概述

该策略是一个基于相对强弱指数(RSI)和指数移动平均线(EMA)的多周期交易系统。它主要利用RSI指标识别超卖条件,并结合长期EMA作为趋势过滤器,在市场出现超卖反转信号时进行买入。该策略还包含了止损和止盈机制,以及在价格下跌时增加头寸的功能,旨在捕捉市场反弹机会并控制风险。

策略原理

该策略的核心原理是利用RSI指标识别超卖条件,并在RSI值低于设定阈值时触发买入信号。具体来说:

- 使用11周期的RSI指标,当RSI值低于20时视为超卖条件。

- 同时使用290周期的EMA作为长期趋势指标,帮助过滤掉不利的市场环境。

- 当满足买入条件时,策略会开仓做多。

- 设置了1.4%的止损和3.5%的止盈,以控制风险并锁定利润。

- 当RSI值超过79时,策略会平仓退出。

- 如果价格下跌2%,策略会增加3倍的头寸,以平均成本并捕捉更大的反弹机会。

这种多层次的交易逻辑旨在提高策略的稳定性和盈利能力。

策略优势

多指标结合:通过结合RSI和EMA,策略能够更准确地识别潜在的反转机会,同时考虑长期趋势。

风险管理:内置的止损和止盈机制有助于控制每笔交易的风险,保护资金安全。

动态仓位管理:在价格下跌时增加头寸的机制可以降低平均成本,提高潜在收益。

灵活性:策略参数可调整,使其适应不同的市场环境和交易品种。

自动化:策略可以在交易平台上自动执行,减少人为情绪干扰。

策略风险

假突破风险:RSI可能出现假突破,导致错误的交易信号。

趋势反转:在强势趋势中,策略可能频繁触发信号,增加交易成本。

参数敏感性:策略性能可能对参数设置十分敏感,需要仔细优化和回测。

滑点和交易成本:频繁交易可能导致高昂的交易成本,影响整体收益。

市场环境依赖:策略在某些市场环境下可能表现不佳,需要持续监控和调整。

策略优化方向

多周期分析:考虑引入多个时间周期的RSI分析,以提高信号的可靠性。

动态参数调整:根据市场波动性动态调整RSI阈值和EMA周期,以适应不同的市场环境。

加入成交量指标:结合成交量分析,可以帮助确认价格走势的有效性。

优化加仓逻辑:可以考虑使用更复杂的加仓算法,如基于ATR的动态加仓。

引入机器学习:使用机器学习算法优化参数选择和信号生成过程。

总结

多周期RSI超卖反转策略是一个结合了技术指标和风险管理的量化交易系统。通过利用RSI的超卖信号和EMA的趋势过滤,该策略旨在捕捉市场反弹机会。内置的止损止盈机制和动态加仓逻辑进一步增强了策略的风险控制能力。然而,使用者需要注意假突破和参数敏感性等潜在风险。通过持续优化和调整,如引入多周期分析和机器学习技术,该策略有潜力在不同市场环境下保持稳定性和盈利能力。

