概述

该策略使用平均真实波幅(ATR)作为跟踪止损(TS)的依据,通过动态调整止损位置来实现追踪趋势的目的。当价格向有利方向移动时,止损位置也会随之调整,从而锁定已获得的利润;当价格向不利方向移动时,止损位置保持不变,一旦价格触及止损价格,则平仓止损。该策略的关键在于止损位置的动态调整,既可以保护已获利润,又能让利润随趋势延续而不断扩大。

策略原理

- 计算ATR,作为跟踪止损的依据。ATR反映了市场波动性,用于衡量价格变动的平均幅度。

- 根据ATR和KeyValue参数计算止损距离nLoss。KeyValue为用户自定义的倍数,nLoss为KeyValue与ATR的乘积,表示止损距离是ATR的几倍。

- 计算动态跟踪止损位置xATRTrailingStop。多头持仓时,将其设为”前一根K线的最高价与(收盘价-nLoss)两者的较大值”;空头持仓时,将其设为”前一根K线的最低价与(收盘价+nLoss)两者的较小值”。

- 产生开仓信号。当收盘价上穿xATRTrailingStop时,做多;当收盘价下穿xATRTrailingStop时,做空。

优势分析

- 止损位置随价格波动而动态调整,既能锁定利润,又能让利润随趋势延续而扩大。

- 止损位置基于ATR计算,能够客观反映市场波动性,与主观设置的固定止损相比更加灵活有效。

- 通过KeyValue参数放大ATR,可以根据自己的风险偏好设置合适的止损距离,较大的KeyValue会带来较宽的止损空间和较少的止损频率。

风险分析

- 趋势型策略在震荡市中表现欠佳,单边趋势不明显时会频繁止损,导致资金快速流失。

- 入场时机依赖收盘价与动态止损线的交叉信号,在震荡行情中可能出现连续的小止损。

- 跟踪止损策略无法避免巨大利空或利多带来的缺口跳空,止损位置调整速度跟不上价格变动速度,导致实际亏损远大于预期可控亏损。

优化方向

- 可以在策略基础上增加趋势判断指标,如均线系统、动量指标等,在趋势明确时才进场,避免在震荡市频繁交易。

- 可以考虑引入止盈策略,如根据凯利公式计算持仓头寸、设置固定获利点数回撤止盈等,降低趋势末期潜在利润回吐的可能。

- 针对跳空缺口,可以设置最大止损限制,如固定金额或固定百分比,一旦达到该限额,无论动态止损价位在何处,都立即止损。

总结

ATR跟踪止损策略能够根据价格波动幅度动态调整止损位置,在趋势行情中可以取得不错的效果。但是,该策略也存在无法应对震荡市、止损过于频繁以及难以避免跳空缺口等风险。针对上述缺陷,可以从趋势判断、止盈策略、最大止损限制等方面对策略进行优化和改进。通过这些调整,有望增强策略的适应性和盈利能力。

