概述

该策略是一个结合了动态追踪止损、风险报酬比和RSI极值退出的高级交易系统。策略通过识别市场中的特定形态(平行K线形态和针型K线形态)来进行交易,同时利用ATR和最近低点来设置动态止损位,并根据预设的风险回报比来确定获利目标。系统还集成了基于RSI指标的市场过热/过冷判断机制,可以在市场达到极值时及时平仓。

策略原理

策略的核心逻辑包括以下几个关键部分: 1. 入场信号基于两种形态:平行K线形态(大阳线跟随大阴线)和双针型K线形态。 2. 动态追踪止损使用ATR乘数对最近N根K线的最低价进行调整,确保止损位能够动态适应市场波动。 3. 获利目标基于固定的风险回报比设置,通过计算每笔交易的风险值®来确定。 4. 仓位规模根据固定风险金额和每笔交易的风险值动态计算。 5. RSI极值退出机制在市场过热或过冷时触发平仓信号。

策略优势

- 动态风险管理:通过ATR和最近低点的结合,止损位能够根据市场波动动态调整。

- 精确的仓位控制:基于固定风险金额的仓位计算方法确保每笔交易的风险一致。

- 多维度的退出机制:结合追踪止损、固定盈利目标和RSI极值三重退出机制。

- 灵活的交易方向选择:可以选择只做多、只做空或者双向交易。

- 清晰的风险回报设置:通过预设的风险回报比明确每笔交易的盈利目标。

策略风险

- 形态识别的准确性风险:平行K线和针型K线的识别可能存在误判。

- 止损设置的滑点风险:在波动剧烈的市场中可能面临较大滑点。

- RSI极值退出可能过早:在强趋势市场中可能导致提前退出而错过更多盈利。

- 固定风险回报比的局限性:不同市场环境下最优的风险回报比可能不同。

- 参数优化的过拟合风险:多个参数的组合可能导致过度优化。

策略优化方向

- 入场信号优化:可以增加更多的形态确认指标,如成交量、趋势指标等。

- 动态风险回报比:根据市场波动性动态调整风险回报比。

- 智能参数自适应:引入机器学习算法对参数进行动态优化。

- 多时间周期确认:增加更多时间周期的信号确认机制。

- 市场环境分类:根据不同的市场环境采用不同的参数组合。

总结

这是一个设计完善的交易策略,通过结合多个成熟的技术分析概念,构建了一个完整的交易系统。策略的优势在于其全面的风险管理体系和灵活的交易规则,但同时也需要注意参数优化和市场适应性的问题。通过建议的优化方向,策略还有进一步提升的空间。

