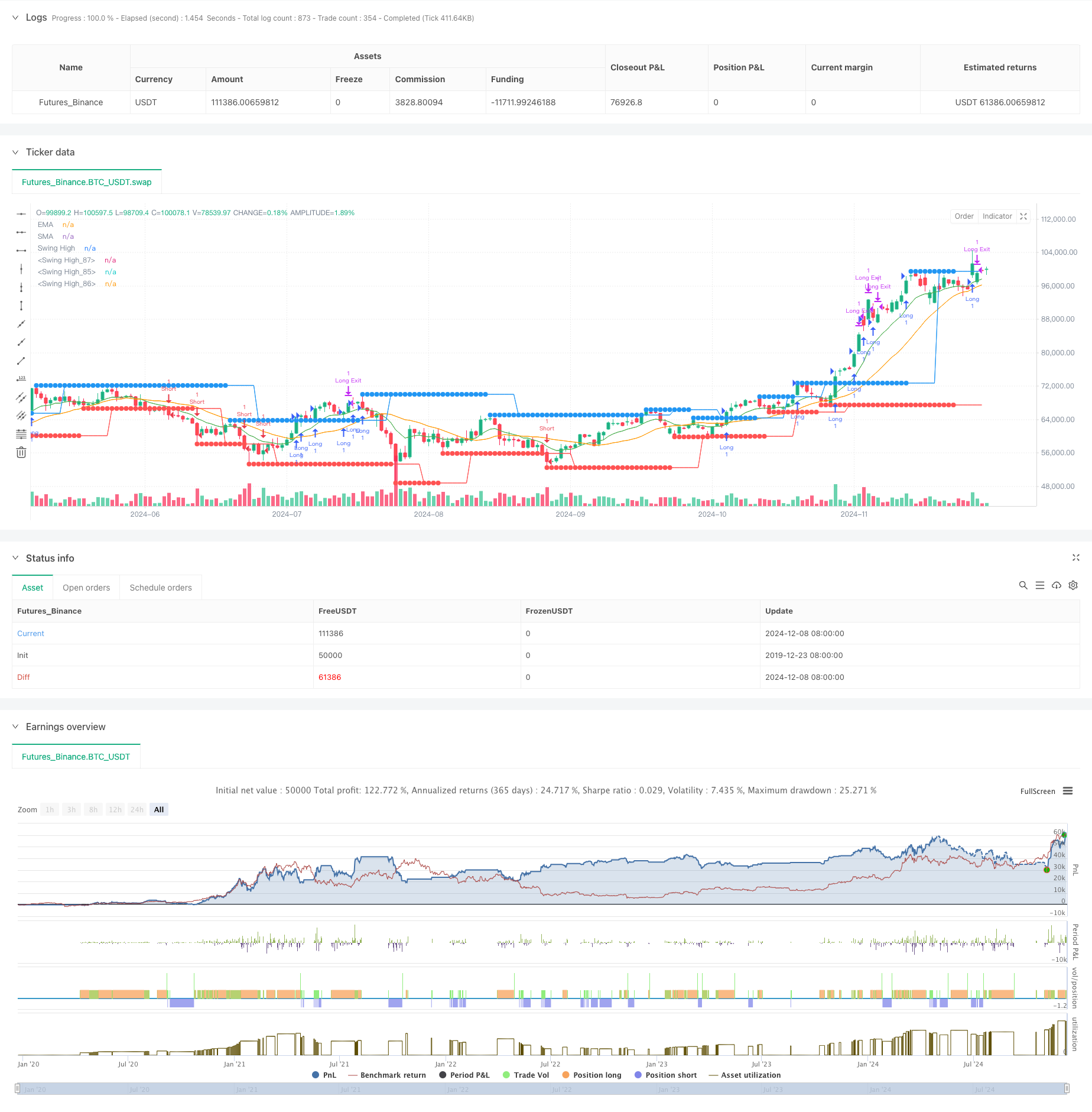

概述

本策略是一个综合性的交易系统,将趋势跟踪与波段交易方法相结合,通过EMA和SMA均线交叉、波段高低点识别、成交量过滤以及百分比止盈和跟踪止损机制来构建完整的交易体系。策略设计注重多维度信号确认,通过技术指标的协同作用提高交易的准确性和可靠性。

策略原理

策略采用多层次信号过滤机制,首先利用EMA(10)和SMA(21)的交叉形成基础趋势判断,然后通过左右六根K线的高低点突破判定入场时机,同时要求成交量大于200周期移动平均线,确保在流动性充足的环境下交易。系统采用2%的百分比止盈和1%的跟踪止损来管理风险。当价格突破波段高点且满足成交量条件时,系统开多单;当价格跌破波段低点且满足成交量条件时,系统开空单。

