概述

该策略是一个基于CDC行动区的交易机器人策略。它使用12周期和26周期的指数移动平均线(EMA)来确定市场趋势,当短期EMA在长期EMA上方时做多,反之做空。该策略使用平均真实波幅(ATR)来设置动态止盈和止损水平。止盈水平基于ATR和一个倍数确定,止损水平固定为当前收盘价的5%。

策略原理

- 计算12周期和26周期的EMA,用于确定市场趋势。

- 计算ATR,用于设置动态止盈和止损水平。

- 当短期EMA在长期EMA上方时,发出买入信号并开仓做多。

- 当短期EMA在长期EMA下方时,发出卖出信号并开仓做空。

- 止盈水平基于ATR和一个倍数确定,当价格达到止盈水平时平仓。

- 止损水平固定为当前收盘价的5%,当价格达到止损水平时平仓。

策略优势

- 使用EMA来捕捉市场趋势,能有效地适应不同的市场环境。

- 采用ATR来设置动态止盈水平,可以更好地保护利润。

- 固定的止损水平有助于控制风险,将损失限制在可接受的范围内。

- 代码结构清晰,易于理解和修改,适合进一步优化。

策略风险

- EMA是一个滞后指标,在市场快速变化时可能会发出错误信号。

- ATR止盈水平可能无法在市场波动较大时及时保护利润。

- 固定的止损水平可能在某些情况下导致过早平仓,错失潜在利润。

- 该策略没有考虑交易成本和滑点,实际交易结果可能与回测结果存在差异。

策略优化方向

- 尝试使用其他趋势指标,如MACD或移动平均线交叉,来提高信号的准确性。

- 优化ATR倍数和止盈止损百分比,以更好地适应不同的市场条件。

- 引入动态止损机制,如跟踪止损或基于波动率的止损,以更好地控制风险。

- 考虑交易成本和滑点,选择合适的交易品种和交易时段,以提高策略的实际表现。

总结

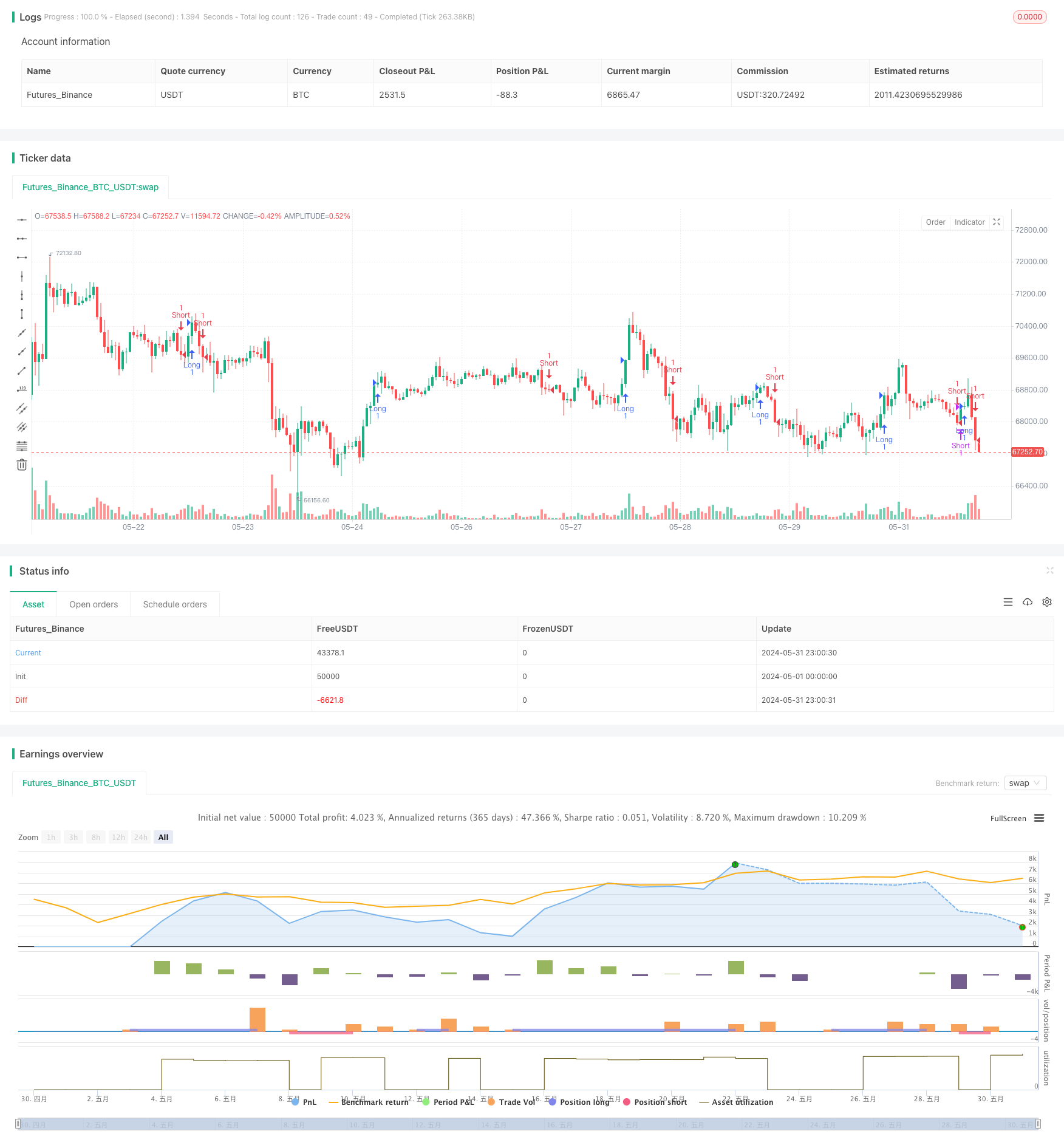

该策略是一个基于CDC行动区的ATR止盈止损交易机器人策略,通过EMA来捕捉市场趋势,ATR来设置动态止盈水平,并采用固定百分比止损来控制风险。虽然该策略具有一定的优势,但仍存在一些风险和改进空间。通过进一步优化和测试,该策略有望在实际交易中取得良好表现。

策略源码

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("CDC Action Zone Trading Bot with ATR for Take Profit and 5% Stop Loss", overlay=true)

// ดึงข้อมูลราคาปิด

close_price = close

// คำนวณเส้น EMA 12 และ EMA 26

ema12 = ta.ema(close_price, 12)

ema26 = ta.ema(close_price, 26)

// คำนวณ ATR

atr_length = input.int(14, title="ATR Length")

atr = ta.atr(atr_length)

// กำหนด Multiplier สำหรับ ATR Trailing Stoploss

mult_atr_stoploss = input.float(2.5, title="ATR Stoploss Multiplier")

// คำนวณ ATR Trailing Stoploss

prev_stoploss = close_price

for i = 1 to 10

