概述

动态布林带突破策略是一种基于布林带指标的交易策略。该策略利用布林带上下轨作为动态支撑位和阻力位,当价格突破上轨时买入,突破下轨时卖出。布林带由中轨(移动平均线)、上轨(中轨加标准差的倍数)和下轨(中轨减标准差的倍数)组成,可以动态调整以适应市场波动。

策略原理

- 计算布林带的中轨、上轨和下轨。中轨为收盘价的简单移动平均线,上轨为中轨加上标准差的倍数,下轨为中轨减去标准差的倍数。

- 当价格上穿布林带上轨时,开仓做多;当价格下穿布林带下轨时,开仓做空。

- 当做多仓位存在时,如果价格下穿布林带上轨,平掉多头仓位;当做空仓位存在时,如果价格上穿布林带下轨,平掉空头仓位。

策略优势

- 布林带能够动态调整,适应不同的市场波动状况,具有一定的自适应性。

- 策略逻辑清晰,容易理解和实现。

- 布林带在市场趋势性较强的时候效果较好,可以有效捕捉趋势。

策略风险

- 在市场波动较大、走势震荡的情况下,该策略可能会频繁交易,导致交易成本增加。

- 布林带参数(如移动平均期间和标准差倍数)的选择会影响策略表现,不同参数可能带来不同结果。

- 该策略没有考虑其他技术指标或基本面因素,仅依赖价格与布林带的关系进行交易决策,可能面临单一信号带来的风险。

策略优化方向

- 引入其他技术指标(如RSI、MACD等)作为过滤条件,以确认布林带突破的有效性,提高信号质量。

- 对布林带参数进行优化,通过回测和参数扫描,寻找最佳的移动平均期间和标准差倍数组合。

- 设置合适的止损和止盈水平,控制单次交易风险和盈利目标。

- 考虑市场状态和波动性,在不同市场状态下动态调整策略参数或仓位大小。

总结

动态布林带突破策略是一种简单易用的交易策略,通过布林带上下轨的突破来产生交易信号。该策略在趋势性市场中表现较好,但在震荡市场中可能面临频繁交易的问题。优化方向包括结合其他技术指标、优化参数、设置适当的止损止盈以及根据市场状态调整策略等。在实际应用中,需要根据具体市场特点和个人风险偏好进行适当调整和优化。

策略源码

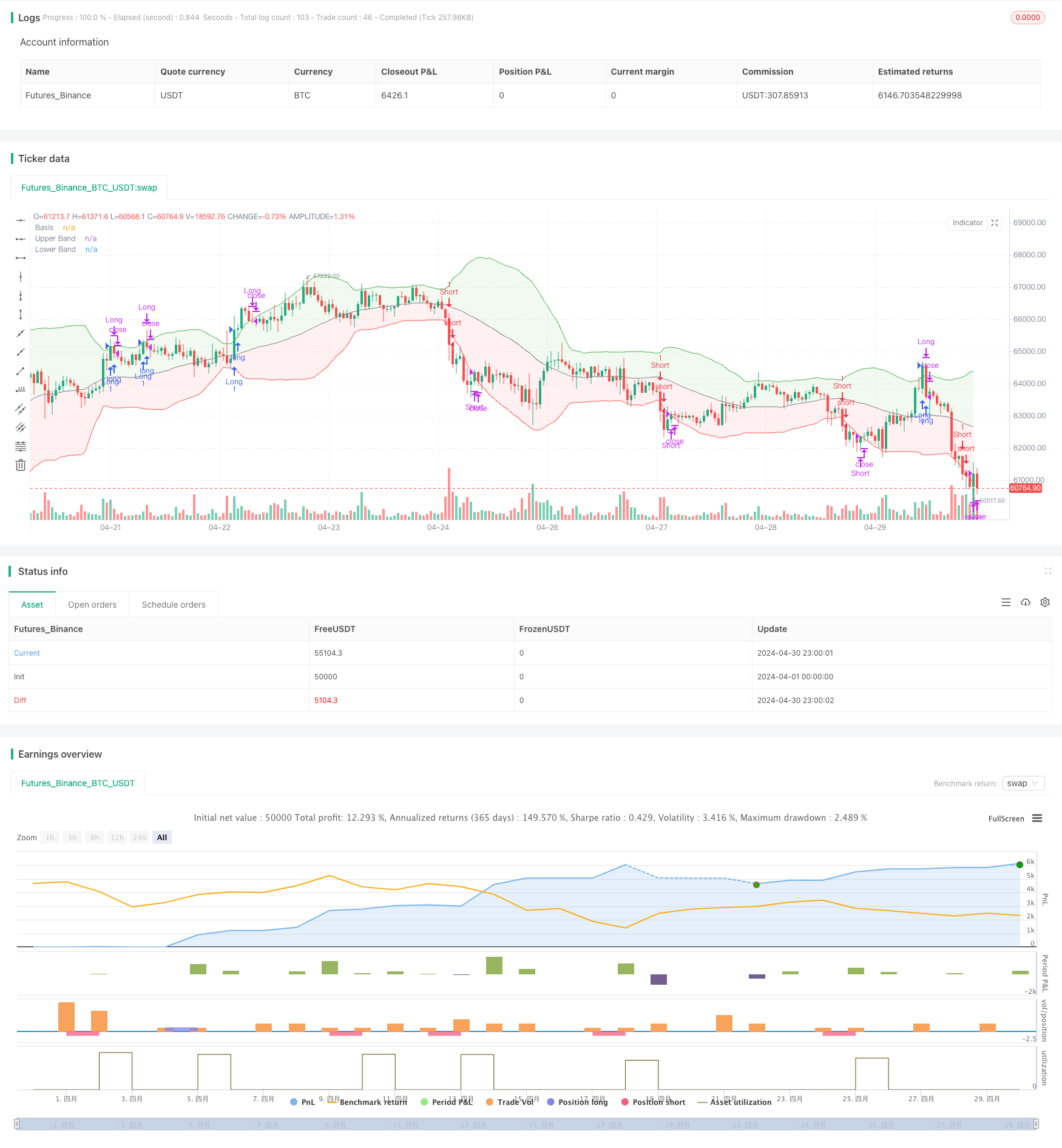

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands with Strategy", shorttitle='MBB', overlay=true)

// Input Variables

src = close

length = input.int(34, "Length", minval=1)

mult = input.float(2.0, "Multiplier", minval=0.001, maxval=50)

// Bollinger Bands Calculation

basis = ta.sma(src, length)

dev = ta.stdev(src, length)

upperBand = basis + mult * dev

lowerBand = basis - mult * dev

// Plotting Bollinger Bands

pBasis = plot(basis, "Basis", color=color.gray)

pUpper = plot(upperBand, "Upper Band", color=color.green)

pLower = plot(lowerBand, "Lower Band", color=color.red)

fill(pUpper, pBasis, color=color.new(color.green, 90))

fill(pBasis, pLower, color=color.new(color.red, 90))

// Strategy Execution Using `if`

if (ta.crossover(src, upperBand))

strategy.entry("Long", strategy.long)

if (ta.crossunder(src, lowerBand))

strategy.entry("Short", strategy.short)

if (ta.crossunder(src, upperBand))

strategy.close("Long")

if (ta.crossover(src, lowerBand))

strategy.close("Short")

相关推荐