概述

这个策略使用了Elliott波浪理论,随机指标和指数移动平均线的组合。Elliott波浪理论用于识别市场趋势和买卖条件,随机指标用于衡量当前趋势的强弱,指数移动平均线用于可视化整体市场趋势以及支撑位和阻力位。这三种技术的结合可以帮助交易者识别交易机会,做出明智的市场决策。

策略原理

该策略首先使用Elliott波浪理论来识别市场趋势。当收盘价突破5日指数移动平均线时,产生买入信号;当收盘价跌破5日指数移动平均线时,产生卖出信号。这有助于捕捉趋势的开始和结束。

接下来,策略使用随机指标来衡量当前趋势的强度。随机指标由两条线组成:K线和D线。K线衡量收盘价相对于最近一段时间的高低点,D线是K线的移动平均线。当K线在D线上方时,表明上涨趋势较强;当K线在D线下方时,表明下跌趋势较强。

最后,该策略使用5个不同周期(5、10、20、50和200)的指数移动平均线来可视化整体市场趋势。较短周期的移动平均线反应短期趋势,较长周期的移动平均线反应长期趋势。当较短周期的移动平均线在较长周期之上时,表明上涨趋势;反之则表明下跌趋势。

策略优势

- 通过结合三种不同的技术指标,该策略提供了一个全面而准确的交易系统。

- Elliott波浪理论和随机指标可以帮助识别趋势和买卖条件,而指数移动平均线可以可视化整体市场趋势。

- 使用多个不同周期的移动平均线,可以更好地理解市场的短期和长期趋势。

- 该策略使用简单而有效的规则来产生买卖信号,易于实施和自动化。

策略风险

- 像所有的技术指标一样,该策略在波动或横盘的市场中效果可能不佳。

- 该策略依赖于历史数据,可能无法很好地适应不断变化的市场条件。

- 该策略没有考虑基本面因素,如经济数据或地缘政治事件,这可能导致错误的交易信号。

- 过度拟合是一个潜在的风险,因为该策略使用了多个参数和指标。

策略优化方向

- 考虑结合其他技术指标,如相对强弱指数(RSI)或平均真实波幅(ATR),以改进趋势识别和风险管理。

- 尝试不同的参数设置,如移动平均线的周期或随机指标的敏感度,以优化策略性能。

- 引入基本面数据,如经济日历事件或情绪指标,以过滤掉可能错误的技术信号。

- 实施更复杂的资金管理规则,如基于波动性调整仓位大小或使用追踪止损,以减少风险敞口。

总结

Elliott Wave Stochastic EMA策略通过结合Elliott波浪理论、随机指标和指数移动平均线,提供了一个全面的交易系统。它利用这些指标来识别趋势、衡量趋势强度以及可视化整体市场趋势。虽然该策略有几个优点,如易于实施和趋势识别能力,但它也存在一些风险,如对波动性的敏感性和过度拟合的可能性。通过纳入其他指标、优化参数设置和改进资金管理,可以进一步增强该策略的性能。总的来说,Elliott Wave Stochastic EMA策略为技术分析提供了一个有前景的起点,但在实际应用中需要谨慎和进一步的回测。

