概述

该策略使用5日指数移动平均线(EMA)和布林带(BB)来识别市场的潜在交易机会。当价格突破布林带上轨或下轨,并满足特定条件时,策略会产生买入或卖出信号。该策略旨在捕捉市场的显著价格波动,同时使用止损和目标价位来管理风险和最大化收益。

策略原理

该策略的核心是利用5日EMA和布林带来判断市场趋势和波动性。当价格突破布林带上轨,并在上一根K线高于5日EMA时,策略会产生卖出信号。相反地,当价格突破布林带下轨,并在上一根K线低于5日EMA时,策略会产生买入信号。这种方法可以帮助识别潜在的趋势反转或突破点。

一旦进场交易,策略会设置止损位和目标价位。止损位置于进场价格的相反方向,用于限制潜在损失。目标价位则是根据固定点数(如1000点)来计算的,以锁定预期收益。如果价格触及止损位或目标价位,该策略将平仓退出交易。

策略优势

- 同时利用EMA和布林带,可以更全面地评估市场趋势和波动性。

- 明确的进场条件有助于识别高概率的交易机会。

- 设置止损和目标价位,可以有效管理风险和锁定利润。

- 策略逻辑清晰,易于理解和实现。

策略风险

- 市场波动性增大时,布林带可能会产生频繁的交易信号,导致过度交易和手续费增加。

- 在震荡市或趋势不明朗时,该策略可能会产生错误信号,导致亏损。

- 固定的止损和目标价位可能无法适应不同的市场条件,限制了策略的灵活性。

策略优化方向

- 考虑使用自适应的止损和目标价位,根据市场波动性和趋势强度动态调整,以提高策略的适应性。

- 引入其他技术指标或信号过滤机制,如相对强弱指数(RSI)或平均真实波幅(ATR),以确认趋势和减少假信号。

- 对参数进行优化,如调整EMA的周期、布林带的标准差倍数等,以适应不同的市场特征和交易品种。

总结

EMA与布林带突破策略利用了两个常用的技术指标,旨在捕捉市场的显著价格波动。该策略具有明确的进场条件、风险管理措施和盈利目标,易于理解和实施。然而,策略的表现可能受到市场波动性和趋势不明朗的影响。通过引入自适应参数、信号过滤机制和参数优化,可以进一步提升策略的稳健性和盈利能力。

