概述

星光移动平均交叉策略是一种基于移动平均线和MACD指标的量化交易策略。该策略利用两条不同周期的简单移动平均线(SMA)的交叉信号来确定买卖时机,同时辅以MACD指标来辅助判断趋势和动量。当短期移动平均线向上突破长期移动平均线时,产生买入信号;反之,当短期移动平均线向下跌破长期移动平均线时,产生卖出信号。这种策略试图捕捉市场的中长期趋势,同时利用MACD指标来确认趋势的强度和可持续性。

策略原理

星光移动平均交叉策略的核心原理是利用不同周期移动平均线的交叉信号来判断市场趋势的变化。当短期移动平均线从下方向上突破长期移动平均线时,表明市场可能正在形成一个新的上升趋势,此时策略会产生买入信号。相反,当短期移动平均线从上方向下跌破长期移动平均线时,表明市场可能正在形成一个新的下降趋势,此时策略会产生卖出信号。

除了使用移动平均线交叉信号外,该策略还引入了MACD指标作为辅助判断工具。MACD由两条线组成:MACD线和信号线。当MACD线从下方向上突破信号线时,表明市场上升动能增强;反之,当MACD线从上方向下跌破信号线时,表明市场下降动能增强。MACD指标可以用来确认移动平均线交叉信号的有效性,提高策略的可靠性。

策略优势

- 简单易懂:星光移动平均交叉策略基于简单移动平均线和MACD指标,概念清晰,易于理解和实现。

- 趋势跟踪:通过使用不同周期的移动平均线,该策略能够有效地捕捉市场的中长期趋势,帮助投资者顺应市场的主要方向。

- 信号确认:引入MACD指标作为辅助判断工具,可以提高移动平均线交叉信号的可靠性,减少虚假信号。

- 适应性强:该策略可以通过调整移动平均线的周期和MACD指标的参数来适应不同的市场环境和投资者偏好。

策略风险

- 滞后性:移动平均线是一种滞后指标,它对市场变化的反应相对较慢,可能导致错过最佳的买卖时机。

- 振荡市场:在市场波动较大、没有明显趋势的情况下,频繁的移动平均线交叉信号可能导致过多的交易,增加交易成本和风险。

- 参数敏感:策略的表现很大程度上取决于所选择的移动平均线周期和MACD指标参数,不恰当的参数设置可能导致策略失效。

策略优化方向

- 参数优化:对移动平均线的周期和MACD指标的参数进行优化,以适应不同的市场环境和资产特征,提高策略的稳健性和盈利能力。

- 信号过滤:引入其他技术指标或市场情绪指标,对移动平均线交叉信号进行过滤,减少虚假信号和噪音干扰。

- 风险管理:结合止损和仓位管理策略,控制单笔交易的风险敞口,防止重大损失。

- 多市场测试:在不同的市场和资产上测试策略,评估其适用性和稳健性,必要时进行策略调整。

总结

星光移动平均交叉策略是一种基于趋势跟踪和动量确认的量化交易策略。它利用了不同周期移动平均线的交叉信号和MACD指标来捕捉市场的中长期趋势,具有简单易懂、趋势跟踪、信号确认和适应性强等优势。然而,该策略也存在滞后性、振荡市场和参数敏感等风险。为了进一步提升策略的表现,可以从参数优化、信号过滤、风险管理和多市场测试等方面进行优化和改进。总的来说,星光移动平均交叉策略为量化交易者提供了一个基于经典技术指标的交易框架,但在实际应用中需要结合具体市场环境和个人偏好进行调整和优化。

