概述

该策略基于MACD(移动平均线聚散)指标的零滞后版本,通过快速响应价格变化,捕捉短期趋势,实现高频交易。策略使用两条不同周期的移动平均线(快线和慢线)构建MACD指标,并引入零滞后算法,消除指标与价格的延迟,提高信号的及时性。同时,使用信号线与MACD线的交叉作为买卖信号,并设置警报,方便交易者及时把握交易机会。

策略原理

- 计算快线(默认12周期)和慢线(默认26周期)的EMA(指数移动平均线)或SMA(简单移动平均线)。

- 使用零滞后算法对快线和慢线进行二次平滑,消除指标与价格的延迟。

- MACD线由零滞后快线与零滞后慢线的差值构成。

- 信号线由MACD线的EMA(默认9周期)或SMA构成。

- MACD柱状图由MACD线与信号线的差值构成,用蓝色表示正值,红色表示负值。

- 当MACD线从下向上穿过信号线,且穿越点位于零轴以下时,产生买入信号(蓝点)。

- 当MACD线从上向下穿过信号线,且穿越点位于零轴以上时,产生卖出信号(红点)。

- 策略根据买卖信号自动下单,并触发相应的警报。

优势分析

- 零滞后算法有效消除了指标与价格的延迟,提高了信号的及时性和准确性。

- 双重移动平均线的设计可以更好地捕捉市场趋势,适应不同的市场环境。

- MACD柱状图直观反映了多空力量对比,辅助交易决策。

- 自动下单和警报功能方便交易者及时把握交易机会,提高交易效率。

风险分析

- 在震荡市场中,频繁的交叉信号可能导致过度交易和损失。

- 参数设置不当可能导致信号失真,影响策略表现。

- 策略依赖历史数据进行计算,对突发事件和黑天鹅事件的适应性较差。

优化方向

- 引入趋势确认指标,如ADX等,过滤震荡市场中的虚假信号。

- 对参数进行优化,找到最佳的快慢线周期和信号线周期组合,提高策略稳定性。

- 结合其他技术指标或基本面因素,构建多因子模型,提高策略的风险调整后收益。

- 引入止损和止盈机制,控制单笔交易风险。

总结

MACD双转换零滞后交易策略通过快速响应价格变化,捕捉短期趋势,实现高频交易。零滞后算法和双重移动平均线的设计提高了信号的及时性和准确性。策略具有一定的优势,如信号直观、操作便捷等,但同时也存在过度交易、参数敏感等风险。未来可以通过引入趋势确认指标、参数优化、多因子模型等方式对策略进行优化,提高策略的稳健性和收益水平。

