概述

BMSB Breakout Strategy是一个基于移动平均线的突破策略。该策略使用20周期的简单移动平均线(SMA)和21周期的指数移动平均线(EMA)来确定市场的趋势方向。当收盘价上穿SMA时,策略会产生买入信号;当收盘价下穿EMA时,策略会产生卖出信号。该策略的主要思路是捕捉趋势的形成和反转,并在趋势方向上进行交易。

策略原理

该策略的核心是利用两条不同周期的移动平均线来判断市场趋势。20周期的SMA相对较慢,代表了市场的中长期趋势;21周期的EMA相对较快,代表了市场的短期趋势。当收盘价上穿SMA时,说明市场从中长期来看已经转为上升趋势,此时策略产生买入信号;当收盘价下穿EMA时,说明市场从短期来看已经转为下降趋势,此时策略产生卖出信号。通过这种方式,策略可以在趋势形成的早期阶段介入,并在趋势反转时及时退出。

优势分析

简单易懂:该策略使用的指标简单,原理清晰,易于理解和实现。

趋势跟踪:通过两条不同周期的移动平均线,策略可以有效地捕捉市场的趋势方向,在趋势形成时及时介入。

及时止损:当趋势反转时,策略可以通过下穿EMA的信号及时平仓,控制损失。

适应性强:该策略可以应用于不同的市场和品种,具有较好的适应性。

风险分析

振荡市:在市场震荡的情况下,该策略可能会产生较多的交易信号,导致频繁交易和较高的交易成本。

滞后性:由于移动平均线是滞后指标,策略的买入和卖出信号可能会有一定的延迟,错过最佳的交易时机。

参数优化:策略的表现会受到移动平均线周期选择的影响,不同的参数可能会导致不同的结果。

优化方向

参数优化:可以通过优化SMA和EMA的周期参数,寻找最佳的参数组合,提高策略的表现。

趋势过滤:在产生交易信号时,可以引入其他趋势指标或价格行为模式,对趋势的强度和持续性进行进一步确认,提高信号的可靠性。

风险控制:可以引入止损和止盈机制,控制单次交易的风险敞口;也可以通过仓位管理,根据市场波动性动态调整仓位大小,降低策略的整体风险。

多空择时:在产生买入和卖出信号时,可以结合其他择时指标或市场情绪指标,对多空双方的力量进行评估,选择更有优势的方向进行交易。

总结

BMSB Breakout Strategy是一个简单易用的趋势追踪策略,通过两条不同周期的移动平均线来判断市场趋势,在趋势形成时及时介入,在趋势反转时及时退出。该策略的优势在于简单易懂,适应性强,同时也存在震荡市下交易频繁,信号滞后等风险。通过参数优化,趋势过滤,风险控制和多空择时等方法,可以进一步提高该策略的表现和稳定性。