策略源码

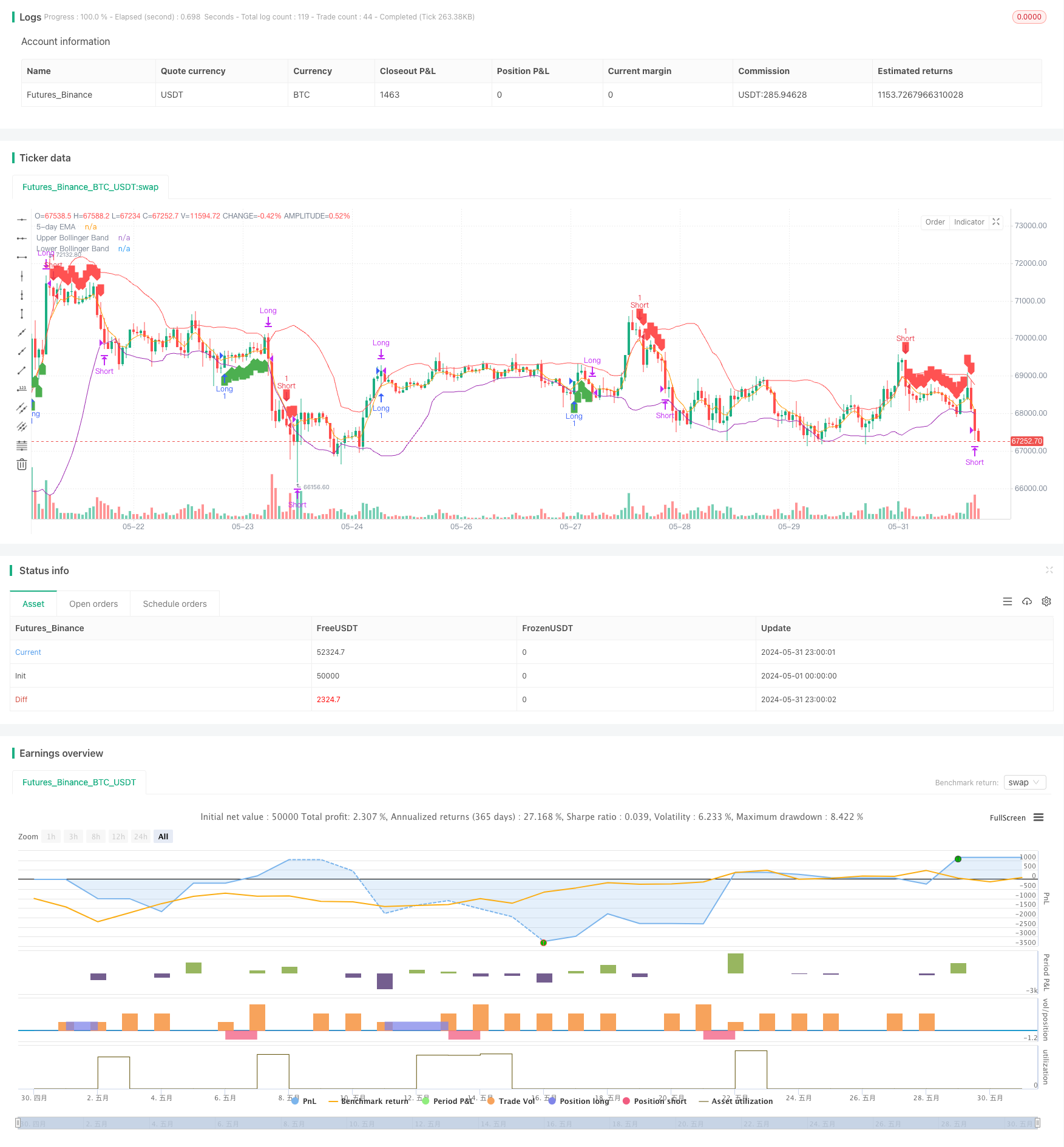

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Nifty Bank Strategy", overlay=true)

// Parameters

lengthEMA = 5

lengthBB = 20

multBB = 1.5

targetPoints = 1000

// Calculate 5-day EMA

ema5 = ta.ema(close, lengthEMA)

// Calculate Bollinger Bands (length 20, multiplier 1.5)

basis = ta.sma(close, lengthBB)

dev = multBB * ta.stdev(close, lengthBB)

upperBB = basis + dev

lowerBB = basis - dev

// Define strategy variables

var float entryPrice = na

var float stopLoss = na

var float targetPrice = na

var bool inTrade = false

var bool isLong = false

var float triggerHigh = na

var float triggerLow = na

var float triggerClose = na

if not inTrade

// Short Entry Trigger Condition

if low > ema5 and low > upperBB and high > upperBB

triggerLow := low

triggerHigh := high

triggerClose := close

label.new(bar_index, high, "Waiting for short trigger", color=color.yellow)

// Long Entry Trigger Condition

else if high < ema5 and high < lowerBB and low < lowerBB

triggerHigh := high

triggerLow := low

triggerClose := close

label.new(bar_index, low, "Waiting for long trigger", color=color.yellow)

// Check for Short Entry

if not inTrade and na(triggerClose) == false and close < triggerClose

if low < triggerLow

entryPrice := close

stopLoss := triggerHigh

targetPrice := entryPrice - targetPoints

strategy.entry("Short", strategy.short)

label.new(bar_index, high, "Short", color=color.red, style=label.style_label_down)

inTrade := true

isLong := false

triggerLow := na

triggerHigh := na

triggerClose := na

// Check for Long Entry

if not inTrade and na(triggerClose) == false and close > triggerClose

if high > triggerHigh

entryPrice := close

stopLoss := triggerLow

targetPrice := entryPrice + targetPoints

strategy.entry("Long", strategy.long)

label.new(bar_index, low, "Long", color=color.green, style=label.style_label_up)

inTrade := true

isLong := true

triggerLow := na

triggerHigh := na

triggerClose := na

// Manage Short Trade

if inTrade and not isLong

if high >= stopLoss

strategy.close("Short", comment="SL Hit")

label.new(bar_index, high, "SL Hit", color=color.red, style=label.style_label_down)

inTrade := false

else if low <= targetPrice

strategy.close("Short", comment="Target Hit")

label.new(bar_index, low, "Target Hit", color=color.green, style=label.style_label_up)

inTrade := false

// Manage Long Trade

if inTrade and isLong

if low <= stopLoss

strategy.close("Long", comment="SL Hit")

label.new(bar_index, low, "SL Hit", color=color.red, style=label.style_label_down)

inTrade := false

else if high >= targetPrice

strategy.close("Long", comment="Target Hit")

label.new(bar_index, high, "Target Hit", color=color.green, style=label.style_label_up)

inTrade := false

// Plotting

plot(ema5, color=color.orange, title="5-day EMA")

plot(upperBB, color=color.red, title="Upper Bollinger Band")

plot(lowerBB, color=color.purple, title="Lower Bollinger Band")

// Plot trade entry and exit points

plotshape(series=inTrade and isLong ? entryPrice : na, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal")

plotshape(series=inTrade and not isLong ? entryPrice : na, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal")

相关推荐