概述

该策略基于相对强弱指数(RSI)指标,通过判断RSI指标的值是否超过预设的上下阈值来确定买入和卖出信号。同时,该策略还设置了止损和持仓时间限制,以控制风险。

策略原理

- 计算RSI指标的值。

- 当RSI值低于预设的买入阈值时,产生买入信号;当RSI值高于预设的卖出阈值时,产生卖出信号。

- 根据买入信号,以当前收盘价计算买入数量,并下单买入。

- 如果设置了止损比例,则计算止损价格,并下单止损。

- 根据卖出信号或止损条件,平仓所有持仓。

- 如果设置了最大持仓时间,则在持仓时间超过最大持仓时间后,无论盈亏,都平仓所有持仓。

策略优势

- RSI指标是一个广泛使用的技术分析指标,能够有效地捕捉市场的超买和超卖信号。

- 该策略引入了止损和持仓时间限制,有助于控制风险。

- 策略逻辑清晰,易于理解和实现。

- 通过调整RSI的参数和阈值,可以适应不同的市场环境。

策略风险

- RSI指标在某些情况下可能会发出错误信号,导致策略出现亏损。

- 该策略没有考虑交易品种的基本面因素,仅依赖技术指标,可能面临市场突发事件的风险。

- 固定的止损比例可能无法适应市场的波动性变化。

- 策略的表现可能受到参数设置的影响,不恰当的参数可能导致策略表现不佳。

策略优化方向

- 引入其他技术指标,如移动平均线,以提高策略的可靠性。

- 优化止损策略,如采用移动止损或基于波动率的动态止损。

- 根据市场情况动态调整RSI的参数和阈值。

- 结合对交易品种基本面的分析,以改善策略的风险控制能力。

- 对策略进行回测和参数优化,以找到最佳的参数组合。

总结

该策略利用RSI指标捕捉市场的超买和超卖信号,同时引入止损和持仓时间限制以控制风险。策略逻辑简单明了,易于实现和优化。然而,策略的表现可能受到市场波动和参数设置的影响,因此需要结合其他分析方法和风险管理手段,以提高策略的稳健性和盈利能力。

