概述

该策略是一个基于FVG指标的动量短线交易策略。它通过识别FVG指标的多头和空头信号,在市场中寻找潜在的短线交易机会。该策略使用紧止损和获利目标来限制潜在损失并最大化收益。该策略适用于短期时间框架(如1分钟或5分钟图表)。

策略原理

该策略使用FVG指标来识别潜在的交易机会。FVG指标通过比较当前收盘价与前三根K线的最高价和最低价来确定多头和空头信号。如果当前收盘价高于前三根K线的最高价,则触发多头信号;如果当前收盘价低于前三根K线的最低价,则触发空头信号。

一旦确定了交易信号,该策略会在FVG范围的中点执行买入或卖出订单。对于多头交易,止损位置设置在FVG最低点下方1%,获利目标设置在FVG最高点上方2%。对于空头交易,止损位置设置在FVG最高点上方1%,获利目标设置在FVG最低点下方2%。

策略优势

该策略使用简单而有效的FVG指标来识别潜在的交易机会。FVG指标能够捕捉短期价格动量,有助于在趋势形成的早期阶段进行交易。

该策略采用紧止损和获利目标,以限制潜在损失并最大化收益。这有助于管理风险并提高整体盈利能力。

该策略适用于短期时间框架,利用了市场中的短期波动。这使得该策略能够快速适应不断变化的市场条件。

策略风险

该策略依赖于FVG指标提供的交易信号。虽然FVG指标在捕捉价格动量方面很有效,但它并不能保证每次交易都成功。错误信号可能导致亏损交易。

该策略使用固定的止损和获利目标。虽然这有助于管理风险,但也可能限制潜在收益。在强劲趋势期间,价格可能会超过预定的获利目标。

短线交易策略面临着较高的交易频率和交易成本。频繁的交易可能会产生大量的滑点和佣金,影响整体盈利能力。

策略优化方向

考虑将动态止损和获利目标纳入策略。根据市场波动性和趋势强度调整止损和获利目标,可以更好地适应不同的市场条件。

将其他技术指标(如移动平均线或相对强弱指数)与FVG指标相结合,提供额外的确认和过滤。这可以帮助减少错误信号并提高交易准确性。

对策略进行回测和优化,以确定最佳参数设置(如FVG周期、止损和获利目标百分比)。通过优化这些参数,可以提高策略的整体性能。

总结

总的来说,FVG动量短线交易策略是一个简单而有效的策略,利用FVG指标在短期时间框架内捕捉价格动量。通过使用紧止损和获利目标,该策略能够管理风险并最大化收益。然而,该策略也面临着错误信号、固定止损和获利目标以及高交易频率等风险。为了进一步优化该策略,可以考虑采用动态止损和获利目标,结合其他技术指标,并对策略参数进行优化。通过这些改进,FVG动量短线交易策略可以成为一个更加强大和可靠的交易工具。