策略源码

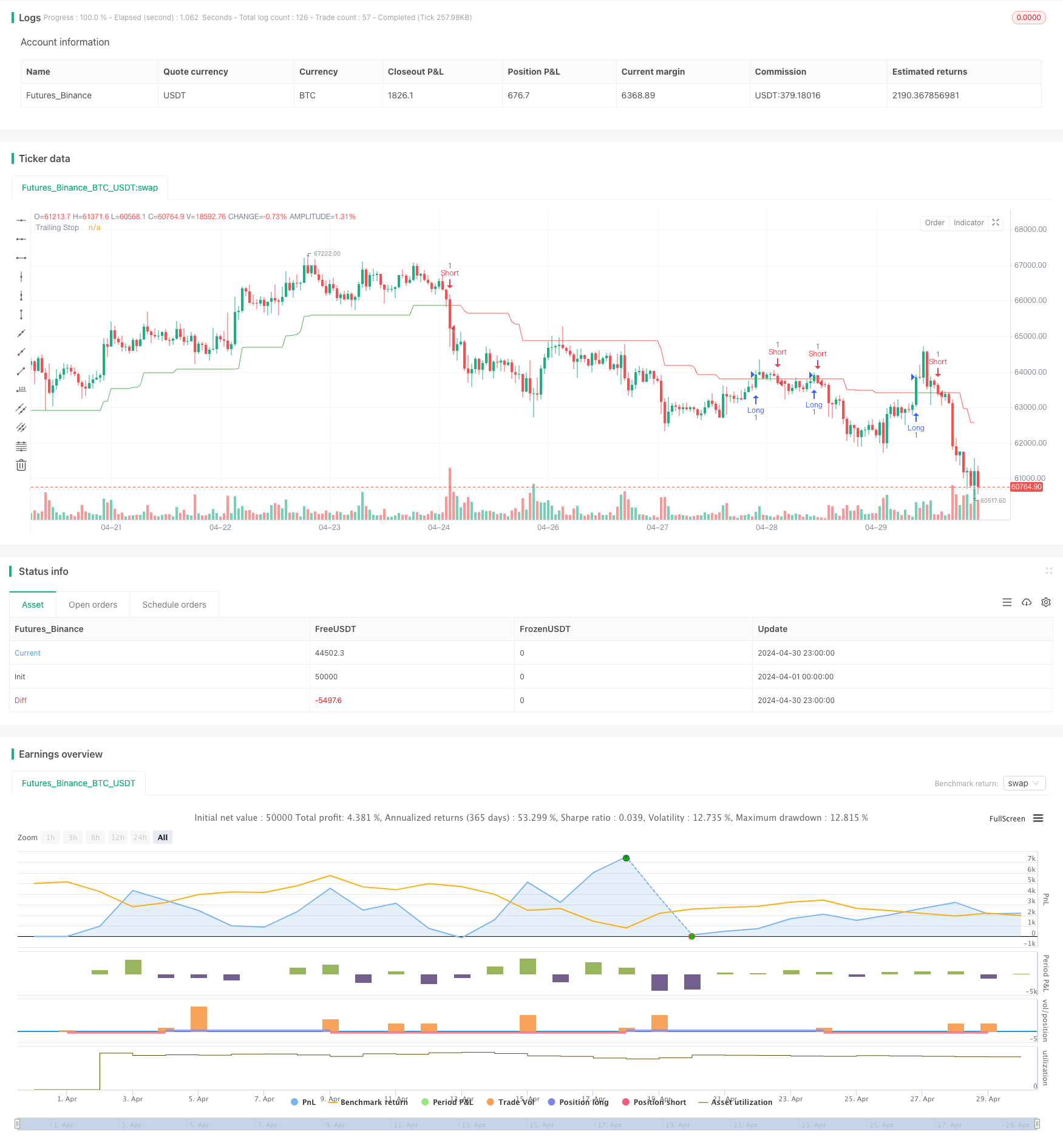

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Long TAP", overlay=true)

// Constants

keyValueDefault = 3.0

keyValueStep = 0.5

atrPeriodDefault = 10

// Inputs

keyValue = input.float(keyValueDefault, title="Key Value")

atrPeriod = input.int(atrPeriodDefault, title="ATR Period")

// Calculations

xATR = ta.atr(atrPeriod)

nLoss = keyValue * xATR

// Trailing Stop Calculation

var float xATRTrailingStop = 0.0

xATRTrailingStop := ta.highest(math.max(nz(xATRTrailingStop[1], 0), close - nLoss), 1)

xATRTrailingStop := ta.lowest(math.min(nz(xATRTrailingStop, 0), close + nLoss), 1)

// Position Calculation

var int pos = 0

pos := nz(pos[1], 0)

if (close[1] < nz(xATRTrailingStop, 0) and close > nz(xATRTrailingStop, 0))

pos := 1

else if (close[1] > nz(xATRTrailingStop, 0) and close < nz(xATRTrailingStop, 0))

pos := -1

// Plotting Trailing Stop

var color xcolor = na

if (pos == -1)

xcolor := color.red

else if (pos == 1)

xcolor := color.green

plot(xATRTrailingStop, color=xcolor, title="Trailing Stop")

// Buy/Sell Signals

buySignal = ta.crossover(close, xATRTrailingStop)

sellSignal = ta.crossunder(close, xATRTrailingStop)

// Strategy

if (buySignal)

strategy.entry("Long", strategy.long)

label.new(bar_index, xATRTrailingStop, text="Buy Signal", color=color.green, style=label.style_label_up, yloc=yloc.belowbar)

if (sellSignal)

strategy.entry("Short", strategy.short)

label.new(bar_index, xATRTrailingStop, text="Sell Signal", color=color.red, style=label.style_label_down, yloc=yloc.abovebar)

// Alerts

alertcondition(buySignal, title='UT BOT Buy', message='UT BOT Buy')

alertcondition(sellSignal, title='UT BOT Sell', message='UT BOT Sell')

相关推荐