概述

EMA SAR 中长期趋势跟踪策略是一种利用指数移动平均线(EMA)和抛物线指标(SAR)的组合来捕捉市场中长期趋势的量化交易策略。该策略通过比较20周期和60周期的EMA,结合SAR指标来确定当前市场的趋势方向,并在趋势确立后进行交易。该策略的主要目标是在趋势形成的早期阶段介入,并持有头寸直到趋势反转的信号出现。

策略原理

该策略的核心是利用两条不同周期的EMA(20和60)的交叉来判断趋势的方向。当20周期EMA从下方向上穿越60周期EMA时,表明上升趋势可能正在形成;反之,当20周期EMA从上方向下穿越60周期EMA时,表明下降趋势可能正在形成。为了进一步确认趋势的真实性,该策略还引入了SAR指标作为辅助判断。只有在EMA交叉的同时,SAR指标也显示出与趋势一致的信号时(上升趋势时SAR在价格下方,下降趋势时SAR在价格上方),该策略才会考虑进场交易。

优势分析

- 通过组合使用EMA和SAR指标,该策略能够较好地过滤掉噪音和假信号,提高趋势判断的准确性。

- 该策略的交易频率相对较低,更适合捕捉中长期的趋势,有助于降低交易成本和频繁交易带来的风险。

- 在趋势形成的早期阶段介入,能够最大化每个趋势的利润空间。

- 止损设置在前一个交易日的高点(做多)或低点(做空),能够有效控制单次交易的风险。

风险分析

- 该策略在震荡市中可能会出现较多的错误信号,导致频繁交易和资金损失。

- 策略的表现在很大程度上依赖于EMA和SAR参数的选择,不同的参数设置可能导致策略表现差异较大。

- 在强趋势市场中,该策略可能会错过最佳的入场机会,因为它需要等待EMA交叉和SAR确认。

- 该策略缺乏对风险与收益的动态权衡,在每次交易中承担的风险可能不尽相同。

优化方向

- 考虑引入其他技术指标或市场情绪指标,以进一步提高趋势判断的准确性和可靠性。

- 对EMA和SAR的参数进行优化,找到在不同市场状况下表现最佳的参数组合。

- 引入动态止损和止盈机制,根据市场波动性和个股特性实时调整风险控制。

- 结合市场领涨股或行业轮动等策略,提高在强趋势市场中的适应性和收益潜力。

总结

EMA SAR 中长期趋势跟踪策略通过组合使用EMA和SAR指标,在趋势形成的早期阶段介入,以捕捉市场中长期趋势性机会。该策略的优势在于能够较好地过滤噪音,并在趋势确立后持有头寸以最大化利润。然而,其在震荡市中可能出现较多错误信号,且表现受参数选择影响较大。未来可以通过引入其他指标、优化参数、动态风控等方式对该策略进行进一步增强,提高其在不同市场环境下的稳健性和收益潜力。

