概述

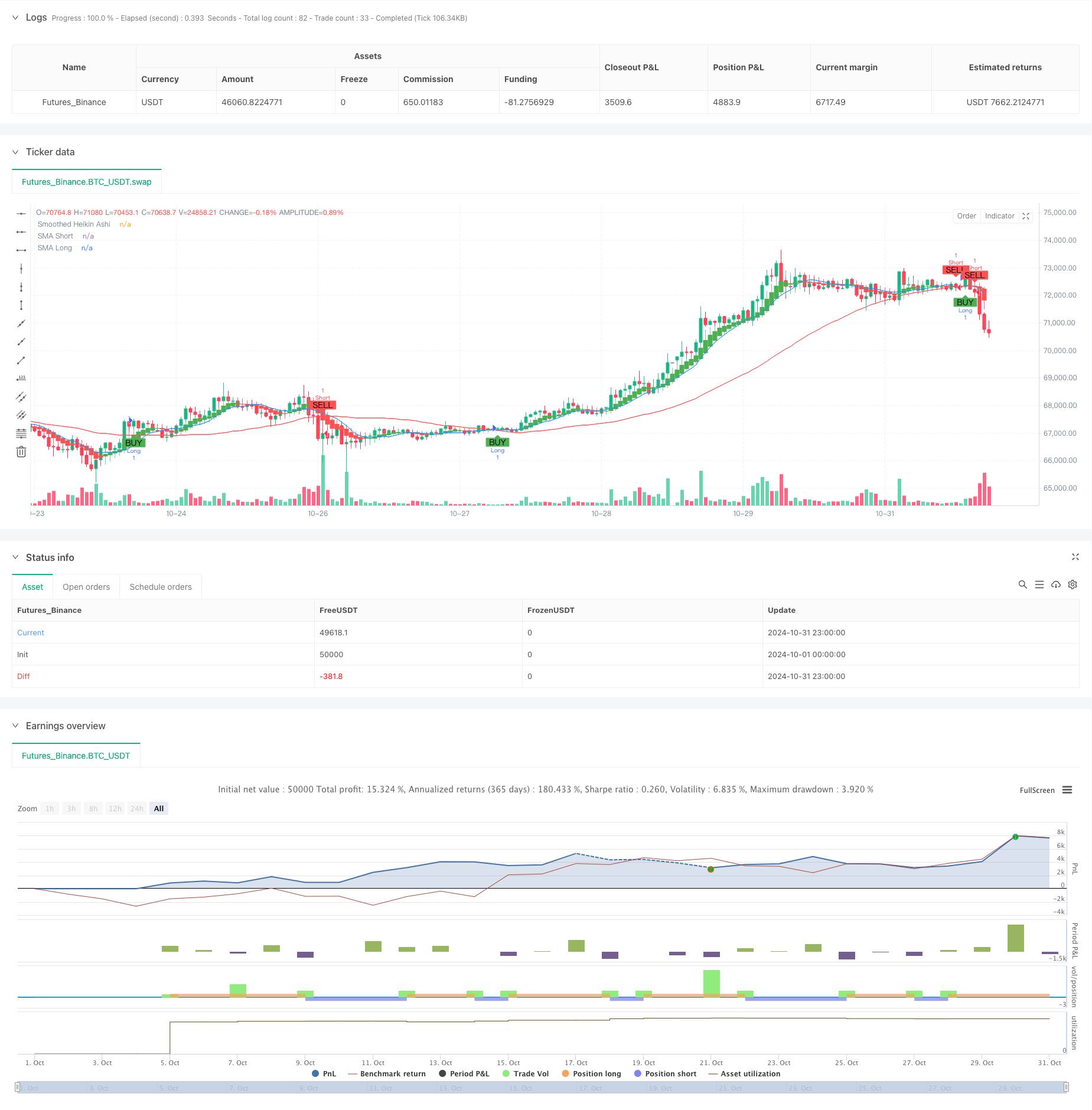

本策略是一个基于平滑型Heikin-Ashi蜡烛图和简单移动平均线(SMA)交叉的趋势跟踪系统。策略通过EMA平滑处理后的Heikin-Ashi蜡烛图与44周期SMA的交叉来识别趋势的变化,从而捕捉市场的主要趋势性机会。策略设计了动态的仓位管理机制,当价格与长期均线距离过近时会自动平仓,以规避盘整市场的震荡风险。

