在量化交易领域中,趋势跟踪策略一直是最受欢迎的交易方法之一。本文将介绍一个基于双均线系统的趋势跟踪策略,该策略通过优化的风险收益比来提高交易效率。

策略概述

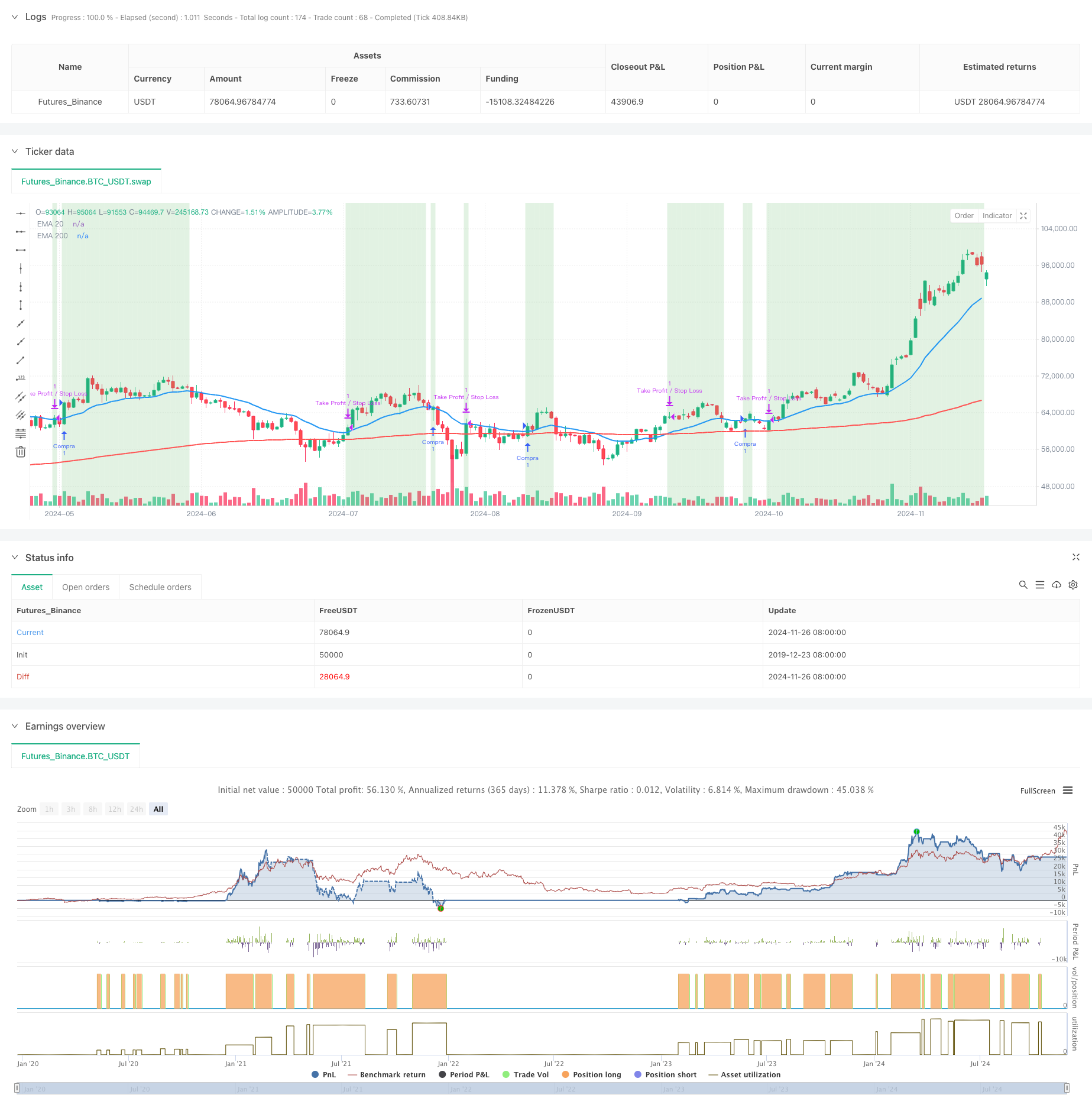

该策略采用20日和200日指数移动平均线(EMA)作为主要指标,结合3:1的风险收益比进行交易决策。当价格突破20日均线且20日均线位于200日均线之上时,系统会发出买入信号。每笔交易都设定了固定的止损(-0.5%)和获利(1.5%)水平,以确保风险可控。

