概述

本策略是一个基于机器学习算法K近邻(KNN)的自适应参数化趋势跟踪系统。该策略通过KNN算法动态调整趋势跟踪参数,结合移动平均线进行交易信号的生成。系统能够根据市场环境的变化自动调整策略参数,提高策略的适应性和稳定性。该策略采用了机器学习方法来优化传统的趋势跟踪策略,是定量投资领域技术与创新的结合。

策略原理

策略的核心原理是利用KNN算法对历史价格数据进行分析,通过计算当前市场状态与历史数据的相似度来预测价格走势。具体实现步骤如下: 1. 设定观察窗口大小和K值,收集历史价格数据形成特征向量 2. 计算当前价格序列与历史数据之间的欧式距离 3. 选择K个最相似的历史价格序列作为近邻样本 4. 分析这K个近邻样本的后续价格变动 5. 结合移动平均线,根据近邻样本的平均价格变化生成交易信号 当K个近邻样本的平均价格变化为正且当前价格位于移动平均线上方时,系统生成做多信号;反之则生成做空信号。

策略优势

- 自适应性强: KNN算法能够根据市场环境的变化自动调整参数,使策略具有较强的适应性

- 多维度分析: 结合了机器学习算法和技术指标,提供了更全面的市场分析视角

- 风险控制合理: 通过移动平均线作为辅助确认,降低了虚假信号的影响

- 计算逻辑清晰: 策略的执行过程透明,便于理解和优化

- 参数灵活可调: 可以根据不同市场环境调整K值和窗口大小等参数

策略风险

- 计算复杂度高: KNN算法需要计算大量历史数据,可能影响策略执行效率

- 参数敏感性: K值和窗口大小的选择对策略性能有重要影响

- 市场环境依赖: 在剧烈波动的市场环境下,历史相似性的参考价值可能降低

- 过拟合风险: 过于依赖历史数据可能导致策略过拟合

- 延迟风险: 由于需要收集足够的历史数据,可能存在信号滞后

策略优化方向

- 特征工程优化:

- 增加更多技术指标作为特征

- 引入市场情绪指标

- 优化特征标准化方法

- 算法效率提升:

- 使用KD树等数据结构优化近邻搜索

- 实现并行计算

- 优化数据存储和访问方式

- 风险控制增强:

- 添加止损止盈机制

- 引入波动率过滤器

- 设计动态仓位管理系统

- 参数优化方案:

- 实现自适应K值选择

- 动态调整观察窗口大小

- 优化移动平均线周期

- 信号生成机制改进:

- 引入信号强度评分系统

- 设计信号确认机制

- 优化入场出场时机

总结

该策略创新性地将KNN算法应用于趋势跟踪交易中,通过机器学习方法优化传统技术分析策略。策略具有较强的自适应性和灵活性,能够根据市场环境动态调整参数。虽然存在计算复杂度高和参数敏感等风险,但通过合理的优化和风险控制措施,策略仍具有较好的应用价值。建议投资者在实际应用中,注意根据市场特点调整参数,并结合其他分析方法进行交易决策。

