概述

该策略是一个基于相对强弱指标(RSI)的量化交易策略。该策略利用RSI指标来判断市场的超买和超卖状态,并在适当的时机进行买入和卖出操作。同时,该策略还引入了马丁格尔系统的理念,在满足条件时会加大交易的仓位。

该策略的主要思路如下: 1. 计算RSI指标的值。 2. 当RSI指标从超卖区域向上穿越时,执行买入操作;当RSI指标从超买区域向下穿越时,执行卖出操作。 3. 设置止盈和止损水平,当价格达到这些水平时平仓。 4. 引入马丁格尔系统,当上一次交易亏损时,将下一次交易的仓位乘以一个倍数。

策略原理

- RSI指标的计算:使用ta.rsi函数计算RSI指标的值,需要设置RSI的周期(默认为14)。

- 买入条件:当RSI指标从低于超卖水平(默认为30)向上穿越时,执行买入操作。

- 卖出条件:当RSI指标从高于超买水平(默认为70)向下穿越时,执行卖出操作。

- 止盈和止损:分别设置止盈和止损的百分比(默认都为0%),当价格达到这些水平时平仓。

- 马丁格尔系统:设置初始仓位(默认为1)和马丁格尔倍数(默认为2)。当上一次交易亏损时,将下一次交易的仓位乘以马丁格尔倍数。

策略优势

- RSI指标是一个被广泛使用的技术指标,它可以有效地判断市场的超买和超卖状态,为交易决策提供依据。

- 该策略逻辑清晰,易于理解和实现。

- 引入马丁格尔系统,可以在一定程度上增加策略的获利能力。当市场出现连续亏损时,通过加大仓位来追求更大的利润。

- 该策略可以根据市场的特点和个人的风险偏好,灵活地调整RSI指标的周期、超买超卖水平、止盈止损百分比等参数。

策略风险

- RSI指标有时会出现信号失灵的情况,特别是在市场趋势较强时。此时,RSI指标可能长时间处于超买或超卖状态,而市场价格却持续上涨或下跌。

- 马丁格尔系统虽然可以增加策略的获利能力,但同时也会放大策略的风险。当市场出现连续亏损时,策略的仓位会急剧增加,可能导致爆仓的风险。

- 该策略没有设置止损和止盈百分比(都为0%),这意味着策略在开仓后不会主动止损或止盈。这可能导致策略在市场剧烈波动时承担较大的风险。

策略优化方向

- 考虑引入其他技术指标,如移动平均线(MA)、布林带(Bollinger Bands)等,以提高策略的信号质量和可靠性。可以将这些指标与RSI指标结合使用,形成更复杂的交易条件。

- 对马丁格尔系统进行优化。可以设置一个最大仓位,避免仓位无限增加。也可以在连续亏损达到一定次数后,暂停使用马丁格尔系统,以控制风险。

- 设置合理的止盈和止损百分比。止损可以帮助策略及时止损,避免过大的亏损;止盈可以帮助策略及时锁定利润,避免利润回吐。

- 对RSI指标的参数进行优化。可以通过回测和参数优化,找到最适合当前市场和标的的RSI周期、超买超卖水平等参数。

总结

该策略是一个基于RSI指标的量化交易策略,同时引入了马丁格尔系统。策略的优势在于RSI指标的有效性和策略逻辑的清晰性。但策略也存在一些风险,如RSI指标失灵、马丁格尔系统放大风险等。未来可以考虑从引入其他技术指标、优化马丁格尔系统、设置止盈止损、优化RSI参数等方面对策略进行优化。总的来说,该策略还需要在实践中不断优化和改进,以适应不断变化的市场环境。

