概述

该策略使用TSI指标作为主要的交易信号。当TSI指标与其信号线发生交叉,且TSI指标低于下限或高于上限时,策略就会产生开仓信号。同时该策略还使用了EMA和ATR等指标来优化策略表现。策略只在特定的交易时段内运行,并设置了最小交易频率来控制过度交易。

策略原理

- 计算TSI指标值和信号线值。

- 判断当前是否在允许交易的时间范围内,并且当前bar距离上次交易至少间隔了指定的最小bar数。

- 如果TSI指标从下向上穿过信号线,且此时信号线低于指定的下限,则产生做多信号。

- 如果TSI指标从上向下穿过信号线,且此时信号线高于指定的上限,则产生做空信号。

- 如果当前持有多头仓位,一旦TSI指标从上向下穿过信号线,则平掉所有多头仓位。

- 如果当前持有空头仓位,一旦TSI指标从下向上穿过信号线,则平掉所有空头仓位。

优势分析

- 策略逻辑清晰,使用TSI指标的交叉作为唯一的开平仓条件,简单易懂。

- 通过限制交易时段和交易频率,有效控制了过度交易的风险。

- 及时止损止盈,一旦出现相反信号就果断平仓,控制了单笔交易的风险敞口。

- 使用了多个指标来辅助判断,如EMA, ATR等,增强了策略的稳健性。

风险分析

- 策略对TSI指标参数的选择比较敏感,不同参数会带来很大的性能差异,需要谨慎选择。

- 开仓和平仓条件都比较简单,缺乏趋势判断和波动率约束,在震荡行情中可能出现亏损。

- 缺乏仓位管理和资金管理,难以控制回撤,一旦连续亏损就会导致大幅回撤。

- 只做多空反转,而不做趋势跟踪,会错失很多趋势行情的机会。

优化方向

- 对TSI指标的参数进行优化,找到更稳健的参数组合。可以使用遗传算法等方法自动寻优。

- 加入趋势判断指标,如MA或MACD,在开仓时选择顺势方向,提高成功率。

- 加入波动率指标,如ATR,在高波动率市场环境中减少交易次数。

- 引入仓位管理模型,根据近期市场表现和账户净值等动态调整每笔交易的仓位大小。

- 可以增加趋势追踪的逻辑,在趋势行情中继续持仓,提高策略捕捉大行情的能力。

总结

该策略以TSI指标为核心,通过TSI与信号线的交叉来产生交易信号。同时限定了交易时间和交易频率来控制风险。策略优点是逻辑简单清晰,及时止损止盈。但是缺点是缺乏趋势判断和仓位管理,对TSI参数敏感,只能捕捉反转行情而错失趋势行情。未来可以从趋势和波动率判断、仓位管理、参数优化等方面对策略进行完善。

