概述

Fisher变换动态阈值趋势跟踪策略基于Fisher变换指标来识别价格趋势的变化。该策略使用Fisher变换将价格归一化到一个标准尺度,以便更容易地检测潜在的趋势反转点。通过动态调整阈值,该策略能够适应不同的市场条件,提高趋势识别的准确性。当Fisher变换值越过正负阈值时,策略会产生买卖信号,以跟踪市场趋势。

策略原理

- 计算Fisher变换值:根据历史最高价和最低价,对当前价格进行归一化处理,得到介于-0.999到0.999之间的Fisher变换值。

- 动态阈值:根据Fisher变换值的历史波动情况,动态调整买卖信号的阈值,以适应不同的市场状态。

- 趋势判断:通过比较当前Fisher变换值与前两个周期的值,判断价格趋势的变化。

- 买卖信号:当Fisher变换值由下往上穿越负阈值时,产生买入信号;当Fisher变换值由上往下穿越正阈值时,产生卖出信号。

优势分析

- 动态阈值调整:根据市场波动情况自适应调整买卖阈值,提高趋势判断的准确性。

- 趋势跟踪:通过Fisher变换指标的趋势判断,可以较好地捕捉市场趋势,实现趋势跟踪交易。

- 减少价格噪音:Fisher变换将价格归一化处理,有助于减少价格噪音对趋势判断的影响。

- 直观的图表展示:策略在图表上绘制Fisher变换曲线和阈值线,方便交易者直观地观察市场趋势和买卖信号。

风险分析

- 参数优化风险:策略的表现依赖于Fisher变换周期、动态阈值计算方式等参数的选择,不同参数可能导致不同的交易结果。

- 趋势识别滞后:Fisher变换指标对价格趋势的判断存在一定的滞后性,可能错过部分趋势行情。

- 震荡市中表现欠佳:在震荡市场环境下,频繁的趋势变化可能导致该策略产生较多的虚假信号,交易表现可能欠佳。

- 极端行情风险:在极端行情下(如快速大幅变化),Fisher变换指标可能失效,导致策略作出错误的交易决策。

优化方向

- 参数优化:对Fisher变换周期、动态阈值计算方式等关键参数进行优化,提高策略在不同市场状态下的适应性。

- 信号过滤:在趋势识别的基础上,引入其他技术指标或市场情绪指标,对交易信号进行二次确认,提高信号可靠性。

- 止损止盈:设置合理的止损止盈规则,控制单次交易风险,提高策略的风险收益比。

- 仓位管理:根据市场趋势强度、价格波动率等因素,动态调整仓位大小,降低持仓风险。

总结

Fisher变换动态阈值趋势跟踪策略通过Fisher变换指标和动态阈值,识别价格趋势的变化,自适应不同的市场状态。该策略能够较好地捕捉市场趋势,实现趋势跟踪交易。策略的优势在于动态阈值调整、减少价格噪音干扰以及直观的图表展示。但同时也存在参数优化风险、趋势识别滞后、震荡市表现欠佳、极端行情风险等问题。通过参数优化、信号过滤、止损止盈、仓位管理等措施,可以进一步提升该策略的稳健性和盈利能力。