策略源码

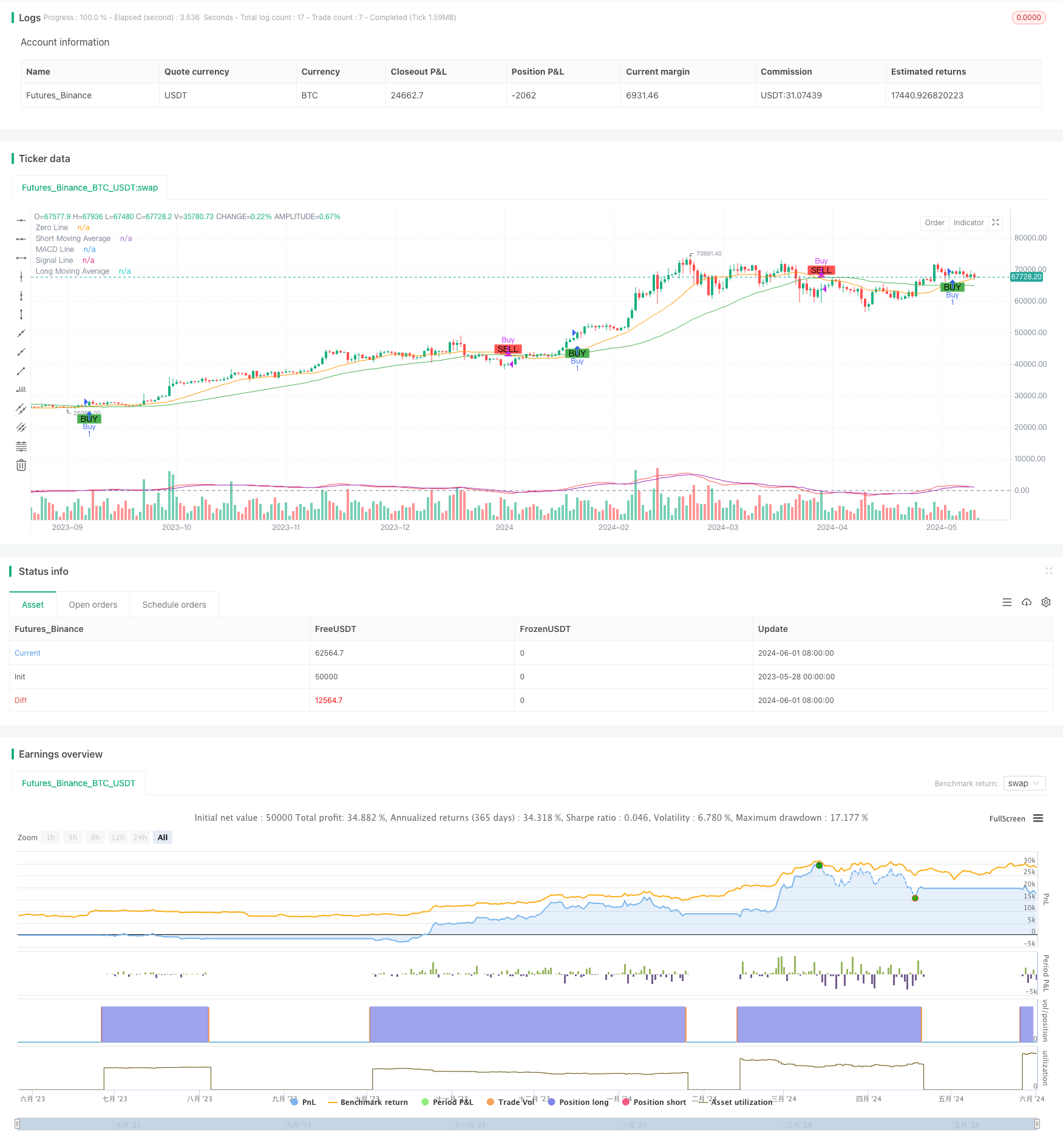

/*backtest

start: 2023-05-28 00:00:00

end: 2024-06-02 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Starlight Strategy", overlay=true)

// Define the inputs for the moving averages

shortLength = input.int(20, title="Short Moving Average Length")

longLength = input.int(50, title="Long Moving Average Length")

// Calculate the moving averages

shortMA = ta.sma(close, shortLength)

longMA = ta.sma(close, longLength)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// Plot the moving averages

plot(shortMA, color=color.orange, title="Short Moving Average")

plot(longMA, color=color.green, title="Long Moving Average")

// Plot MACD on a separate chart

hline(0, "Zero Line", color=color.gray)

plot(macdLine, color=color.red, title="MACD Line")

plot(signalLine, color=color.purple, title="Signal Line")

// Generate buy and sell signals

buySignal = ta.crossover(shortMA, longMA)

sellSignal = ta.crossunder(shortMA, longMA)

// Plot buy and sell signals

plotshape(series=buySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Strategy execution

if (buySignal)

strategy.entry("Buy", strategy.long)

if (sellSignal)

strategy.close("Buy")

相关推荐