概述

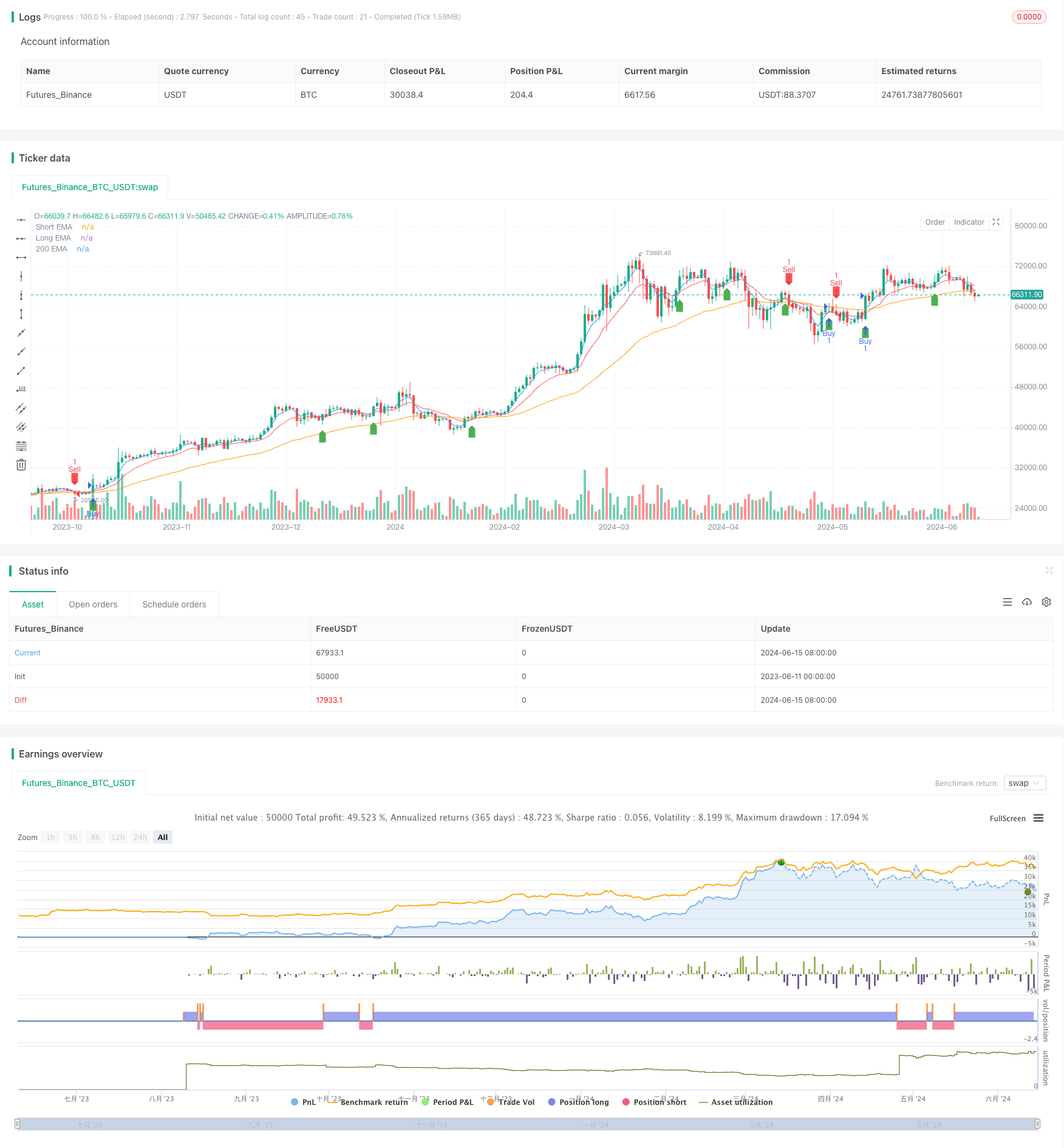

该策略结合了多个技术指标,包括三个不同周期的指数移动平均线(EMA)和相对强弱指数(RSI),通过分析它们之间的关系来识别潜在的买卖信号。该策略的主要思路是利用短期、中期和长期EMA的交叉来确定趋势方向,同时使用RSI来过滤可能的假信号。当价格在长期EMA之上,短期EMA上穿中期EMA,且RSI未达到超买区时,产生买入信号;相反地,当价格在长期EMA之下,短期EMA下穿中期EMA,且RSI未达到超卖区时,产生卖出信号。