策略原理

策略的核心逻辑包含三个关键要素:首先是将传统K线转换为Heikin-Ashi蜡烛图,通过计算开高低收四个价格的算术平均值来过滤市场噪音;其次使用6周期EMA对Heikin-Ashi进行平滑处理,进一步提升信号的可靠性;最后将平滑后的Heikin-Ashi收盘价与44周期SMA结合,通过上穿产生做多信号,下穿产生做空信号。同时引入了”无仓位阈值”的概念,当价格与长期均线距离小于阈值时触发平仓信号,有效避免横盘整理行情带来的频繁交易。

策略优势

- 信号过滤机制完善,通过Heikin-Ashi和EMA双重平滑显著降低假突破的可能性

- 趋势跟踪逻辑清晰,能有效捕捉大趋势行情

- 设计了动态止损机制,在横盘整理时及时离场

- 参数设置合理,短期均线11周期和长期均线44周期的配比符合市场运行规律

- 可视化效果优秀,交易信号清晰直观

策略风险

- 趋势反转初期可能会有一定的滞后性,导致入场时机略有延迟

- 在剧烈波动的市场环境下,可能会产生虚假的交叉信号

- 对参数设置较为敏感,不同品种可能需要针对性调整

- 在缺乏明显趋势的市场中可能会产生频繁交易

策略优化方向

- 建议增加趋势强度过滤器,例如ADX指标,只在趋势明显时才开仓

- 可以引入量价配合的交易确认机制,提高信号可靠性

- 考虑加入防滑点机制,避免在重要价位附近频繁交易

- 可以设计动态的止盈止损机制,根据市场波动率自动调整

- 建议增加仓位管理模块,根据趋势强度动态调整持仓比例

总结

该策略通过结合Heikin-Ashi蜡烛图和SMA均线系统,构建了一个稳健的趋势跟踪交易系统。策略的信号生成机制完善,风险控制合理,特别适合在具有明显趋势特征的市场中应用。通过建议的优化方向,策略的实战效果还可以进一步提升。总体而言,这是一个设计合理、逻辑清晰的趋势跟踪策略。

策略源码

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Smoothed Heikin Ashi with SMA Strategy", overlay=true)

// Input parameters for SMAs

s1 = input.int(11, title="Short SMA Period")

s2 = input.int(44, title="Long SMA Period")

noPositionThreshold = input.float(0.001, title="No Position Threshold", step=0.0001)

// Calculate the original Heikin-Ashi values

haClose = (open + high + low + close) / 4

var float haOpen = na

haOpen := na(haOpen[1]) ? (open + close) / 2 : (haOpen[1] + haClose[1]) / 2

haHigh = math.max(high, math.max(haOpen, haClose))

haLow = math.min(low, math.min(haOpen, haClose))

// Smoothing using exponential moving averages

smoothLength = input.int(6, title="Smoothing Length")

smoothedHaClose = ta.ema(haClose, smoothLength)

smoothedHaOpen = ta.ema(haOpen, smoothLength)

smoothedHaHigh = ta.ema(haHigh, smoothLength)

smoothedHaLow = ta.ema(haLow, smoothLength)

// Calculate SMAs

smaShort = ta.sma(close, s1)

smaLong = ta.sma(close, s2)

// Plotting the smoothed Heikin-Ashi values

plotcandle(smoothedHaOpen, smoothedHaHigh, smoothedHaLow, smoothedHaClose, color=(smoothedHaClose >= smoothedHaOpen ? color.green : color.red), title="Smoothed Heikin Ashi")

plot(smaShort, color=color.blue, title="SMA Short")

plot(smaLong, color=color.red, title="SMA Long")

// Generate buy/sell signals based on SHA crossing 44 SMA

longCondition = ta.crossover(smoothedHaClose, smaLong)

shortCondition = ta.crossunder(smoothedHaClose, smaLong)

noPositionCondition = math.abs(smoothedHaClose - smaLong) < noPositionThreshold

// Strategy logic

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

if (noPositionCondition and strategy.position_size != 0)

strategy.close_all("No Position")

// Plot buy/sell signals

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY", size=size.small)

plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", size=size.small)

plotshape(series=noPositionCondition and strategy.position_size != 0, location=location.belowbar, color=color.yellow, style=shape.labeldown, text="EXIT", size=size.small)

相关推荐