策略原理

策略的核心逻辑包含以下几个关键要素: 1. 使用20日和200日EMA判断市场趋势,200日均线代表长期趋势,20日均线反映短期走势 2. 当价格突破20日均线且20日均线位于200日均线上方时,表明市场处于上升趋势 3. 采用3:1的风险收益比,即止盈点(1.5%)是止损点(0.5%)的3倍 4. 设置变量跟踪交易状态,避免重复进场 5. 当价格跌破20日均线时重置交易状态,为下一次交易做准备

策略优势

- 双均线系统能够有效过滤市场噪音,提高交易信号的可靠性

- 固定的风险收益比有助于长期稳定盈利

- 清晰的入场和出场规则,减少主观判断

- 自动化程度高,易于实现和回测

- 风险控制机制完善,每笔交易都有明确的止损位

策略风险

- 在横盘市场可能产生频繁的假信号

- 固定的止损止盈位置可能不适应所有市场环境

- 未考虑交易成本可能影响实际收益

- 在高波动性市场中,止损位置可能过于接近入场点

- 没有考虑市场流动性因素

优化方向

- 引入量能指标,提高趋势判断的准确性

- 根据市场波动率动态调整止损止盈位置

- 增加趋势强度过滤器,减少假信号

- 考虑加入市场情绪指标

- 优化仓位管理系统,实现更好的资金管理

总结

这是一个结构完整、逻辑清晰的趋势跟踪策略。通过结合双均线系统和固定的风险收益比,策略在保证收益的同时也很好地控制了风险。虽然还存在一些需要优化的地方,但整体而言这是一个值得进一步研究和改进的交易系统。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Estrategia de Compra con Ratio 3:1", overlay=true)

// Parámetros de la temporalidad diaria y las EMAs

ema20 = ta.ema(close, 20)

ema200 = ta.ema(close, 200)

// Condiciones para la entrada en largo

cierre_por_encima_ema20 = close > ema20

ema20_mayor_ema200 = ema20 > ema200

// Variable para registrar si ya se realizó una compra

var bool compra_realizada = false

// Condición para registrar una compra: primera vez que cierra por encima de EMA 20 con EMA 20 > EMA 200

if (cierre_por_encima_ema20 and ema20_mayor_ema200 and not compra_realizada)

// Abrir una operación de compra

strategy.entry("Compra", strategy.long)

compra_realizada := true // Registrar que se realizó una compra

// Definir los niveles de stop loss y take profit basados en el ratio 3:1

stop_loss = strategy.position_avg_price * 0.995 // -0.50% (rendimiento)

take_profit = strategy.position_avg_price * 1.015 // +1.50% (3:1 ratio)

// Establecer el stop loss y take profit

strategy.exit("Take Profit / Stop Loss", from_entry="Compra", stop=stop_loss, limit=take_profit)

// Condición para resetear la compra: cuando el precio cierra por debajo de la EMA de 20

if (close < ema20)

compra_realizada := false // Permitir una nueva operación

// Ploteo de las EMAs

plot(ema20, title="EMA 20", color=color.blue, linewidth=2)

plot(ema200, title="EMA 200", color=color.red, linewidth=2)

// Colorear el fondo cuando el precio está por encima de ambas EMAs

bgcolor(cierre_por_encima_ema20 and ema20_mayor_ema200 ? color.new(color.green, 80) : na)

相关推荐