策略源码

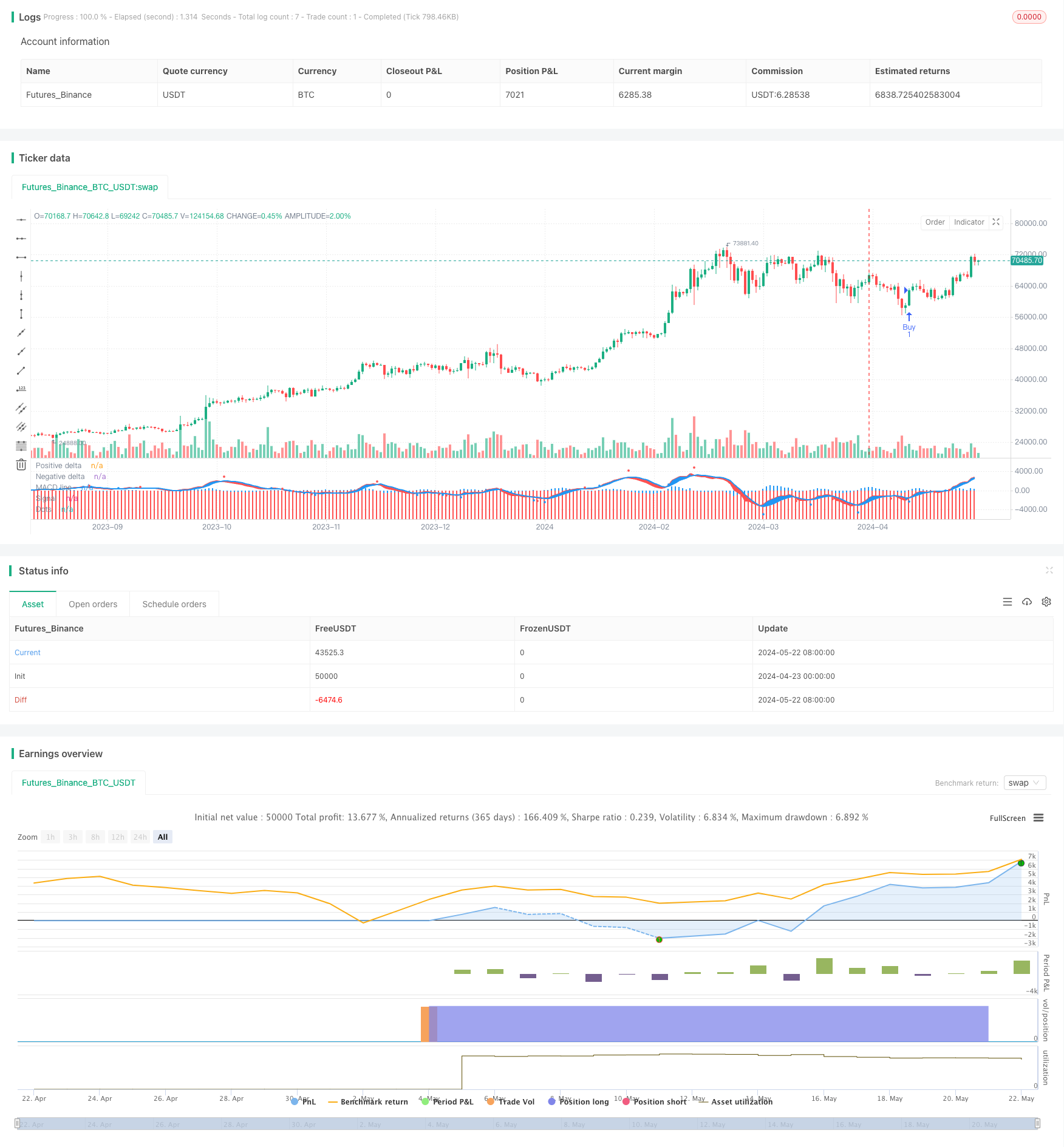

/*backtest

start: 2024-04-23 00:00:00

end: 2024-05-23 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("BNM INTRADAY SETUP MACD 3M - Version 1.2", shorttitle="Zero Lag MACD Enhanced 1.2")

source = close

fastLength = input(12, title="Fast MM period", minval=1)

slowLength = input(26,title="Slow MM period", minval=1)

signalLength =input(9,title="Signal MM period", minval=1)

useEma = input(true, title="Use EMA (otherwise SMA)")

useOldAlgo = input(false, title="Use Glaz algo (otherwise 'real' original zero lag)")

showDots = input(true, title="Show symbols to indicate crossing")

dotsDistance = input(1.5, title="Symbols distance factor", minval=0.1)

// Fast line

ma1 = useEma ? ema(source, fastLength) : sma(source, fastLength)

ma2 = useEma ? ema(ma1, fastLength) : sma(ma1, fastLength)

zerolagEMA = ((2 * ma1) - ma2)

// Slow line

mas1 = useEma ? ema(source, slowLength) : sma(source, slowLength)

mas2 = useEma ? ema(mas1, slowLength) : sma(mas1, slowLength)

zerolagslowMA = ((2 * mas1) - mas2)

// MACD line

ZeroLagMACD = zerolagEMA - zerolagslowMA

// Signal line

emasig1 = ema(ZeroLagMACD, signalLength)

emasig2 = ema(emasig1, signalLength)

signal = useOldAlgo ? sma(ZeroLagMACD, signalLength) : (2 * emasig1) - emasig2

hist = ZeroLagMACD - signal

upHist = (hist > 0) ? hist : 0

downHist = (hist <= 0) ? hist : 0

p1 = plot(upHist, color=color.blue, transp=40, style=plot.style_columns, title='Positive delta')

p2 = plot(downHist, color=color.red, transp=40, style=plot.style_columns, title='Negative delta')

zeroLine = plot(ZeroLagMACD, color=color.red, transp=0, linewidth=2, title='MACD line')

signalLine = plot(signal, color=color.blue, transp=0, linewidth=2, title='Signal')

ribbonDiff = hist > 0 ? color.blue : color.red

fill(zeroLine, signalLine, color=ribbonDiff)

circleYPosition = signal * dotsDistance

ribbonDiff2 = hist > 0 ? color.blue : color.red

// Generate dots for cross signals

plot(showDots and cross(ZeroLagMACD, signal) ? circleYPosition : na, style=plot.style_circles, linewidth=4, color=ribbonDiff2, title='Dots')

// Alerts for buy and sell signals

buySignal = cross(ZeroLagMACD, signal) and (ribbonDiff2 == color.blue) and (ZeroLagMACD < 0)

sellSignal = cross(ZeroLagMACD, signal) and (ribbonDiff2 == color.red) and (ZeroLagMACD > 0)

// Use 'strategy.entry' for placing orders in strategy context

if (buySignal)

strategy.entry("Buy", strategy.long)

alert("Buy Signal: Blue dot below zero line", alert.freq_once_per_bar_close)

if (sellSignal)

strategy.entry("Sell", strategy.short)

alert("Sell Signal: Red dot above zero line", alert.freq_once_per_bar_close)

相关推荐