概述

该策略使用ATR(平均真实波幅)和EMA(指数移动平均线)两个指标,通过动态调整止盈止损点位来适应市场的波动。策略的主要思路是:利用ATR指标来衡量市场波动率,并根据波动率的大小来设置止盈止损点位;同时使用EMA指标来确定交易方向,当价格向上突破EMA时开多单,向下突破EMA时开空单。该策略能够根据市场波动的变化自动调整止盈止损点位,以达到动态控制风险的目的。

策略原理

- 计算ATR指标,用来衡量市场波动率的大小。

- 根据ATR的值和输入的倍数参数,计算出动态止损点位。

- 使用EMA指标作为过滤条件,当价格向上突破EMA时开多单,向下突破EMA时开空单。

- 持仓时,根据价格的变化和动态止损点位的变化,不断调整止盈止损位置。

- 当价格触及动态止损点位时,平仓并反向开仓。

策略优势

- 自适应性强:通过动态调整止盈止损点位,策略能够适应不同市场状态下的波动率变化,控制风险。

- 趋势跟踪能力强:利用EMA指标来判断交易方向,能够有效捕捉市场趋势。

- 参数可调:通过调整ATR的周期和倍数参数,可以灵活控制策略的风险和收益。

策略风险

- 参数设置风险:ATR周期和倍数参数的设置会直接影响策略的表现,参数设置不当可能导致策略失效。

- 震荡市风险:在震荡市中,频繁的开平仓可能会导致较大的滑点和手续费损失。

- 趋势转折风险:当市场趋势发生转折时,策略可能会出现连续亏损的情况。

策略优化方向

- 引入更多的技术指标,如MACD、RSI等,以提高趋势判断的准确性。

- 优化止盈止损点位的计算方法,如引入移动止盈、动态比率止盈等方法。

- 对参数进行优化,找到最佳的ATR周期和倍数参数组合,提高策略的稳定性和盈利能力。

- 加入仓位管理模块,根据市场波动率和账户风险水平动态调整仓位大小。

总结

该策略利用ATR和EMA两个指标,通过动态调整止盈止损点位来适应市场波动率的变化,同时使用EMA指标来判断交易方向。策略具有较强的自适应性和趋势跟踪能力,但在参数设置、震荡市和趋势转折时可能面临一定的风险。未来可以通过引入更多技术指标、优化止盈止损算法、参数优化和加入仓位管理等方式来提升策略的表现。