prev_stoploss := math.max(prev_stoploss, high[i] - mult_atr_stoploss * atr)

// กำหนด Take Profit เป็น ATR Trailing Stoploss

takeProfitPercent = input.float(10, title="Take Profit (%)") / 100

takeProfit = close_price + (close_price - prev_stoploss) * takeProfitPercent

// กำหนด Stop Loss เป็น 5% ของราคาปิดปัจจุบัน

stopLossPercent = input.float(5, title="Stop Loss (%)") / 100

stopLoss = close_price * stopLossPercent

// กำหนดสีแท่งกราฟ

buyColor = input.color(color.green, title="Buy Color")

sellColor = input.color(color.red, title="Sell Color")

neutralColor = input.color(color.gray, title="Neutral Color")

color = if (ema12 > ema26)

buyColor

else if (ema12 < ema26)

sellColor

else

neutralColor

// สัญญาณ Buy

buySignal = (color == buyColor) and (color[1] != buyColor)

// สัญญาณ Sell

sellSignal = (color == sellColor) and (color[1] != sellColor)

// เปิด Position Long

if (buySignal)

strategy.entry("Long", strategy.long)

// เปิด Position Short

if (sellSignal)

strategy.entry("Short", strategy.short)

// ปิด Position เมื่อถึง Take profit

if (strategy.position_size > 0 and close_price > takeProfit)

strategy.exit("Long", profit=takeProfit)

// ปิด Position เมื่อถึง Stop loss

if (strategy.position_size > 0 and close_price < stopLoss)

strategy.exit("Long", loss=stopLoss)

// ปิด Position เมื่อถึง Take profit

if (strategy.position_size < 0 and close_price < takeProfit)

strategy.exit("Short", profit=takeProfit)

// ปิด Position เมื่อถึง Stop loss

if (strategy.position_size < 0 and close_price > stopLoss)

strategy.exit("Short", loss=stopLoss)

相关推荐