策略优势

- 多重信号确认机制降低虚假信号:通过均线趋势、价格突破和成交量放大三重验证,提高交易可靠性

- 灵活的止盈止损机制:采用百分比方式设置止盈位,并配合跟踪止损锁定利润

- 完善的可视化系统:提供均线、突破点位的图形展示,便于交易监控

- 高度可定制性:关键参数均可调整,适应不同市场环境

- 系统化的风险管理:通过预设的止损和止盈位控制风险

策略风险

- 横盘市场可能产生频繁假突破

- 成交量过滤可能错过部分有效信号

- 固定百分比止盈可能在强势行情中过早离场

- 均线系统在快速转向市场中存在滞后性

- 需要考虑交易成本对策略收益的影响

策略优化方向

- 引入波动率自适应机制,动态调整止盈止损参数

- 增加趋势强度过滤,避免在弱趋势中交易

- 优化成交量过滤算法,考虑相对成交量变化

- 添加时间过滤机制,避免在不利时段交易

- 考虑加入市场环境分类,针对不同市场采用不同参数

总结

该策略通过均线系统、价格突破和成交量验证构建了一个完整的交易体系,适合中长期趋势跟踪。系统的优势在于多重信号确认和完善的风险管理机制,但也需要注意在横盘市场中的表现。通过建议的优化方向,策略还有提升空间,特别是在自适应性方面的改进将有助于提高策略的稳定性。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// Strategy combining EMA/SMA Crossover, Swing High/Low, Volume Filtering, and Percentage TP & Trailing Stop

strategy("Swing High/Low Strategy with Volume, EMA/SMA Crossovers, Percentage TP and Trailing Stop", overlay=true)

// --- Inputs ---

source = close

TITLE = input(false, title='Enable Alerts & Background Color for EMA/SMA Crossovers')

turnonAlerts = input(true, title='Turn on Alerts?')

colorbars = input(true, title="Color Bars?")

turnonEMASMA = input(true, title='Turn on EMA1 & SMA2?')

backgroundcolor = input(false, title='Enable Background Color?')

// EMA/SMA Lengths

emaLength = input.int(10, minval=1, title='EMA Length')

smaLength = input.int(21, minval=1, title='SMA Length')

ema1 = ta.ema(source, emaLength)

sma2 = ta.sma(source, smaLength)

// Swing High/Low Lengths

leftBars = input.int(6, title="Left Bars for Swing High/Low", minval=1)

rightBars = input.int(6, title="Right Bars for Swing High/Low", minval=1)

// Volume MA Length

volMaLength = input.int(200, title="Volume Moving Average Length")

// Percentage Take Profit with hundredth place adjustment

takeProfitPercent = input.float(2.00, title="Take Profit Percentage (%)", minval=0.01, step=0.01) / 100

// Trailing Stop Loss Option

useTrailingStop = input.bool(true, title="Enable Trailing Stop Loss?")

trailingStopPercent = input.float(1.00, title="Trailing Stop Loss Percentage (%)", minval=0.01, step=0.01) / 100

// --- Swing High/Low Logic ---

pivotHigh(_leftBars, _rightBars) =>

ta.pivothigh(_leftBars, _rightBars)

pivotLow(_leftBars, _rightBars) =>

ta.pivotlow(_leftBars, _rightBars)

ph = fixnan(pivotHigh(leftBars, rightBars))

pl = fixnan(pivotLow(leftBars, rightBars))

// --- Volume Condition ---

volMa = ta.sma(volume, volMaLength)

// Declare exit conditions as 'var' so they are initialized

var bool longExitCondition = na

var bool shortExitCondition = na

// --- Long Entry Condition: Close above Swing High & Volume >= 200 MA ---

longCondition = (close > ph and volume >= volMa)

if (longCondition)

strategy.entry("Long", strategy.long)

// --- Short Entry Condition: Close below Swing Low & Volume >= 200 MA ---

shortCondition = (close < pl and volume >= volMa)

if (shortCondition)

strategy.entry("Short", strategy.short)

// --- Take Profit and Trailing Stop Logic ---

// For long position: Set take profit at the entry price + takeProfitPercent

longTakeProfitLevel = strategy.position_avg_price * (1 + takeProfitPercent)

shortTakeProfitLevel = strategy.position_avg_price * (1 - takeProfitPercent)

// --- Long Exit Logic ---

if (useTrailingStop)

// Trailing Stop for Long

strategy.exit("Long Exit", "Long", stop=na, trail_offset=strategy.position_avg_price * trailingStopPercent, limit=longTakeProfitLevel)

else

// Exit Long on Take Profit only

strategy.exit("Long Exit", "Long", limit=longTakeProfitLevel)

// --- Short Exit Logic ---

if (useTrailingStop)

// Trailing Stop for Short

strategy.exit("Short Exit", "Short", stop=na, trail_offset=strategy.position_avg_price * trailingStopPercent, limit=shortTakeProfitLevel)

else

// Exit Short on Take Profit only

strategy.exit("Short Exit", "Short", limit=shortTakeProfitLevel)

// --- Plot Swing High/Low ---

plot(ph, style=plot.style_circles, linewidth=1, color=color.blue, offset=-rightBars, title="Swing High")

plot(ph, style=plot.style_line, linewidth=1, color=color.blue, offset=0, title="Swing High")

plot(pl, style=plot.style_circles, linewidth=1, color=color.red, offset=-rightBars, title="Swing High")

plot(pl, style=plot.style_line, linewidth=1, color=color.red, offset=0, title="Swing High")

// --- Plot EMA/SMA ---

plot(turnonEMASMA ? ema1 : na, color=color.green, title="EMA")

plot(turnonEMASMA ? sma2 : na, color=color.orange, title="SMA")

// --- Alerts ---

alertcondition(longCondition, title="Long Entry", message="Price closed above Swing High with Volume >= 200 MA")

alertcondition(shortCondition, title="Short Entry", message="Price closed below Swing Low with Volume >= 200 MA")

// --- Bar Colors for Visualization ---

barcolor(longCondition ? color.green : na, title="Long Entry Color")

barcolor(shortCondition ? color.red : na, title="Short Entry Color")

bgcolor(backgroundcolor ? (ema1 > sma2 ? color.new(color.green, 50) : color.new(color.red, 50)) : na)

相关推荐