策略原理

- 计算三个不同周期的EMA:短期(默认为4)、中期(默认为12)和长期(默认为48)。

- 计算RSI指标,默认周期为14,超买区默认为70,超卖区默认为30。

- 当满足以下条件时,产生买入信号:

- 短期EMA上穿中期EMA

- RSI未达到超买区

- 收盘价在长期EMA之上

- 当满足以下条件时,产生卖出信号:

- 短期EMA下穿中期EMA

- RSI未达到超卖区

- 收盘价在长期EMA之下

- 根据买卖信号执行相应的多头或空头交易。

策略优势

- 多重指标确认:该策略结合了趋势跟踪指标(EMA)和动量指标(RSI),通过多个指标的共同确认来提高信号的可靠性,有助于过滤掉一些假信号。

- 趋势适应性:通过使用不同周期的EMA,该策略能够适应不同时间尺度的趋势,捕捉短期、中期和长期的趋势变化。

- 风险控制:通过RSI的超买超卖条件,该策略避免在市场可能反转时进行交易,一定程度上控制了风险。

- 简单易用:该策略逻辑清晰,使用的指标简单实用,易于理解和应用。

策略风险

- 参数优化风险:该策略的表现依赖于EMA和RSI的参数选择,不同的参数可能导致不同的结果。如果参数没有经过充分的回测和优化,可能导致策略表现不佳。

- 震荡市风险:在震荡市场条件下,频繁的EMA交叉可能导致过多的交易信号,增加交易成本并降低策略效率。

- 趋势逆转风险:该策略在趋势已经确立后才会产生信号,可能错过趋势初期的一部分利润。同时,当趋势突然逆转时,该策略可能反应不够及时,导致一定的损失。

策略优化方向

- 动态参数优化:考虑使用动态参数优化方法,如遗传算法或网格搜索,找到在不同市场条件下表现最佳的参数组合,提高策略的适应性和稳健性。

- 加入其他过滤条件:为了进一步提高信号质量,可以考虑加入其他技术指标或市场情绪指标作为过滤条件,如成交量、波动率等。

- 趋势强度确认:在产生交易信号前,可以通过分析趋势强度(如ADX指标)来确认趋势的可靠性,避免在弱趋势或无趋势市场中交易。

- 止损止盈优化:引入更高级的止损止盈策略,如移动止损或基于波动率的动态止损,以更好地控制风险和保护利润。

总结

该策略通过结合三个不同周期的EMA和RSI指标,形成了一个简单有效的趋势跟踪交易系统。它利用EMA交叉来识别趋势方向,并通过RSI来过滤可能的假信号,在捕捉趋势的同时控制了风险。尽管该策略存在一些局限性,如参数优化风险和趋势逆转风险,但通过进一步的优化,如动态参数选择、加入其他过滤条件和改进止损止盈策略,可以提高该策略的适应性和稳健性,使其成为一个更加完善和可靠的交易系统。

策略源码

/*backtest

start: 2023-06-11 00:00:00

end: 2024-06-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © fitradn

//@version=4

//@version=4

strategy("EMA & RSI Strategy with 200 EMA", shorttitle="EMARSI200", overlay=true)

// Input for EMAs

shortEmaLength = input(4, title="Short EMA Length")

longEmaLength = input(12, title="Long EMA Length")

longTermEmaLength = input(48, title="Long Term EMA Length")

// Calculate EMAs

shortEma = ema(close, shortEmaLength)

longEma = ema(close, longEmaLength)

longTermEma = ema(close, longTermEmaLength)

// Plot EMAs

plot(shortEma, color=color.blue, title="Short EMA")

plot(longEma, color=color.red, title="Long EMA")

plot(longTermEma, color=color.orange, title="200 EMA")

// Input for RSI

rsiLength = input(14, title="RSI Length")

overbought = input(70, title="Overbought Level")

oversold = input(30, title="Oversold Level")

// Calculate RSI

rsi = rsi(close, rsiLength)

// Buy and Sell Conditions

buySignal = crossover(shortEma, longEma) and rsi < overbought and close > longTermEma

sellSignal = crossunder(shortEma, longEma) and rsi > oversold and close < longTermEma

// Execute Trades

if (buySignal)

strategy.entry("Buy", strategy.long)

if (sellSignal)

strategy.entry("Sell", strategy.short)

// Plot Buy and Sell Signals

plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal")

plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal")

相关推荐