概述

DZ London Session Breakout Strategy是一个基于伦敦交易时段突破的量化交易策略。该策略主要思路是捕捉伦敦交易时段内的突破机会,通过判断价格是否突破之前的高点或低点来进行交易决策。策略会检查当前时间是否在指定的伦敦交易时段内,然后判断价格是否突破了当前交易日、周期或周的最高价或最低价。如果在规定时间内发生了突破,并且出现了新的低点或高点,则策略会进行相应的多头或空头交易。

策略原理

DZ London Session Breakout Strategy的核心原理是基于伦敦交易时段的突破交易。伦敦作为全球最大的外汇交易中心之一,交易量巨大,市场波动性较高。策略通过设置伦敦交易时段的开始和结束时间,判断当前时间是否在该时段内。然后,策略通过获取当前交易日、周期和周的最高价和最低价,判断价格是否突破了这些关键价位。如果发生突破,并且在1分钟图表上出现了新的低点或高点,则认为有潜在的交易机会。策略会根据突破方向进行相应的多头或空头交易。

策略优势

- 基于伦敦交易时段:伦敦是全球最大的外汇交易中心之一,交易量巨大,市场波动性较高。在这个时段内进行交易,可以捕捉到更多的交易机会。

- 多时间框架分析:策略综合考虑了当前交易日、周期和周的最高价和最低价,提供了更全面的市场信息,有助于做出更准确的交易决策。

- 突破交易:策略基于价格突破关键价位进行交易,可以捕捉到市场的强势趋势,潜在的盈利空间较大。

- 新高新低确认:策略在发生突破后,还会判断是否出现了新的低点或高点,进一步确认趋势的有效性,降低了假突破的风险。

策略风险

- 伦敦交易时段波动性风险:虽然伦敦交易时段的交易量巨大,但同时也伴随着较高的波动性风险。市场可能出现剧烈波动,导致交易风险增加。

- 假突破风险:策略基于价格突破关键价位进行交易,但有时可能出现假突破,即价格短暂突破后快速回撤,导致交易亏损。

- 参数设置风险:策略的表现受到参数设置的影响,如伦敦交易时段的开始和结束时间。如果参数设置不当,可能会错过交易机会或产生更多的交易噪音。

策略优化方向

- 引入更多过滤条件:为了降低假突破的风险,可以引入更多的过滤条件,如成交量、波动率等指标,以确认突破的有效性。

- 动态调整参数:可以根据市场状况的变化,动态调整策略的参数,如伦敦交易时段的起止时间,以适应不同的市场环境。

- 结合其他技术指标:可以将其他技术指标,如移动平均线、震荡指标等,与突破策略相结合,提供更多的交易信号确认,提高交易的准确性。

- 加入风险管理:在策略中加入适当的风险管理措施,如设置止损和止盈、仓位管理等,以控制潜在的交易风险。

总结

DZ London Session Breakout Strategy是一个基于伦敦交易时段突破的量化交易策略。该策略利用伦敦交易时段的高交易量和波动性,通过判断价格是否突破关键价位来捕捉潜在的交易机会。策略综合考虑了多个时间框架的最高价和最低价,并通过新高新低的确认来过滤假突破。尽管该策略具有一定的优势,但同时也面临着伦敦交易时段的高波动性、假突破和参数设置等风险。为了进一步优化策略,可以考虑引入更多的过滤条件、动态调整参数、结合其他技术指标以及加入适当的风险管理措施。总的来说,DZ London Session Breakout Strategy为量化交易者提供了一种基于时间和价格突破的交易思路,但在实际应用中需要谨慎评估风险并不断优化策略参数。