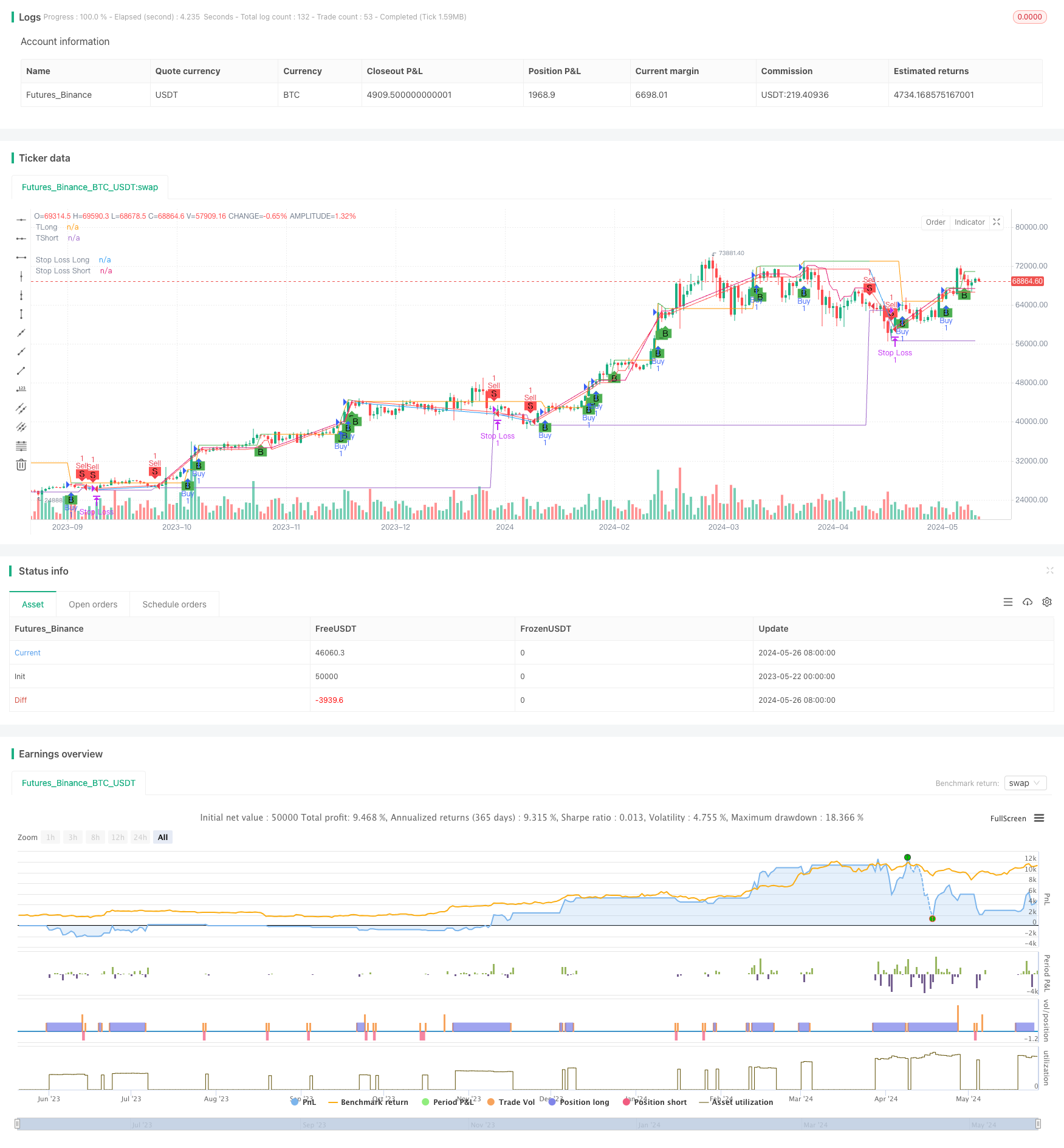

/*backtest

start: 2023-05-22 00:00:00

end: 2024-05-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("ScalpingStrategy", overlay=true)

// Define the FVG calculation

fvgLow = ta.lowest(low, 3)

fvgHigh = ta.highest(high, 3)

var float entrySL=0

// Define the Bullish and Bearish FVG conditions

bullishFVG = low[1] > high[3]

bearishFVG = high[1] < low[3]

// Define the mid-point of the FVG range

fvgMid = (fvgLow + fvgHigh) / 2

// Define the buy and sell conditions

buyCondition = bullishFVG and close >= fvgMid and low<=fvgHigh

sellCondition = bearishFVG and close <= fvgMid and high>=fvgLow

// Plot buy and sell signals

plotshape(buyCondition, style=shape.labelup, location=location.belowbar, color=color.green, text="B")

plotshape(sellCondition, style=shape.labeldown, location=location.abovebar, color=color.red, text="S")

// Execute buy and sell orders

var float targetLong = 0

var float targetShort = 0

if (buyCondition)

strategy.entry("Buy", strategy.long)

targetLong := high * 1.0012 // Calculate target price 2% above high

strategy.exit("Target", "Buy", limit=targetLong)

entrySL=fvgLow*0.994

if (sellCondition)

strategy.entry("Sell", strategy.short)

targetShort := low * 0.994 // Calculate target price 2% below low

strategy.exit("Target", "Sell", limit=targetShort)

entrySL=fvgHigh*1.0028

// Trailing stoploss

//stopLossLong = fvgLow * 0.997 // strategy.position_avg_price * 0.995

//stopLossShort = fvgHigh * 1.003 // strategy.position_avg_price * 1.005

stopLossLong = math.max(fvgLow * 0.997, strategy.position_avg_price * 0.995)

stopLossShort = math.min(fvgHigh * 1.003, strategy.position_avg_price * 1.005)

// Plot stoploss lines with small length

plot(stopLossLong, title="Stop Loss Long", color= strategy.position_size > 0 ? color.red : na, linewidth=1)

plot(stopLossShort, title="Stop Loss Short", color= strategy.position_size < 0 ? color.red : na, linewidth=1)

plot(targetLong, title="TLong", color= strategy.position_size > 0 ? color.green : na, linewidth=1)

plot(targetShort, title="TShort",color= strategy.position_size < 0 ? color.green : na, linewidth=1)

// Exit with stoploss

strategy.exit("Stop Loss", "Buy", stop=stopLossLong)

strategy.exit("Stop Loss", "Sell", stop=stopLossShort)