策略源码

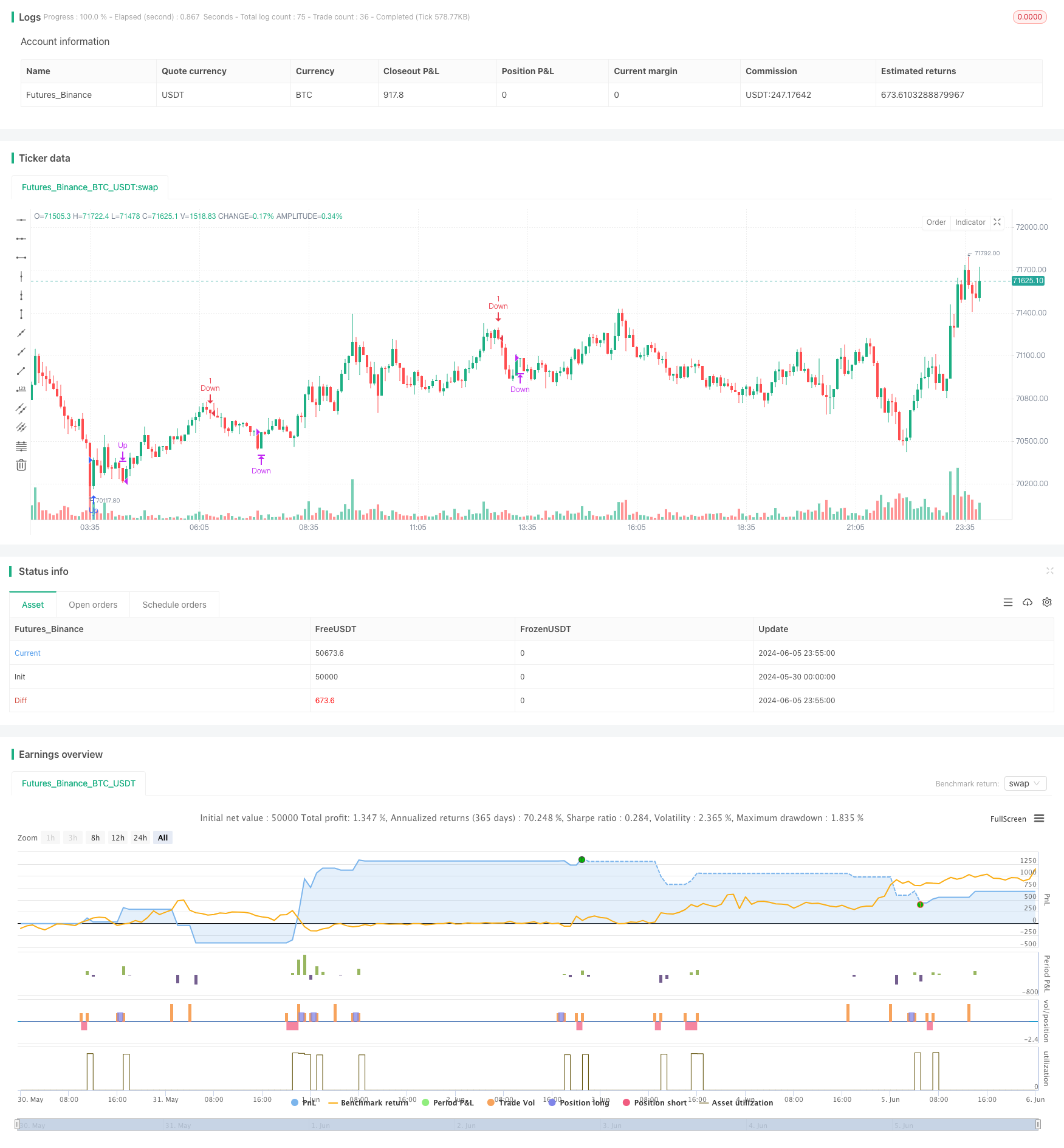

/*backtest

start: 2024-05-30 00:00:00

end: 2024-06-06 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © nikgavalas

//@version=5

strategy("TSI Entries", overlay=true, margin_long=100, margin_short=100)

//

// INPUTS

//

// Define the start and end hours for trading

string sessionInput = input("1000-1530", "Session")

// Day of the week.

string daysInput = input.string("23456", tooltip = "1 = Sunday, 7 = Saturday")

// Minimum number of bar's between entries

requiredBarsBetweenEntries = input.int(12, "Required Bars Between Entries")

// Show debug labels

bool showDebugLabels = input.bool(false, "Show Debug Labels")

//

// FUNCTIONS

//

//@function Define the triple exponential moving average function

tema(src, len) => tema = 3 * ta.ema(src, len) - 3 * ta.ema(ta.ema(src, len), len) + ta.ema(ta.ema(ta.ema(src, len), len), len)

//@function Atr with EMA

atr_ema(length) =>

trueRange = na(high[1])? high-low : math.max(math.max(high - low, math.abs(high - close[1])), math.abs(low - close[1]))

//true range can be also calculated with ta.tr(true)

ta.ema(trueRange, length)

//@function Check if time is in range

timeinrange() =>

sessionString = sessionInput + ":" + daysInput

inSession = not na(time(timeframe.period, sessionString, "America/New_York"))

//@function Displays text passed to `txt` when called.

debugLabel(txt, color, y, style) =>

if (showDebugLabels)

label.new(bar_index, y, text = txt, color = color, style = style, textcolor = color.black, size = size.small)

//

// INDICATOR CODE

//

long = input(title="TSI Long Length", defval=8)

short = input(title="TSI Short Length", defval=8)

signal = input(title="TSI Signal Length", defval=3)

lowerLine = input(title="TSI Lower Line", defval=-50)

upperLine = input(title="TSI Upper Line", defval=50)

price = close

double_smooth(src, long, short) =>

fist_smooth = ta.ema(src, long)

ta.ema(fist_smooth, short)

pc = ta.change(price)

double_smoothed_pc = double_smooth(pc, long, short)

double_smoothed_abs_pc = double_smooth(math.abs(pc), long, short)

tsiValue = 100 * (double_smoothed_pc / double_smoothed_abs_pc)

signalValue = ta.ema(tsiValue, signal)

//

// COMMON VARIABLES

//

var color trendColor = na

var int lastEntryBar = na

bool tradeAllowed = timeinrange() == true and (na(lastEntryBar) or bar_index - lastEntryBar > requiredBarsBetweenEntries)

//

// CROSSOVER

//

bool crossOver = ta.crossover(tsiValue, signalValue)

bool crossUnder = ta.crossunder(tsiValue,signalValue)

if (tradeAllowed)

if (signalValue < lowerLine and crossOver == true)

strategy.entry("Up", strategy.long)

lastEntryBar := bar_index

else if (signalValue > upperLine and crossUnder == true)

strategy.entry("Down", strategy.short)

lastEntryBar := bar_index

//

// EXITS

//

if (strategy.position_size > 0 and crossUnder == true)

strategy.close("Up", qty_percent = 100)

else if (strategy.position_size < 0 and crossOver == true)

strategy.close("Down", qty_percent = 100)

相关推荐