策略源码

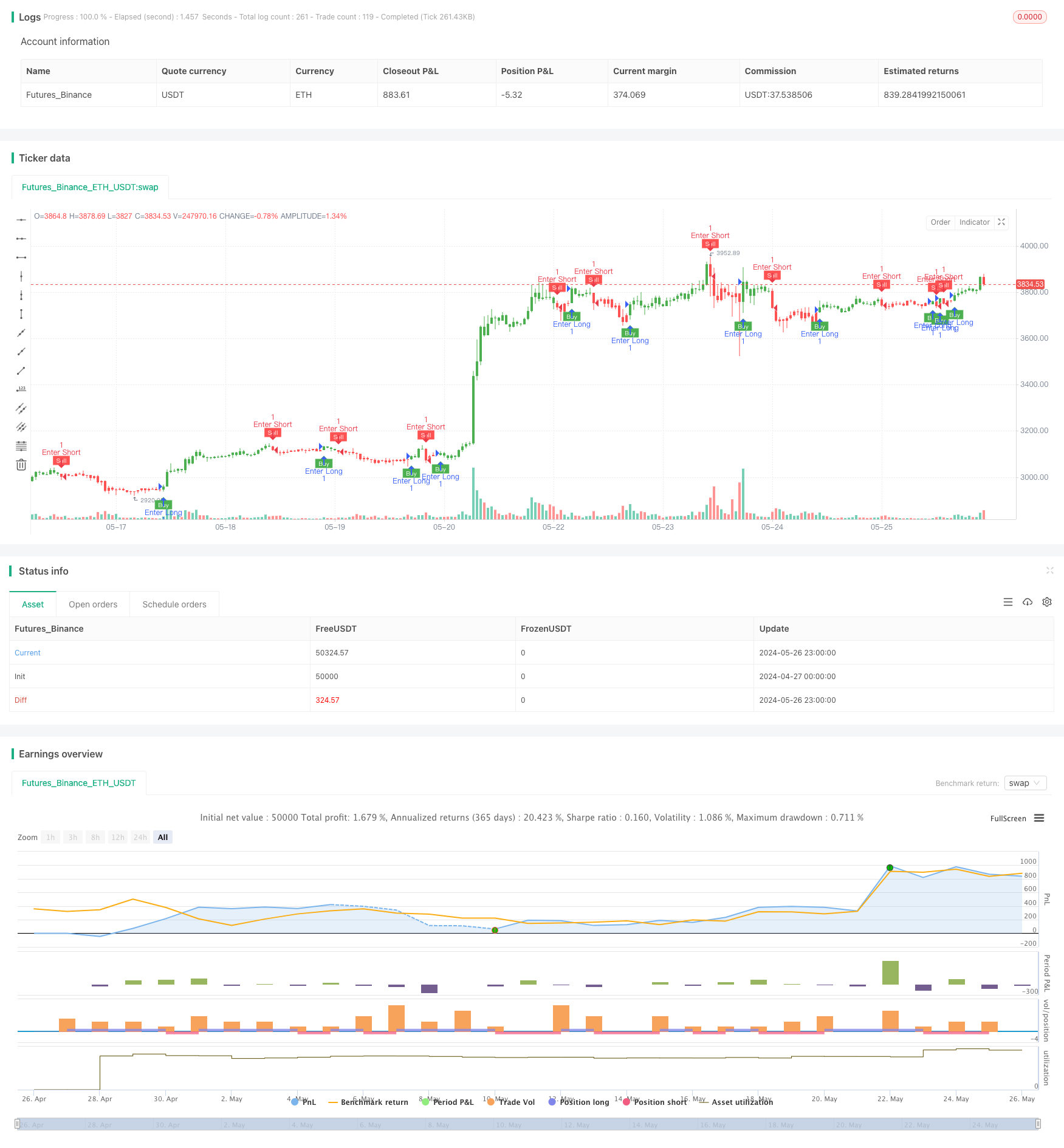

/*backtest

start: 2024-04-27 00:00:00

end: 2024-05-27 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy(title='UT MB&SS Bot', overlay=true)

// Inputs

a = input(1, title='Key Value. \'This changes the sensitivity\'')

c = input(10, title='ATR Period')

h = input(false, title='Signals from Heikin Ashi Candles')

stoploss = input(2.0, title='Stop Loss (ATR Multiples)')

xATR = ta.atr(c)

nLoss = a * xATR

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close, lookahead=barmerge.lookahead_off) : close

var xATR_trailing_stop = 0.0

iff_1 = src > nz(xATR_trailing_stop[1], 0) ? src - nLoss : src + nLoss

iff_2 = src < nz(xATR_trailing_stop[1], 0) and src[1] < nz(xATR_trailing_stop[1], 0) ? math.min(nz(xATR_trailing_stop[1]), src + nLoss) : iff_1

xATR_trailing_stop := src > nz(xATR_trailing_stop[1], 0) and src[1] > nz(xATR_trailing_stop[1], 0) ? math.max(nz(xATR_trailing_stop[1]), src - nLoss) : iff_2

pos = 0

iff_3 = src[1] > nz(xATR_trailing_stop[1], 0) and src < nz(xATR_trailing_stop[1], 0) ? -1 : nz(pos[1], 0)

pos := src[1] < nz(xATR_trailing_stop[1], 0) and src > nz(xATR_trailing_stop[1], 0) ? 1 : iff_3

xcolor = pos == -1 ? color.red : pos == 1 ? color.green : color.blue

ema = ta.ema(src, 1)

above = ta.crossover(ema, xATR_trailing_stop)

below = ta.crossover(xATR_trailing_stop, ema)

buy = src > xATR_trailing_stop and above

sell = src < xATR_trailing_stop and below

barbuy = src > xATR_trailing_stop

barsell = src < xATR_trailing_stop

plotshape(buy, title='Buy', text='Buy', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(sell, title='Sell', text='Sell', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

barcolor(barbuy ? color.green : na)

barcolor(barsell ? color.red : na)

stop_level = pos == 1 ? xATR_trailing_stop - stoploss * xATR : xATR_trailing_stop + stoploss * xATR

stop_level := math.max(stop_level, nz(stop_level[1]))

if pos == 1

strategy.exit('Exit Long', 'UT Long', stop=stop_level)

else if pos == -1

strategy.exit('Exit Short', 'UT Short', stop=stop_level)

if buy

strategy.entry("Enter Long", strategy.long)

else if sell

strategy.entry("Enter Short", strategy.short)

相关推荐