策略源码

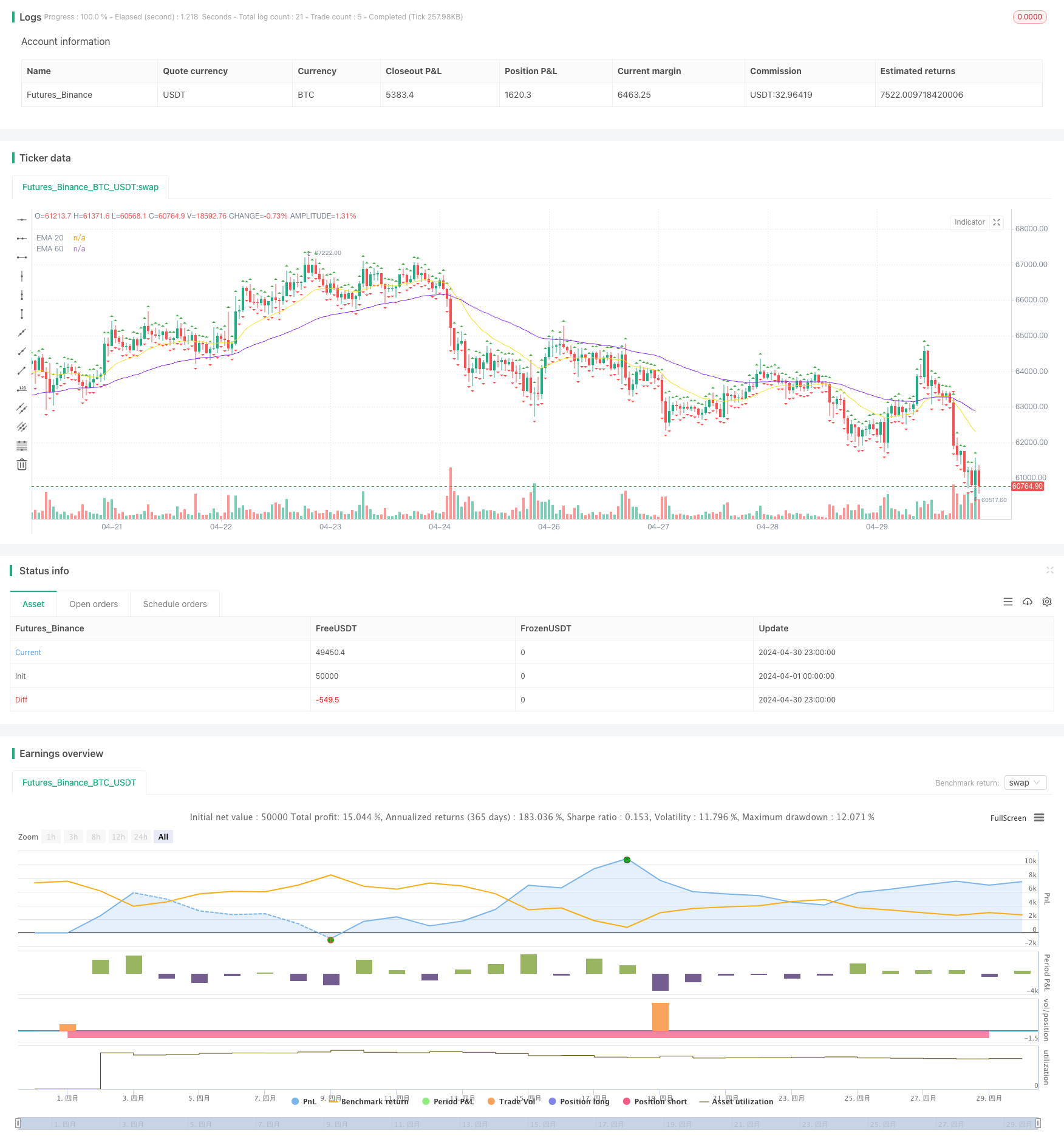

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA SAR Strategy", overlay=true)

// EMA Settings

ema_20 = ta.ema(close, 20)

ema_60 = ta.ema(close, 60)

/// SAR Settings

sar = ta.sar(0.02, 0.2, 0.2)

sar_value = sar

is_trend_up = sar[1] > sar[2] ? true : false // Evaluating the trend direction

/// Condition for Buy Signal

buy_condition = ta.crossover(ema_20, ema_60) and (sar_value < ema_20) and (is_trend_up)

// Condition for Sell Signal

sell_condition = ta.crossunder(ema_20, ema_60) and (sar_value > ema_20) and (not is_trend_up)

// Define Entry Time

entry_time = time + 180000

// Strategy Entry

strategy.entry("Buy", strategy.long, when=buy_condition, comment="Buy Signal", stop=high[1])

strategy.entry("Sell", strategy.short, when=sell_condition, comment="Sell Signal", stop=low[1], when=entry_time)

// Plot EMAs

plot(ema_20, color=#f3e221, linewidth=1, title="EMA 20")

plot(ema_60, color=#8724f0, linewidth=1, title="EMA 60")

// Plot SAR

plotshape(sar_value, style=shape.triangleup, location=location.abovebar, color=color.green, size=size.small, title="SAR Up")

plotshape(sar_value, style=shape.triangledown, location=location.belowbar, color=color.red, size=size.small, title="SAR Down")

// Plot Buy and Sell Signals

plotshape(series=buy_condition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=sell_condition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

// Send Alerts

alertcondition(condition=buy_condition, title="Buy Signal", message="Buy Signal - EMA SAR Strategy")

alertcondition(condition=sell_condition, title="Sell Signal", message="Sell Signal - EMA SAR Strategy")

相关推荐