策略源码

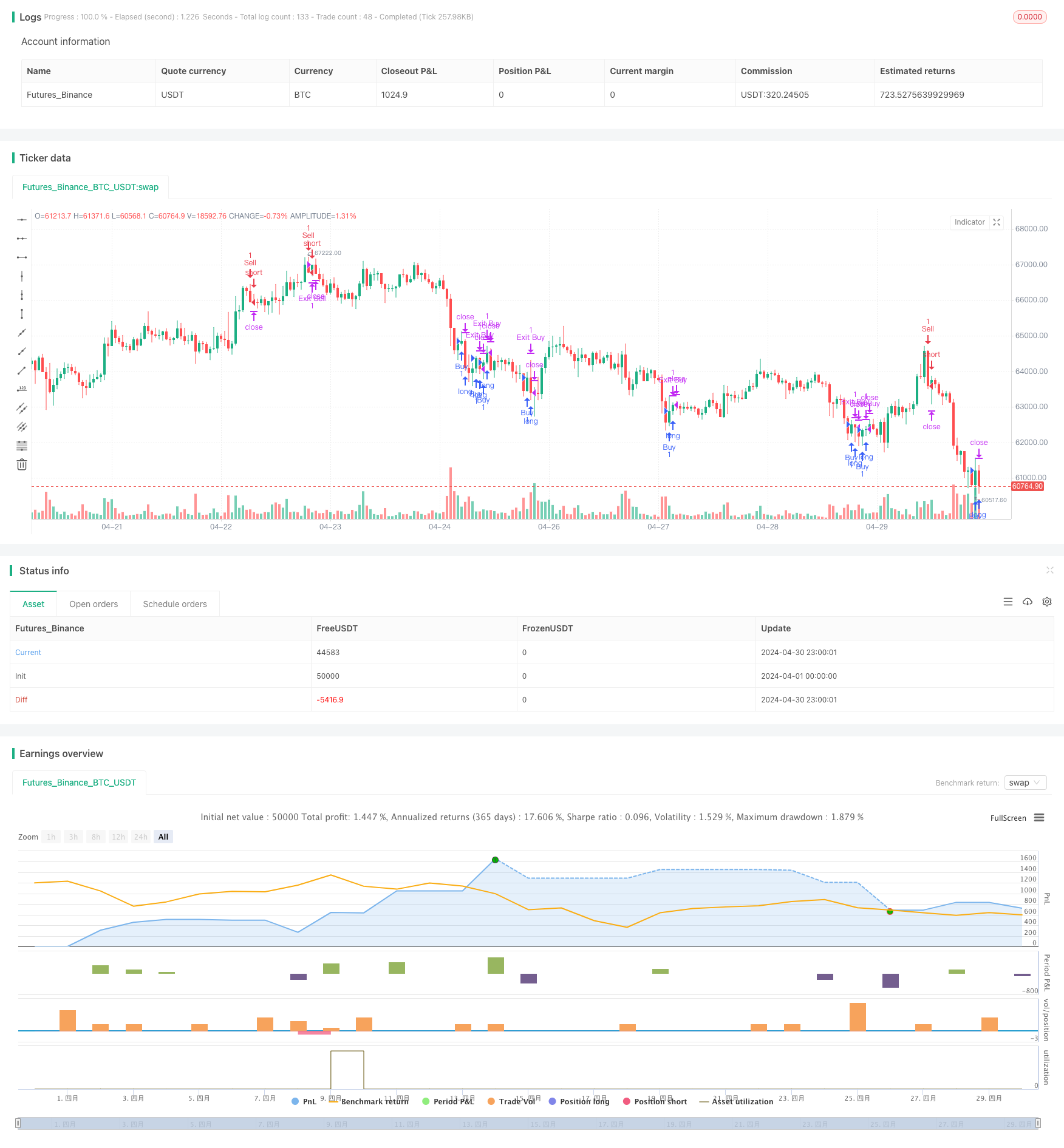

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Cloudexp1

//@version=5

strategy("RSI Martingale Strategy", overlay=true)

// RSI settings

rsi_length = input(14, title="RSI Length")

overbought_level = input(70, title="Overbought Level")

oversold_level = input(30, title="Oversold Level")

// Martingale settings

initial_quantity = input(1, title="Initial Quantity")

martingale_multiplier = input(2, title="Martingale Multiplier")

// Calculate RSI

rsi = ta.rsi(close, rsi_length)

// Entry conditions

buy_condition = ta.crossover(rsi, oversold_level)

sell_condition = ta.crossunder(rsi, overbought_level)

// Take profit and stop loss

take_profit_percent = 0

stop_loss_percent = 0

// Strategy logic

strategy.entry("Buy", strategy.long, when = buy_condition)

strategy.entry("Sell", strategy.short, when = sell_condition)

// Calculate take profit and stop loss levels

take_profit_level = close * (1 + take_profit_percent / 100)

stop_loss_level = close * (1 - stop_loss_percent / 100)

// Exit conditions

strategy.exit("Exit Buy", "Buy", limit = take_profit_level, stop = stop_loss_level)

strategy.exit("Exit Sell", "Sell", limit = take_profit_level, stop = stop_loss_level)

// Martingale logic

var float last_quantity = na

if (buy_condition)

last_quantity := initial_quantity

if (sell_condition)

last_quantity := initial_quantity

if (strategy.position_size > 0)

strategy.entry("Buy Martingale", strategy.long, qty = last_quantity * martingale_multiplier)

if (strategy.position_size < 0)

strategy.entry("Sell Martingale", strategy.short, qty = last_quantity * martingale_multiplier)