策略源码

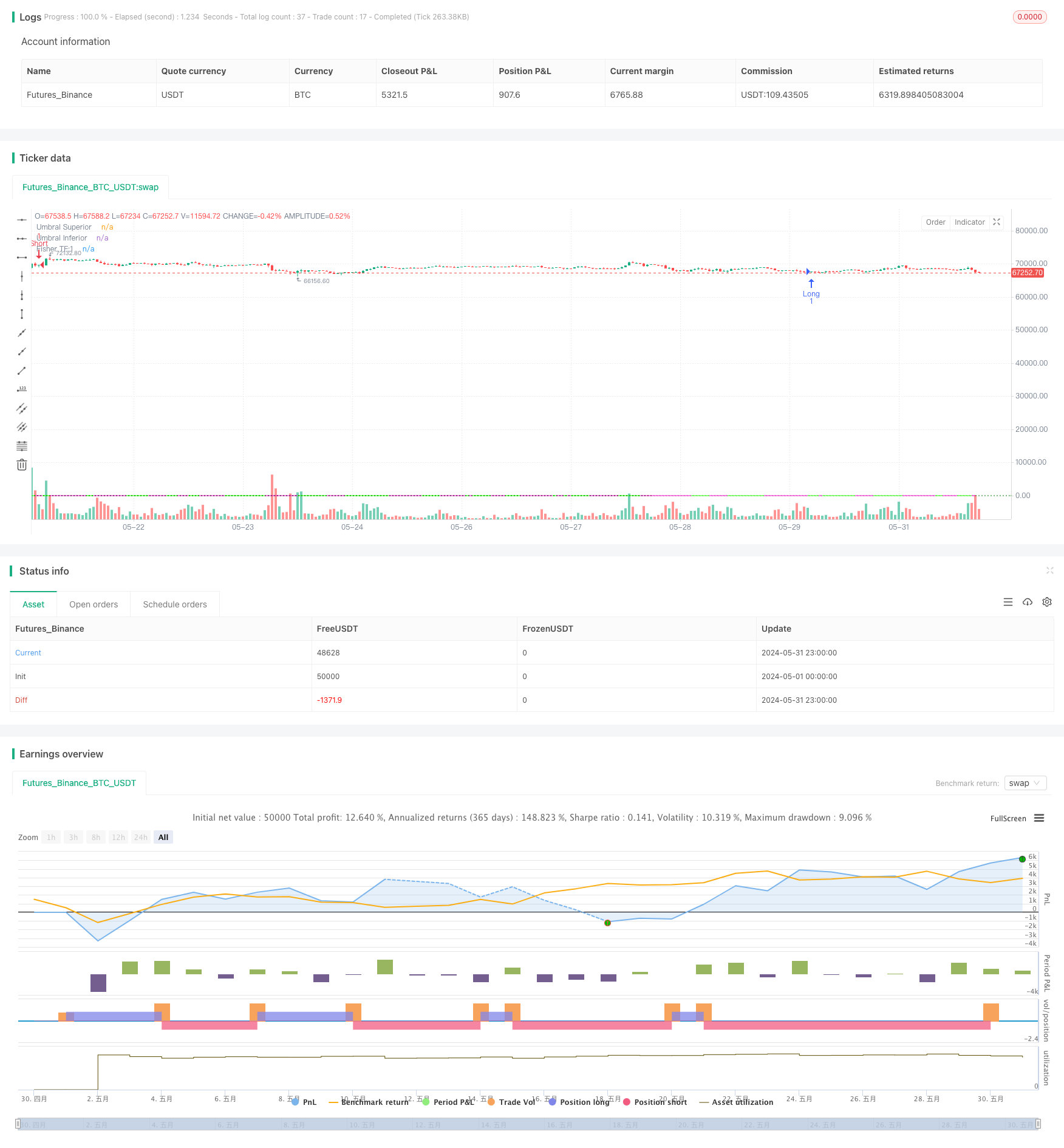

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Qiuboneminer - Fisher Transform", overlay=true)

// Parámetros

Len = input.int(10, minval=1)

mult1 = input.int(1, minval=1)

threshold = 2.6

// Función Fisher Transform

fish(Length, timeMultiplier) =>

var float nValue1 = na

var float nFish = na

xHL2 = hl2

xMaxH = ta.highest(xHL2, Length * timeMultiplier)

xMinL = ta.lowest(xHL2, Length * timeMultiplier)

nValue1 := 0.33 * 2 * ((xHL2 - xMinL) / (xMaxH - xMinL) - 0.5) + 0.67 * nz(nValue1[1])

nValue2 = if nValue1 > 0.99

0.999

else if nValue1 < -0.99

-0.999

else

nValue1

nFish := 0.5 * math.log((1 + nValue2) / (1 - nValue2)) + 0.5 * nz(nFish[1])

nFish

// Cálculo del Fisher Transform para mult1

Fisher1 = fish(Len, mult1)

// Condiciones de entrada y salida

longCondition = Fisher1 > nz(Fisher1[1]) and nz(Fisher1[1]) <= nz(Fisher1[2]) and Fisher1 < -threshold

shortCondition = Fisher1 < nz(Fisher1[1]) and nz(Fisher1[1]) >= nz(Fisher1[2]) and Fisher1 > threshold

// Estrategia de entrada

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Ploteo del Fisher Transform

plot(Fisher1, color=(Fisher1 > nz(Fisher1[1]) ? color.rgb(34, 255, 0) : color.rgb(255, 0, 212)), title="Fisher TF:1")

// Ploteo de líneas de umbral

hline(threshold, "Umbral Superior", color=color.rgb(255, 0, 0), linestyle=hline.style_dotted)

hline(-threshold, "Umbral Inferior", color=#008704, linestyle=hline.style_dotted)