本文将详细介绍一个基于三重指数移动平均线的趋势跟踪交易策略。该策略通过短期、中期和长期三个不同周期的指数移动平均线之间的交叉关系来识别市场趋势,并结合动态止损和止盈机制进行交易管理。

策略概述

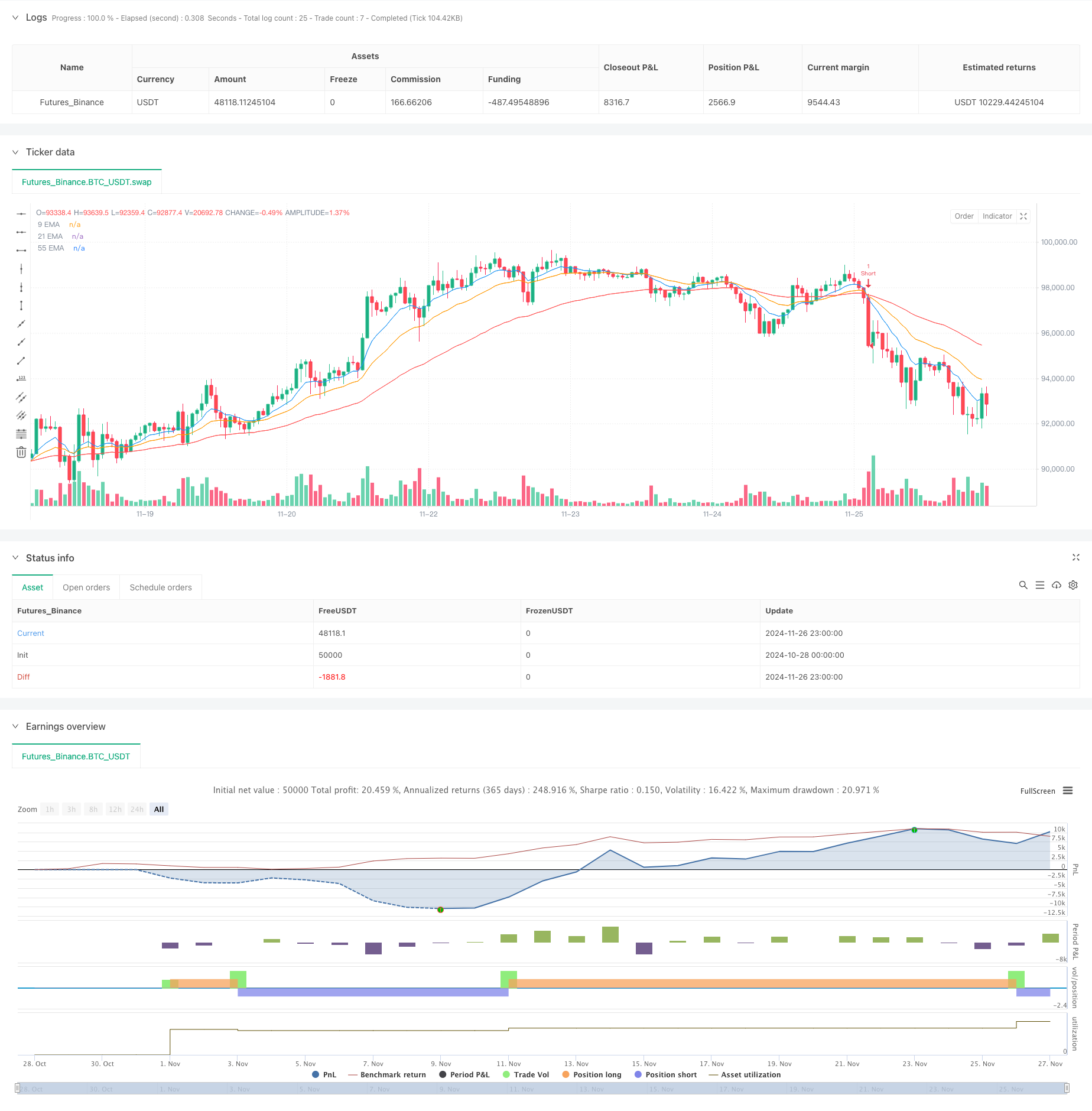

该策略基于三条不同周期的指数移动平均线(EMA)进行交易决策,分别是9周期、21周期和55周期。通过观察这些均线之间的交叉关系以及相对位置,来判断市场趋势的方向和强度,从而找到合适的交易机会。策略还整合了基于ATR的动态止损机制和基于风险收益比的止盈设置,以实现更好的风险管理。

