概述

该策略是一个基于多重均线系统和RSI指标的趋势跟踪策略。策略采用20、50和200周期的移动平均线组合,通过分析不同均线之间的位置关系来判断市场趋势,并结合RSI指标进行交易信号的确认。策略设置了动态止损和盈利目标,通过追踪止损的方式来保护已获得的利润。

策略原理

策略的核心是通过分析三条均线(MA20、MA50、MA200)之间的相对位置关系来确定市场趋势。策略定义了18种不同的均线组合场景,主要关注均线交叉和位置关系。当短期均线位于长期均线之上时,倾向于做多;反之则倾向于做空。为了避免过度交易,策略引入了RSI指标作为过滤条件,当RSI低于70时允许做多,高于30时允许做空。策略采用了1:10的风险收益比设置,并使用25点的追踪止损来保护盈利。

策略优势

- 多维度趋势确认:通过分析多条均线之间的关系,能够更准确地判断市场趋势的强度和方向

- 动态风险管理:采用追踪止损机制,能够在保护已获利润的同时允许利润继续增长

- 过滤机制完善:结合RSI指标进行信号过滤,有效减少虚假信号

- 风险收益比优化:采用1:10的风险收益比设置,追求大趋势带来的收益

- 适应性强:策略可以应用于不同的市场和时间周期

策略风险

- 震荡市场风险:在横盘震荡市场中可能产生频繁的假突破信号

- 滑点风险:在快速市场中,25点的追踪止损可能因滑点而无法准确执行

- 趋势反转风险:在趋势反转时,策略可能反应较慢,导致已获利润回吐

- 参数依赖性:策略效果很大程度上依赖于均线周期和RSI参数的选择

策略优化方向

- 引入成交量指标:可以通过添加成交量分析来提高趋势判断的准确性

- 优化场景定义:可以简化部分重复的场景定义,提高策略运行效率

- 动态参数调整:可以根据市场波动率动态调整追踪止损点位

- 增加时间过滤:添加交易时间段过滤,避开波动较大的市场开盘和收盘时段

- 优化信号确认:可以添加趋势强度确认指标,提高交易信号的可靠性

总结

这是一个结构完整、逻辑清晰的趋势跟踪策略。通过多重均线系统的配合使用,结合RSI指标的过滤,形成了一个相对可靠的交易系统。策略的风险管理机制设计合理,通过追踪止损的方式既保护了利润又不会过早离场。虽然策略还存在一些需要优化的空间,但整体框架设计较为科学,具有实际应用价值。