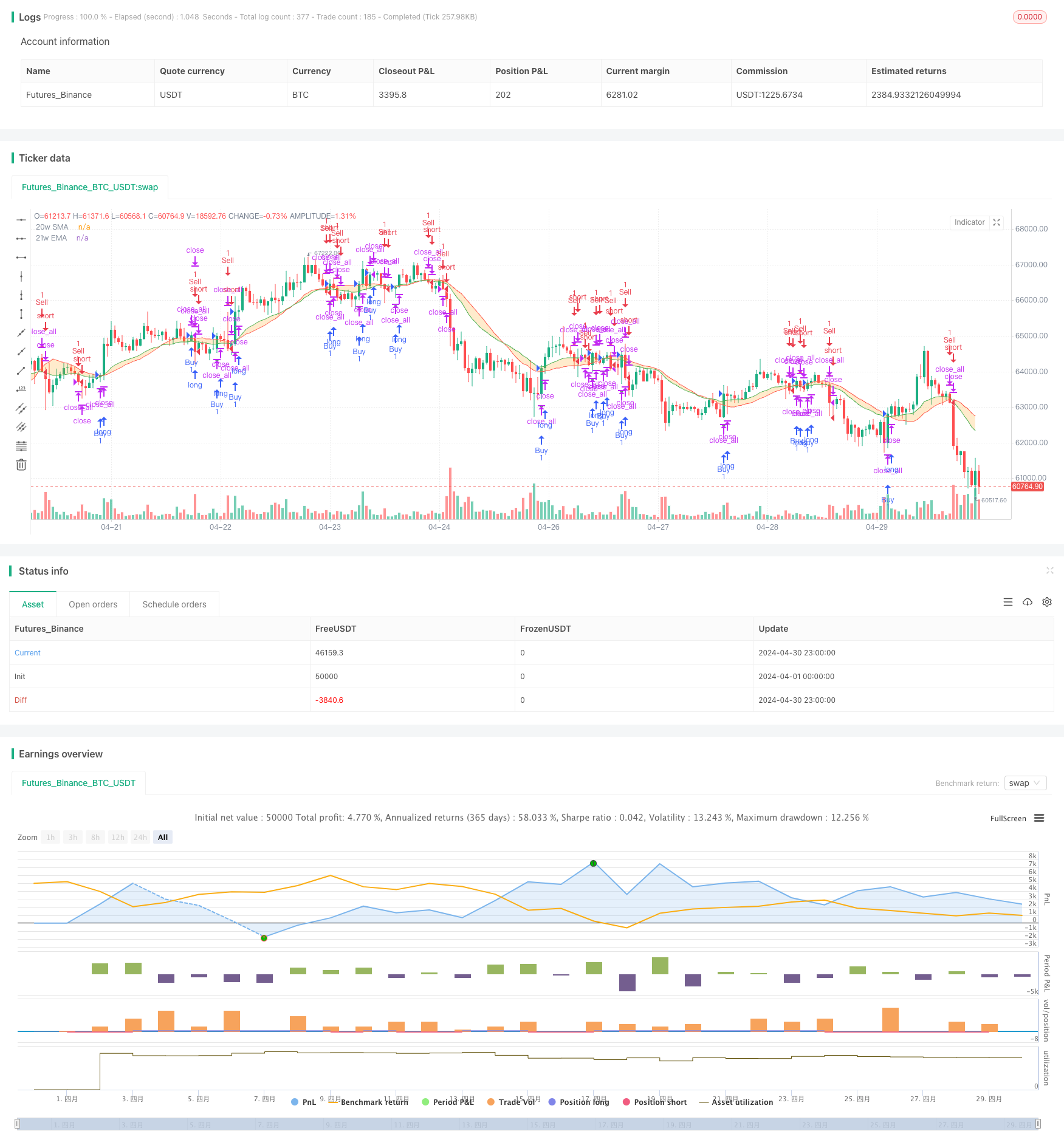

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("BMSB Breakout Strategy", overlay=true)

// Definición de la BMSB

smaLength = 20

emaLength = 21

source = close

sma = ta.sma(source, smaLength)

ema = ta.ema(source, emaLength)

outSma = request.security(syminfo.tickerid, timeframe.period, sma)

outEma = request.security(syminfo.tickerid, timeframe.period, ema)

smaPlot = plot(outSma, color=color.new(color.red, 0), title='20w SMA')

emaPlot = plot(outEma, color=color.new(color.green, 0), title='21w EMA')

fill(smaPlot, emaPlot, color=color.new(color.orange, 75), fillgaps=true)

// Señales de Compra y Venta

buySignal = ta.crossover(close, outSma)

sellSignal = ta.crossunder(close, outEma)

// Lógica de la Estrategia

if (buySignal)

if (strategy.opentrades > 0)

strategy.close_all()

strategy.entry("Buy", strategy.long)

if (sellSignal)

if (strategy.opentrades > 0)

strategy.close_all()

strategy.entry("Sell", strategy.short)

plotshape(series=buySignal, title="Compra", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=sellSignal, title="Venta", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)