概述

本策略是一个基于平滑Heikin Ashi蜡烛图的趋势跟踪系统。通过在较高时间周期计算Heikin Ashi蜡烛图,并将其应用于较低时间周期的交易决策中,有效降低了市场噪音的影响。策略提供了灵活的交易方向选择,可以只做多、只做空或双向交易,并集成了止损止盈功能,实现了全自动化的交易过程。

策略原理

策略的核心逻辑是利用Heikin Ashi蜡烛图在高时间周期的平滑特性来识别趋势。Heikin Ashi蜡烛图通过对开盘价和收盘价进行移动平均计算,能够有效过滤市场噪音,突出显示主要趋势。当出现绿色蜡烛时代表上升趋势,系统会在做多模式下开仓;当出现红色蜡烛时代表下降趋势,系统会在做空模式下开仓。策略还包含了基于百分比的止损和止盈机制,帮助控制风险和锁定利润。

策略优势

- 多周期结合降低假信号:通过在较高时间周期计算Heikin Ashi指标,有效减少了短期波动带来的干扰。

- 风险管理完善:集成了止损止盈功能,可以根据市场波动率灵活调整参数。

- 方向选择灵活:可以根据市场特点选择只做多、只做空或双向交易。

- 全自动化运作:策略逻辑清晰,参数可调,适合自动化交易。

- 适应性强:可应用于不同市场和时间周期,具有良好的普适性。

策略风险

- 趋势反转风险:在趋势转向时可能出现较大回撤,需要合理设置止损。

- 震荡市场风险:在横盘震荡市场中可能频繁交易导致损失。

- 参数优化风险:过度优化可能导致策略在实盘中表现不佳。

- 滑点成本风险:频繁交易可能带来较高的交易成本。

策略优化方向

- 增加趋势确认指标:可以引入其他技术指标如RSI或MACD作为辅助确认。

- 优化止损机制:可以实现跟踪止损或基于波动率的动态止损。

- 引入交易量分析:结合成交量指标提高入场信号的可靠性。

- 开发自适应参数:根据市场波动率自动调整止损止盈比例。

- 增加时间过滤:避免在非交易活跃时段频繁交易。

总结

该策略通过多周期Heikin Ashi指标的平滑特性,有效捕捉市场趋势,并通过完善的风险管理机制控制回撤。策略的灵活性和可扩展性使其具有良好的实用价值,通过持续优化和改进,能够适应不同市场环境。虽然存在一定的风险,但通过合理的参数设置和风险管理,可以实现稳定的交易表现。