策略源码

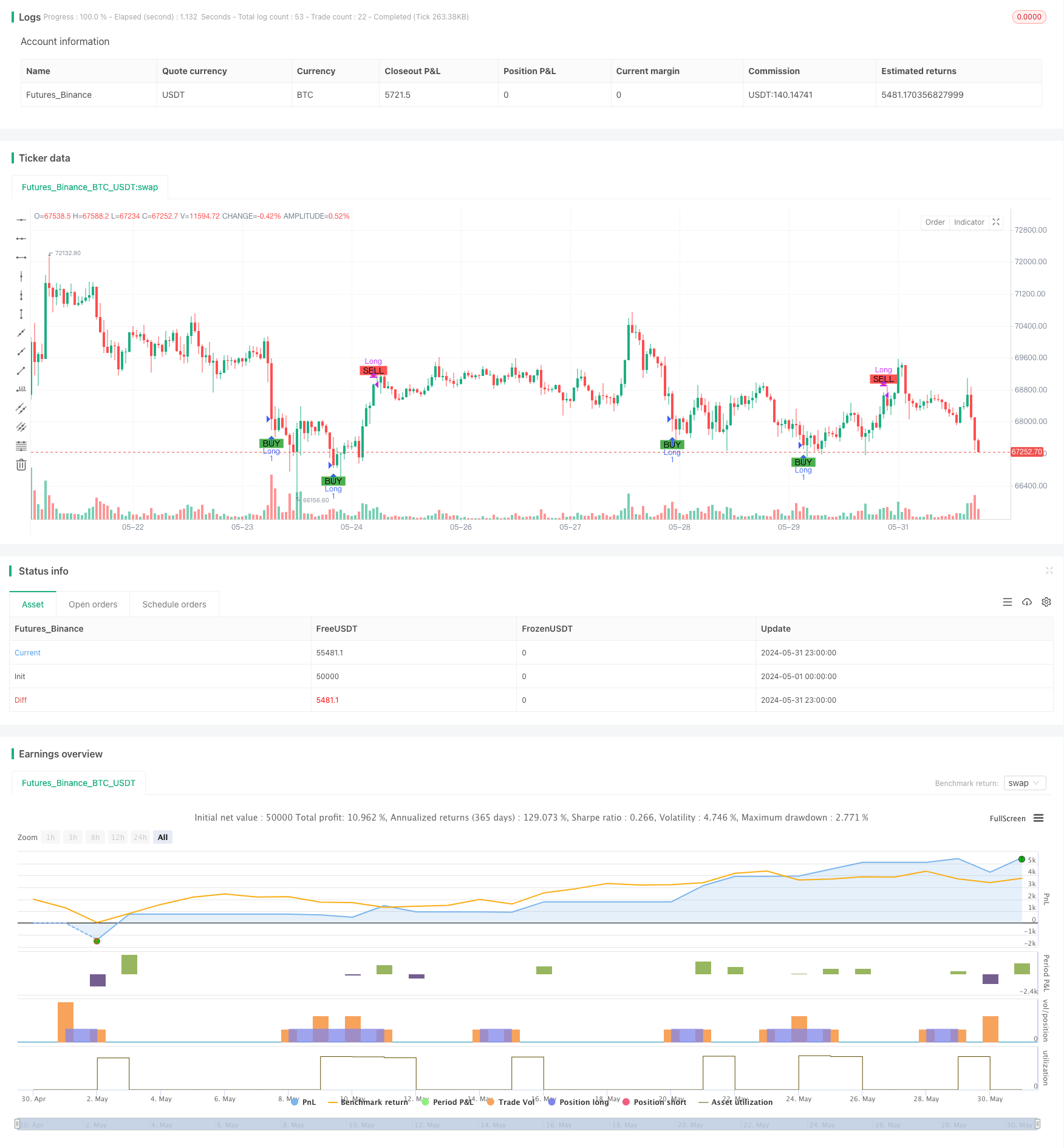

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Simple RSI Strategy", overlay=true, initial_capital=20, commission_value=0.1, commission_type=strategy.commission.percent)

// Define the hardcoded date (Year, Month, Day, Hour, Minute)

var hardcodedYear = 2024

var hardcodedMonth = 6

var hardcodedDay = 10

// Convert the hardcoded date to a timestamp

var start_date = timestamp(hardcodedYear, hardcodedMonth, hardcodedDay)

// settings

order_size_usdt = input.float(20, title="Order Size (USDT)")

rsiLength = input.int(9, title="RSI Length")

rsiBuyThreshold = input.int(30, title="RSI Buy Threshold")

rsiSellThreshold = input.int(70, title="RSI Sell Threshold")

rsibuystrat = input.int(1, title="buy strat 1=achieved,2=recross")

rsisellstrat = input.int(1, title="sell strat 1=achieved,2=recross")

stoploss = input.int(1, title="Stop loss percent")

max_duration = input(24, title="Max Position Duration (hours)")*60

// emaPeriod = input.int(50, title="EMA Period")

// smaPeriod = input.int(200, title="SMA Period")

rsi = ta.rsi(close, rsiLength)

// ma_rsi = ta.sma(rsi, rsiLength)

// ema = ta.ema(close,emaPeriod)

// sma = ta.sma(close,smaPeriod)

// plot(sma, color=color.red, title="exp Moving Average")

// plot(smal, color=color.blue, title="Simple Moving Average")

longCondition = ((ta.crossunder(rsi, rsiBuyThreshold) and rsibuystrat==1) or (ta.crossover(rsi, rsiBuyThreshold) and rsibuystrat==2) ) and strategy.position_size == 0

shortCondition = ( (ta.crossover(rsi, rsiSellThreshold) and rsisellstrat==1) or (ta.crossunder(rsi, rsiSellThreshold) and rsisellstrat==2) ) and strategy.position_size > 0

// Execute Buy and Sell orders

if (longCondition)

positionSize = order_size_usdt / close

strategy.entry("Long", strategy.long,qty=positionSize)

if (stoploss>0)

stopLossPrice = close * (1 - stoploss/100 )

strategy.exit("Stop Loss", from_entry="Long", stop=stopLossPrice)

if (shortCondition )//or stopCondition)

strategy.close("Long")

//add condition open time

if (strategy.position_size > 0 and max_duration >0)

var float entry_time = na

if (strategy.opentrades > 0)

entry_time := nz(strategy.opentrades.entry_time(0), na)

else

entry_time := na

current_time = time

var float duration_minutes = -1

if (not na(entry_time))

duration_minutes := (current_time - entry_time) / 60000

// Close positions after a certain duration (e.g., 60 minutes)

// if ( duration_minutes > max_duration and close>=strategy.opentrades.entry_price(0))

if ( duration_minutes > max_duration )

label.new(bar_index, high, text="Duration: " + str.tostring(duration_minutes/60) + " hrs", color=color.blue, textcolor=color.white, style=label.style_label_down, size=size.small)

strategy.close("Long")

// Plot Buy and Sell signals

plotshape(series=longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

//plotshape(series=stopCondition, title="stop Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Plot RSI

// hline(rsiBuyThreshold, "RSI Buy Threshold", color=color.green)

// hline(rsiSellThreshold, "RSI Sell Threshold", color=color.red)

相关推荐