概述

这个策略是一个基于RSI超卖信号、长短期均线趋势和成交量确认的趋势跟踪策略。它主要通过识别长期上升趋势中的短期超卖机会来建立多头仓位,同时利用成交量放大来确认交易信号的有效性。策略采用了10周期RSI指标、250和500周期的双均线系统,以及20周期成交量均线作为核心指标组合。

策略原理

策略的核心逻辑基于三个关键条件的协同: 1. RSI超卖信号(RSI<=30):用于捕捉市场超卖反弹机会 2. 双均线多头排列(SMA250>SMA500):确认长期上升趋势 3. 成交量确认(当前成交量>20周期成交量均线*2.5):验证价格变动的有效性

当以上三个条件同时满足时,策略进入多头仓位。平仓信号则由短期均线下穿长期均线(死叉)触发。同时,策略设置了5%的止损来控制风险。

策略优势

- 多重确认机制降低虚假信号:结合RSI、均线和成交量三重过滤,显著提高了交易信号的可靠性

- 趋势跟随特性:通过长期均线判断大趋势,避免逆势交易

- 风险控制完善:设置固定止损位,有效控制单笔交易风险

- 适应性强:策略参数可根据不同市场特征灵活调整

- 交易机会筛选严格:多重条件过滤确保只在最佳时机入场

策略风险

- 滞后性风险:长周期均线存在显著滞后,可能错过早期趋势

- 过度过滤风险:严格的多重条件可能错过部分有效交易机会

- 震荡市场风险:在横盘震荡市场中可能频繁触发虚假信号

- 止损设置风险:固定比例止损可能不适合所有市场环境

- 参数优化风险:过度优化可能导致策略在实盘中表现不佳

策略优化方向

- 动态止损优化:可考虑基于ATR或波动率的动态止损机制

- 趋势强度量化:引入ADX等趋势强度指标,提高趋势判断准确性

- 仓位管理优化:根据信号强度和市场波动率动态调整持仓比例

- 出场机制完善:增加利润目标和移动止损等灵活出场机制

- 时间过滤:添加交易时间过滤,避开低效交易时段

总结

这是一个设计合理、逻辑严谨的趋势跟踪策略,通过多重技术指标的配合使用,有效平衡了收益和风险。策略的核心优势在于其完善的信号确认机制和风险控制体系,但同时也面临着过度过滤和滞后性等挑战。通过建议的优化方向,策略有望在实际应用中取得更好的表现。

