概述

“加密货币大幅波动随机RSI策略”是一个专为TradingView平台设计的复杂交易算法,利用随机RSI的强大功能,结合显著价格变动检测,以把握市场趋势。该策略专为加密货币市场量身定制,并针对15分钟交易时间框架进行了优化。

该策略的主要思路是利用随机RSI指标和价格大幅波动检测,在市场出现显著波动且随机RSI指标达到超卖或超买区域时产生交易信号。通过结合这两个条件,策略能够在趋势初期就捕捉到交易机会,同时又能避免在震荡市中频繁交易。

策略原理

计算RSI指标和随机RSI指标。RSI指标用于衡量价格的超买超卖状态,而随机RSI指标则将RSI值进一步处理,得到更加平滑和可靠的超买超卖信号。

检测显著价格波动。策略会比较当前收盘价和lookbackPeriod个周期之前的收盘价,计算其变化百分比。如果变化百分比超过bigMoveThreshold设定的阈值,则认为发生了显著价格波动。

根据随机RSI水平和大幅价格波动来确定进场条件。当随机RSI的K线或D线低于3时,且发生显著上涨,则产生做多信号;当随机RSI的K线或D线高于97时,且发生显著下跌,则产生做空信号。

执行交易。如果触发做多信号,则策略开仓做多;如果触发做空信号,则策略开仓做空。

绘制进场信号以便视觉确认。策略会在图表上标记做多和做空信号,以方便用户查看和验证交易。

策略优势

结合随机RSI和价格大幅波动两个条件,能够在趋势初期就捕捉到交易机会,同时避免在震荡市频繁交易,从而提高策略的盈利能力和稳定性。

随机RSI指标对RSI值进行平滑处理,能够给出更加可靠的超买超卖信号,有助于提高策略的准确性。

通过参数优化,可以灵活调整策略在不同市场状况下的表现,从而适应不同的交易品种和周期。

策略逻辑清晰,易于理解和实现,可以作为进一步开发和优化的基础。

策略风险

策略在趋势型市场中表现良好,但在震荡市中可能会出现较多的假信号,导致频繁交易和资金损失。

随机RSI指标有一定的滞后性,在市场快速变化时,可能会错过最佳的进场时机。

策略依赖于对历史数据进行回测和优化,在实盘交易中可能会出现与历史数据不一致的情况,从而影响策略表现。

策略缺乏明确的止损和止盈机制,在市场出现剧烈波动或黑天鹅事件时,可能会承受较大的风险。

策略优化方向

引入更多的技术指标,如移动平均线、布林带等,以提高交易信号的可靠性和准确性。

结合基本面分析,如新闻事件、经济数据等,对交易信号进行过滤和确认,以减少假信号的出现。

优化参数设置,如调整随机RSI的时间周期、超买超卖阈值等,以适应不同的市场状况和交易品种。

引入风险管理机制,如设置合理的止损和止盈位,控制单笔交易的风险敞口,以提高策略的稳健性和长期表现。

结合多时间框架分析,如在较高时间框架上确认趋势方向,在较低时间框架上寻找进场点,以提高交易的准确性和盈利潜力。

总结

“加密货币大幅波动随机RSI策略”是一个利用随机RSI指标和价格大幅波动检测来捕捉交易机会的量化交易策略。该策略能够在趋势初期就产生交易信号,同时避免在震荡市中频繁交易,具有一定的盈利潜力和稳定性。然而,策略也存在一些局限性和风险,如在震荡市中可能出现较多假信号,缺乏明确的风险管理机制等。未来可以通过引入更多技术指标、优化参数设置、结合基本面分析和风险管理等方面来进一步优化和完善该策略,以提高其在实盘交易中的表现和稳健性。