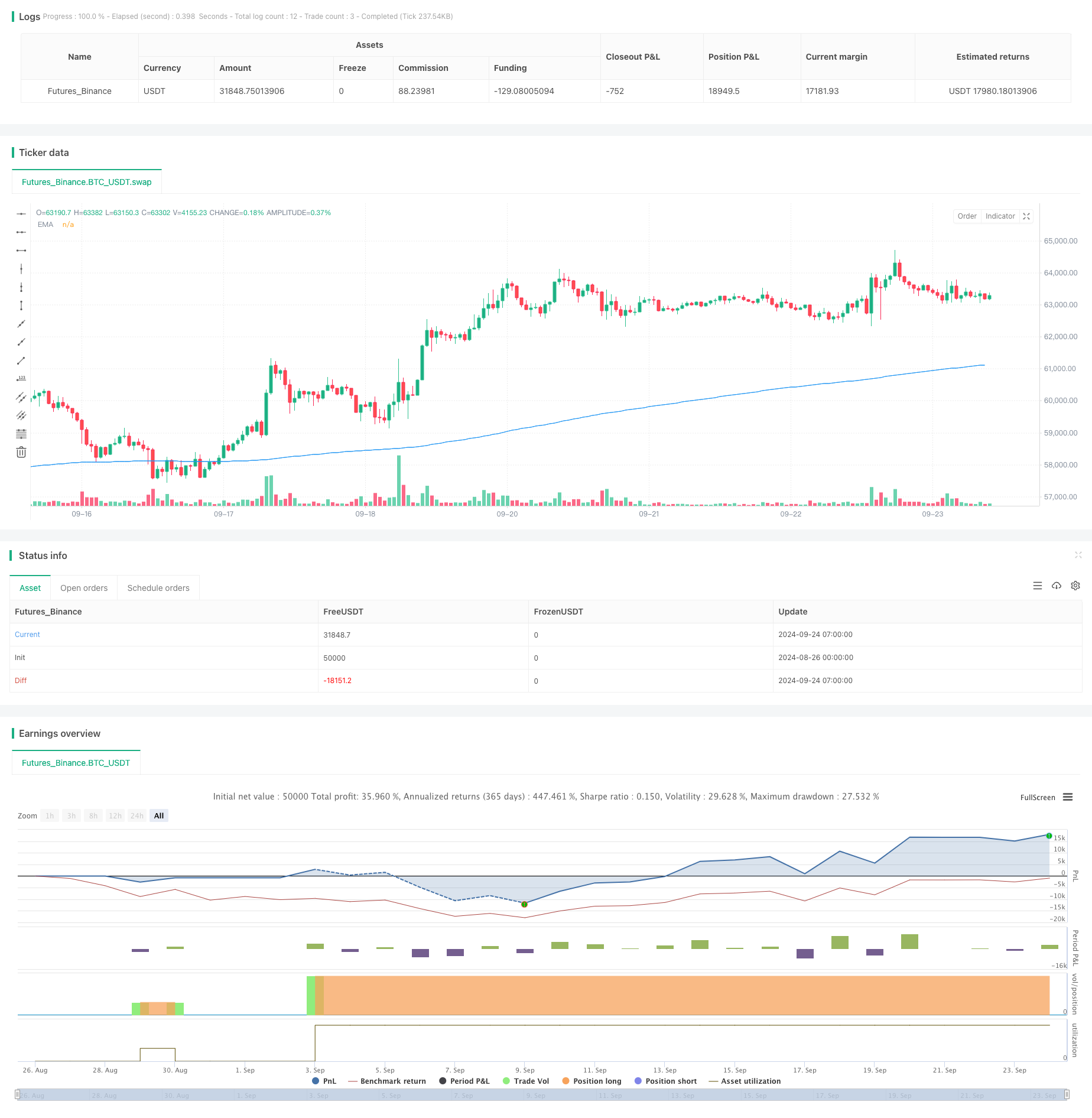

/*backtest

start: 2024-08-26 00:00:00

end: 2024-09-24 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(" 15min oversold gold", overlay=true)

// Parameters

rsiPeriod = input.int(11, title="RSI Period")

rsiSource = close

rsiEntryValue = input.float(20, title="RSI Value for Entry", step=0.1)

rsiExitValue = input.float(79, title="RSI Value for Exit", step=0.1)

emaPeriod = input.int(290, title="EMA Period")

stopLossPercent = input.float(1.4, title="Stop Loss (%)") / 100 // Convert percentage to a decimal.

takeProfitPercent = input.float(3.5, title="Take Profit (%)") / 100 // Convert percentage to a decimal.

// Calculate RSI and EMA

rsiValue = ta.rsi(rsiSource, rsiPeriod)

longEma = ta.ema(rsiSource, emaPeriod)

// Plot the EMA

plot(longEma, title="EMA", color=color.blue, linewidth=1)

// Entry conditions for long trades

longCondition = rsiValue < rsiEntryValue

// Exit conditions for long trades

rsiExitCondition = rsiValue > rsiExitValue

// Tracking the entry price, setting stop loss, and take profit

var float entryPrice = na

if (longCondition)

entryPrice := close

stopLossPrice = entryPrice * (1 - stopLossPercent)

takeProfitPrice = entryPrice * (1 + takeProfitPercent)

stopLossHit = close < stopLossPrice

takeProfitHit = close > takeProfitPrice

// Execute trades using the if statement

if (longCondition)

strategy.entry("Long", strategy.long)

// Distinct exit conditions

if (rsiExitCondition)

strategy.close("Long", comment="RSI Exit")

if (takeProfitHit)

strategy.close("Long", comment="Take Profit Hit")

///add a more limit buy

morebuy=entryPrice*(0.98)

buymore=close<morebuy

if buymore

strategy.entry('add more', strategy.long, qty = 3, comment = 'letgo bitch')