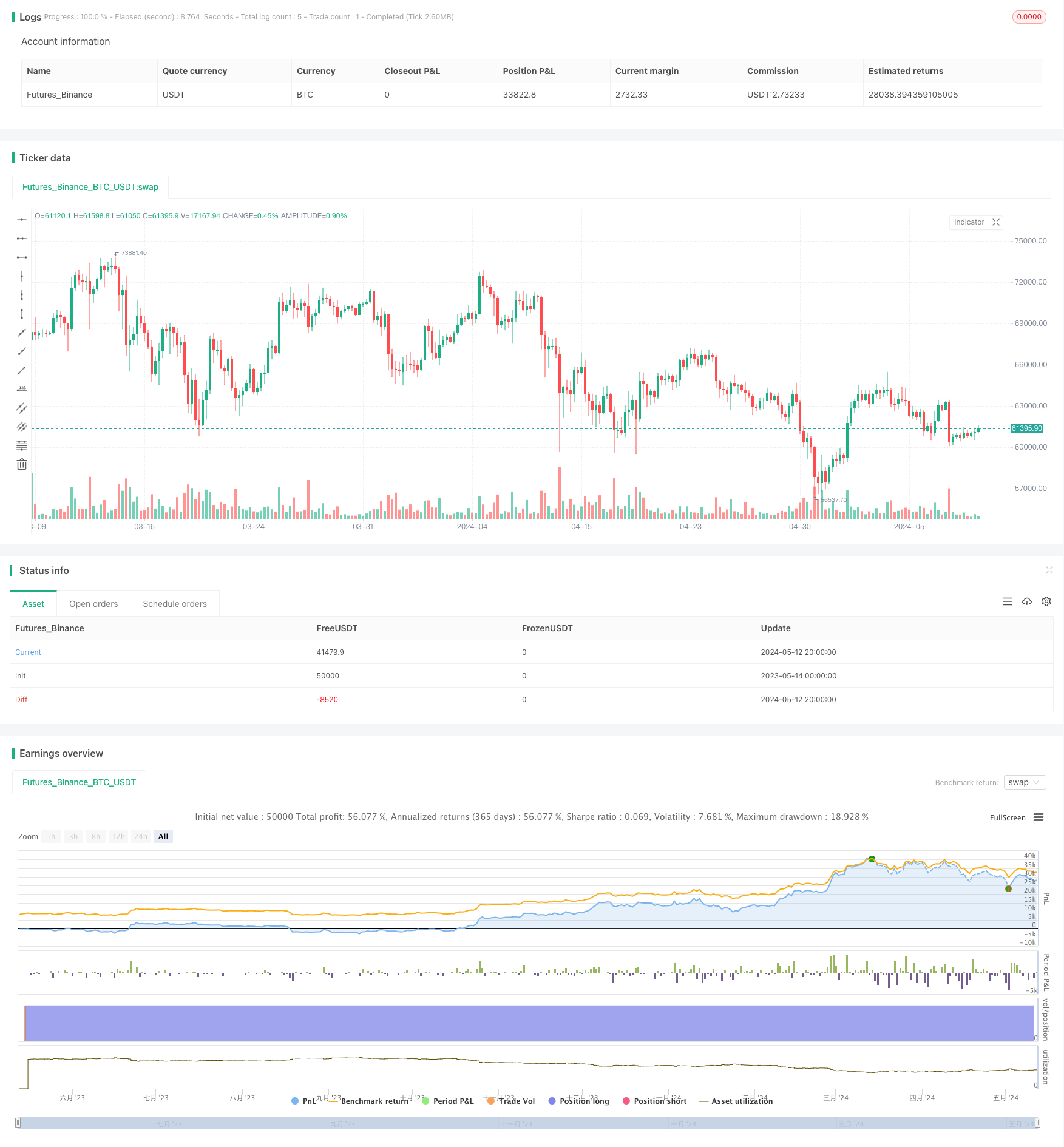

/*backtest

start: 2023-05-14 00:00:00

end: 2024-05-13 00:00:00

period: 6h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("DZ Strategy ICT", overlay=true)

// Input parameters

london_open_hour = input(13, "London Open Hour")

london_open_minute = input(30, "London Open Minute")

london_close_hour = input(16, "London Close Hour")

// Get current datetime

hour = hour(time)

minute = minute(time)

// Get session high, daily high, and weekly high

sessionHigh = request.security(syminfo.tickerid, "D", high)

dailyHigh = request.security(syminfo.tickerid, "D", high)

weeklyHigh = request.security(syminfo.tickerid, "W", high)

// Condition for being in the specified time range

inLondonTimeRange = (hour >= london_open_hour and hour < london_close_hour) or (hour == london_close_hour and minute == 0)

// Check for breakout above session, daily, or weekly high

breakoutAboveSessionHigh = high > sessionHigh

breakoutAboveDailyHigh = high > dailyHigh

breakoutAboveWeeklyHigh = high > weeklyHigh

// Check for breakout below session, daily, or weekly high

breakoutBelowSessionHigh = low < sessionHigh

breakoutBelowDailyHigh = low < dailyHigh

breakoutBelowWeeklyHigh = low < weeklyHigh

// Check for new lower low or higher high on 1-minute chart

newLowerLow = ta.lowest(low, 10)[1] > low

newHigherHigh = ta.highest(high, 10)[1] < high

// Set entry point based on imbalance

imbalanceLevel = low[1] // Placeholder for imbalance level, adjust this as needed

// Entry conditions for short position

if (inLondonTimeRange and (breakoutAboveSessionHigh or breakoutAboveDailyHigh or breakoutAboveWeeklyHigh) and newLowerLow)

strategy.entry("Short Entry", strategy.short)

// Entry conditions for long position

if (inLondonTimeRange and (breakoutBelowSessionHigh or breakoutBelowDailyHigh or breakoutBelowWeeklyHigh) and newHigherHigh)

strategy.entry("Long Entry", strategy.long)