策略原理

策略的核心逻辑是通过三条EMA的交叉和位置关系来识别趋势。具体来说: 1. 当短期EMA(9周期)向上穿越中期EMA(21周期),且中期EMA位于长期EMA(55周期)之上时,触发做多信号 2. 当短期EMA向下穿越中期EMA,且中期EMA位于长期EMA之下时,触发做空信号 3. 使用ATR的1.5倍作为动态止损距离,确保止损点位能够适应市场波动性 4. 基于1.2倍的风险收益比设置止盈位置,保证每笔交易都具有合理的盈亏比

策略优势

- 趋势识别能力强: 三重EMA的组合能够更准确地识别市场趋势,过滤掉市场噪音

- 风险管理完善: 通过ATR动态止损和固定风险收益比的设置,确保每笔交易都有清晰的风险控制

- 适应性强: 策略可以应用于不同的市场和时间周期,具有良好的普适性

- 操作规则明确: 入场、出场条件清晰,减少主观判断带来的干扰

策略风险

- 滞后性风险: EMA作为滞后指标,可能导致入场时机偏晚

- 震荡市场风险: 在横盘震荡市场中可能产生频繁的假信号

- 止损设置风险: ATR倍数的选择需要根据不同市场特征进行优化

- 资金管理风险: 固定风险收益比可能不适合所有市场环境

策略优化方向

- 趋势过滤器优化: 可以添加ADX等趋势强度指标,帮助过滤弱势市场的信号

- 动态参数优化: 可以根据市场波动性动态调整EMA周期和ATR倍数

- 资金管理优化: 可以根据市场环境动态调整风险收益比

- 入场时机优化: 可以结合RSI等摆动指标优化入场时机

总结

三重EMA趋势交易策略是一个逻辑清晰、风险可控的交易系统。通过合理的参数设置和优化,可以在不同市场环境下获得稳定的交易机会。策略的成功关键在于正确理解和运用趋势跟踪的核心原理,同时做好风险管理。在实际应用中,建议投资者根据具体市场特征和自身风险承受能力进行适当的参数调整。

策略源码

/*backtest

start: 2024-10-28 00:00:00

end: 2024-11-27 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Triple EMA Crossover Strategy", overlay=true)

// Define the input lengths for the EMAs

shortEmaLength = input(9, title="Short EMA Length")

mediumEmaLength = input(21, title="Medium EMA Length")

longEmaLength = input(55, title="Long EMA Length")

// Define the risk/reward ratios for SL and TP

riskRewardRatio = input(1.2, title="Risk/Reward Ratio") // Example: risk 1 to gain 1.2

atrMultiplier = input(1.5, title="ATR Multiplier for SL") // ATR multiplier for stop loss

// Calculate EMAs

ema9 = ta.ema(close, shortEmaLength)

ema21 = ta.ema(close, mediumEmaLength)

ema55 = ta.ema(close, longEmaLength)

// Plot EMAs on the chart

plot(ema9, color=color.blue, title="9 EMA")

plot(ema21, color=color.orange, title="21 EMA")

plot(ema55, color=color.red, title="55 EMA")

// Define Long and Short Conditions

longCondition = ta.crossover(ema9, ema21) and ema21 > ema55

shortCondition = ta.crossunder(ema9, ema21) and ema21 < ema55

// Calculate the Average True Range (ATR) for better stop loss positioning

atr = ta.atr(14) // Using a 14-period ATR for dynamic SL

// Execute Long trades

if (longCondition)

// Set stop loss and take profit prices

stopLoss = close - (atr * atrMultiplier)

takeProfit = close + ((close - stopLoss) * riskRewardRatio)

strategy.entry("Long", strategy.long, stop=stopLoss, limit=takeProfit)

// Execute Short trades

if (shortCondition)

// Set stop loss and take profit prices

stopLoss = close + (atr * atrMultiplier)

takeProfit = close - ((stopLoss - close) * riskRewardRatio)

strategy.entry("Short", strategy.short, stop=stopLoss, limit=takeProfit)

相关推荐