策略源码

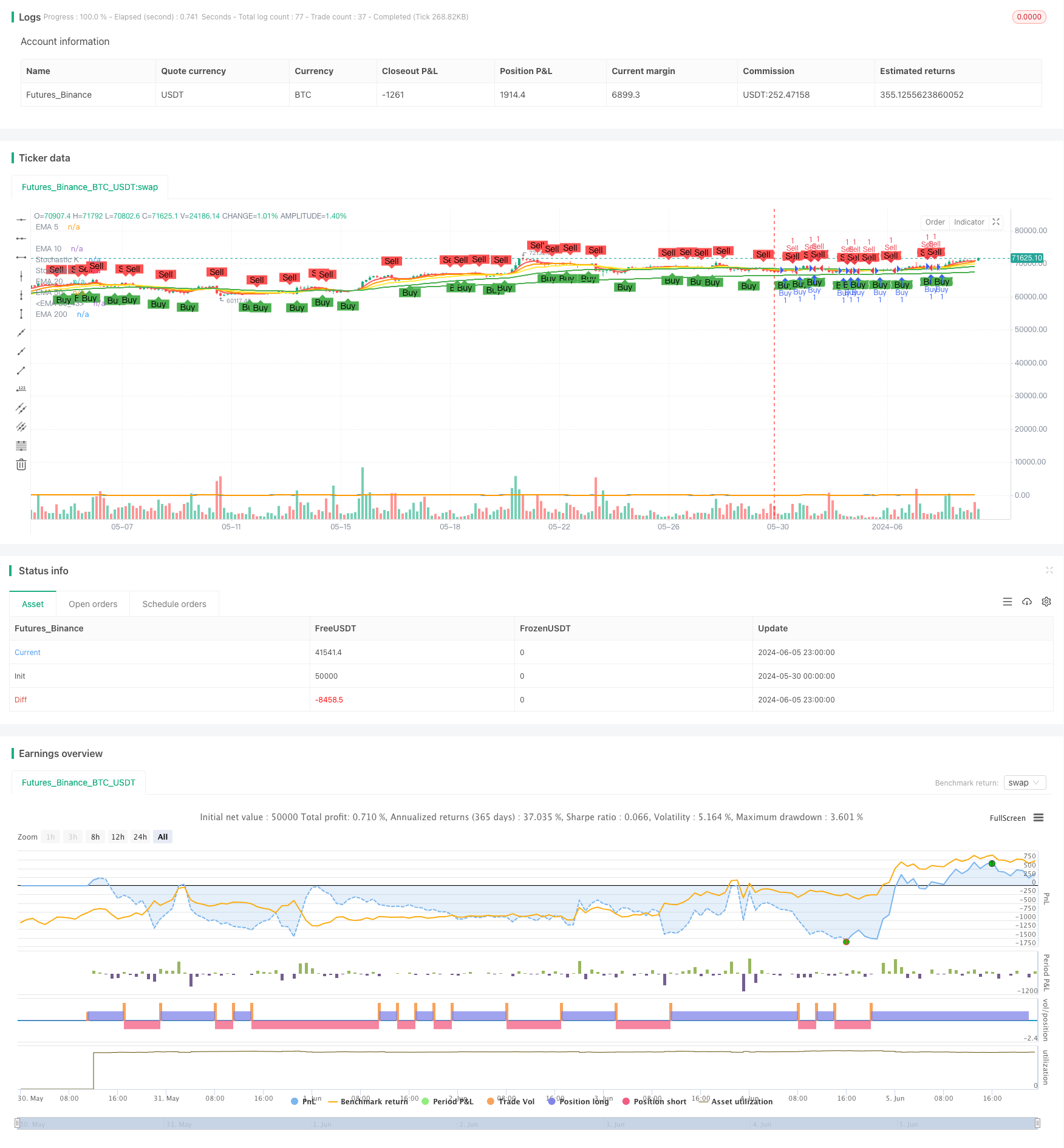

/*backtest

start: 2024-05-30 00:00:00

end: 2024-06-06 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © montanarigiuliano9

//@version=5

strategy("Elliott Wave with Stochastic and Exponential Averages", overlay=true)

// Definizione delle onde di Elliott

length = input.int(14, title="Length")

ema1 = ta.ema(close, 5)

ema2 = ta.ema(close, 10)

ema3 = ta.ema(close, 20)

ema4 = ta.ema(close, 50)

ema5 = ta.ema(close, 200)

// Calcolo delle onde di Elliott

buySignal = ta.crossover(close, ema1)

sellSignal = ta.crossunder(close, ema1)

// Calcolo dell'indicatore Stochastic

k = ta.sma(ta.stoch(close, high, low, 14), 3)

d = ta.sma(k, 3)

stoch = k

// Applicazione delle condizioni di trading

if (buySignal)

strategy.entry("Buy", strategy.long)

if (sellSignal)

strategy.entry("Sell", strategy.short)

// Visualizzazione delle onde di Elliott

plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, text="Buy")

plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell")

// Visualizzazione dell'indicatore Stochastic

plot(stoch, color=color.blue, linewidth=2, title="Stochastic K")

plot(d, color=color.orange, linewidth=2, title="Stochastic D")

// Visualizzazione delle medie esponenziali

plot(ema1, color=color.red, linewidth=2, title="EMA 5")

plot(ema2, color=color.orange, linewidth=2, title="EMA 10")

plot(ema3, color=color.yellow, linewidth=2, title="EMA 20")

plot(ema4, color=color.green, linewidth=2, title="EMA 50")

plot(ema4, color=color.green, linewidth=2, title="EMA 50")

plot(ema5, color=color.green, linewidth=2, title="EMA 200")

相关推荐