概述

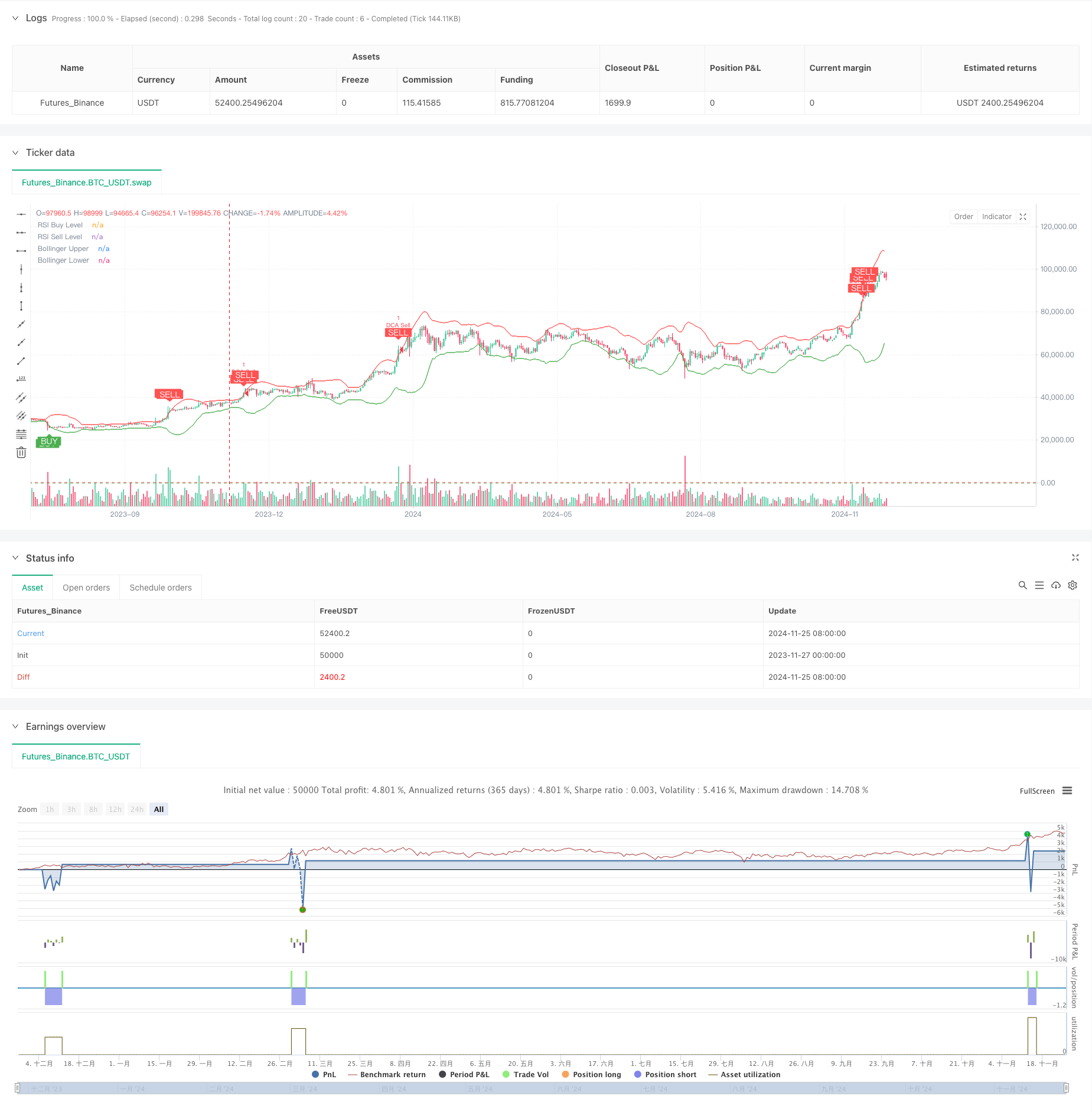

该策略是一个结合了布林带(Bollinger Bands)、相对强弱指标(RSI)和动态成本平均(DCA)的量化交易系统。策略通过设定资金管理规则,在市场波动中自动执行分批建仓操作,同时结合技术指标进行买卖信号判断,实现风险可控的交易执行。系统还包含了止盈逻辑和累计利润跟踪功能,可以有效监控和管理交易表现。

策略原理

策略主要基于以下几个核心组件运作: 1. 布林带指标用于判断价格波动区间,当价格触及下轨时考虑买入,触及上轨时考虑卖出 2. RSI指标用于确认市场超买超卖状态,RSI低于25时确认超卖,高于75时确认超卖 3. DCA模块根据账户权益动态计算每次建仓金额,实现资金的自适应管理 4. 止盈模块设置5%的获利目标,达到目标自动平仓保护利润 5. 市场状态监控模块计算90天市场变化幅度,帮助判断整体趋势 6. 累计利润跟踪模块记录每笔交易的盈亏状况,方便评估策略绩效

策略优势

- 结合多重技术指标交叉验证,提高信号可靠性

- 采用动态仓位管理,避免固定仓位带来的风险

- 设置合理止盈条件,及时锁定利润

- 具备市场趋势监控功能,便于把握大局

- 完善的利润跟踪系统,便于分析策略表现

- 警报功能配置完善,可实时提醒交易机会

策略风险

- 震荡市场可能频繁触发信号导致交易成本增加

- RSI指标在趋势市场可能产生滞后

- 固定百分比止盈可能在强趋势市场过早退出

- DCA策略在单边下跌市场可能造成较大回撤 建议采取以下措施管理风险:

- 设置最大持仓限制

- 根据市场波动度动态调整参数

- 增加趋势过滤器

- 实施分级止盈策略

策略优化方向

- 参数动态优化:

- 布林带参数可根据波动率自适应调整

- RSI阈值可随市场周期变化

- DCA资金比例可跟随账户规模调整

- 信号系统增强:

- 增加成交量确认

- 添加趋势线分析

- 结合更多技术指标交叉验证

- 风险控制完善:

- 实现动态止损

- 添加最大回撤控制

- 设置每日亏损限制

总结

该策略通过综合运用技术分析和资金管理方法,构建了一个较为完整的交易系统。策略的优势在于多重信号确认和完善的风险管理,但仍需要在实盘中进行充分测试和优化。通过持续改进参数设置和增加辅助指标,该策略有望在实际交易中取得稳定表现。

策略源码

/*backtest

start: 2023-11-27 00:00:00

end: 2024-11-26 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Combined BB RSI with Cumulative Profit, Market Change, and Futures Strategy (DCA)", shorttitle="BB RSI Combined DCA Strategy", overlay=true)

// Input Parameters

length = input.int(20, title="BB Length") // Adjusted BB length

mult = input.float(2.5, title="BB Multiplier") // Adjusted BB multiplier

rsiLength = input.int(14, title="RSI Length") // Adjusted RSI length

rsiBuyLevel = input.int(25, title="RSI Buy Level") // Adjusted RSI Buy Level

rsiSellLevel = input.int(75, title="RSI Sell Level") // Adjusted RSI Sell Level

dcaPositionSizePercent = input.float(1, title="DCA Position Size (%)", tooltip="Percentage of equity to use in each DCA step")

takeProfitPercentage = input.float(5, title="Take Profit (%)", tooltip="Take profit percentage for DCA strategy")

// Calculate DCA position size

equity = strategy.equity // Account equity

dcaPositionSize = (equity * dcaPositionSizePercent) / 100 // DCA position size as percentage of equity

// Bollinger Bands Calculation

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper = basis + dev

lower = basis - dev

// RSI Calculation

rsi = ta.rsi(close, rsiLength)

// Plotting Bollinger Bands and RSI levels

plot(upper, color=color.red, title="Bollinger Upper")

plot(lower, color=color.green, title="Bollinger Lower")

hline(rsiBuyLevel, "RSI Buy Level", color=color.green)

hline(rsiSellLevel, "RSI Sell Level", color=color.red)

// Buy and Sell Signals

buySignal = (rsi < rsiBuyLevel and close <= lower)

sellSignal = (rsi > rsiSellLevel and close >= upper)

// DCA Strategy: Enter Long or Short based on signals with calculated position size

if (buySignal)

strategy.entry("DCA Buy", strategy.long)

if (sellSignal)

strategy.entry("DCA Sell", strategy.short)

// Take Profit Logic

if (strategy.position_size > 0) // If long

strategy.exit("Take Profit Long", from_entry="DCA Buy", limit=close * (1 + takeProfitPercentage / 100))

if (strategy.position_size < 0) // If short

strategy.exit("Take Profit Short", from_entry="DCA Sell", limit=close * (1 - takeProfitPercentage / 100))

// Plot Buy/Sell Signals on the chart

plotshape(buySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY", textcolor=color.white)

plotshape(sellSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", textcolor=color.white)

// Alerts for Buy/Sell Signals

alertcondition(buySignal, title="Buy Alert", message="Buy Signal Detected")

alertcondition(sellSignal, title="Sell Alert", message="Sell Signal Detected")

// Cumulative Profit Calculation

var float buyPrice = na

var float profit = na

var float cumulativeProfit = 0.0 // Cumulative profit tracker

if (buySignal)

buyPrice := close

if (sellSignal and not na(buyPrice))

profit := (close - buyPrice) / buyPrice * 100

cumulativeProfit := cumulativeProfit + profit // Update cumulative profit

label.new(bar_index, high, text="P: " + str.tostring(profit, "#.##") + "%", color=color.blue, style=label.style_label_down)

buyPrice := na // Reset buyPrice after sell

// Plot cumulative profit on the chart

var label cumulativeLabel = na

if (not na(cumulativeProfit))

if not na(cumulativeLabel)

label.delete(cumulativeLabel)

cumulativeLabel := label.new(bar_index, high + 10, text="Cumulative Profit: " + str.tostring(cumulativeProfit, "#.##") + "%", color=color.purple, style=label.style_label_up)

// Market Change over 3 months Calculation

threeMonthsBars = 3 * 30 * 24 // Approximation of 3 months in bars (assuming 1 hour per bar)

priceThreeMonthsAgo = request.security(syminfo.tickerid, "D", close[threeMonthsBars])

marketChange = (close - priceThreeMonthsAgo) / priceThreeMonthsAgo * 100

// Plot market change over 3 months

var label marketChangeLabel = na

if (not na(marketChange))

if not na(marketChangeLabel)

label.delete(marketChangeLabel)

marketChangeLabel := label.new(bar_index, high + 20, text="Market Change (3 months): " + str.tostring(marketChange, "#.##") + "%", color=color.orange, style=label.style_label_up)

// Both labels (cumulative profit and market change) are displayed simultaneously

var label infoLabel = na

if (not na(cumulativeProfit) and not na(marketChange))

if not na(infoLabel)

label.delete(infoLabel)

infoLabel := label.new(bar_index, high + 30, text="Cumulative Profit: " + str.tostring(cumulativeProfit, "#.##") + "% | Market Change (3 months): " + str.tostring(marketChange, "#.##") + "%", color=color.purple, style=label.style_label_upper_right)

相关推荐