策略源码

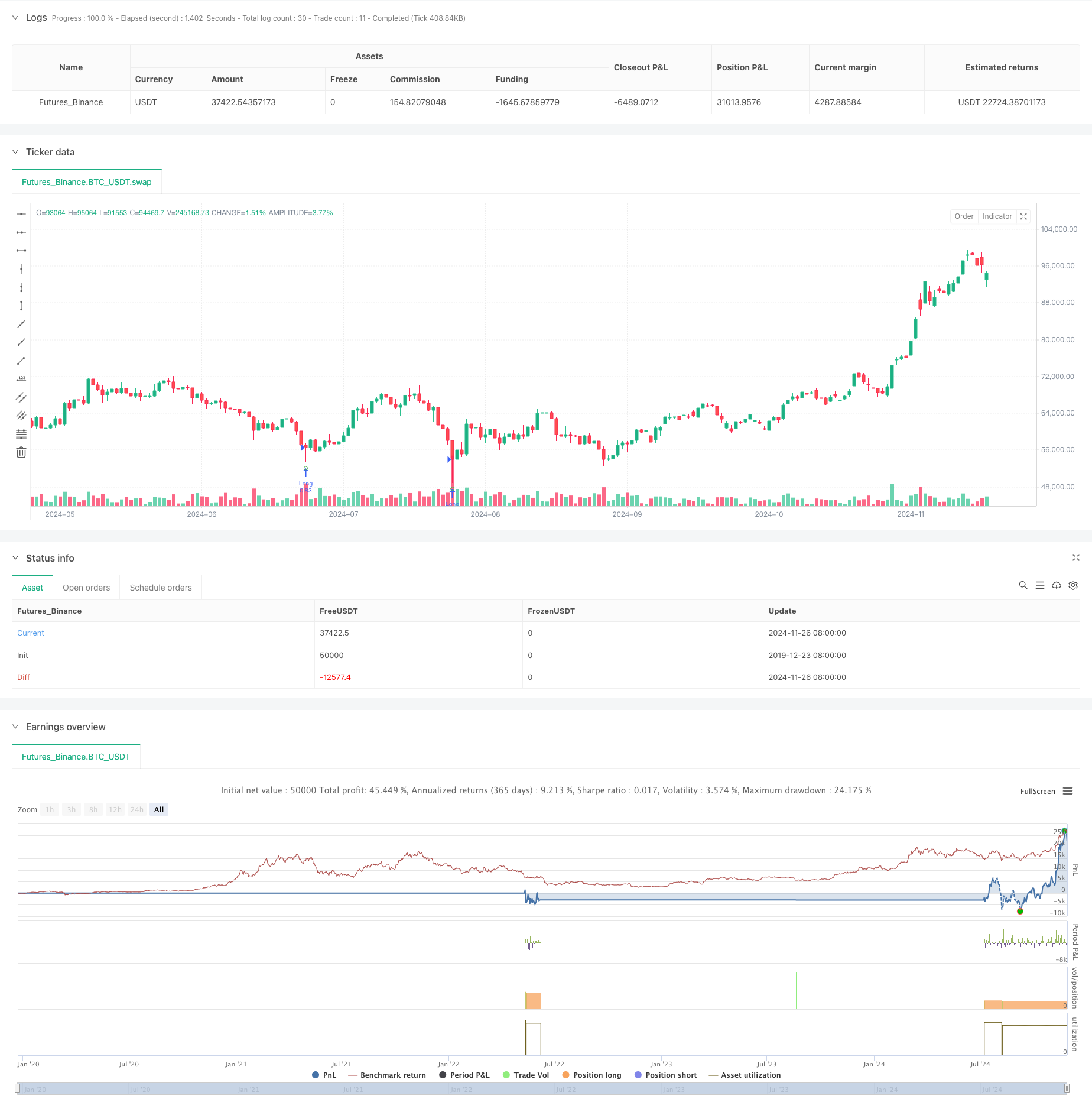

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) https://creativecommons.org/licenses/by-nc-sa/4.0/

// © wielkieef

//@version=5

strategy(title=' Rsi Long-Term Strategy [15min]', overlay=true, pyramiding=1, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, calc_on_order_fills=false, slippage=0, commission_type=strategy.commission.percent, commission_value=0.03)

// Rsi

rsi_lenght = input.int(10, title='RSI lenght', minval=0)

rsi_up = ta.rma(math.max(ta.change(close), 0), rsi_lenght)

rsi_down = ta.rma(-math.min(ta.change(close), 0), rsi_lenght)

rsi_value = rsi_down == 0 ? 100 : rsi_up == 0 ? 0 : 100 - 100 / (1 + rsi_up / rsi_down)

rsi_overs = rsi_value <= 30

rsi_overb = rsi_value >= 70

// Volume

vol_sma_length = input.int(20, title='Volume lenght ', minval=1)

Volume_condt = volume > ta.sma(volume, vol_sma_length) * 2.5

//SMA1

lengthSMA1 = input(250, title="Lenght SMA 1")

SMA1 = ta.sma(close, lengthSMA1)

//plot(SMA1, color=color.rgb(245, 108, 3), linewidth=1, title="SMA250")

//SMA2

lengthSMA2 = input(500, title="Lenght SMA 2")

SMA2 = ta.sma(close, lengthSMA2)

//plot(SMA2, color=#9803f5, linewidth=1, title="SMA500")

//Entry Logic

Long_cond = (rsi_overs and SMA1 > SMA2 and Volume_condt )

if Long_cond

strategy.entry('Long', strategy.long)

//Close Logic

Long_close = ta.crossunder(SMA1,SMA2)

if Long_close

strategy.close("Long")

//Bar colors

Bar_color = Volume_condt ? #fc9802 : SMA1 > SMA2 ? color.rgb(84, 252, 0) : SMA1 < SMA2 ? color.maroon : color.gray

barcolor(color=Bar_color)

// Rsi value Plotshapes

plotshape(rsi_value < 30 and SMA1 > SMA2 and Volume_condt, title='Buy', color=color.new(color.green, 0), style=shape.circle, location=location.belowbar, size=size.tiny, textcolor=color.new(color.black, 0))

plotshape(rsi_value > 70 and SMA1 < SMA2 and Volume_condt, title='Sell', color=color.new(color.red, 0), style=shape.circle, location=location.abovebar, size=size.tiny, textcolor=color.new(color.black, 0))

plotshape(ta.crossunder(SMA1,SMA2) , title='DEATH CROSS', color=#000000, style=shape.xcross, location=location.abovebar, size=size.small, textcolor=color.new(color.black, 0))

//Stop-Loss// this code is from author RafaelZioni, modified by wielkieef

pera(pcnt) =>

strategy.position_size != 0 ? math.round(pcnt / 100 * strategy.position_avg_price / syminfo.mintick) : float(na)

stoploss = input.float(title=' stop loss', defval=5.0, minval=0.5)

los = pera(stoploss)

strategy.exit('SL', loss=los)

// by wielkieef

相关推荐