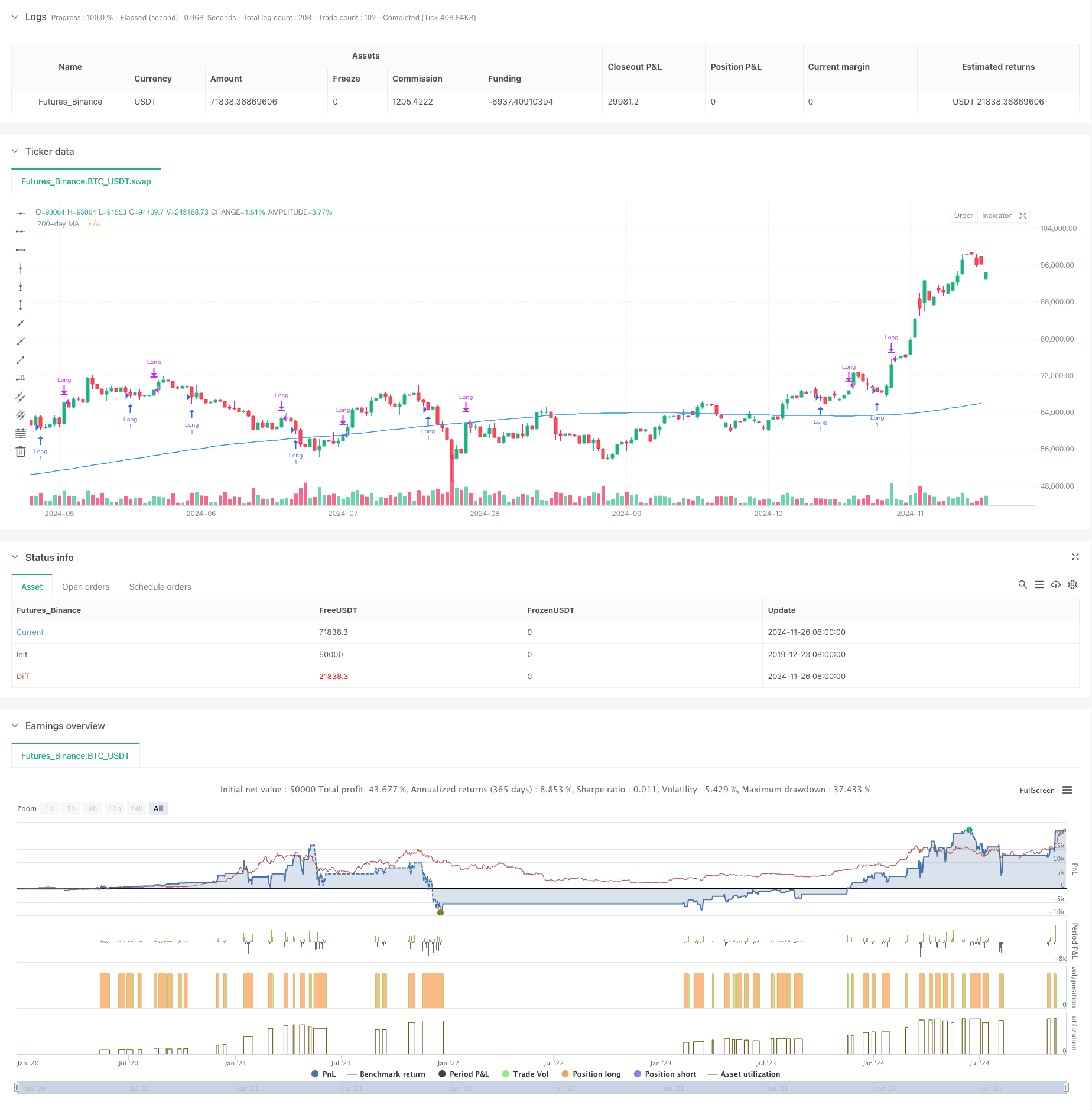

概述

本策略是一个结合趋势跟踪和均值回归的量化交易系统。它通过200日移动平均线(MA200)确定大趋势方向,同时利用7日价格波动识别短期超跌机会,实现在上升趋势中把握最佳买入时机。这种方法既保证了交易方向的正确性,又能在价格调整时及时介入,充分发挥技术分析在交易中的指导作用。

策略原理

策略的核心逻辑包含两个维度:一是通过MA200判断长期趋势,只有当价格位于MA200之上时才考虑开仓;二是观察最近7个交易日的价格表现,当出现7日新低且仍在MA200之上时建仓做多,当价格达到7日新高时平仓。这种设计既确保了顺势而为,又能在调整时低位建仓,是一个融合了趋势跟踪和均值回归思想的系统化策略。

策略优势

- 趋势确认的可靠性:使用MA200作为趋势过滤器,能有效避免在下跌趋势中开仓。

- 入场时机的精准性:通过7日低点识别超跌修正机会,提高建仓性价比。

- 系统化程度高:策略规则明确,无主观判断因素,易于程序化实现。

- 风险控制完善:通过趋势过滤和超跌判断双重机制,降低错误信号概率。

- 适用性广:策略逻辑简单且普适性强,可应用于多个市场和品种。

策略风险

- 趋势判断滞后:MA200作为长期均线具有滞后性,在趋势转折点可能造成判断失误。

- 假突破风险:价格突破7日高点后可能出现假突破,导致过早平仓。

- 震荡市不适用:在横盘震荡市场中,频繁的短期高低点可能产生过多交易信号。

- 市场环境依赖:策略效果受市场趋势特征影响较大,不同市场环境表现差异明显。

策略优化方向

- 动态周期优化:可根据不同市场特征动态调整MA周期和短期观察周期。

- 多重确认机制:增加成交量、波动率等辅助指标,提高信号可靠性。

- 仓位管理优化:引入动态仓位管理机制,根据市场波动性调整持仓比例。

- 止损机制完善:设计更灵活的止损方案,如跟踪止损或波动率止损。

- 分型优化:针对不同市场环境设计差异化的参数组合。

总结

Double Seven Strategy是一个将趋势跟踪与均值回归有机结合的量化交易系统。通过MA200和7日价格波动的配合使用,既保证了交易方向的正确性,又能把握较好的入场时机。虽然存在一定的局限性,但通过合理的优化和风险控制,该策略具有较好的实用价值和扩展空间。建议交易者在实际应用中结合市场特征和自身需求进行针对性优化,以提升策略的稳定性和收益性。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © EdgeTools

//@version=5

strategy("Larry Connors' Double Seven Strategy", overlay=true)

// 200-day moving average

ma200 = ta.sma(close, 200)

// Conditions for Double Seven Strategy

priceAboveMa200 = close > ma200

// Find the lowest close over the last 7 days

lowestClose7Days = ta.lowest(close, 7)

// Find the highest close over the last 7 days

highestClose7Days = ta.highest(close, 7)

// Entry and exit rules

longCondition = priceAboveMa200 and close <= lowestClose7Days

exitCondition = close >= highestClose7Days

// Enter long position

if (longCondition)

strategy.entry("Long", strategy.long)

// Exit long position

if (exitCondition)

strategy.close("Long")

// Plot moving averages

plot(ma200, "200-day MA", color=color.blue)

相关推荐