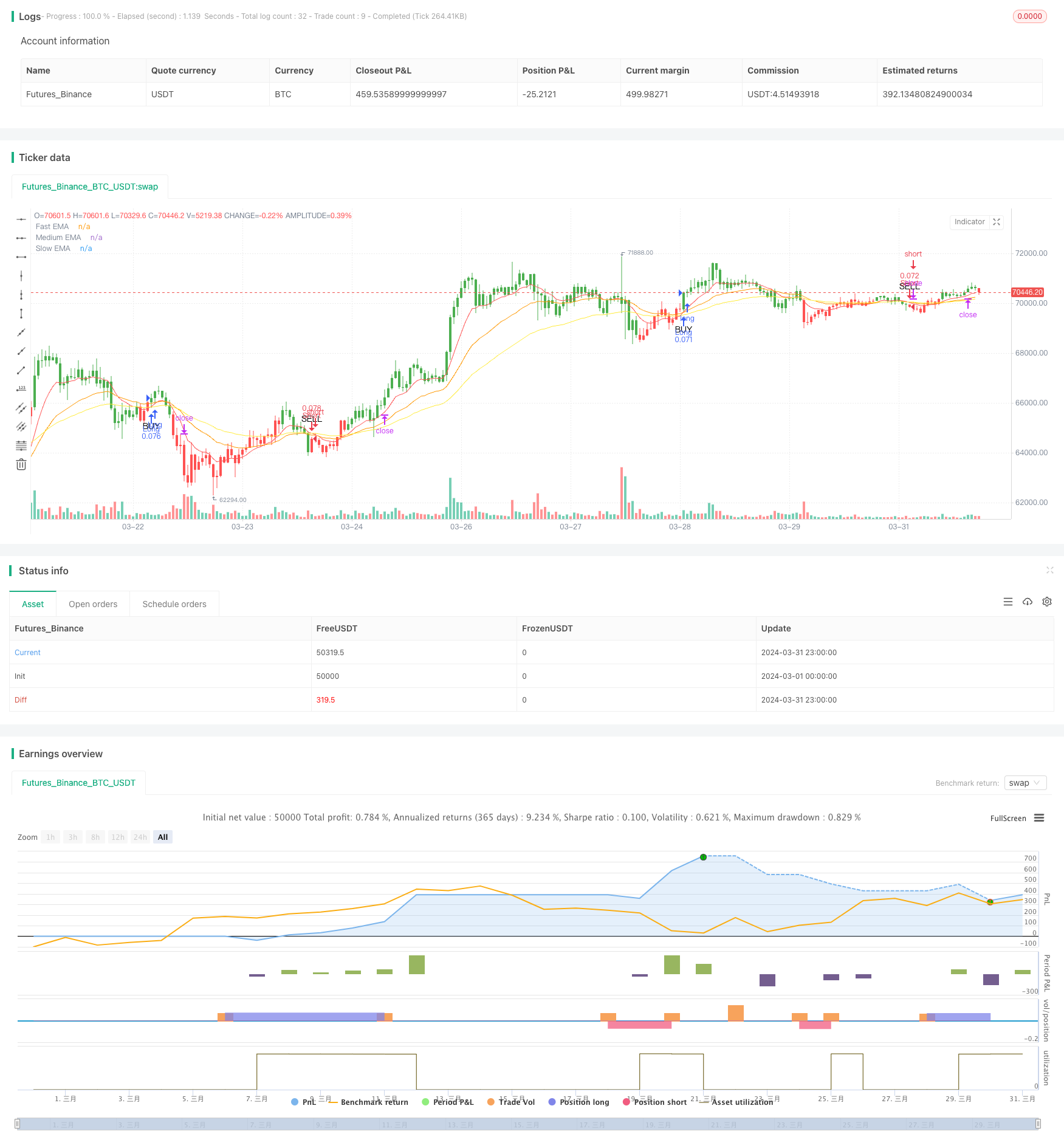

总结

三重EMA交叉策略通过利用不同周期的指数移动平均线交叉信号,结合ATR动态止损和止盈设置,为交易者提供了一种趋势跟踪和风险管理的有效方法。尽管该策略在趋势市场中表现良好,但在震荡市场中可能面临挑战。因此,交易者应考虑将其与其他技术分析工具相结合,并根据不同的市场状况和资产类别对参数进行优化,以提高策略的可靠性和盈利潜力。

策略源码

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Triple EMA Crossover Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Input for EMA periods

fastLength = input(10, title="Fast EMA Length")

mediumLength = input(25, title="Medium EMA Length")

slowLength = input(50, title="Slow EMA Length")

riskMultiplier = input(3.0, title="Risk Multiplier for Stop Loss and Take Profit")

// Calculating EMAs

fastEMA = ta.ema(close, fastLength)

mediumEMA = ta.ema(close, mediumLength)

slowEMA = ta.ema(close, slowLength)

// Plot EMAs

plot(fastEMA, color=color.red, title="Fast EMA")

plot(mediumEMA, color=color.orange, title="Medium EMA")

plot(slowEMA, color=color.yellow, title="Slow EMA")

// Define the crossover conditions for a bullish and bearish signal

bullishCrossover = ta.crossover(fastEMA, slowEMA) and mediumEMA > slowEMA

bearishCrossover = ta.crossunder(fastEMA, slowEMA) and mediumEMA < slowEMA

// ATR for stop and limit calculations

atr = ta.atr(14)

longStopLoss = close - atr * riskMultiplier

shortStopLoss = close + atr * riskMultiplier

longTakeProfit = close + atr * riskMultiplier * 2

shortTakeProfit = close - atr * riskMultiplier * 2

// Entry signals with visual shapes

plotshape(series=bullishCrossover, location=location.belowbar, color=color.green, style=shape.triangleup, title="Buy Signal", text="BUY")

plotshape(series=bearishCrossover, location=location.abovebar, color=color.red, style=shape.triangledown, title="Sell Signal", text="SELL")

// Strategy execution

if (bullishCrossover)

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", "Long", stop=longStopLoss, limit=longTakeProfit)

if (bearishCrossover)

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", "Short", stop=shortStopLoss, limit=shortTakeProfit)

// Color bars based on EMA positions

barcolor(fastEMA > slowEMA ? color.green : slowEMA > fastEMA ? color.red : na, title="Bar Color")

相关推荐