策略源码

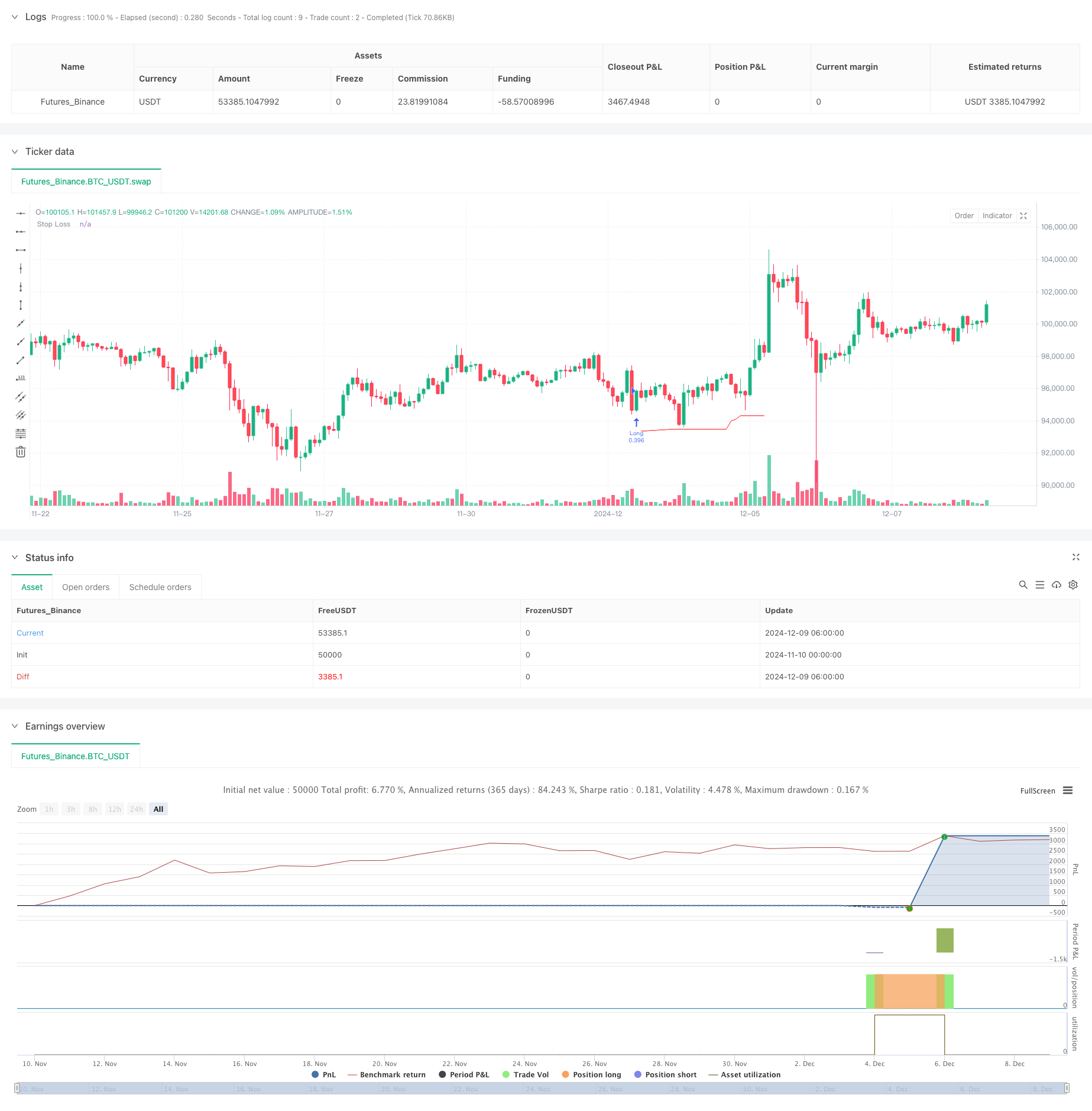

/*backtest

start: 2024-11-10 00:00:00

end: 2024-12-09 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ZenAndTheArtOfTrading | www.TheArtOfTrading.com

// @version=5

strategy("Trailing stop 1", overlay=true)

// Get user input

int BAR_LOOKBACK = input.int(10, "Bar Lookback")

int ATR_LENGTH = input.int(14, "ATR Length")

float ATR_MULTIPLIER = input.float(1.0, "ATR Multiplier")

rr = input.float(title="Risk:Reward", defval=3)

// Basic definition

var float shares=na

risk = 1000

var float R=na

E = strategy.position_avg_price

// Input option to choose long, short, or both

side = input.string("Long", title="Side", options=["Long", "Short", "Both"])

// RSI exit option

RSIexit = input.string("Yes", title="Exit at RSI extreme?", options=["Yes", "No"])

RSIup = input(75)

RSIdown = input(25)

// Get indicator values

float atrValue = ta.atr(ATR_LENGTH)

// Calculate stop loss values

var float trailingStopLoss = na

float longStop = ta.lowest(low, BAR_LOOKBACK) - (atrValue * ATR_MULTIPLIER)

float shortStop = ta.highest(high, BAR_LOOKBACK) + (atrValue * ATR_MULTIPLIER)

// Check if we can take trades

bool canTakeTrades = not na(atrValue)

bgcolor(canTakeTrades ? na : color.red)

//Long pattern

//Two pin bar

onepinbar = (math.min(close,open)-low)/(high-low)>0.6 and math.min(close,open)-low>ta.sma(high-low,14)

twopinbar = onepinbar and onepinbar[1]

notatbottom = low>ta.lowest(low[1],10)

// Parallel

bigred = (open-close)/(high-low)>0.8 and high-low>ta.sma(high-low,14)

biggreen = (close-open)/(high-low)>0.8 and high-low>ta.sma(high-low,14)

parallel = bigred[1] and biggreen

atbottom = low==ta.lowest(low,10)

// Enter long trades (replace this entry condition)

longCondition = parallel

if (longCondition and canTakeTrades and strategy.position_size == 0 and (side == "Long" or side == "Both"))

R:= close-longStop

shares:= risk/R

strategy.entry("Long", strategy.long,qty=shares)

// Enter short trades (replace this entry condition)

shortCondition = parallel

if (shortCondition and canTakeTrades and strategy.position_size == 0 and (side == "Short" or side == "Both"))

R:= shortStop - close

shares:= risk/R

strategy.entry("Short", strategy.short,qty=shares)

// Update trailing stop

if (strategy.position_size > 0)

if (na(trailingStopLoss) or longStop > trailingStopLoss)

trailingStopLoss := longStop

else if (strategy.position_size < 0)

if (na(trailingStopLoss) or shortStop < trailingStopLoss)

trailingStopLoss := shortStop

else

trailingStopLoss := na

// Exit trades with trailing stop

strategy.exit("Long Exit", "Long", stop=trailingStopLoss, limit = E + rr*R )

strategy.exit("Short Exit", "Short", stop=trailingStopLoss, limit = E - rr*R)

//Close trades at RSI extreme

if ta.rsi(high,14)>RSIup and RSIexit == "Yes"

strategy.close("Long")

if ta.rsi(low,14)<RSIdown and RSIexit == "Yes"

strategy.close("Short")

// Draw stop loss

plot(trailingStopLoss, "Stop Loss", color.red, 1, plot.style_linebr)

相关推荐