概述

该策略利用纳达拉亚-沃森带状图对价格进行平滑处理,并根据平滑后的价格计算上下轨。然后使用ADX和DI指标判断趋势强度和方向,RSI指标确认趋势动能,同时通过价格突破上下轨来识别潜在的突破点。最后结合趋势、突破点和动能等多重信号来执行交易,并采用动态止损来管理风险。

策略原理

- 使用纳达拉亚-沃森带状图对价格进行平滑处理,计算上下轨。

- 利用ADX和DI指标判断趋势强度和方向。当ADX大于阈值,且+DI大于-DI时表示上升趋势,反之为下降趋势。

- 判断价格是否突破带状图上轨或下轨,分别表示潜在的向上突破和向下突破。

- 使用RSI指标确认趋势动能。当RSI大于70表示上升动能,小于30表示下降动能。

- 结合趋势、突破点和动能等多重信号来执行交易:

- 当存在强上升趋势、向上突破和上升动能时开多仓。

- 当存在强下降趋势、向下突破和下降动能时开空仓。

- 采用动态止损来管理风险,止损价格根据最高价/最低价和收盘价计算得出。

- 通过在图表上标注趋势线、突破点和动能信号,直观展示策略信号。

策略优势

- 纳达拉亚-沃森带状图可以有效平滑价格数据,减少噪音干扰。

- 多重信号确认机制提高了信号可靠性,趋势、突破点和动能信号互为补充,共同验证交易机会。

- 动态止损管理可以更好地适应市场波动,降低风险。止损价格根据最高价/最低价和收盘价计算得出,可以跟随市场调整。

- 在图表上直观标注趋势线、突破点和动能信号,方便用户观察和解读策略信号。

策略风险

- 在震荡市场或趋势转折期,频繁的突破信号可能导致过度交易和亏损。

- 动态止损在趋势反转时可能无法及时止损,导致回撤加大。

- 策略参数如纳达拉亚-沃森带状图的带宽、ADX的阈值等需要根据不同市场和标的进行优化,参数设置不当可能影响策略效果。

策略优化方向

- 引入更多有效的趋势判断指标,如MACD、均线系统等,提高趋势判断的准确性和稳定性。

- 优化动态止损计算方法,如考虑ATR、SAR等与波动率相关的指标,使止损更加灵活有效。

- 针对不同市场特点,如趋势型、震荡型等,设置不同的参数组合,提高策略的适应性。

- 加入仓位管理模块,根据市场趋势、波动率等因素动态调整仓位,控制风险。

总结

该策略通过纳达拉亚-沃森带状图平滑价格,结合ADX、DI等趋势指标和RSI动能指标,以及价格突破点等多重信号,构建了一个较为完善的交易系统。动态止损管理可以一定程度上适应市场变化,控制风险。但在实际应用中仍需注意优化趋势判断、动态止损和参数设置等方面,以提高策略的稳健性和盈利能力。