策略源码

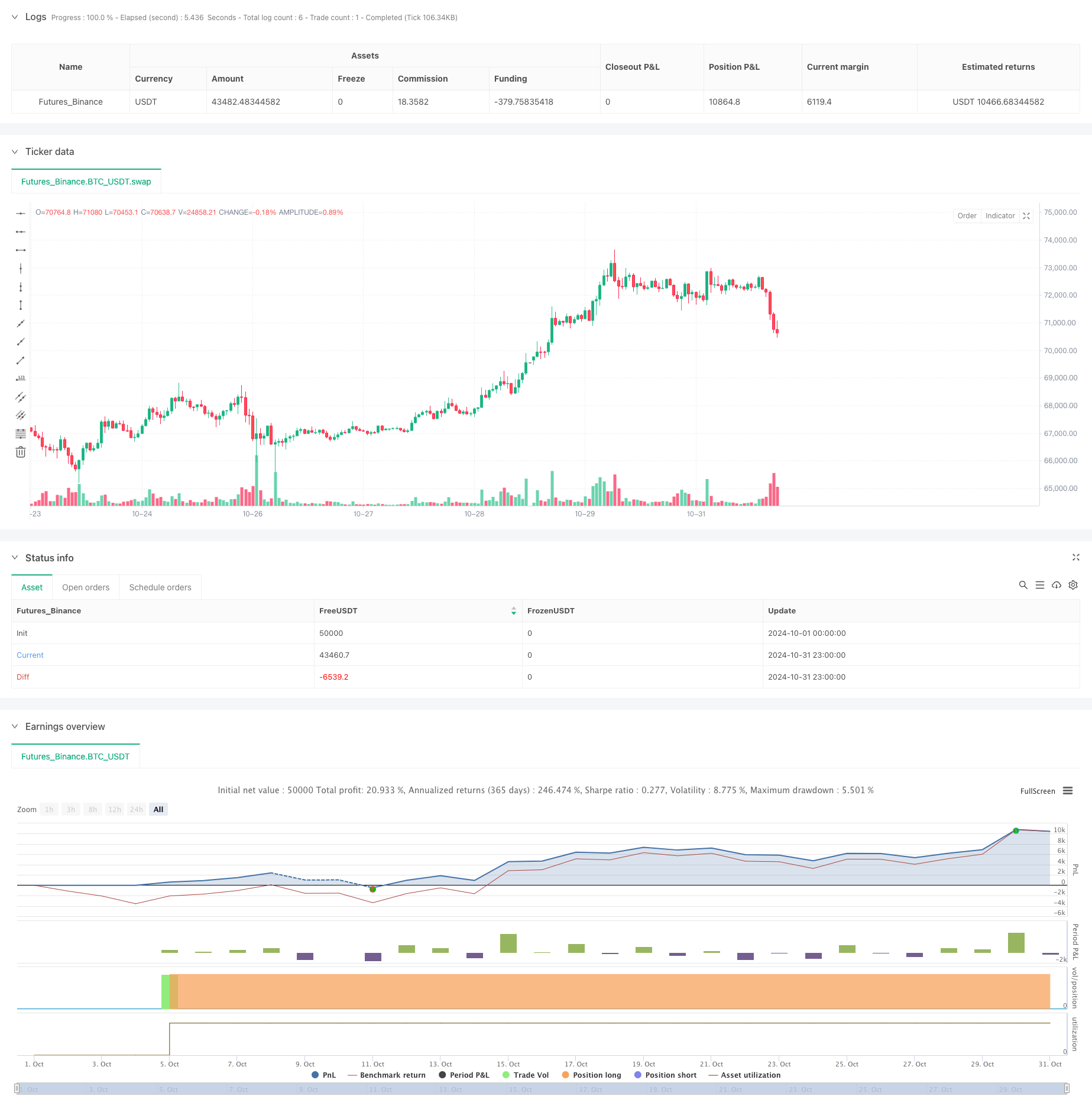

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Trend Following Strategy with KNN", overlay=true,commission_value=0.03,currency='USD', commission_type=strategy.commission.percent,default_qty_type=strategy.cash)

// Input parameters

k = input.int(5, title="K (Number of Neighbors)", minval=1) // Number of neighbors for KNN algorithm

window_size = input.int(20, title="Window Size", minval=1) // Window size for feature vector calculation

ma_length = input.int(50, title="MA Length", minval=1) // Length of the moving average

// Calculate moving average

ma = ta.sma(close, ma_length)

// Initialize variables

var float[] features = na

var float[] distances = na

var int[] nearest_neighbors = na

if bar_index >= window_size - 1 // Ensure there is enough historical data

features := array.new_float(0) // Keep only the current window data

for i = 0 to window_size - 1

array.push(features, close[i])

// Calculate distances

distances := array.new_float(0) // Clear the array for each calculation

for i = 0 to window_size - 1 // Calculate the distance between the current price and all prices in the window

var float distance = 0.0

for j = 0 to window_size - 1

distance += math.pow(close[j] - array.get(features, j), 2)

distance := math.sqrt(distance)

array.push(distances, distance)

// Find the nearest neighbors

if array.size(distances) > 0 and array.size(distances) >= k

nearest_neighbors := array.new_int(0)

for i = 0 to k - 1

var int min_index = -1

var float min_distance = na

for j = 0 to array.size(distances) - 1

if na(min_distance) or array.get(distances, j) < min_distance

min_index := j

min_distance := array.get(distances, j)

if min_index != -1

array.push(nearest_neighbors, min_index)

array.remove(distances, min_index) // Remove the processed neighbor

// Calculate the average price change of the neighbors

var float average_change = 0.0

if array.size(nearest_neighbors) > 0

for i = 0 to array.size(nearest_neighbors) - 1

var int index = array.get(nearest_neighbors, i)

// Ensure index + 1 is within range

if index + 1 < bar_index

average_change += (close[index] - close[index + 1])

average_change := average_change / array.size(nearest_neighbors)

// Generate trading signals

if average_change > 0 and close > ma

strategy.entry("Long", strategy.long)

else if average_change < 0 and close < ma

strategy.entry("Short", strategy.short)

相关推荐