概述

该策略基于一小时图表上的趋势偏差、十五分钟图表上MACD指标的交叉信号以及五分钟图表上的快速波动率和缺口来确定进场点。通过在不同时间周期上使用多个指标,该策略旨在捕捉市场的长期趋势、中期动量和短期波动性,以实现更精确的市场预测。

策略原理

该策略的核心原理是将不同时间周期的技术指标结合起来,以更全面地分析市场。具体来说:

- 在一小时图表上,通过比较收盘价和50周期移动平均线来确定长期趋势偏差。

- 在十五分钟图表上,通过MACD指标的交叉信号来确认中期的多空动量。

- 在五分钟图表上,通过观察快速波动率(使用平均真实范围指标计算)和价格缺口来找到潜在的进场点。

通过结合这三个不同时间周期的信号,该策略能够更好地把握市场的整体走势,同时利用短期波动来优化进场点,从而提高交易的准确性和盈利潜力。

策略优势

- 多时间周期分析:通过在不同时间周期上使用多个指标,该策略能够更全面地分析市场,捕捉不同层面的趋势和动量信号。

- 趋势确认:通过比较一小时图表上的收盘价和移动平均线,该策略能够确定长期趋势偏差,为交易决策提供有力支撑。

- 动量信号:在十五分钟图表上使用MACD指标,能够及时捕捉到市场的多空动量变化,为趋势确认提供进一步的依据。

- 精确入场:通过观察五分钟图表上的快速波动率和价格缺口,该策略能够找到更优化的进场点,提高交易效率。

- 风险控制:该策略使用止盈止损设置,同时考虑了杠杆因素,能够在追求收益的同时控制潜在风险。

策略风险

- 参数优化:该策略的表现可能对参数选择较为敏感,如MACD指标的参数设置、移动平均线周期等,需要进行充分的回测和优化。

- 市场波动:在市场剧烈波动或趋势突变的情况下,该策略的有效性可能会受到影响。

- 杠杆风险:虽然该策略考虑了杠杆因素,但过高的杠杆仍可能导致较大的损失。需要审慎选择杠杆倍数,并严格控制风险。

策略优化方向

- 动态参数优化:考虑使用机器学习或优化算法,根据市场状况动态调整策略参数,以适应不同的市场环境。

- 多空仓位管理:可以引入更高级的仓位管理策略,如根据市场波动性或趋势强度动态调整仓位大小,以更好地控制风险和优化收益。

- 加入其他指标:考虑引入其他技术指标或基本面因素,如相对强弱指数(RSI)、市场情绪指标等,以进一步提高策略的稳健性和适应性。

总结

该策略通过结合一小时图表上的趋势偏差、十五分钟图表上的MACD动量信号以及五分钟图表上的快速波动率和价格缺口,构建了一个多时间周期、多指标的交易系统。这种方法能够更全面地分析市场,捕捉不同层面的趋势和机会,同时控制风险。然而,策略的表现可能对参数选择较为敏感,并且在市场剧烈波动时可能面临一定挑战。未来可以考虑引入动态参数优化、高级仓位管理以及其他指标,以进一步提升策略的适应性和稳健性。

