概述

该策略基于Keltner通道指标,利用指数移动平均线(EMA)和平均真实波动幅度(ATR)构建上下通道,当价格突破下轨时开仓做多,当价格突破上轨时平仓。该策略试图捕捉价格的波动区间,在价格向上突破通道上轨时获利了结。

策略原理

- 计算指定周期的EMA作为Keltner通道的中轨。

- 计算指定周期的ATR,然后乘以一个倍数作为通道的上下轨道。

- 当收盘价跌破下轨时开仓做多,并记录开仓价格。

- 当开盘价突破上轨时平仓。

- 在开仓状态下,如果开盘价高于上轨,则平掉多单。

策略优势

- 能够自适应价格波动幅度。由于Keltner通道利用ATR构建上下轨,ATR能够衡量价格的波动率,因此在波动率较大时,通道宽度会相应增加,从而有效降低频繁交易带来的成本。

- 具有逻辑清晰简单,易于理解和实现的特点。该策略使用的指标简单,核心逻辑也比较容易把握。

- 具有一定的趋势跟踪能力。在上升趋势中,该策略能够持有多头头寸,直到价格突破上轨。

策略风险

- 缺乏明确的止损机制。该策略在开仓后并没有设置止损位,这可能导致在逆向行情中承受较大的回撤。

- 对突破信号的定义比较粗糙。仅仅使用收盘价跌破下轨和开盘价突破上轨作为开平仓信号,可能会产生一些误判,导致亏损交易。

- 策略参数的选择对结果有很大影响。EMA和ATR的周期选择以及ATR倍数的设置都会影响策略表现,但策略并未给出明确的参数优化方法。

策略优化方向

- 引入明确的止损机制。可以考虑在开仓时同时设置一个固定点数或百分比的止损位,从而控制单次交易的最大亏损。

- 优化信号的判断条件。可以考虑使用更多的价格信息来确认突破,比如要求收盘价连续数根K线低于下轨才开仓,避免单根K线的假突破。

- 进行参数优化。可以使用遗传算法等方法对EMA、ATR的周期以及ATR倍数进行优化,寻找更适合当前市场的参数组合。

- 增加过滤条件。可以考虑增加一些过滤信号,比如只在ADX高于某个阈值时才开仓,或者使用MA的多头排列作为趋势过滤等。

总结

该策略基于Keltner通道指标,利用价格突破上下轨的逻辑开展交易。它的优点是逻辑简单清晰,适应性强,缺点是缺乏止损和信号质量欠佳。未来可以从引入止损,优化信号,参数寻优和增加过滤条件等方面对策略进行完善。

策略源码

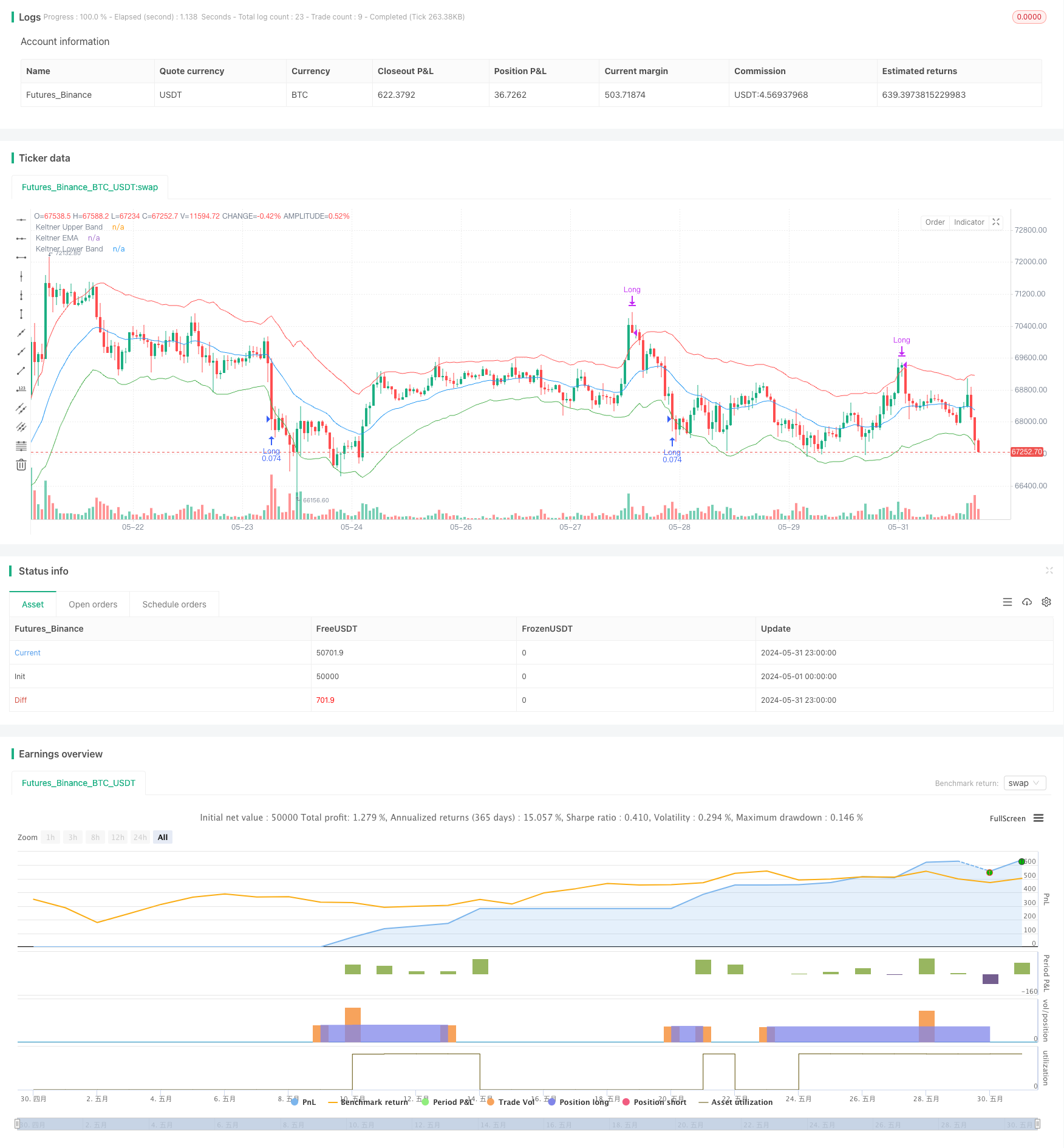

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © satrusskumar

//@version=5

// Input parameters

length = input.int(21, title="EMA Length")

mult = input.float(2, title="ATR Multiplier")

atrLength = input.int(13, title="ATR Length")

// Calculate Keltner Channels

ema = ta.ema(close, length)

atr = ta.atr(atrLength)

upper_band = ema + mult * atr

lower_band = ema - mult * atr

// Plot Keltner Channels

plot(upper_band, color=color.red, title="Keltner Upper Band")

plot(ema, color=color.blue, title="Keltner EMA")

plot(lower_band, color=color.green, title="Keltner Lower Band")

// Strategy logic

var float entry_price = na

var bool in_trade = false

if (not in_trade and close < lower_band)

strategy.entry("Long", strategy.long)

entry_price := close

in_trade := true

if (in_trade and open > upper_band)

strategy.close("Long")

in_trade := false

// Strategy settings

strategy("Keltner Channel Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

相关推荐