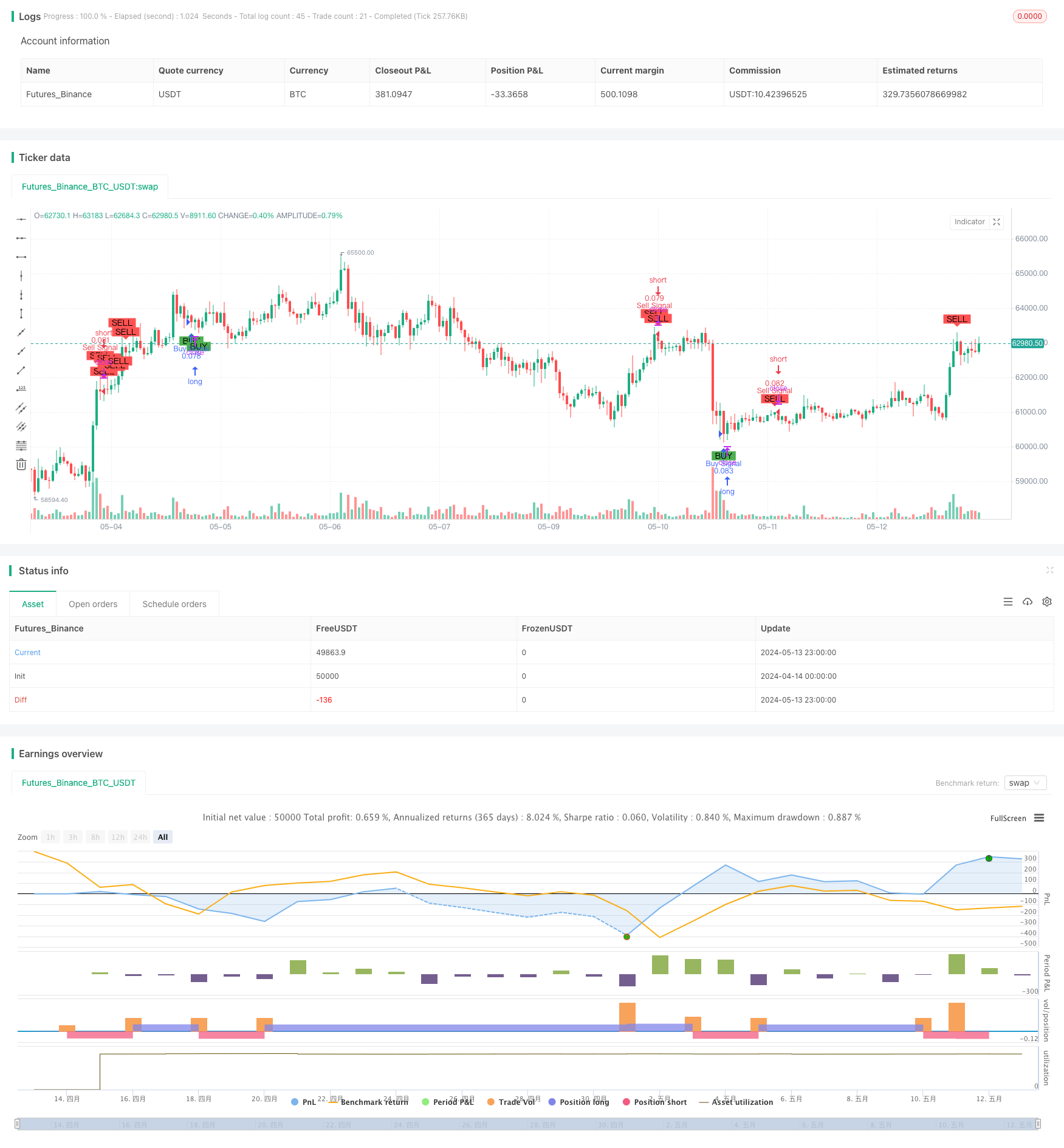

/*backtest

start: 2024-04-14 00:00:00

end: 2024-05-14 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Crypto Big Move Stoch RSI Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Define inputs

lookbackPeriod = input.int(24, "Lookback Period (in bars for 30min timeframe)", minval=1)

bigMoveThreshold = input.float(2.5, "Big Move Threshold (%)", step=0.1) / 100

rsiLength = input.int(14, "RSI Length")

stochLength = input.int(14, "Stochastic Length")

k = input.int(3, "Stochastic %K")

d = input.int(3, "Stochastic %D")

// Calculate RSI and Stochastic RSI

rsi = ta.rsi(close, rsiLength)

stochRsi = ta.stoch(rsi, rsi, rsi, stochLength)

stochRsiK = ta.sma(stochRsi, k)

stochRsiD = ta.sma(stochRsiK, d)

// Detect significant price movements

price12HrsAgo = close[lookbackPeriod - 1]

percentChange = math.abs(close - price12HrsAgo) / price12HrsAgo

// Entry conditions based on Stoch RSI levels and big price moves

enterLong = (percentChange >= bigMoveThreshold) and (stochRsiK < 3 or stochRsiD < 3)

enterShort = (percentChange >= bigMoveThreshold) and (stochRsiK > 97 or stochRsiD > 97)

// Execute trades

if (enterLong)

strategy.entry("Buy Signal", strategy.long)

if (enterShort)

strategy.entry("Sell Signal", strategy.short)

// Plot entry signals for visual confirmation

plotshape(series=enterLong, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY", size=size.small)

plotshape(series=enterShort, location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", size=size.small)