策略源码

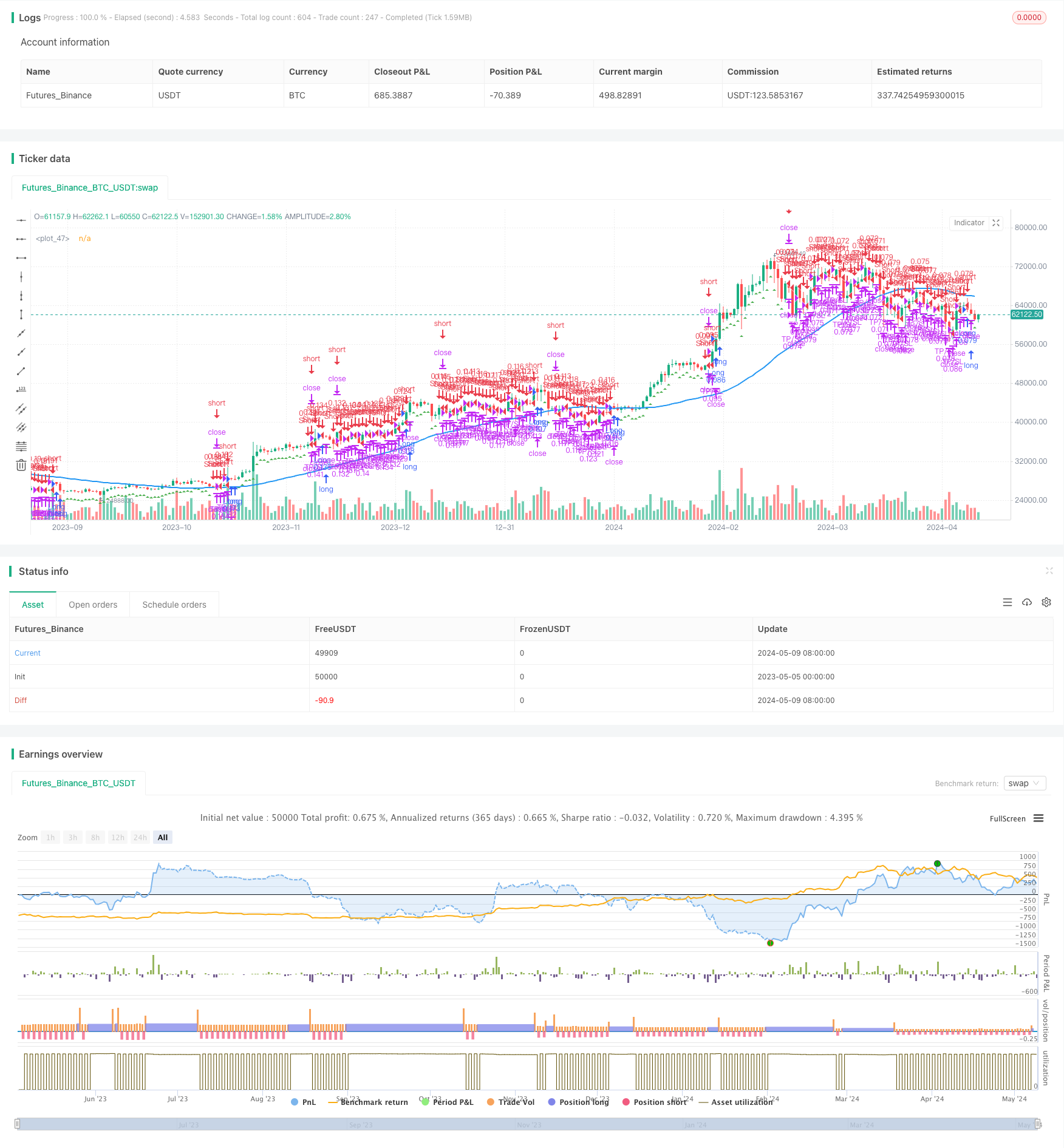

/*backtest

start: 2023-05-05 00:00:00

end: 2024-05-10 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("H1 Bias + M15 MSS + M5 FVG", overlay=true, initial_capital=1000, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// H1 Bias

h1_bias = request.security(syminfo.tickerid, "60", close)

h1_ma = ta.sma(h1_bias, 50)

// M15 MSS

[m15_macd_line, m15_macd_signal, _] = ta.macd(request.security(syminfo.tickerid, "15", close), 12, 26, 9)

// M5 FVG Entry

m5_volatility = ta.atr(14)

// Entry conditions for long and short positions

long_condition = m15_macd_line > m15_macd_signal and m5_volatility > 0.001

short_condition = m15_macd_line < m15_macd_signal and m5_volatility > 0.001

// Exit conditions

exit_long_condition = m15_macd_line < m15_macd_signal

exit_short_condition = m15_macd_line > m15_macd_signal

// Strategy

if (long_condition)

strategy.entry("Long", strategy.long)

if (short_condition)

strategy.entry("Short", strategy.short)

if (exit_long_condition)

strategy.close("Long")

if (exit_short_condition)

strategy.close("Short")

// Take-Profit and Stop-Loss settings considering leverage

leverage = 10.0 // Leverage as a float

tp_percentage = 15.0 // TP percentage without leverage as a float

sl_percentage = 5.0 // SL percentage without leverage as a float

tp_level = strategy.position_avg_price * (1.0 + (tp_percentage / 100.0 / leverage)) // TP considering leverage as a float

sl_level = strategy.position_avg_price * (1.0 - (sl_percentage / 100.0 / leverage)) // SL considering leverage as a float

strategy.exit("TP/SL", "Long", limit=tp_level, stop=sl_level)

strategy.exit("TP/SL", "Short", limit=tp_level, stop=sl_level)

// Plotting

plot(h1_ma, color=color.blue, linewidth=2)

plotshape(long_condition, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(short_condition, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

相关推荐