策略源码

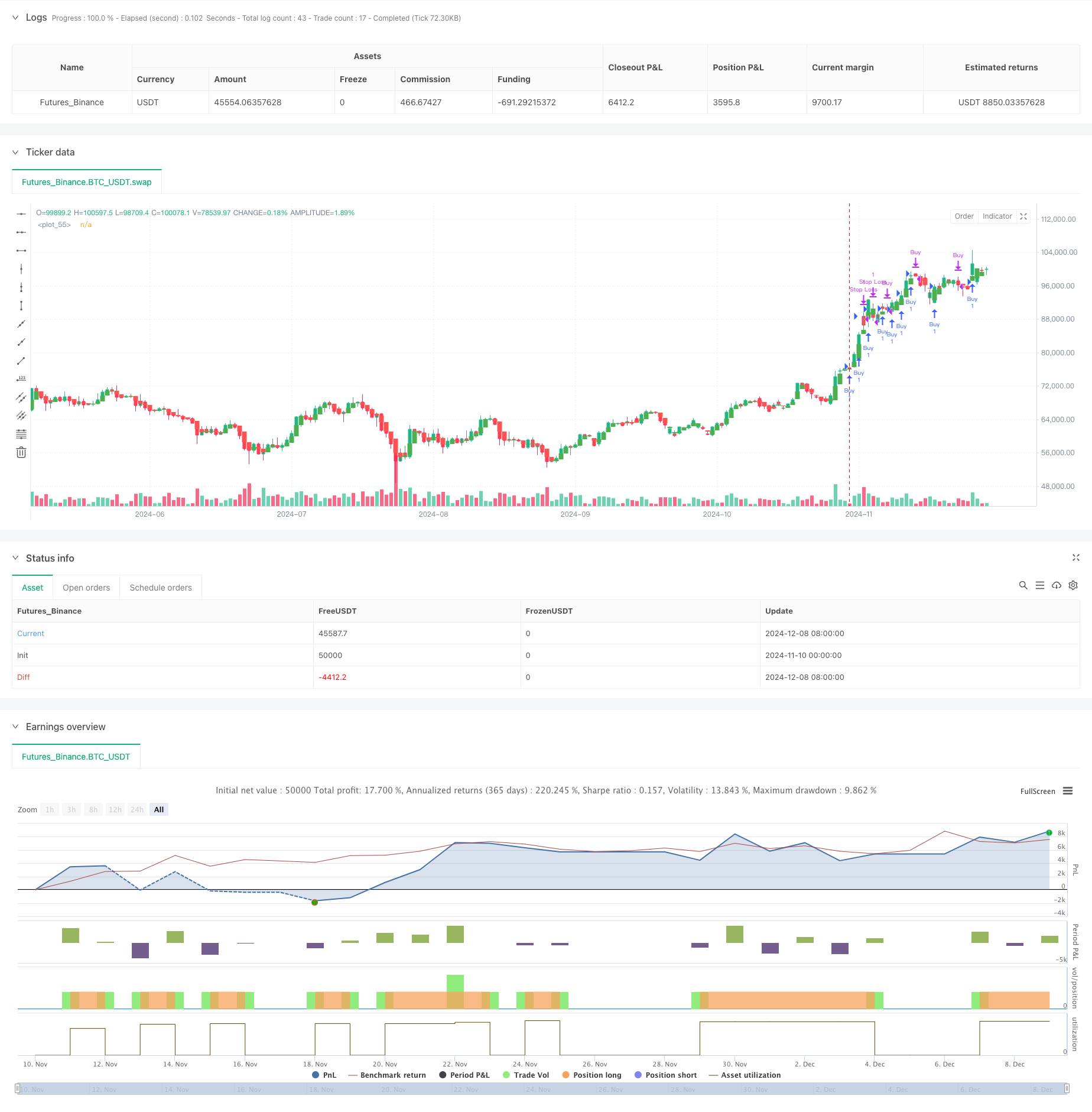

/*backtest

start: 2024-11-10 00:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Optimized Heikin Ashi Strategy with Buy/Sell Options", overlay=true)

// User inputs for customizing backtest settings

startDate = input(timestamp("2023-01-01 00:00"), title="Backtest Start Date", tooltip="Start date for the backtest")

endDate = input(timestamp("2024-01-01 00:00"), title="Backtest End Date", tooltip="End date for the backtest")

// Input for Heikin Ashi timeframe optimization

ha_timeframe = input.timeframe("D", title="Heikin Ashi Timeframe", tooltip="Choose the timeframe for Heikin Ashi candles")

// Inputs for optimizing stop loss and take profit

use_stop_loss = input.bool(true, title="Use Stop Loss")

stop_loss_percent = input.float(2.0, title="Stop Loss (%)", minval=0.0, tooltip="Set stop loss percentage")

use_take_profit = input.bool(true, title="Use Take Profit")

take_profit_percent = input.float(4.0, title="Take Profit (%)", minval=0.0, tooltip="Set take profit percentage")

// Input to choose Buy or Sell

trade_type = input.string("Buy Only", options=["Buy Only", "Sell Only"], title="Trade Type", tooltip="Choose whether to only Buy or only Sell")

// Heikin Ashi calculation on a user-defined timeframe

ha_open = request.security(syminfo.tickerid, ha_timeframe, ta.sma(open, 2), barmerge.gaps_off, barmerge.lookahead_on)

ha_close = request.security(syminfo.tickerid, ha_timeframe, ta.sma(close, 2), barmerge.gaps_off, barmerge.lookahead_on)

ha_high = request.security(syminfo.tickerid, ha_timeframe, math.max(high, close), barmerge.gaps_off, barmerge.lookahead_on)

ha_low = request.security(syminfo.tickerid, ha_timeframe, math.min(low, open), barmerge.gaps_off, barmerge.lookahead_on)

// Heikin Ashi candle colors

ha_bullish = ha_close > ha_open // Green candle

ha_bearish = ha_close < ha_open // Red candle

// Backtest period filter

inDateRange = true

// Trading logic depending on user input

if (inDateRange) // Ensures trades happen only in the selected period

if (trade_type == "Buy Only") // Buy when green, Sell when red

if (ha_bullish and strategy.position_size <= 0) // Buy on green candle only if no position is open

strategy.entry("Buy", strategy.long)

if (ha_bearish and strategy.position_size > 0) // Sell on red candle (close the long position)

strategy.close("Buy")

if (trade_type == "Sell Only") // Sell when red, Exit sell when green

if (ha_bearish and strategy.position_size >= 0) // Sell on red candle only if no position is open

strategy.entry("Sell", strategy.short)

if (ha_bullish and strategy.position_size < 0) // Exit the sell position on green candle

strategy.close("Sell")

// Add Stop Loss and Take Profit conditions if enabled

if (use_stop_loss)

strategy.exit("Stop Loss", from_entry="Buy", stop=strategy.position_avg_price * (1 - stop_loss_percent / 100))

if (use_take_profit)

strategy.exit("Take Profit", from_entry="Buy", limit=strategy.position_avg_price * (1 + take_profit_percent / 100))

// Plot Heikin Ashi candles on the chart

plotcandle(ha_open, ha_high, ha_low, ha_close, color=ha_bullish ? color.green : color.red)

相关推荐