策略源码

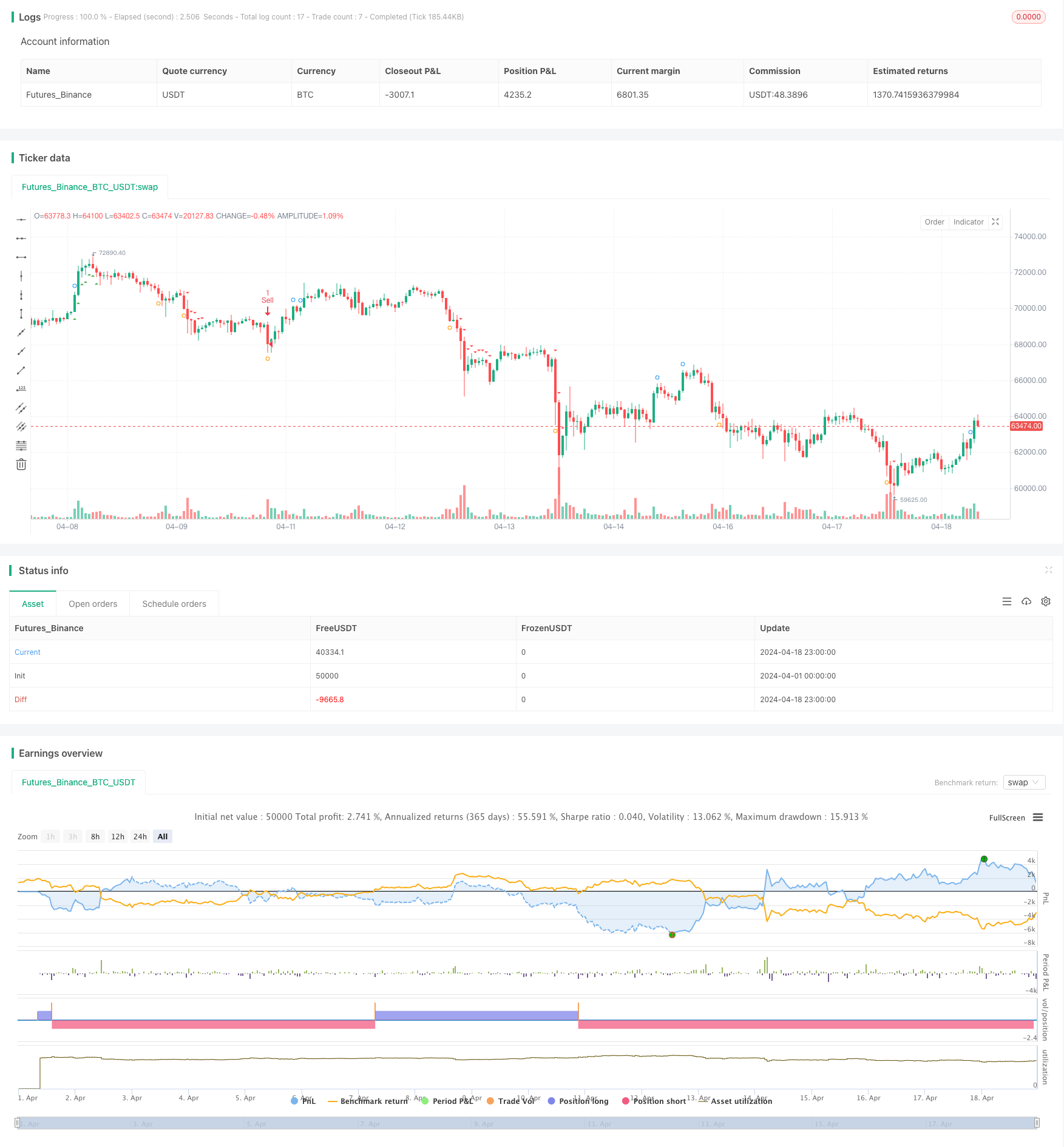

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-18 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Nadaraya-Watson Envelope with Multi-Confirmation and Dynamic Stop-Loss", overlay=true)

// Input parameters

h = input.float(7.2, "Bandwidth", minval=0)

mult = input.float(2.1, minval=0)

src = input(close, "Source")

// ADX and DI Input Parameters

adxLength = input.int(14, "ADX Length")

adxThreshold = input.float(25, "ADX Threshold")

adxSmoothing = input.int(14, "ADX Smoothing")

// Calculate ADX and DI

[dmiPlus, dmiMinus, adx] = ta.dmi(adxLength, adxSmoothing)

strongTrendUp = dmiPlus > dmiMinus and adx > adxThreshold

strongTrendDown = dmiMinus > dmiPlus and adx > adxThreshold

// Nadaraya-Watson Envelope Calculation

gauss(x, h) =>

math.exp(-(math.pow(x, 2) / (h * h * 2)))

coefs = array.new_float(0)

den = 0.0

for i = 0 to 100

w = gauss(i, h)

array.push(coefs, w)

den := array.sum(coefs)

out = 0.0

for i = 0 to 100

out += src[i] * array.get(coefs, i)

out /= den

mae = ta.sma(math.abs(src - out), 100) * mult

upper = ta.sma(out + mae, 10)

lower = ta.sma(out - mae, 10)

// Confirmations

breakoutUp = ta.crossover(src, upper)

breakoutDown = ta.crossunder(src, lower)

// Original RSI period and thresholds

rsiPeriod = input.int(14, "RSI Period")

rsi = ta.rsi(src, rsiPeriod)

momentumUp = rsi > 70 and adx > adxThreshold

momentumDown = rsi < 30 and adx > adxThreshold

// // Plot ADX-based Trend Confirmation Lines

// if (strongTrendUp)

// line.new(bar_index, low, bar_index + 1, low, color=color.new(color.blue, 50), width=2, style=line.style_dashed)

// if (strongTrendDown)

// line.new(bar_index, high, bar_index + 1, high, color=color.new(color.red, 50), width=2, style=line.style_dashed)

// Plot Breakout Confirmation Dots

plotshape(series=breakoutUp, style=shape.circle, location=location.abovebar, color=color.blue, size=size.tiny, title="Breakout Up")

plotshape(series=breakoutDown, style=shape.circle, location=location.belowbar, color=color.orange, size=size.tiny, title="Breakout Down")

// Plot Momentum Confirmation Arrows

plotshape(series=momentumUp, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny, title="Momentum Up")

plotshape(series=momentumDown, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny, title="Momentum Down")

// Strategy Entry and Exit

var float stopLossLevel = na

var float highestPrice = na

potentialBuy = strongTrendUp and breakoutUp

potentialSell = strongTrendDown and breakoutDown

momentumConfirmUp = potentialBuy and momentumUp

momentumConfirmDown = potentialSell and momentumDown

if (momentumConfirmUp)

strategy.entry("Buy", strategy.long)

stopLossLevel := close * 0.90

highestPrice := close

if (momentumConfirmDown)

strategy.entry("Sell", strategy.short)

stopLossLevel := close * 1.10

highestPrice := close

if (strategy.position_size > 0)

highestPrice := math.max(highestPrice, close)

stopLossLevel := math.max(highestPrice * 0.85, close * 0.90)

if (strategy.position_size < 0)

highestPrice := math.min(highestPrice, close)

stopLossLevel := math.min(highestPrice * 1.15, close * 1.10)

// Close position if stop loss is hit

if (strategy.position_size > 0 and close < stopLossLevel)

strategy.close("Buy")

if (strategy.position_size < 0 and close > stopLossLevel)

strategy.close("Sell")

相关推荐