策略源码

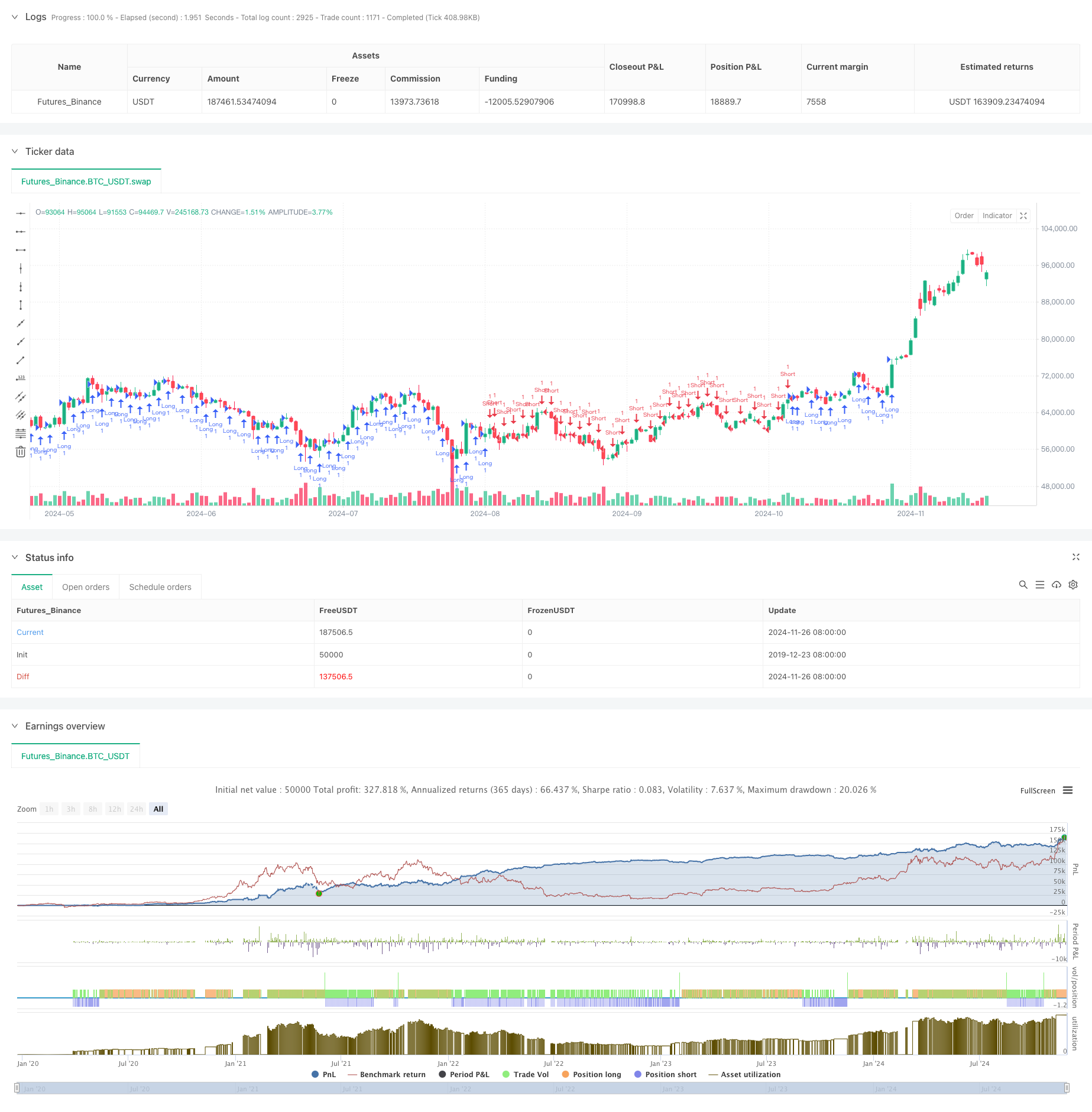

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Refined MA Strategy with Trailing Stop for 30m", overlay=true)

// Define the moving averages

TR20 = ta.sma(close, 20)

TR50 = ta.sma(close, 50)

TR200 = ta.sma(close, 200)

// Define the RSI for additional filtering

rsi = ta.rsi(close, 14)

// Define the scenarios

scenario1 = TR20 > TR50 and TR50 > TR200

scenario2 = TR50 > TR20 and TR20 > TR200

scenario3 = TR200 > TR50 and TR50 > TR20

scenario4 = TR50 > TR200 and TR200 > TR20

scenario5 = TR20 > TR200 and TR200 > TR50

scenario6 = TR200 > TR20 and TR20 > TR50

scenario7 = TR20 == TR50 and TR50 > TR200

scenario8 = TR50 == TR20 and TR20 > TR200

scenario9 = TR200 == TR50 and TR50 > TR20

scenario10 = TR20 > TR50 and TR50 == TR200

scenario11 = TR50 > TR20 and TR20 == TR200

scenario12 = TR20 > TR50 and TR50 == TR200

scenario13 = TR20 == TR50 and TR50 == TR200

scenario14 = TR20 > TR50 and TR200 == TR50

scenario15 = TR50 > TR20 and TR200 == TR50

scenario16 = TR20 > TR50 and TR50 == TR200

scenario17 = TR20 > TR50 and TR50 == TR200

scenario18 = TR20 > TR50 and TR50 == TR200

// Entry conditions

longCondition = (scenario1 or scenario2 or scenario5) and rsi < 70

shortCondition = (scenario3 or scenario4 or scenario6) and rsi > 30

// Execute trades based on scenarios with 50 points stop loss and 1:10 RR, using a trailing stop of 25 points

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.exit("Take Profit", from_entry="Long", limit=close + 250, trail_offset=25)

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.exit("Take Profit", from_entry="Short", limit=close - 250, trail_offset=25)